GOP Tax Plan: Does It Really Cut The Deficit? A Mathematical Look

Table of Contents

Analyzing the Revenue Projections of GOP Tax Plans

Understanding the potential impact of a GOP tax plan on the national deficit requires a careful examination of its revenue projections. These projections, however, are heavily reliant on several key assumptions, making accurate predictions challenging.

The Role of Economic Growth Assumptions

- Projected GDP growth significantly impacts revenue forecasts. A higher GDP growth rate generally leads to higher tax revenues, as a larger economy generates more taxable income. Conversely, slower growth reduces tax revenue.

- Economic forecasting is inherently uncertain. Predicting future economic activity is notoriously difficult, and even small errors in GDP growth projections can significantly affect revenue estimates.

- Past GOP tax plans often showed discrepancies between projected and actual revenue outcomes. Historical data reveals a pattern where projected revenue increases from tax cuts often fail to materialize to the extent initially anticipated. This highlights the limitations of relying solely on optimistic growth projections.

- The Laffer Curve's relevance to supply-side economics arguments. Supply-side economics often argues that tax cuts stimulate economic growth, leading to higher tax revenue despite lower tax rates. However, the actual effect is debated, with the Laffer Curve offering a theoretical framework, but with its practical application often difficult to determine accurately.

For example, the Tax Cuts and Jobs Act of 2017 projected significant revenue increases due to economic growth spurred by the tax cuts. However, the Congressional Budget Office (CBO) later revised these projections downward, indicating that the actual revenue gains were considerably less than initially forecast. This underscores the importance of cautious interpretation of revenue projections associated with GOP tax plans and their impact on the GOP Tax Plan Deficit.

Tax Cuts and Their Impact on Tax Revenue

- GOP tax plans typically include corporate and individual income tax cuts. These cuts directly reduce the amount of revenue collected by the federal government.

- Historical data shows mixed results from similar tax cuts. Some tax cuts have been followed by periods of increased economic activity and revenue, while others have resulted in net revenue losses.

- Tax avoidance and evasion can significantly impact actual revenue. The complexity of the tax code provides opportunities for both legal tax avoidance and illegal tax evasion, reducing the actual revenue collected, even when tax rates remain unchanged.

