Gold Road Acquisition: Gold Fields' A$3.7 Billion Investment Strategy

Table of Contents

The Rationale Behind the Gold Road Acquisition

Gold Fields' decision to acquire Gold Road wasn't arbitrary; it's a strategic move driven by several key factors.

Strategic Expansion in a Prime Location

The acquisition significantly strengthens Gold Fields' presence in Western Australia's prolific Yilgarn Craton, renowned for its high-grade gold deposits. This strategic expansion offers numerous advantages:

- Access to existing infrastructure: Gold Road's established infrastructure minimizes upfront capital expenditure for Gold Fields, accelerating project timelines and reducing overall costs. This is crucial in optimizing return on investment for this significant Gold Road acquisition.

- Portfolio diversification: Adding Gold Road's assets diversifies Gold Fields' portfolio, mitigating the risks associated with over-reliance on single-mine operations. This diversification strategy is a cornerstone of responsible resource management.

- Synergies with existing operations: Gold Fields can leverage existing operational infrastructure and expertise in the region, leading to significant operational efficiencies and cost savings. The integration of these resources will be key to maximizing the value of the Gold Road acquisition.

Securing High-Grade Gold Resources

The Gold Road acquisition provides Gold Fields with access to substantial high-grade gold reserves and resources, crucial for bolstering its long-term production profile.

- Robust gold reserves: Gold Road's existing gold reserves represent a significant addition to Gold Fields' production capacity, extending its operational lifespan and securing future revenue streams. A detailed assessment of these reserves and their projected lifespan was undoubtedly a key factor in the Gold Road acquisition decision.

- Exploration potential: The acquired assets offer significant potential for further exploration and the discovery of additional gold resources, enhancing the long-term value of this investment. This exploration potential adds significant upside to the Gold Road acquisition.

- Increased production: The integration of Gold Road's resources will lead to a noticeable increase in Gold Fields' overall gold production output and revenue streams, contributing significantly to its profitability.

Financial Synergies and Cost Savings

The integration of Gold Road into Gold Fields is expected to yield considerable financial synergies and cost savings through economies of scale and streamlined operations.

- Reduced overhead: Combining administrative and operational functions is anticipated to reduce overhead costs significantly, boosting profitability margins. This efficiency is a critical element in the success of the Gold Road acquisition.

- Improved procurement: Gold Fields' increased purchasing power will lead to more favorable procurement contracts, generating further cost savings. This is a typical benefit of mergers and acquisitions in the mining sector, as seen in the Gold Road acquisition.

- Strong ROI: Financial modeling conducted by Gold Fields likely projects a substantial return on investment, justifying the A$3.7 billion expenditure. The detailed financial projections supporting the Gold Road acquisition were undoubtedly a crucial part of the decision-making process.

Impact and Implications of the Acquisition

The Gold Road acquisition carries significant implications for both Gold Fields and Gold Road Resources, as well as the wider gold mining market.

Benefits for Gold Fields

This Gold Road acquisition promises substantial benefits for Gold Fields, strengthening its position in the global gold mining industry.

- Increased production and revenue: The acquisition directly translates into a projected increase in gold production volume and, consequently, a rise in revenue. This is a central expectation of the Gold Road acquisition.

- Improved profitability: Enhanced operational efficiencies and synergies will contribute to improved profitability margins for Gold Fields. The cost-saving measures are designed to significantly improve the bottom line of the Gold Road acquisition.

- Enhanced investor confidence: The strategic nature of the acquisition is expected to boost investor confidence and ultimately increase shareholder value. A successful integration of the Gold Road acquisition will be vital for demonstrating this confidence.

Implications for Gold Road Resources

For Gold Road Resources, the acquisition offers significant advantages for its shareholders and employees.

- Premium for shareholders: Gold Road shareholders receive a substantial premium for their shares, representing a lucrative outcome. The acquisition price and premium offered played a vital role in the Gold Road acquisition.

- Smooth transition: A well-defined transition plan ensures a smooth integration of Gold Road's employees into Gold Fields' operations, minimizing disruption. The integration process will be critical for success in the Gold Road acquisition.

- Future development: Gold Road's assets will benefit from Gold Fields' expertise and resources, ensuring their continued development and maximizing their long-term potential. This long-term perspective is crucial for evaluating the full impact of the Gold Road acquisition.

Market Reactions and Future Outlook

The market's reaction to the announcement, gold price forecasts, and predictions for future operations all contribute to the overall assessment of the Gold Road acquisition.

- Market response: Stock market performance of both Gold Fields and Gold Road following the announcement will be a key indicator of market sentiment toward the acquisition.

- Analyst predictions: Analyst commentary and predictions will offer valuable insights into the potential success of the integration and the long-term impact of the Gold Road acquisition.

- Industry outlook: The long-term outlook for the gold mining industry and prevailing gold prices will significantly influence the ultimate value and success of this investment. The future of gold prices will play a significant role in evaluating the success of the Gold Road acquisition.

Conclusion

The Gold Road acquisition marks a significant strategic move for Gold Fields, positioning it for substantial growth and long-term success within the global gold mining sector. By securing access to high-grade gold resources, leveraging operational synergies, and realizing cost efficiencies, Gold Fields has demonstrated a clear vision for its future. The A$3.7 billion investment's success will be closely monitored, potentially shaping the future of gold mining in Australia and beyond. To stay informed on the latest developments in the Gold Road acquisition and other major mining investments, continue to follow our updates. Understanding the Gold Road acquisition and its impact is vital for investors and industry professionals.

