Government Crackdown On Delinquent Student Loan Borrowers: What You Need To Know

Table of Contents

Understanding Student Loan Delinquency

Student loan delinquency occurs when you miss scheduled payments. The specific definition varies, but generally, a loan is considered delinquent after 90 days of missed payments. This seemingly small lapse can have significant repercussions.

-

Defining Delinquency: Delinquency isn't just about one missed payment; it's a pattern of missed or late payments that trigger negative consequences. Even a single missed payment can begin to damage your credit score.

-

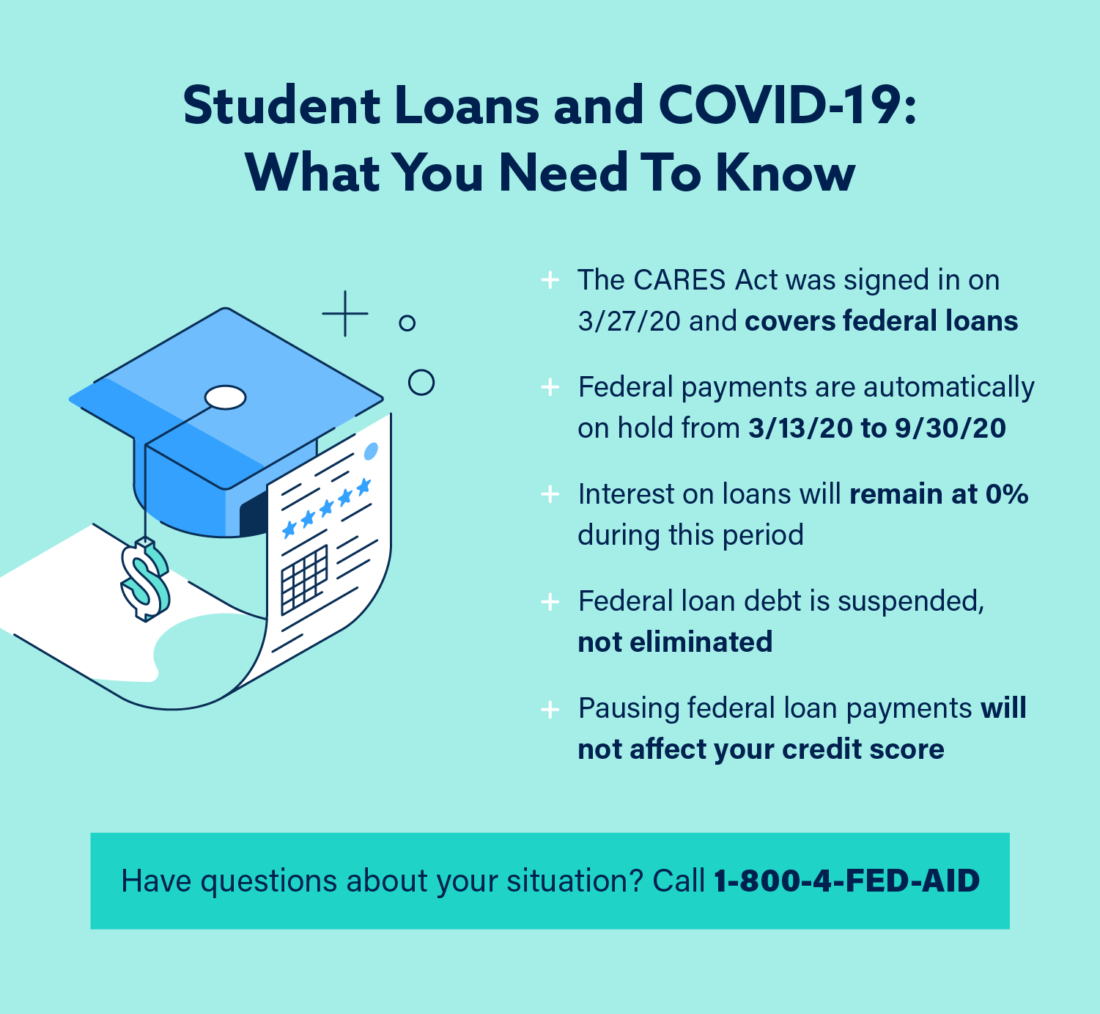

Types of Student Loans Affected: Both federal and private student loans can lead to delinquency. However, federal student loans are subject to more stringent government enforcement actions, including wage garnishment and tax refund offset. Private loan consequences may vary depending on the lender.

