Gold Price Dips: First Consecutive Weekly Losses Of 2025

Table of Contents

Factors Contributing to the Gold Price Decline

Several interconnected factors have contributed to the recent gold price decline and the consecutive weekly losses. Understanding these elements is crucial for navigating the current gold market volatility.

Strengthening US Dollar

The US dollar and gold prices typically exhibit an inverse relationship. A stronger US dollar makes gold more expensive for holders of other currencies, reducing demand. Recent indicators point to a strengthening USD, impacting gold's appeal as a safe-haven asset.

- The US Dollar Index (DXY) has shown consistent growth over the past few weeks, surpassing key resistance levels.

- Increased US interest rates make the dollar more attractive to investors seeking higher returns, diverting funds away from gold.

- This decreased international demand directly translates into lower gold prices.

Rising Interest Rates

Increased interest rates significantly impact gold investments. Higher rates make holding non-yielding assets like gold less attractive compared to interest-bearing alternatives like bonds and savings accounts.

- The Federal Reserve's recent interest rate hikes have made holding gold a less appealing option for many investors.

- The opportunity cost of holding gold, which offers no interest, increases when interest rates rise. Investors are more likely to shift their funds to higher-yielding investments.

- This shift in investment preference puts downward pressure on gold prices, contributing to the recent gold price dips.

Increased Investor Sentiment

A shift in investor sentiment towards gold can heavily influence its price. Negative news or changing market perceptions can lead to decreased confidence and selling pressure.

- Recent reports highlighting concerns about the global economy have negatively impacted investor sentiment toward gold.

- Alternative investments, such as certain technology stocks, have attracted investor interest, further reducing demand for gold.

- This decreased investor confidence has contributed to the current gold price drop.

Geopolitical Factors

Geopolitical events and uncertainties can significantly impact investor risk appetite and gold prices. However, in this instance, the recent easing of certain geopolitical tensions has reduced the safe-haven demand for gold.

- The recent de-escalation of tensions in [mention specific geopolitical region] has lessened the perceived need for a safe-haven asset like gold.

- Reduced global uncertainty has led to a shift away from gold towards riskier assets perceived to offer higher returns.

- This reduction in safe-haven demand is a contributing factor to the current gold price dips.

Analysis of the Market's Reaction

The gold price dip has had significant ramifications across the gold market, impacting various stakeholders.

Short-Term vs. Long-Term Implications

The short-term implications of this gold price drop suggest further volatility in the near future. However, the long-term outlook for gold remains a subject of debate among analysts.

- Short-term predictions suggest continued price fluctuation, possibly further declines before a potential rebound.

- Long-term projections vary, with some analysts maintaining a bullish outlook for gold due to long-term inflation concerns and geopolitical risks. Others remain cautious.

- This uncertainty highlights the importance of careful risk management for gold investors.

Impact on Gold Mining Companies

The gold price dip directly affects the profitability and stock prices of gold mining companies. Lower gold prices reduce their revenue and margins.

- Major gold mining companies have seen their stock prices decline alongside the gold price.

- Many are likely to implement cost-cutting measures to mitigate the impact of reduced profitability.

- The extent of the impact will vary based on the individual company's operating costs and debt levels.

Implications for Gold Investors

The current market conditions require a cautious approach to gold investment. Investors should carefully evaluate their risk tolerance and investment goals.

- Risk-averse investors may consider holding their current gold positions or diversifying their portfolios.

- More aggressive investors might consider buying the dip, anticipating a future price rebound.

- Thorough research and understanding the factors influencing gold price dips are crucial for informed investment decisions.

Gold Price Dips – What's Next?

In summary, the recent gold price dips are attributable to a confluence of factors including a strengthening US dollar, rising interest rates, decreased investor sentiment, and the easing of certain geopolitical tensions. These factors have created a challenging environment for gold investors.

Key takeaways include the need for careful risk management and a thorough understanding of market dynamics. The short-term outlook is uncertain, while long-term projections vary widely.

Stay tuned for further updates on gold price fluctuations. Understanding the factors influencing gold price dips is crucial for informed investment decisions. Continue researching the gold market and adjust your strategy as needed to navigate the ever-changing landscape of precious metals investment.

Featured Posts

-

Analyzing Marvels Recent Output Identifying Areas For Improvement

May 04, 2025

Analyzing Marvels Recent Output Identifying Areas For Improvement

May 04, 2025 -

In Praise Of A Special Little Bag A Celebration Of Everyday Carry

May 04, 2025

In Praise Of A Special Little Bag A Celebration Of Everyday Carry

May 04, 2025 -

Qua Xua Quen Lang Nay Duoc Dan Thanh Pho Uu Ai Gia 60 000d Kg

May 04, 2025

Qua Xua Quen Lang Nay Duoc Dan Thanh Pho Uu Ai Gia 60 000d Kg

May 04, 2025 -

Actors And Writers Strike Hollywood Faces Unprecedented Production Shutdown

May 04, 2025

Actors And Writers Strike Hollywood Faces Unprecedented Production Shutdown

May 04, 2025 -

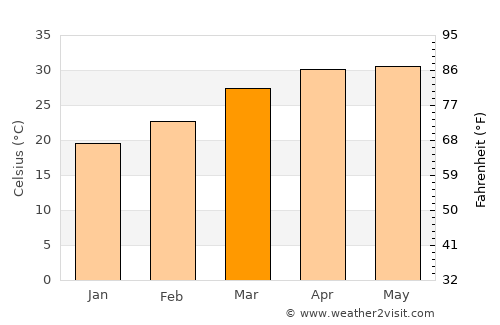

Kolkata Temperature Forecast March Heatwave Warning

May 04, 2025

Kolkata Temperature Forecast March Heatwave Warning

May 04, 2025

Latest Posts

-

West Bengal Holi Weather High Tide And Temperature Forecast

May 04, 2025

West Bengal Holi Weather High Tide And Temperature Forecast

May 04, 2025 -

Wb Weather Update Holi Brings High Tide And Temperature Warnings

May 04, 2025

Wb Weather Update Holi Brings High Tide And Temperature Warnings

May 04, 2025 -

Rising Temperatures In Kolkata March Weather Update And Outlook

May 04, 2025

Rising Temperatures In Kolkata March Weather Update And Outlook

May 04, 2025 -

Rain Forecast For North Bengal Wb Weather Departments Prediction

May 04, 2025

Rain Forecast For North Bengal Wb Weather Departments Prediction

May 04, 2025 -

Me T Department Issues Thunderstorm Warning For Kolkata And Surrounding Areas

May 04, 2025

Me T Department Issues Thunderstorm Warning For Kolkata And Surrounding Areas

May 04, 2025