Gold's 2025 Decline: Back-to-Back Weekly Losses

Table of Contents

Macroeconomic Factors Driving Gold's 2025 Decline

Rising interest rates and a strengthening US dollar are significantly impacting gold prices in 2025. These macroeconomic factors are intertwined and exert considerable downward pressure on the gold market downturn.

-

Increased Interest Rates: Higher interest rates make non-yielding assets like gold less attractive. Investors can earn a return on their investments in interest-bearing accounts, reducing the appeal of holding gold, which doesn't generate income. This shift in investment preference directly contributes to the weekly gold losses.

-

Strong US Dollar: A strengthening US dollar makes gold more expensive for buyers using other currencies. This reduces international demand and further weakens the gold price. The dollar's strength is often inversely correlated with gold prices, exacerbating the gold price decline 2025.

-

Inflation Expectations: While gold is often considered a hedge against inflation, changing inflation expectations can influence demand. If inflation is anticipated to moderate, the perceived need for gold as an inflation hedge diminishes, leading to decreased demand and contributing to the current gold market downturn.

-

Monetary Policy Changes: Central bank actions, such as adjustments to interest rates or quantitative easing programs, significantly impact investor sentiment and gold prices. Changes in monetary policy can influence inflation expectations and the overall investment climate, contributing to the gold price decline 2025. Monitoring central bank announcements is crucial for understanding the market's reaction.

