GPB Capital Founder Sentenced: 7 Years For Ponzi-Scheme Fraud

Table of Contents

The GPB Capital Ponzi Scheme: Unraveling the Fraud

The GPB Capital Ponzi scheme represents a sophisticated and devastating example of investment fraud. It preyed on investors seeking high returns, ultimately leaving them with significant financial losses and emotional distress.

The Scheme's Mechanics: How the Fraud Operated

The scheme's mechanics involved a complex web of deception, skillfully masking the fraudulent nature of the operation. Gentile and his associates employed several tactics:

- False marketing materials: Investors were presented with misleading marketing materials that exaggerated GPB Capital's financial performance and the profitability of its investments.

- Fabricated financial statements: Financial statements were manipulated to inflate the value of assets and conceal the scheme's true financial position. Auditors ultimately failed to uncover the fraud.

- Misrepresentation of investments: The nature of investments was frequently misrepresented, promising returns that were simply unattainable. Investors were often misled about the risk involved.

- Use of shell companies: Complex corporate structures, including numerous shell companies, were used to obscure the flow of funds and make it harder to trace the money.

- Lack of transparency: A significant lack of transparency made it incredibly difficult for investors to independently verify the performance of their investments.

GPB Capital primarily promoted investments in auto dealerships and waste management companies, promising substantial returns that were never delivered. Instead, new investor funds were used to pay off earlier investors, a classic hallmark of a Ponzi scheme.

The Role of David Gentile: Orchestrating the Fraud

David Gentile, as the founder and CEO of GPB Capital, played a central role in orchestrating the fraudulent scheme. His leadership position allowed him to oversee and direct the deceptive practices, actively participating in the activities that defrauded investors. His actions involved:

- Leadership role: Gentile's leadership role facilitated the creation and execution of the scheme.

- Direct participation in fraudulent activities: He was directly involved in the creation and dissemination of false information to investors.

- Efforts to conceal the fraud: He actively worked to hide the scheme's fraudulent nature from both investors and regulatory bodies.

The Victims of GPB Capital's Fraud: A Devastating Impact

The GPB Capital fraud impacted a large number of investors, resulting in significant financial losses and considerable emotional distress.

- Number of victims: Thousands of investors were affected by the scheme.

- Range of financial losses: Individual losses varied greatly, ranging from tens of thousands to millions of dollars.

- Emotional toll of the fraud: The emotional impact on victims was substantial, leading to stress, anxiety, and feelings of betrayal.

- Legal recourse for victims: Victims have pursued legal recourse through civil lawsuits, seeking to recover their lost funds.

The Legal Proceedings and Sentencing

The GPB Capital case involved a comprehensive investigation by the Securities and Exchange Commission (SEC) and ultimately resulted in a significant sentence for David Gentile.

SEC Investigation and Charges: Uncovering the Deception

The SEC's investigation meticulously uncovered the fraudulent activities of GPB Capital. The investigation included:

- Timeline of the investigation: The investigation spanned several years, requiring extensive scrutiny of financial records and interviews with numerous individuals.

- Key evidence presented: The evidence presented included incriminating documents, witness testimony, and financial analyses demonstrating the Ponzi scheme's structure.

- Plea bargain details: Gentile ultimately pleaded guilty to multiple charges of securities fraud.

- Guilty plea or conviction: His guilty plea led directly to the sentencing.

The 7-Year Sentence and Other Penalties: Justice Served

Gentile's seven-year prison sentence reflects the seriousness of his crimes. Additional penalties included:

- Length of prison sentence: Seven years imprisonment.

- Financial penalties: Significant financial penalties were imposed, aimed at recovering some of the stolen funds.

- Restitution orders: Orders were issued for restitution to the victims, though full recovery is unlikely.

- Forfeiture of assets: Gentile was ordered to forfeit assets acquired through the fraudulent activities.

