Gold Market Update: Back-to-Back Weekly Declines For 2025

Table of Contents

Weakening Dollar Strength and its Impact on Gold Prices

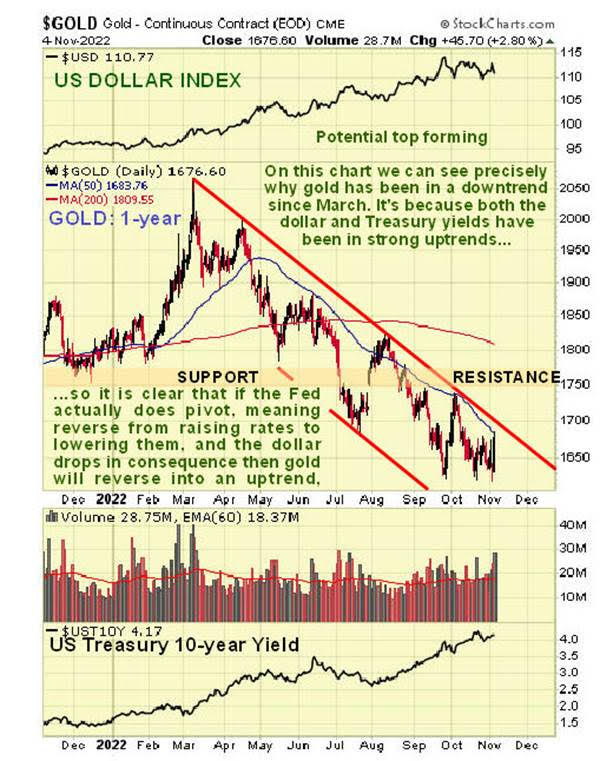

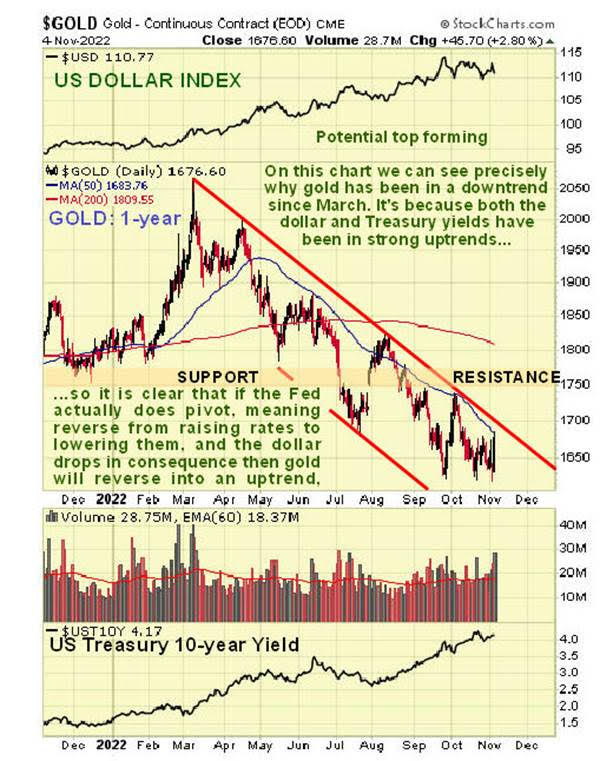

The inverse correlation between the US dollar and gold.

The US dollar and gold prices typically exhibit an inverse correlation. This means that when the dollar strengthens, gold prices tend to fall, and vice versa. This is primarily because gold is priced in US dollars. A stronger dollar makes gold more expensive for holders of other currencies, thus reducing demand and putting downward pressure on the price.

- The inverse relationship: A strengthening dollar increases the purchasing power of the dollar, making gold relatively more expensive for international investors.

- Recent USD movements: The US Dollar Index (DXY) has shown significant strength in recent weeks, climbing [insert percentage]% since [insert date]. This rise in the dollar's value is a key factor contributing to the recent decline in gold prices.

- Data illustration: [Insert a chart or graph clearly showing the inverse correlation between the USD and gold prices over a relevant period, clearly labeled and cited].

