Gold Price Record Rally: Bullion As A Trade War Safe Haven

Table of Contents

Understanding the Current Gold Price Record Rally

Factors Driving Gold Prices Higher

Several factors contribute to the current gold price surge. The ongoing trade disputes between major global economies have created significant uncertainty in the financial markets, driving investors towards the perceived safety of gold. Other key drivers include:

- Increased global uncertainty due to trade disputes: The threat of tariffs and trade wars creates significant economic uncertainty, making gold a more attractive investment.

- Weakening US dollar: A weaker dollar typically boosts the price of gold, as it becomes cheaper for investors holding other currencies to purchase.

- Negative real interest rates: In many developed economies, real interest rates (nominal interest rates minus inflation) are negative. This makes holding cash less attractive, pushing investors towards assets like gold that offer a store of value.

- Safe-haven demand: Investors seek protection from market volatility, flocking to gold as a traditional safe haven asset during times of economic and political stress. This "flight to safety" significantly impacts gold prices.

- Supply and demand dynamics: While gold production is relatively stable, increasing demand, especially from central banks and investors, can outpace supply, driving prices higher. [Insert relevant chart/statistic showing supply vs demand].

Historical Context: Gold's Performance During Previous Trade Wars or Economic Downturns

Gold has historically performed well during periods of economic uncertainty and geopolitical tension. For example, [cite example of gold's performance during a past trade war or economic downturn, include a chart if possible]. This historical performance reinforces its reputation as a reliable safe haven asset.

Gold as a Hedge Against Trade War Uncertainty

Diversification and Portfolio Protection

Gold acts as a crucial diversifier in investment portfolios. It often exhibits a negative correlation with other asset classes like stocks and bonds, meaning it tends to perform well when these other assets are struggling. This characteristic reduces overall portfolio risk, especially during times of economic instability.

- Reduces portfolio volatility: Gold's price fluctuations are often independent of stock and bond markets.

- Preserves capital: It can help maintain the value of your investments during market downturns.

- Improves risk-adjusted returns: By diversifying, investors can potentially improve their overall returns while lowering their risk.

During periods of trade war uncertainty, the benefits of gold diversification become even more pronounced. [Include a chart or table comparing the performance of gold versus stocks and bonds during a period of trade tensions].

Inflation Hedge

Gold is often viewed as an effective inflation hedge. Inflation erodes the purchasing power of fiat currencies, and gold, being a tangible asset, tends to maintain its value or even increase in value during inflationary periods.

- Inflation and gold price correlation: Historically, gold prices have tended to rise alongside inflation.

- Protecting purchasing power: Gold helps preserve the real value of your investments, shielding them from the damaging effects of inflation.

- Historical precedent: [Provide historical examples of gold's performance during inflationary periods].

Investing in Gold During a Trade War

Different Ways to Invest in Gold

There are several ways to gain exposure to gold:

- Physical gold (bars, coins): Offers tangible ownership but requires secure storage and incurs costs associated with purchase, storage, and insurance.

- Gold ETFs (Exchange-Traded Funds): Provide diversified exposure to gold without the need for physical storage. They are easily bought and sold on stock exchanges.

- Gold mining stocks: Investing in companies involved in gold mining offers leveraged exposure to gold prices, but carries higher risk.

- Gold futures contracts: Allow for leveraged exposure and speculation on gold price movements but come with significant risks.

Risk Management Considerations

While gold can offer protection during uncertain times, it's crucial to acknowledge the inherent risks:

- Volatility: Gold prices can fluctuate significantly.

- Diversification within gold: Don't put all your eggs in one basket; diversify your gold investments across different asset classes.

- Long-term perspective: Gold is best viewed as a long-term investment; short-term price fluctuations should be expected.

The Future of Gold and Geopolitical Risks

Predicting future gold price movements

Predicting gold price movements with certainty is impossible. However, several factors could influence future gold prices:

- Ongoing trade tensions: Continued trade disputes will likely support gold's safe-haven demand.

- Central bank policies: Monetary policies, particularly interest rate decisions, significantly affect gold prices.

- Global economic growth: Slowing global growth often increases investor demand for gold.

Gold as a long-term investment

Gold's long-term value proposition remains strong. Its historical performance, combined with its role as a store of value and a hedge against various risks, makes it a compelling asset for long-term investors seeking diversification and protection against uncertainty.