Implications for Future Regulatory Oversight: Strengthening Investor Protections

The GPB Capital case has significant implications for future regulatory oversight of the private equity and alternative investment industries. It highlights the need for:

- Strengthened investor protection regulations: Greater protections are needed to safeguard investors from fraudulent schemes.

- Increased transparency requirements: Increased transparency in financial reporting will help prevent future frauds.

- Enhanced due diligence standards: More rigorous due diligence will be crucial in evaluating investment opportunities.

Protecting Yourself from Investment Fraud: Due Diligence and Awareness

Protecting yourself from investment fraud requires vigilance and a proactive approach.

Due Diligence and Red Flags: Identifying Potential Scams

Conducting thorough due diligence is crucial before investing in any opportunity. Be wary of:

- Researching investment opportunities: Independently research investment opportunities thoroughly before committing funds.

- Verifying credentials and track records: Verify the credentials and track records of investment managers and companies.

- Being wary of high-return promises: Unusually high-return promises are often a red flag.

- Seeking professional financial advice: Consult a qualified financial advisor before making significant investment decisions.

Reporting Suspicious Activity: Taking Action

If you suspect investment fraud, report it immediately to the appropriate authorities:

- Contacting the SEC: Report suspicious activity to the Securities and Exchange Commission.

- Filing a complaint with state securities regulators: File a complaint with your state's securities regulator.

- Reporting to law enforcement: Report suspected criminal activity to law enforcement agencies.

Conclusion: Learning from the GPB Capital Case

The GPB Capital case serves as a stark reminder of the devastating consequences of Ponzi schemes and the importance of investor protection. David Gentile's seven-year sentence underscores the gravity of his actions and sends a strong message that such fraudulent activities will be prosecuted vigorously. This case should prompt increased scrutiny of the investment industry and encourage investors to exercise greater caution and perform diligent due diligence before investing. Don't become a victim of investment fraud: learn how to protect yourself from GPB Capital-style Ponzi schemes. Visit the SEC website () for more information on investor protection and reporting suspicious activity.

Featured Posts

-

Chat Gpt Maker Open Ai Facing Ftc Investigation Key Questions Answered

May 10, 2025

Chat Gpt Maker Open Ai Facing Ftc Investigation Key Questions Answered

May 10, 2025 -

The Unexpected Journey From Wolves Rejection To European Football Glory

May 10, 2025

The Unexpected Journey From Wolves Rejection To European Football Glory

May 10, 2025 -

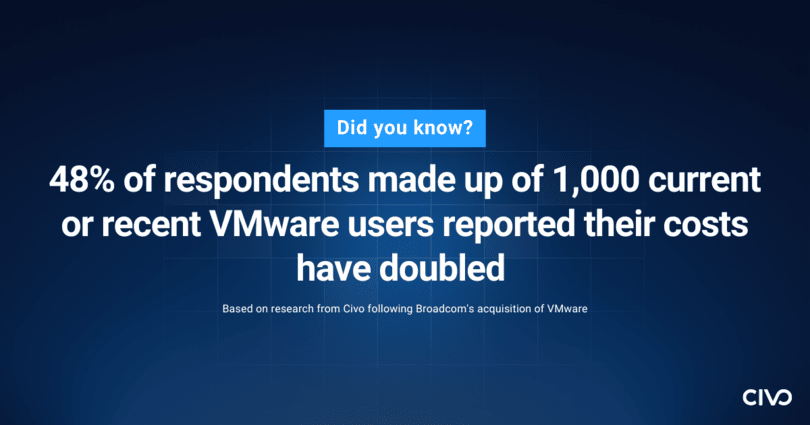

1 050 V Mware Price Increase Proposed By Broadcom At And Ts Concerns

May 10, 2025

1 050 V Mware Price Increase Proposed By Broadcom At And Ts Concerns

May 10, 2025 -

Exploring The Business Empire Of Samuel Dickson A Canadian Lumber Baron

May 10, 2025

Exploring The Business Empire Of Samuel Dickson A Canadian Lumber Baron

May 10, 2025 -

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025