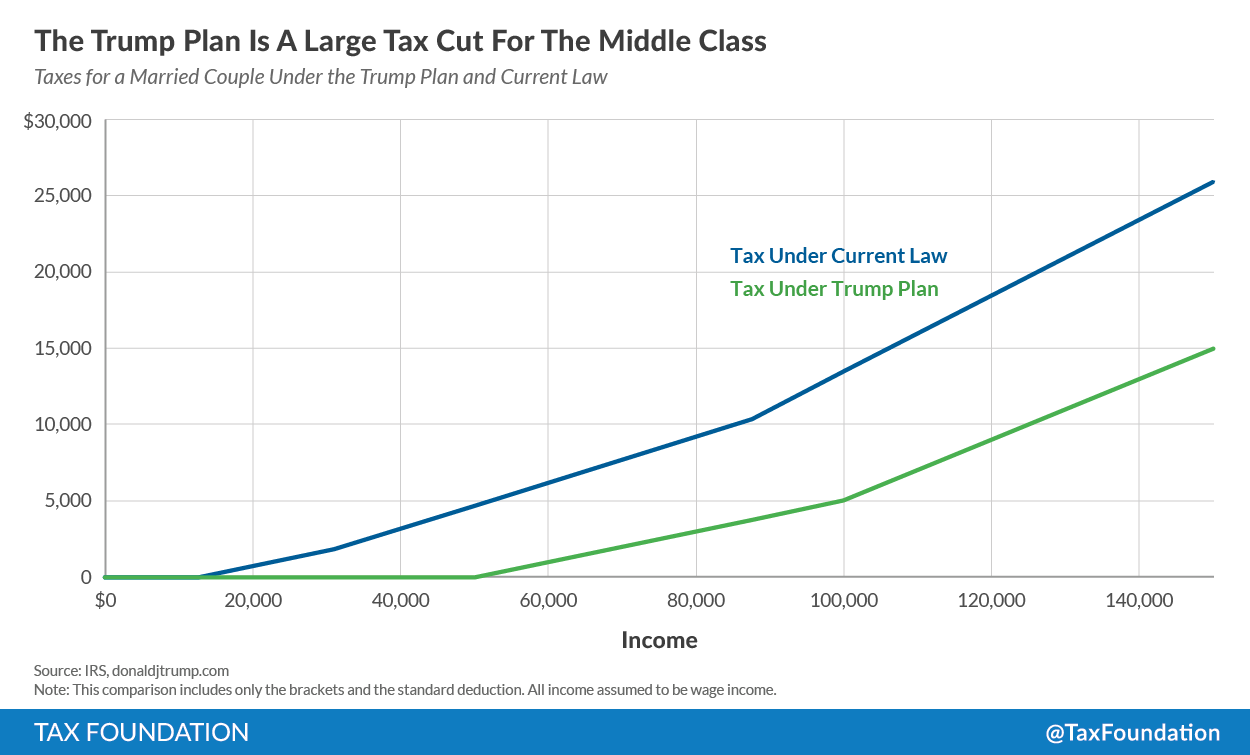

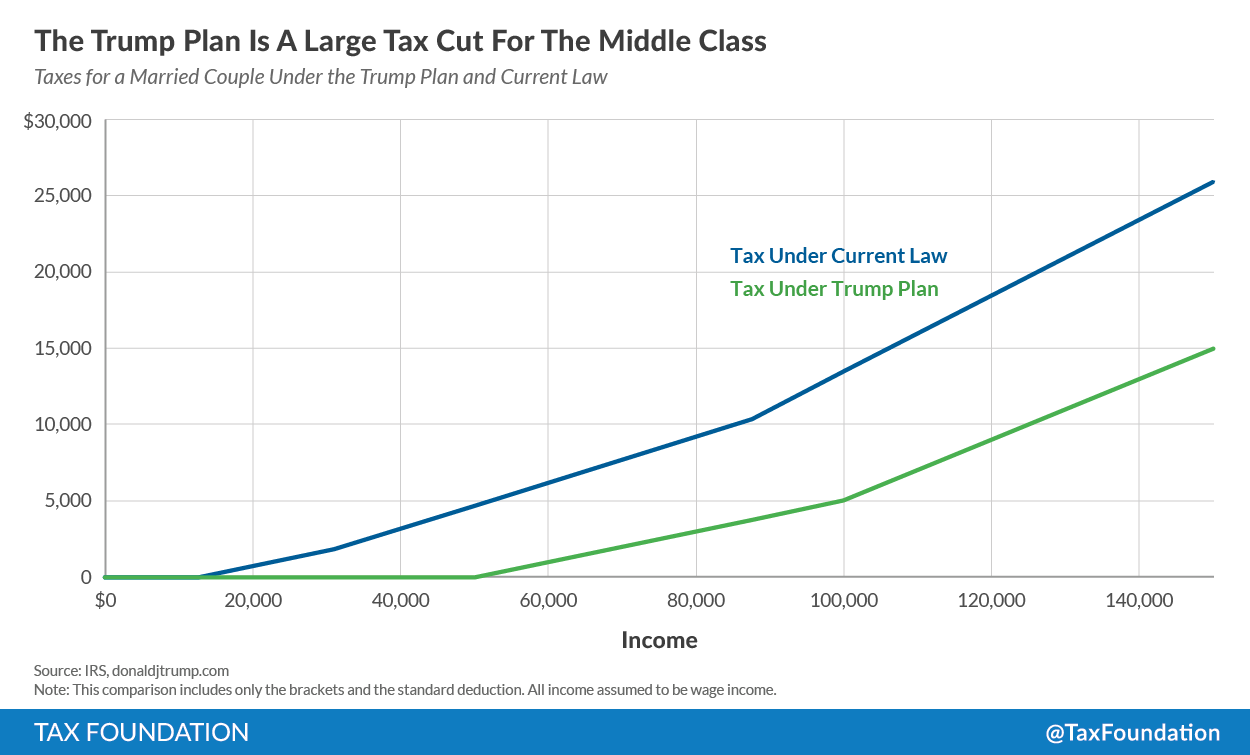

The following graph (hypothetical example, replace with actual data from reputable sources like the CBO or Tax Policy Center) illustrates the projected versus actual revenue impact of a hypothetical GOP tax plan. [Insert graph here showing projected vs. actual revenue]. Different methodologies used to estimate revenue impact, such as static scoring and dynamic scoring (discussed in detail later), lead to vastly different results, highlighting the need for transparency and careful scrutiny of these estimations and their influence on the GOP Tax Plan Deficit.

Assessing the Spending Projections in GOP Tax Plans

Analyzing the impact of a GOP tax plan on the deficit also requires careful consideration of spending projections. This involves examining both mandatory and discretionary spending.

Mandatory Spending and Entitlement Programs

- Tax cuts can indirectly increase mandatory spending. Slower economic growth, potentially a consequence of tax cuts, can increase the number of individuals needing government assistance programs like Social Security and Medicare, increasing their costs.

- Most GOP plans do not propose significant changes to entitlement programs to offset revenue losses. This means that reduced tax revenue is often not accompanied by corresponding reductions in spending, widening the deficit.

- The long-term implications for entitlement programs are significant. The aging population and rising healthcare costs create substantial pressures on these programs, further exacerbated by decreased tax revenue.

Understanding the relationship between economic growth, tax cuts, and the cost of entitlement programs is crucial for accurate deficit projections. A decrease in economic growth following tax cuts may lead to a higher cost of these programs, adding to the overall deficit and its impact on the GOP Tax Plan Deficit.

