Gold's 2025 Slump: Two Straight Weeks Of Losses

Table of Contents

The precious metals market has seen a notable shift, with gold prices experiencing a concerning slump. Two consecutive weeks of losses in 2025 have left investors questioning the future of this traditionally safe-haven asset. This unexpected downturn, impacting gold investment strategies worldwide, necessitates a closer look at the underlying causes. This article will delve into the potential factors behind this decline, examining various economic and geopolitical forces influencing gold's performance.

Rising Interest Rates and Their Impact on Gold Prices

Gold, a non-interest-bearing asset, traditionally exhibits an inverse relationship with interest rates. This means that as interest rates rise, gold prices tend to fall, and vice-versa. This is primarily because higher interest rates make holding assets that don't generate returns, like gold, less attractive.

- Increased interest rates make holding non-interest-bearing assets like gold less attractive. Investors are incentivized to shift their capital towards interest-bearing instruments like bonds and savings accounts offering higher yields.

- Higher yields on bonds and other investments draw capital away from gold. The opportunity cost of holding gold increases as alternative investments become more lucrative.

- The Federal Reserve's monetary policy significantly influences gold prices. Recent aggressive interest rate hikes by the Federal Reserve in an attempt to combat inflation have directly contributed to the decreased demand for gold.

- Recent interest rate hikes correlate strongly with the gold price decline. Analyzing the correlation between the timing of rate increases and the subsequent drops in gold prices provides compelling evidence of this relationship.

[Insert relevant chart or graph here illustrating the correlation between interest rate hikes and gold price drops]

Strengthening US Dollar and Its Effect on Gold

Gold is priced in US dollars. Therefore, a strong US dollar generally puts downward pressure on gold prices. This is because when the dollar strengthens against other currencies, gold becomes more expensive for investors holding those currencies, thus reducing demand.

- A stronger dollar makes gold more expensive for holders of other currencies, reducing demand. This negatively impacts international investment in gold.

- The current USD strength is directly related to recent gold price drops. The dollar's recent surge has coincided with a significant decline in gold's value.

- Global economic factors impacting the USD's strength influence gold prices. Factors like global economic growth, inflation differentials, and geopolitical stability all contribute to the dollar's strength and, consequently, gold's price.

[Insert examples of currency fluctuations and their corresponding impact on the gold price here.]

Geopolitical Factors Influencing Gold's Performance

Gold is often seen as a safe-haven asset during times of geopolitical uncertainty. However, the recent gold slump is somewhat counterintuitive, given the ongoing global geopolitical tensions.

- Recent geopolitical events, such as [mention specific events if applicable], have impacted investor confidence. While typically a driver of gold price increases, these events haven't had the anticipated effect.

- Gold typically performs as a safe-haven asset during times of uncertainty. However, this hasn't been the case in the current climate, suggesting other factors are at play.

- The unexpected stability in certain geopolitical areas may be reducing demand for gold as a safe haven. This unexpected calm may be a contributing factor to the current downturn.

[Insert data points or examples supporting the analysis of geopolitical factors.]

Inflation's Unexpected Role in the Gold Slump

Historically, gold has served as a hedge against inflation. However, the current gold price decline is occurring despite persistent inflationary pressures.

- Typically, inflation drives up gold prices as investors seek to protect their purchasing power. This traditional relationship is currently not being observed.

- Why inflation might not be driving gold prices upwards in this instance is complex. Other economic factors may be outweighing inflation's typical effect on gold.

- The significant increase in interest rates may be overshadowing the effects of inflation. The current monetary policy response to inflation may be a major contributing factor.

Conclusion

The recent two-week slump in gold prices in 2025 is a complex issue influenced by several interacting factors. Rising interest rates, a strong US dollar, and unexpectedly stable geopolitical conditions, alongside a surprising inflation impact, all contribute to the current market trend. Understanding these dynamics is crucial for navigating the gold market.

Call to Action: While the current gold slump presents challenges, staying informed about the evolving dynamics influencing gold's 2025 performance is critical. Monitor interest rate changes, USD strength, and geopolitical developments for potential shifts in the gold market. Stay tuned for further analysis on gold price fluctuations and insightful perspectives on gold investing strategies. Continue to research the causes of this gold's 2025 slump to make informed investment decisions.

Featured Posts

-

Election Outcome And Its Effect On Australian Asset Markets

May 06, 2025

Election Outcome And Its Effect On Australian Asset Markets

May 06, 2025 -

Arnold Schwarzenegger Bueszke Fiara Joseph Baena Sikertoertenete

May 06, 2025

Arnold Schwarzenegger Bueszke Fiara Joseph Baena Sikertoertenete

May 06, 2025 -

Gigi Hadid Celebrates 30th Birthday Confirms Bradley Cooper Relationship On Instagram

May 06, 2025

Gigi Hadid Celebrates 30th Birthday Confirms Bradley Cooper Relationship On Instagram