-

Consequences of Delinquency:

- Negative impact on your credit score (reducing your creditworthiness for years).

- Increased interest charges and late fees, rapidly increasing your overall debt.

- Potential wage garnishment (a portion of your paycheck is seized to repay the loan).

- Tax refund offset (your tax refund is used to pay down your debt).

- Collection agency involvement (potentially leading to harassing phone calls and legal action).

Recent Government Initiatives Targeting Delinquent Loans

The government is intensifying its efforts to collect on delinquent student loans. Several initiatives reflect this increased focus:

-

Increased Enforcement: The Department of Education (ED) and other agencies are employing stricter collection practices, including more frequent wage garnishments and tax refund offsets. They are also collaborating more closely with collection agencies.

-

New Programs and Initiatives (Limited Relief): While some programs aim to help borrowers manage their debt, many have strict eligibility requirements and may not offer substantial relief. It's crucial to carefully review program details to see if you qualify.

-

Examples of Government Actions:

- Increased use of automated collection systems.

- Higher penalties for borrowers who fail to respond to collection attempts.

- Changes in the process for challenging collection actions.

- Greater collaboration between the ED and the IRS for tax refund offsets.

Protecting Yourself from Government Action

Understanding your rights and taking proactive steps are vital to avoiding the worst consequences of student loan delinquency.

-

Understanding Your Rights: You have the right to fair and accurate reporting of your loan status. You also have the right to communicate with your loan servicer and explore options for repayment.

-

Exploring Debt Management Options: Several options can help:

- Income-driven repayment plans (IDR): Adjust your monthly payment based on your income and family size.

- Loan consolidation: Combine multiple loans into one, potentially simplifying payments.

- Deferment or forbearance: Temporarily suspend payments, although interest may continue to accrue.

- Student Loan Rehabilitation: A program that can help remove negative marks from your credit report.

-

Steps to Take if Contacted by a Collection Agency: Respond promptly and in writing. Keep records of all communications. Don't ignore them; engage with them to discuss repayment options.

-

Importance of Communication: Maintain open communication with your loan servicer. Early intervention is key to preventing delinquency from escalating.

Consequences of Ignoring Delinquent Loans

Ignoring the problem will only worsen the situation. The potential consequences include:

-

Financial Penalties: Significant increases in your total debt due to accumulated interest, fees, and collection costs.

-

Legal Ramifications: Wage garnishment, tax refund offset, lawsuits, and even potential damage to your credit rating. This can significantly impact your ability to obtain credit in the future.

-

Impact on Future Borrowing: Delinquency severely damages your credit score, making it difficult to secure loans, mortgages, or even rent an apartment in the future.

Conclusion

The government's increased focus on collecting delinquent student loans necessitates proactive management of your debt. Ignoring the issue will only lead to more significant financial and legal problems. Review your loan status immediately, explore available repayment options, and don't hesitate to seek help from a reputable non-profit credit counseling agency if needed. Taking control of your student loans now is crucial for protecting your financial future. Visit the [link to relevant government website, e.g., studentaid.gov] and explore resources to effectively manage your student loans and avoid a government crackdown on your student loan debt.

