Grim Retail Numbers: Are Bank Of Canada Rate Cuts On The Horizon?

Table of Contents

Weak Retail Sales Indicate Economic Slowdown

Recent retail sales figures paint a worrying picture of economic slowdown in Canada. The decline is not limited to a single sector; it's a broad-based weakness affecting various retail segments. This suggests a more systemic issue than isolated market fluctuations, raising serious questions about the overall health of the Canadian economy.

- Percentage decline: Retail sales have fallen by X% compared to the same period last year, marking the steepest decline in Y years. (Note: Replace X and Y with actual data).

- Consumer confidence: Consumer confidence indices have plummeted, reflecting a pessimistic outlook among Canadian consumers. This diminished confidence directly translates to reduced spending.

- Regional disparities: While the decline is nationwide, certain provinces, such as [mention specific provinces], have experienced more pronounced drops in retail sales, highlighting regional economic vulnerabilities.

- Contributing factors: This downturn can be largely attributed to a confluence of factors, including persistently high inflation, elevated interest rates implemented by the Bank of Canada to combat inflation, and reduced consumer spending power. The impact of these factors is particularly evident in sectors like clothing and furniture, where sales have been especially hard hit.

Inflation Remains a Concern, Complicating Rate Cut Decisions

Despite the weakening retail sector, the Bank of Canada faces a significant hurdle: inflation. While inflation might be showing signs of easing, it remains stubbornly above the Bank of Canada's target range. Implementing rate cuts in this environment risks reigniting inflationary pressures, potentially undoing much of the progress already made.

- Current inflation rate: The current inflation rate stands at X% (Note: Replace X with actual data), still significantly above the Bank of Canada's target of 2%.

- Inflationary pressures from rate cuts: Reducing interest rates could stimulate demand and potentially lead to higher prices for goods and services, exacerbating inflationary pressures.

- Bank of Canada's inflation target: The Bank of Canada has repeatedly emphasized its commitment to returning inflation to its 2% target. Rate cuts could jeopardize this crucial objective.

- Impact on the Canadian dollar: Rate cuts could weaken the Canadian dollar, making imports more expensive and potentially adding further inflationary pressure.

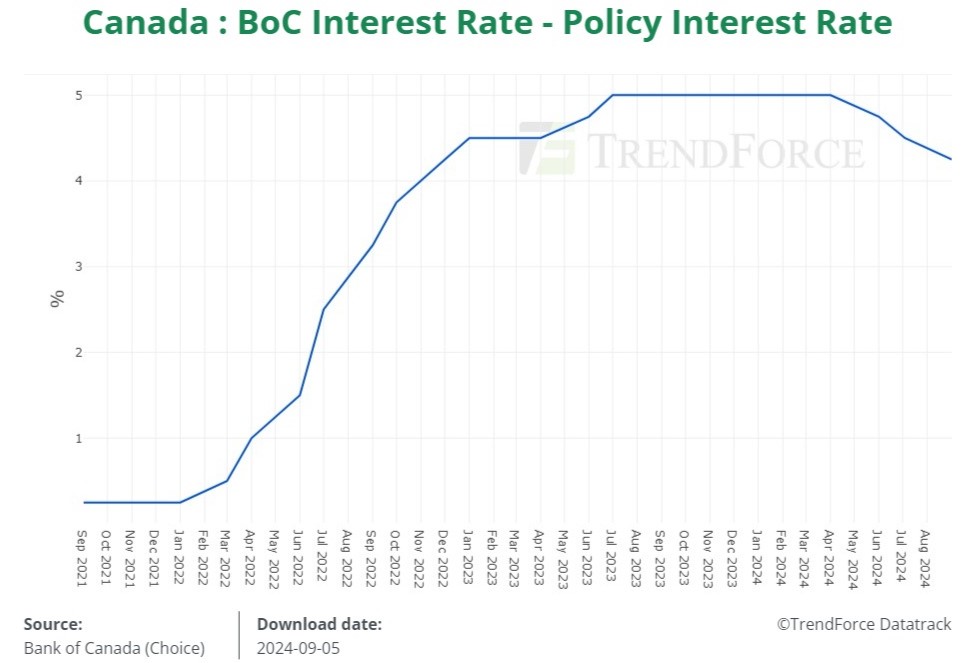

Analyzing the Bank of Canada's Recent Statements and Actions

The Bank of Canada's recent pronouncements offer some clues, albeit ambiguous ones, regarding the likelihood of rate cuts. While acknowledging the economic slowdown, the central bank has remained cautious about altering its monetary policy stance too aggressively.