Discretionary Spending and Defense Budgets

- GOP tax plans may lead to cuts in discretionary spending. To limit the deficit, cuts to areas such as education, infrastructure, or other government programs may be necessary to compensate for revenue lost due to tax cuts.

- Trade-offs between tax cuts and government programs are inherent. Decisions must be made regarding the allocation of limited resources, with tax cuts potentially coming at the expense of other government priorities.

- Increased borrowing may be necessary to finance the deficit. If tax cuts are not accompanied by spending reductions, increased government borrowing may be required to cover the shortfall, potentially leading to higher national debt.

Analyzing historical trends in discretionary spending as a percentage of GDP can illustrate the potential consequences of substantial tax cuts. [Insert graph or data here showing historical trends in discretionary spending]. The political complexities involved in reducing discretionary spending further complicate the issue, and their influence on the GOP Tax Plan Deficit.

Dynamic Scoring vs. Static Scoring: Understanding the Methodology

The choice of scoring methodology significantly influences the projected impact of a GOP tax plan on the deficit.

The Differences and Implications

- Static scoring assumes no change in economic behavior in response to tax changes. It simply calculates the direct revenue impact of tax cuts without considering any potential indirect effects.

- Dynamic scoring incorporates the effects of tax changes on economic behavior. It assumes that tax cuts might stimulate economic activity, leading to increased tax revenues in the long run, albeit with potentially uncertain timing.

- Both methods have inherent biases. Static scoring tends to underestimate the potential benefits of tax cuts, while dynamic scoring can overestimate them due to its reliance on complex and often uncertain economic models.

Using different scoring methods can lead to vastly different conclusions regarding the deficit impact. For instance, static scoring might show a significant increase in the deficit, while dynamic scoring might predict a smaller increase or even a decrease. This difference in methodology significantly affects the credibility of deficit reduction claims and their relationship to the GOP Tax Plan Deficit.

Conclusion

This article has examined the mathematical underpinnings of the GOP tax plan's claims regarding deficit reduction. By analyzing revenue projections, spending estimates, and the different scoring methodologies used, we've shown that the impact on the deficit is complex and depends heavily on several key assumptions, particularly regarding economic growth. The historical data suggests that the projected deficit reduction often falls short of reality.

Understanding the complexities of the GOP Tax Plan and its potential impact on the deficit is crucial for informed civic engagement. Further research and critical analysis of future GOP Tax Plan proposals, focusing on transparent and robust economic modeling, are necessary to accurately assess their fiscal impact on the national debt. Continue your research on the GOP Tax Plan Deficit to form your own informed opinion. Investigate the methodology used in future proposals, specifically looking at how different economic models and scoring methods affect projections of the GOP Tax Plan and its effect on the deficit.

Featured Posts

-

Honest Review Young Playwrights Watercolor Themed Play

May 21, 2025

Honest Review Young Playwrights Watercolor Themed Play

May 21, 2025 -

Abn Amro Hogere Aex Koers Na Positieve Kwartaalcijfers

May 21, 2025

Abn Amro Hogere Aex Koers Na Positieve Kwartaalcijfers

May 21, 2025 -

Fridays D Wave Quantum Qbts Stock Rally A Detailed Look

May 21, 2025

Fridays D Wave Quantum Qbts Stock Rally A Detailed Look

May 21, 2025 -

Blockbusters Bgt Special The Ultimate Review

May 21, 2025

Blockbusters Bgt Special The Ultimate Review

May 21, 2025 -

Uk Luxury Lobby Blames Brexit For Slower Eu Export Growth

May 21, 2025

Uk Luxury Lobby Blames Brexit For Slower Eu Export Growth

May 21, 2025

Latest Posts

-

Fsv Mainz 05 Vs Bayer 04 Leverkusen Matchday 34 Match Report And Highlights

May 21, 2025

Fsv Mainz 05 Vs Bayer 04 Leverkusen Matchday 34 Match Report And Highlights

May 21, 2025 -

Live Bundesliga Streaming Best Options And Where To Watch

May 21, 2025

Live Bundesliga Streaming Best Options And Where To Watch

May 21, 2025 -

Bundesliga Matchday 34 Fsv Mainz 05 Vs Bayer 04 Leverkusen Highlights And Full Match Report

May 21, 2025

Bundesliga Matchday 34 Fsv Mainz 05 Vs Bayer 04 Leverkusen Highlights And Full Match Report

May 21, 2025 -

Strengthening Your Resilience A Guide To Mental Well Being

May 21, 2025

Strengthening Your Resilience A Guide To Mental Well Being

May 21, 2025 -

Watch For Damaging Winds Fast Moving Storms

May 21, 2025

Watch For Damaging Winds Fast Moving Storms

May 21, 2025