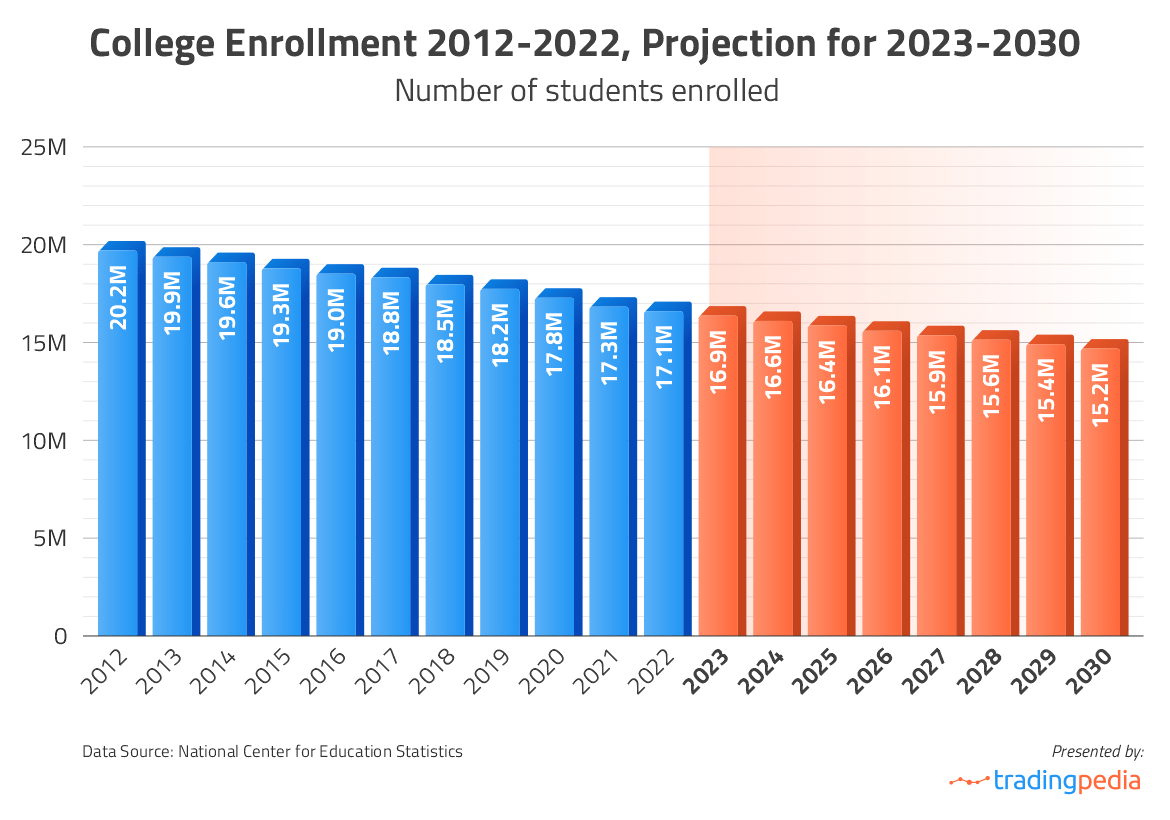

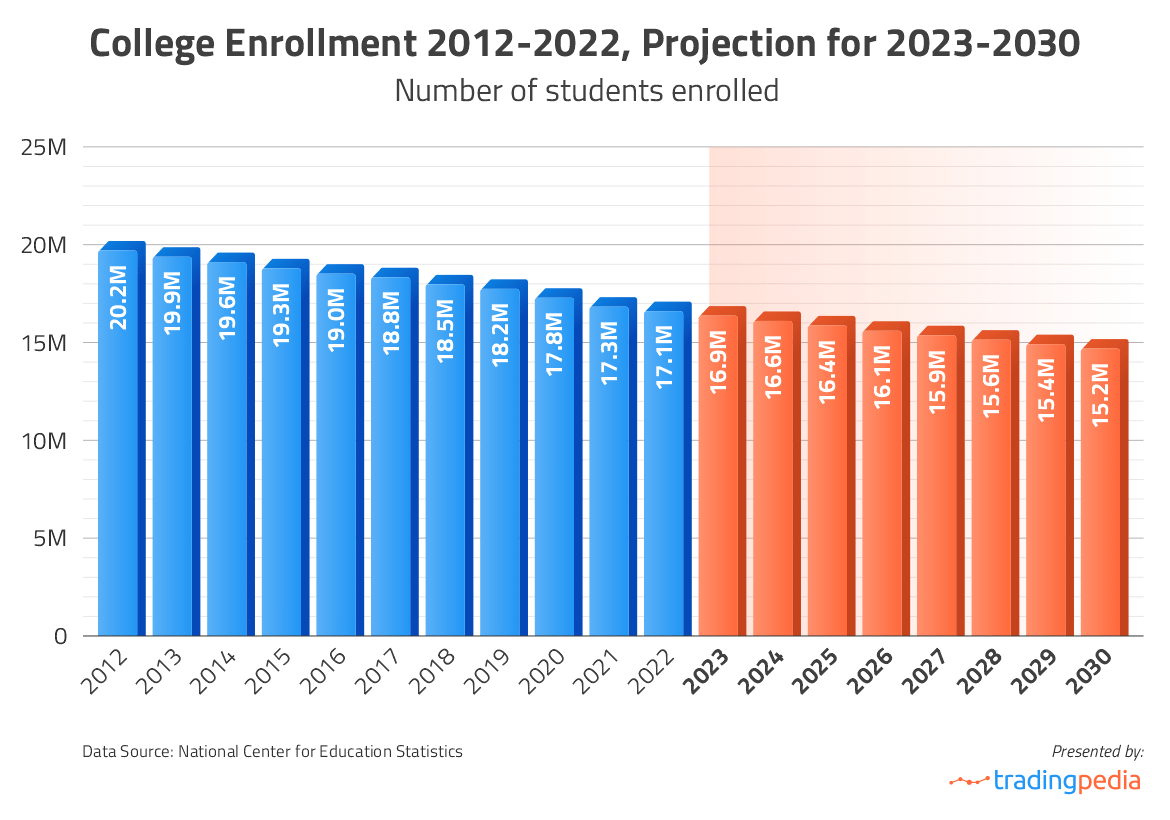

(Insert relevant chart or graph showing correlation between interest rates, US dollar strength, and gold prices)

Geopolitical Events and their Impact on Gold Prices in 2025

Geopolitical events play a crucial role in influencing investor sentiment and, consequently, gold prices. While a period of relative calm might be observed, unexpected shifts can dramatically alter the market.

-

Easing Geopolitical Tensions: Reduced geopolitical uncertainty can decrease the safe-haven demand for gold. Investors might shift their focus to riskier assets, leading to decreased gold demand and contributing to the weekly gold losses.

-

Global Market Uncertainty: Despite periods of calm, global market uncertainty can still affect investor confidence. Unexpected events can trigger a flight to safety, increasing gold demand and temporarily reversing the downward trend. However, sustained uncertainty isn't inherently bullish for gold.

-

Unexpected Events and Trade Relations: Sudden changes in international trade relations, unexpected political upheavals, or major conflicts can create volatility and influence gold prices. These events can lead to both short-term spikes and long-term shifts in the gold market.

