Harvard And Yale Face Potential Millions In Increased Endowment Taxes Under New House Bill

Table of Contents

The Proposed House Bill: Key Provisions and Implications

The recently proposed House Bill aims to increase taxes on university endowments, arguing that these institutions, with their massive wealth, should contribute more significantly to public good. The core tenets of the bill focus on a tiered system of taxation based on endowment size.

- Specific tax percentage increase: The bill proposes a progressive tax rate, increasing from 1% for endowments below a certain threshold, escalating to 3% or even higher for endowments exceeding several billion dollars.

- Thresholds for endowment size triggering increased taxation: Endowments exceeding $1 billion would face the higher tax brackets, with specific thresholds defining each level.

- Exemptions or loopholes: At present, details regarding specific exemptions or loopholes are limited; however, potential exceptions for endowments specifically dedicated to financial aid or specific research initiatives might be considered during future legislative discussions. This needs further clarification.

- Projected revenue generation from the bill: The projected revenue generation from the bill is estimated in the hundreds of millions of dollars annually, allocated to various public services. Precise figures are still subject to debate and depend on the final form of the legislation.

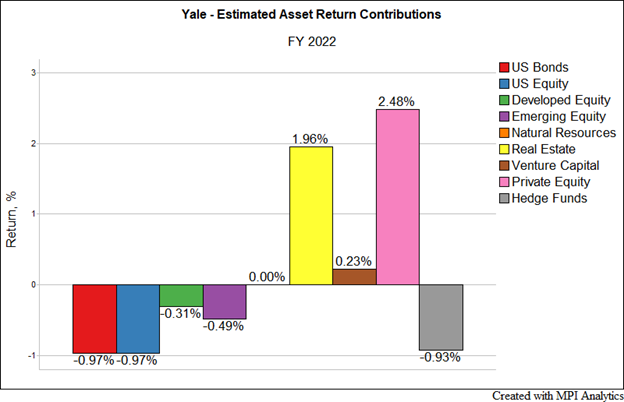

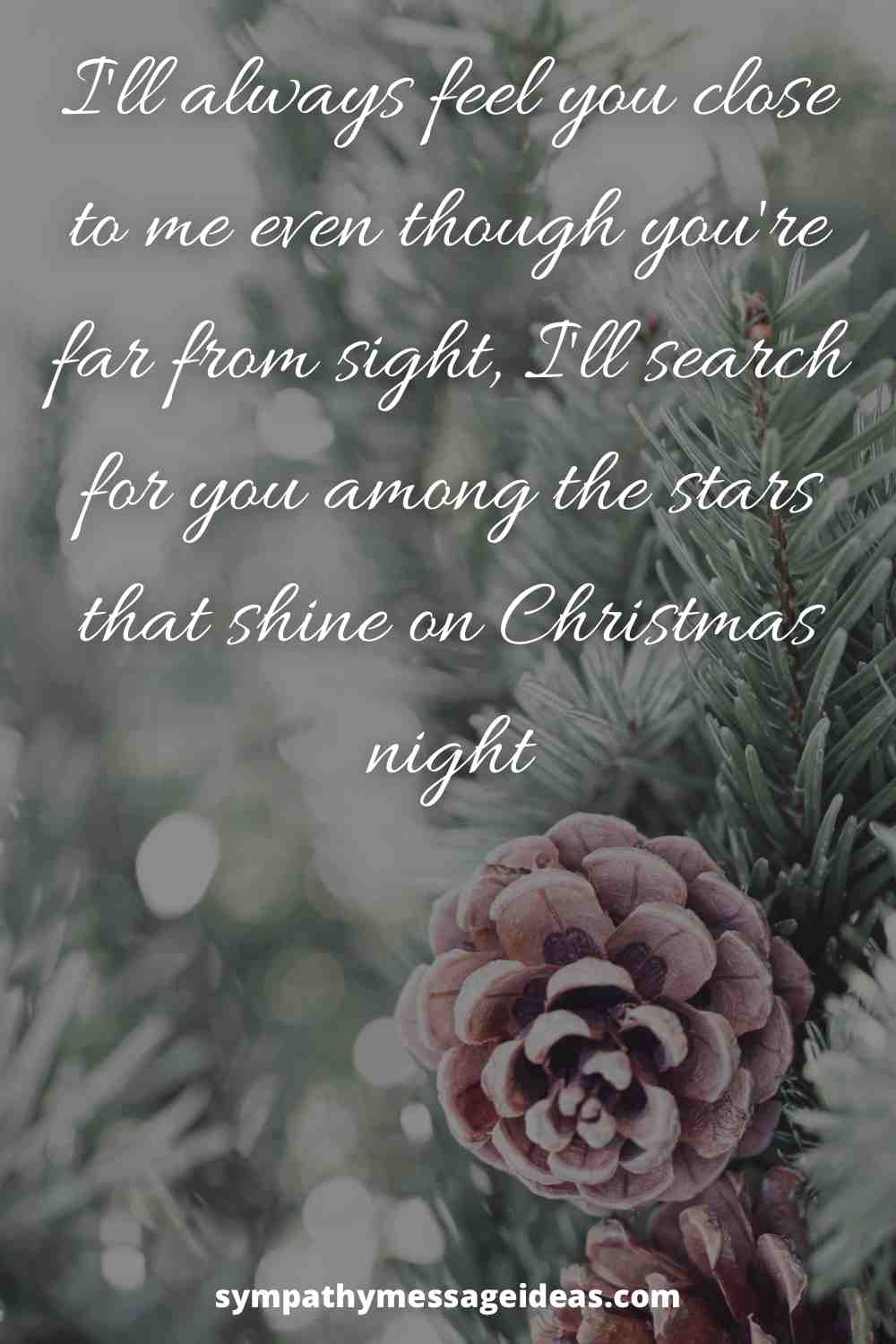

Financial Impact on Harvard and Yale: A Detailed Analysis

Given their substantial endowments, Harvard and Yale would likely bear a disproportionate share of the increased tax burden. Harvard's endowment, exceeding $50 billion (Source: [Insert credible source]), and Yale's similarly large endowment (Source: [Insert credible source]) could face tens of millions of dollars in increased annual taxes under this proposal.

The ramifications of this increased tax burden could be extensive:

- Potential cuts to financial aid: Reduced revenue could necessitate cuts to financial aid programs, potentially limiting access for low-income students.

- Impact on research funding: Crucial research initiatives across various fields could suffer from funding cuts, hindering scientific advancements.

- Reduced capacity for infrastructure improvements: Planned campus renovations, building upgrades, and technology investments might be delayed or scaled back.

- Potential tuition increases: To offset revenue losses, the universities might be forced to raise tuition fees, making higher education even less accessible.

Arguments For and Against the Proposed Legislation

Supporters of the House Bill argue for greater equity in the tax system, claiming that wealthy institutions like Harvard and Yale should contribute more to society given their considerable financial resources. They highlight the potential for increased funding for public education and other essential social programs.