Gold Price Record Rally – A Safe Haven in Uncertain Times

This article has highlighted the record rally in gold prices, explaining its link to escalating trade wars and global uncertainty. Gold's role as a safe haven asset, inflation hedge, and portfolio diversifier has been underscored. We've also explored various investment strategies and risk management considerations. Understanding the benefits of gold as part of a diversified portfolio is crucial during times of economic instability. Learn more about how to leverage the gold price record rally to protect your investments and secure your portfolio with gold – a proven safe haven asset during times of trade war uncertainty.

Featured Posts

-

7 Hot New Orlando Restaurants To Try In 2025 Beyond Disney

Apr 26, 2025

7 Hot New Orlando Restaurants To Try In 2025 Beyond Disney

Apr 26, 2025 -

Analyzing The China Problem Case Studies Of Bmw And Porsches Struggles

Apr 26, 2025

Analyzing The China Problem Case Studies Of Bmw And Porsches Struggles

Apr 26, 2025 -

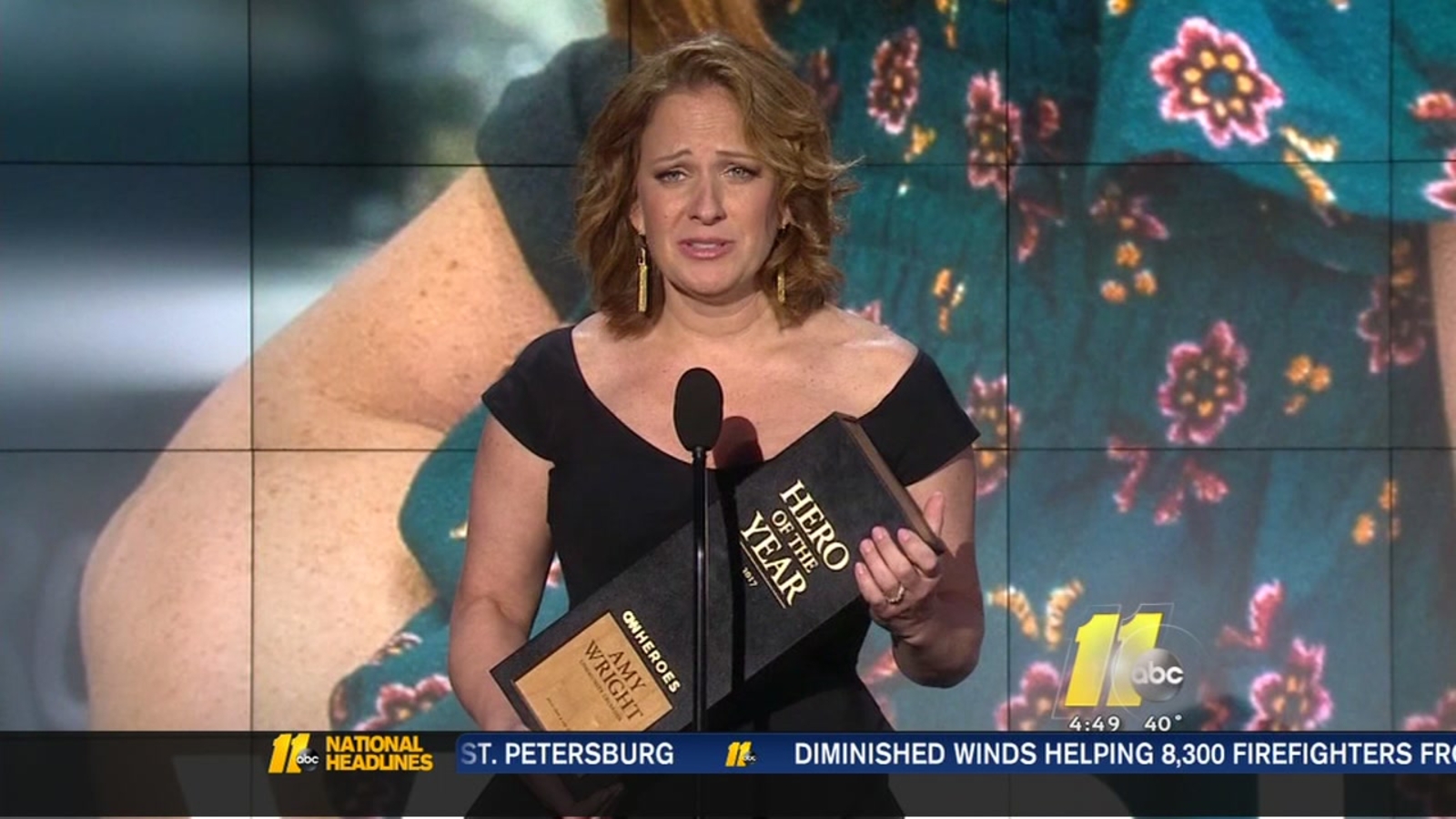

A Cnn Anchors Personal Florida Paradise

Apr 26, 2025

A Cnn Anchors Personal Florida Paradise

Apr 26, 2025 -

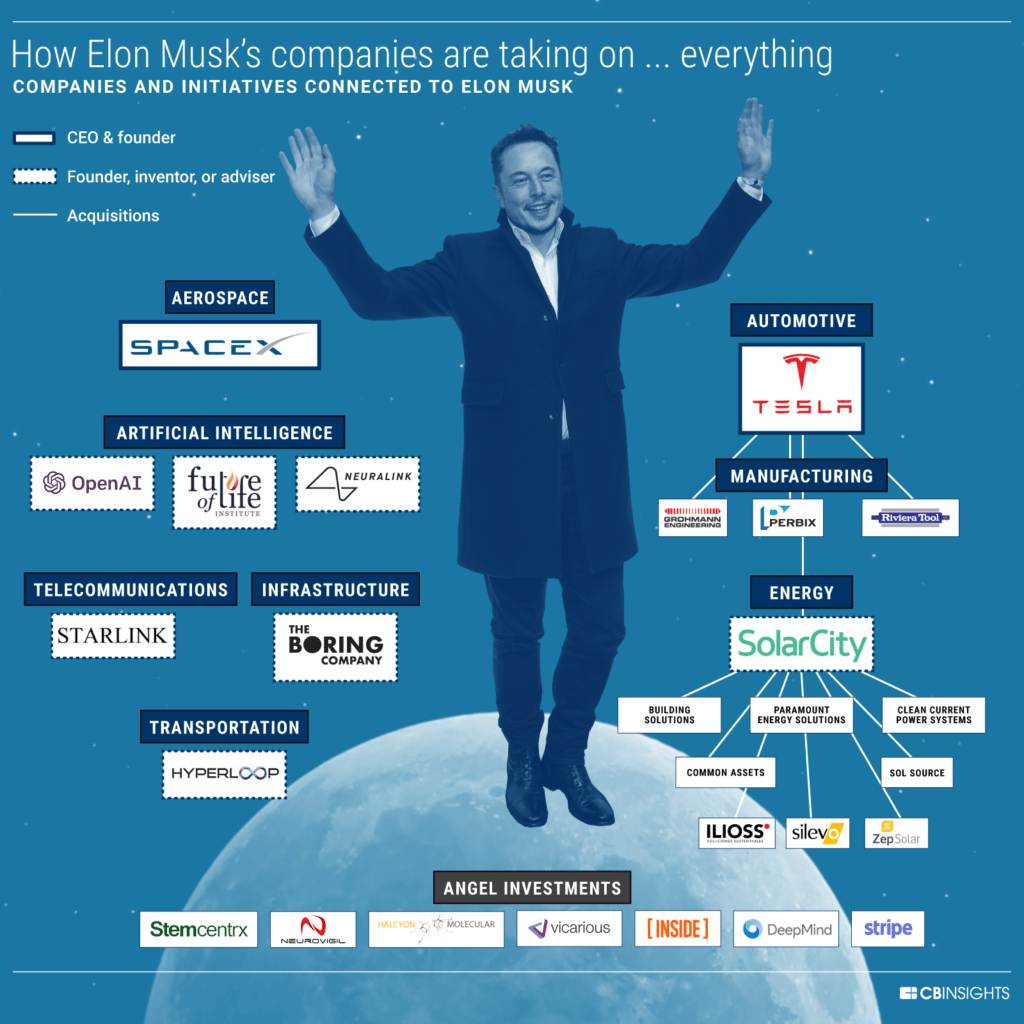

A Side Hustle Access To Elon Musks Private Companies

Apr 26, 2025

A Side Hustle Access To Elon Musks Private Companies

Apr 26, 2025 -

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025

Latest Posts

-

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025 -

Charleston Tennis Pegula Beats Collins In Thrilling Match

Apr 27, 2025

Charleston Tennis Pegula Beats Collins In Thrilling Match

Apr 27, 2025 -

Pegula Triumphs Charleston Open Update

Apr 27, 2025

Pegula Triumphs Charleston Open Update

Apr 27, 2025 -

Charleston Tennis Pegula Claims Victory Against Collins

Apr 27, 2025

Charleston Tennis Pegula Claims Victory Against Collins

Apr 27, 2025 -

Top Seed Pegula Triumphs Over Collins In Charleston Final

Apr 27, 2025

Top Seed Pegula Triumphs Over Collins In Charleston Final

Apr 27, 2025