May 06, 2025 -

Jeffrey Goldberg And National Defense Information Benny Johnson Weighs In

May 06, 2025

Jeffrey Goldberg And National Defense Information Benny Johnson Weighs In

May 06, 2025 -

Cord Cutters Guide Watching March Madness Online

May 06, 2025

Cord Cutters Guide Watching March Madness Online

May 06, 2025

Latest Posts

-

Dylan Beard Balancing A Deli Job And Elite Track Career

May 06, 2025

Dylan Beard Balancing A Deli Job And Elite Track Career

May 06, 2025 -

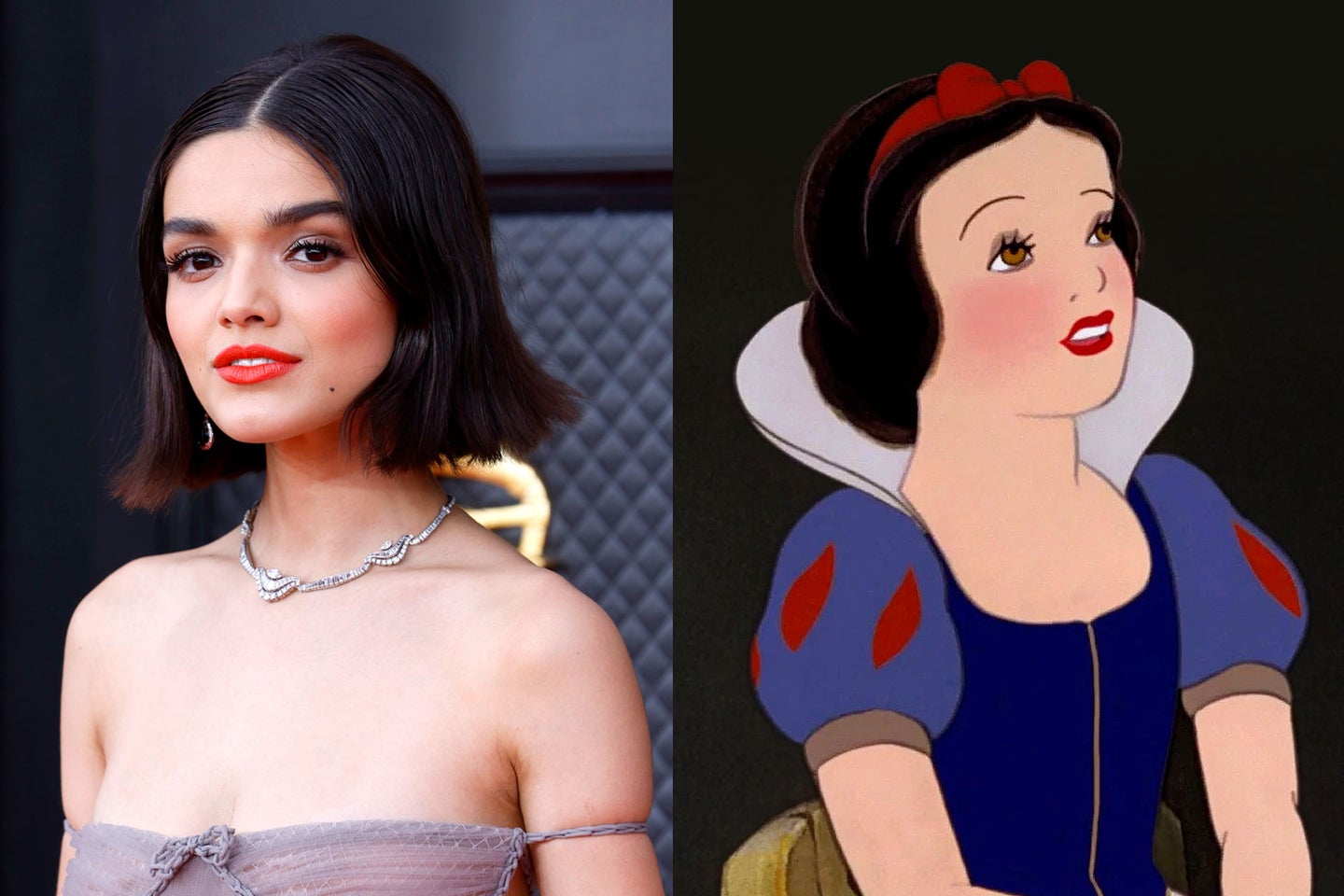

Snow White Controversy Doesnt Stop Rachel Zegler From Gracing The Met Gala Red Carpet

May 06, 2025

Snow White Controversy Doesnt Stop Rachel Zegler From Gracing The Met Gala Red Carpet

May 06, 2025 -

From Walmart Deli To Track Star Dylan Beards Story

May 06, 2025

From Walmart Deli To Track Star Dylan Beards Story

May 06, 2025 -

Celebrating Black Women A Nashville Mural Initiative

May 06, 2025

Celebrating Black Women A Nashville Mural Initiative

May 06, 2025 -

Nikes New Fitness Venture With Kim Kardashian The Skims Collaboration

May 06, 2025

Nikes New Fitness Venture With Kim Kardashian The Skims Collaboration

May 06, 2025