(Include links to reputable news sources discussing relevant geopolitical events and their impact on gold)

Technical Analysis: Chart Patterns Suggesting a Gold Price Decline

Technical analysis of gold price charts reveals indicators suggesting a continuation of the downward trend. Examining chart patterns and indicators can provide valuable insights into the potential future direction of gold prices.

-

Chart Patterns: The appearance of bearish chart patterns, such as head and shoulders or double tops, could signal a continuation of the decline. These patterns, when combined with other indicators, provide stronger signals.

-

Support and Resistance Levels: Identifying support and resistance levels is crucial for understanding potential price reversals. A break below a key support level can accelerate the decline, while a bounce off resistance can signal temporary price stabilization.

-

Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, can indicate the prevailing trend. A bearish crossover (shorter-term moving average crossing below a longer-term moving average) suggests a strengthening downtrend.

(Insert relevant charts and images illustrating technical indicators and chart patterns)

Investor Sentiment and Gold's 2025 Performance

Changes in investor sentiment toward gold significantly impact its price. Analyzing investment flows provides valuable insight into market dynamics.

-

ETF Holdings: Monitoring changes in gold-backed exchange-traded fund (ETF) holdings reveals the overall investor appetite for gold. Decreasing holdings suggest reduced confidence.

-

Investor Confidence: Overall investor confidence levels influence gold demand. Periods of low confidence can drive investors towards safe-haven assets like gold, potentially mitigating the decline. Conversely, increasing confidence can lead investors to riskier assets, reducing gold demand.

-

Safe-Haven Status: The perception of gold as a safe-haven asset is crucial. Events impacting this perception directly affect investor behavior and gold prices.

Conclusion: Navigating Gold's 2025 Decline: Looking Ahead

Gold's 2025 decline is a complex issue stemming from a confluence of macroeconomic factors, geopolitical events, technical analysis indicators, and shifting investor sentiment. Rising interest rates, a strong US dollar, and changing inflation expectations contribute to reduced demand. Geopolitical factors, while currently relatively calm, can quickly shift the market. Technical indicators suggest a bearish trend, and waning investor confidence further dampens gold's appeal. The future trajectory of gold prices remains uncertain, with various factors potentially influencing price movements. Staying informed about macroeconomic conditions, geopolitical events, and technical analysis is crucial for navigating this dynamic market. Consider diversifying your portfolio to mitigate the risks associated with Gold's 2025 Decline. For further updates and analysis on the gold market, [link to relevant resource].

Featured Posts

-

Mark Carneys White House Meeting With Trump What To Expect

May 04, 2025

Mark Carneys White House Meeting With Trump What To Expect

May 04, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging After La Fires

May 04, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging After La Fires

May 04, 2025 -

La Fire Aftermath Investigation Into Landlord Price Gouging Practices

May 04, 2025

La Fire Aftermath Investigation Into Landlord Price Gouging Practices

May 04, 2025 -

Ufc 314 Ppv Updated Fight Card After Prates Vs Neal Cancellation

May 04, 2025

Ufc 314 Ppv Updated Fight Card After Prates Vs Neal Cancellation

May 04, 2025 -

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods

May 04, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods

May 04, 2025

Latest Posts

-

Chandler Vs Pimblett Ufc 314 Co Main Event Fight Predictions And Betting Odds

May 04, 2025

Chandler Vs Pimblett Ufc 314 Co Main Event Fight Predictions And Betting Odds

May 04, 2025 -

Ufc 314 Co Main Event Chandler Vs Pimblett Odds And Predictions

May 04, 2025

Ufc 314 Co Main Event Chandler Vs Pimblett Odds And Predictions

May 04, 2025 -

Controversy Brews Paddy Pimbletts Concerns About Michael Chandler Before Ufc 314

May 04, 2025

Controversy Brews Paddy Pimbletts Concerns About Michael Chandler Before Ufc 314

May 04, 2025 -

Pimblett Vs Chandler Ufc 314 Referee Intervention Requested Due To Alleged Foul Play

May 04, 2025

Pimblett Vs Chandler Ufc 314 Referee Intervention Requested Due To Alleged Foul Play

May 04, 2025 -

Ufc 314 Pimblett Accuses Chandler Of Unfair Fighting Techniques

May 04, 2025

Ufc 314 Pimblett Accuses Chandler Of Unfair Fighting Techniques

May 04, 2025