Featured Posts

-

Polska Firma Dostarczy Trotyl Dla Armii Amerykanskiej

May 06, 2025

Polska Firma Dostarczy Trotyl Dla Armii Amerykanskiej

May 06, 2025 -

Hollywood At A Standstill The Joint Actors And Writers Strike

May 06, 2025

Hollywood At A Standstill The Joint Actors And Writers Strike

May 06, 2025 -

Brazil Arrests Suspect In Lady Gaga Bomb Plot Targeting Lgbtq Community Alleged Child Sacrifice

May 06, 2025

Brazil Arrests Suspect In Lady Gaga Bomb Plot Targeting Lgbtq Community Alleged Child Sacrifice

May 06, 2025 -

Romania Election Runoff Far Right Vs Centrist Mayor

May 06, 2025

Romania Election Runoff Far Right Vs Centrist Mayor

May 06, 2025 -

Crypto Entrepreneurs Father Rescued Following Kidnapping And Injury

May 06, 2025

Crypto Entrepreneurs Father Rescued Following Kidnapping And Injury

May 06, 2025

Latest Posts

-

Dylan Beard Balancing A Deli Job And Elite Track Career

May 06, 2025

Dylan Beard Balancing A Deli Job And Elite Track Career

May 06, 2025 -

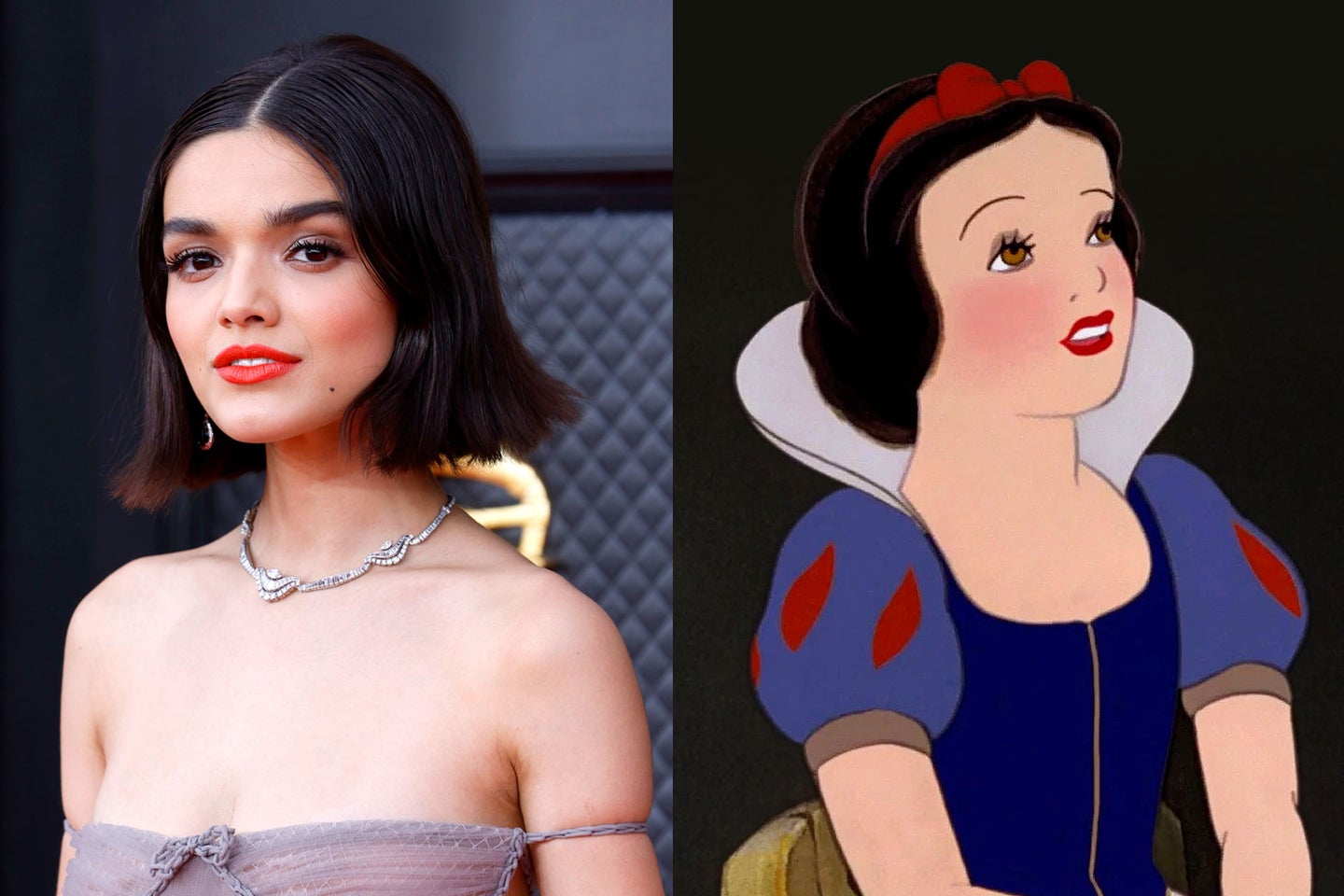

Snow White Controversy Doesnt Stop Rachel Zegler From Gracing The Met Gala Red Carpet

May 06, 2025

Snow White Controversy Doesnt Stop Rachel Zegler From Gracing The Met Gala Red Carpet

May 06, 2025 -

From Walmart Deli To Track Star Dylan Beards Story

May 06, 2025

From Walmart Deli To Track Star Dylan Beards Story

May 06, 2025 -

Celebrating Black Women A Nashville Mural Initiative

May 06, 2025

Celebrating Black Women A Nashville Mural Initiative

May 06, 2025 -

Nikes New Fitness Venture With Kim Kardashian The Skims Collaboration

May 06, 2025

Nikes New Fitness Venture With Kim Kardashian The Skims Collaboration

May 06, 2025