Opponents, however, counter that endowments are crucial for maintaining institutional strength, funding vital research, and providing financial aid. They argue that excessive taxation could stifle innovation, reduce access to higher education, and ultimately harm the overall educational landscape.

- Arguments in favor: Increased tax revenue for public good, addressing wealth inequality, ensuring fair contribution from wealthy institutions.

- Arguments against: Detrimental impact on research, reduced financial aid opportunities, potential for tuition hikes, chilling effect on philanthropy.

Reactions and Responses from Harvard and Yale

Both Harvard and Yale have publicly expressed their concerns regarding the proposed legislation. Official statements from university spokespeople have emphasized the potential negative consequences for research, financial aid, and overall institutional operations. (Source: [Insert links to official statements/press releases]).

- Statements from university presidents or spokespeople: [Insert quotes from official statements expressing concern].

- Details of lobbying strategies and their effectiveness: Both universities are likely engaged in lobbying efforts to influence the legislation, although specific details may not be publicly available.

- Potential legal challenges: If the bill passes, legal challenges are a possibility, contesting the constitutionality of the increased tax rates.

Conclusion: The Future of Endowment Taxes and the Impact on Ivy League Institutions

The proposed House Bill represents a significant challenge to Harvard and Yale, potentially resulting in multi-million dollar increases in endowment taxes. The debate highlights the tension between ensuring fair taxation and safeguarding the financial health of institutions crucial to research, education, and innovation. While proponents emphasize equity and public benefit, opponents raise concerns about the potential negative repercussions on higher education. Stay informed about the future of endowment taxes and the impact on institutions like Harvard and Yale. Contact your representatives to express your views on this crucial legislation affecting higher education.

Featured Posts

-

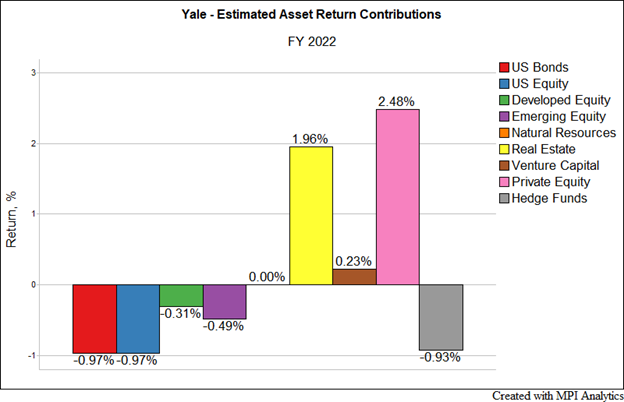

Scarlett Johansson And Colin Jost A Look At Their Respective Earnings

May 13, 2025

Scarlett Johansson And Colin Jost A Look At Their Respective Earnings

May 13, 2025 -

Is Devon Sawa Returning For The Final Destination 25th Anniversary

May 13, 2025

Is Devon Sawa Returning For The Final Destination 25th Anniversary

May 13, 2025 -

Remembering Our Lost Recent Local Obituaries

May 13, 2025

Remembering Our Lost Recent Local Obituaries

May 13, 2025 -

The Ultimate Nba Draft Lottery Quiz 2000 Present

May 13, 2025

The Ultimate Nba Draft Lottery Quiz 2000 Present

May 13, 2025 -

Sheffield Uniteds Lucky Escape Red Card Controversy In Leeds United Match

May 13, 2025

Sheffield Uniteds Lucky Escape Red Card Controversy In Leeds United Match

May 13, 2025