- Recent statements: [Insert quotes from recent Bank of Canada press releases or speeches by officials regarding interest rates and the current economic climate]. These statements emphasize a data-dependent approach, suggesting future decisions will hinge on incoming economic data.

- Current monetary policy stance: The Bank of Canada's current stance indicates a pause in rate hikes, but a clear commitment to maintaining its current policy rate until inflation shows a clear and sustained path back to its target.

- Potential timing of rate cuts: Market analysts offer varying opinions on the timing of potential rate cuts, ranging from [mention timeframe] to [mention timeframe], depending on economic data and inflation trends.

- Alternative monetary policy tools: Besides interest rate cuts, the Bank of Canada could explore alternative tools, such as quantitative easing, to stimulate the economy while managing inflationary risks.

Potential Impact of Rate Cuts on Consumers and Businesses

Bank of Canada rate cuts would have far-reaching consequences for both consumers and businesses. While they could offer some relief to borrowers, they also carry potential risks.

- Impact on mortgage rates and consumer debt: Lower interest rates would reduce mortgage payments for homeowners, potentially boosting consumer spending. However, it could also lead to increased borrowing and further accumulation of consumer debt.

- Effects on business investment and expansion plans: Lower borrowing costs could encourage businesses to invest and expand, creating jobs and stimulating economic growth.

- Potential impact on employment: While rate cuts could boost employment in the short term, the long-term impact depends on the effectiveness of the stimulus and the overall health of the economy.

- Ripple effect through various sectors: The effects of rate cuts would ripple through various sectors of the Canadian economy, impacting everything from housing to manufacturing to retail.

Conclusion

The possibility of Bank of Canada rate cuts remains uncertain. While weak retail sales signal a need for economic stimulus, persistent inflation makes such a move a risky proposition. The Bank of Canada’s future interest rate decisions will likely hinge on a careful balancing act between supporting economic growth and controlling inflation. It's crucial to monitor economic indicators like retail sales, inflation rates, and the Bank of Canada's pronouncements closely. Stay informed about the latest developments concerning Bank of Canada rate cuts by subscribing to reputable economic news sources, following the Bank of Canada's announcements, and consulting with a financial advisor to understand how future monetary policy adjustments by the Bank of Canada might affect your personal finances.

Featured Posts

-

Adhd In Adults With Autism And Intellectual Disability A New Study

Apr 29, 2025

Adhd In Adults With Autism And Intellectual Disability A New Study

Apr 29, 2025 -

Shen Yuns Upcoming Performance In Mesa

Apr 29, 2025

Shen Yuns Upcoming Performance In Mesa

Apr 29, 2025 -

Fox News Faces Defamation Lawsuit From Jan 6 Figure Ray Epps

Apr 29, 2025

Fox News Faces Defamation Lawsuit From Jan 6 Figure Ray Epps

Apr 29, 2025 -

The China Factor How Market Shifts Affect Bmw Porsche And Other Automakers

Apr 29, 2025

The China Factor How Market Shifts Affect Bmw Porsche And Other Automakers

Apr 29, 2025 -

Cardinal Convicted Of Crimes Demands Conclave Participation

Apr 29, 2025

Cardinal Convicted Of Crimes Demands Conclave Participation

Apr 29, 2025

Latest Posts

-

Iva Ristic Confirms Marriage Details On Her Incredible Husband

Apr 29, 2025

Iva Ristic Confirms Marriage Details On Her Incredible Husband

Apr 29, 2025 -

Skolmassakern Historien Om Helena Och Iva

Apr 29, 2025

Skolmassakern Historien Om Helena Och Iva

Apr 29, 2025 -

Helena Och Iva Oeverlevande Fran Skolmassakern

Apr 29, 2025

Helena Och Iva Oeverlevande Fran Skolmassakern

Apr 29, 2025 -

Skolskjutningen Helenas Och Ivas Kamp Foer Oeverlevnad

Apr 29, 2025

Skolskjutningen Helenas Och Ivas Kamp Foer Oeverlevnad

Apr 29, 2025 -

Isvarymas 11 Aspektu Apzvelgiant Spektakli Ir Jo Adaptacija Kine

Apr 29, 2025

Isvarymas 11 Aspektu Apzvelgiant Spektakli Ir Jo Adaptacija Kine

Apr 29, 2025