Featured Posts

-

Rare Earth Minerals A Critical Resource In A Potential New Cold War

May 17, 2025

Rare Earth Minerals A Critical Resource In A Potential New Cold War

May 17, 2025 -

How Tom Thibodeaus Adjustments Reshaped The New York Knicks Season

May 17, 2025

How Tom Thibodeaus Adjustments Reshaped The New York Knicks Season

May 17, 2025 -

How Late Student Loan Payments Impact Your Credit

May 17, 2025

How Late Student Loan Payments Impact Your Credit

May 17, 2025 -

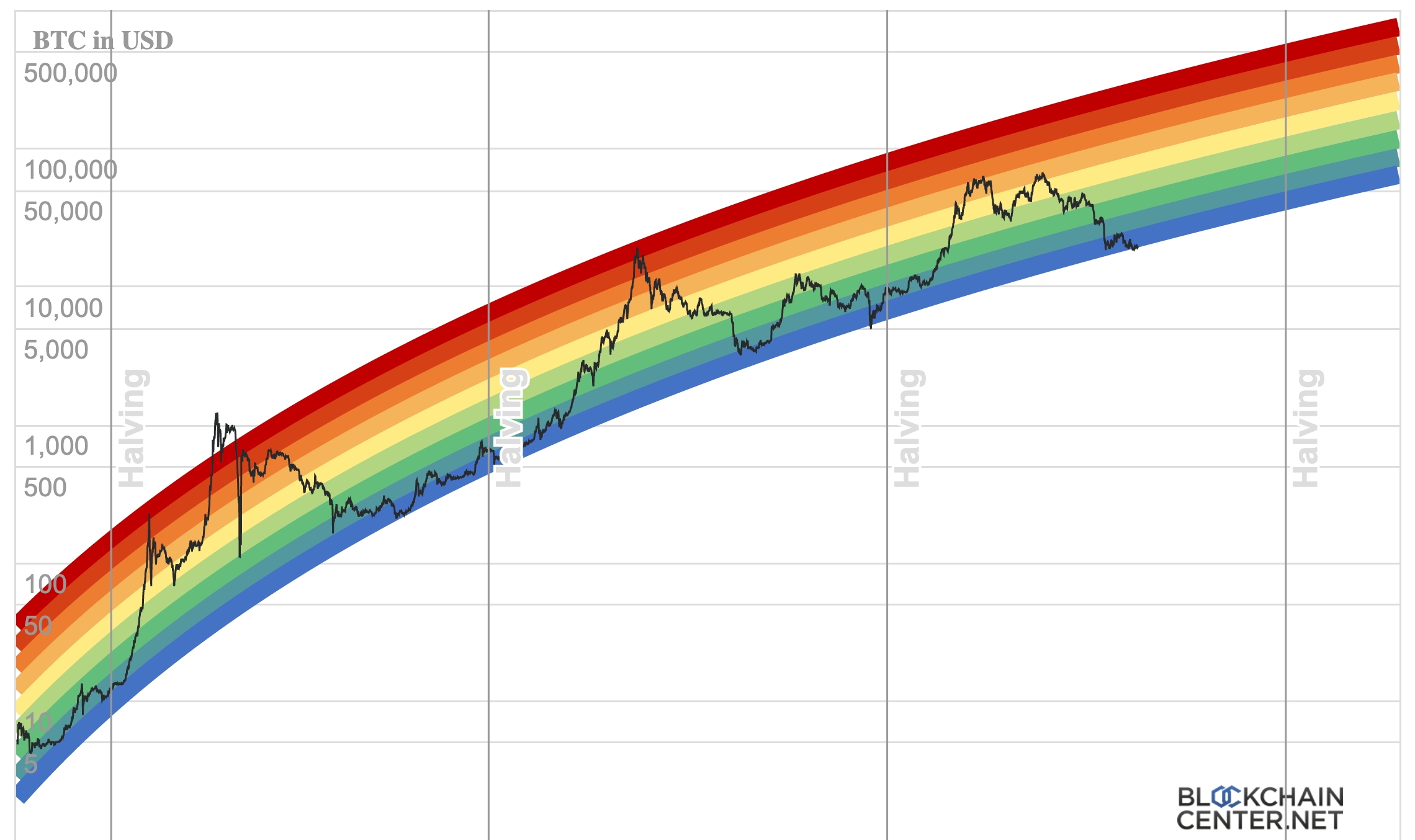

Bitcoin And Crypto Casino Guide 2025 Find The Best Sites

May 17, 2025

Bitcoin And Crypto Casino Guide 2025 Find The Best Sites

May 17, 2025 -

Giants Vs Mariners Assessing Injuries Before The April 4 6 Series

May 17, 2025

Giants Vs Mariners Assessing Injuries Before The April 4 6 Series

May 17, 2025

Latest Posts

-

Iga Svjontek Dominira Pobeda Nad Ukrajinkom I Povezane Vesti

May 17, 2025

Iga Svjontek Dominira Pobeda Nad Ukrajinkom I Povezane Vesti

May 17, 2025 -

Ky Tich Indian Wells Kieu Nu 17 Tuoi Xu Bach Duong Dang Quang

May 17, 2025

Ky Tich Indian Wells Kieu Nu 17 Tuoi Xu Bach Duong Dang Quang

May 17, 2025 -

Analisis De Prensa Latina Previsiones Deportivas Semanales

May 17, 2025

Analisis De Prensa Latina Previsiones Deportivas Semanales

May 17, 2025 -

Kieu Nu 17 Tuoi Lap Ky Tich Vo Dich Indian Wells

May 17, 2025

Kieu Nu 17 Tuoi Lap Ky Tich Vo Dich Indian Wells

May 17, 2025 -

Prensa Latina Previsiones Deportivas Para La Semana

May 17, 2025

Prensa Latina Previsiones Deportivas Para La Semana

May 17, 2025