Global Economic Uncertainty and its Effect on Safe-Haven Demand for Gold

Gold is often seen as a safe-haven asset, meaning that investors flock to it during times of economic or geopolitical uncertainty. However, the recent decline suggests a reduced safe-haven demand. While global uncertainty persists (e.g., [mention specific geopolitical event or economic concern]), investor confidence in other asset classes may be outweighing the traditional flight to safety.

- Reduced safe-haven demand: Despite ongoing global uncertainties, investor sentiment towards riskier assets has remained relatively positive, lessening the demand for gold as a safe haven.

- Recent geopolitical events: [Mention specific recent events that could be influencing investor sentiment, and explain their impact on gold demand. Example: Easing of geopolitical tensions in [region] has reduced the perceived need for safe-haven assets.]

- Investment flows: Data on recent investment flows into gold ETFs and other gold-related instruments show a [increase/decrease] in investment, indicating [positive/negative] sentiment towards the precious metal. [Cite source].

Impact of Rising Interest Rates on Gold Investment

Opportunity Cost of Holding Gold

Rising interest rates increase the opportunity cost of holding non-yielding assets like gold. Higher interest rates make alternative investments, such as bonds and savings accounts, more attractive. This reduces the appeal of gold, which doesn't pay interest.

- Opportunity cost explained: The opportunity cost is the potential return lost by investing in one asset instead of another. With higher interest rates, the potential returns from bonds and other interest-bearing assets become more significant compared to holding gold.

- Attractiveness of alternative investments: The yield on [mention specific type of bond, e.g., 10-year Treasury bonds] has increased to [percentage]%, making it a more compelling alternative to gold for many investors.

- Current interest rate trends: The Federal Reserve's recent interest rate hikes have contributed to the increased attractiveness of fixed-income investments, impacting gold's appeal.

Inflationary Pressures and Gold's Role as a Hedge

Traditionally, gold has been viewed as a hedge against inflation. However, the current gold price action seems to contradict this traditional role. While inflation remains a concern, other economic factors may be outweighing gold's inflation-hedging properties in the short term.

- Gold as an inflation hedge: Historically, gold prices have tended to rise during periods of high inflation as investors seek to protect their purchasing power.

- Current inflation rates: Current inflation rates are at [percentage]%, [mention whether this is up or down from previous periods].

- Contradictory price action: The recent decline in gold prices despite persistent inflationary pressures suggests that other market forces are currently dominating investor sentiment.

Technical Analysis: Chart Patterns and Price Predictions

Key Support and Resistance Levels

Technical analysis of gold price charts reveals key support and resistance levels. These levels represent price points where buying or selling pressure is expected to be particularly strong.

- Recent price charts: [Insert a chart showing recent gold price movements, clearly marking key support and resistance levels.]

- Support and resistance levels: Based on the chart, key support levels are located at [price levels], while key resistance levels are situated at [price levels].

- Potential price targets: Based on these technical indicators, a short-term price target could be [price level], contingent on a breach of [resistance/support level].

Short-Term vs. Long-Term Outlook for Gold

Short-term predictions based on technical analysis suggest [predict short-term price movement and rationale, e.g., a potential further decline before a rebound]. The long-term outlook, however, depends heavily on fundamental factors such as inflation, economic growth, and geopolitical stability.

- Short-term predictions: Technical indicators suggest a [bullish/bearish] short-term outlook for gold.

- Long-term outlook: The long-term outlook remains uncertain, depending largely on the resolution of macroeconomic uncertainties and the trajectory of inflation.

- Potential catalysts: A significant shift in either inflation, interest rates, or geopolitical events could act as a catalyst to reverse the current downward trend.

Conclusion

The back-to-back weekly declines in the gold market in early 2025 are a result of a confluence of factors, including a stronger dollar, reduced safe-haven demand, and rising interest rates. While these factors currently suppress gold prices, the long-term outlook remains heavily dependent on factors such as inflation and global economic uncertainty. Technical analysis offers short-term predictions, but fundamental analysis is crucial for understanding longer-term price movements.

Call to Action: Stay informed on the latest gold market updates and make informed investment decisions based on a thorough understanding of these fluctuating dynamics. Continue monitoring the gold price and market trends for further insights into the future of this precious metal. Regularly review our website for further analysis on the gold market in 2025 and expert opinions to help you navigate this dynamic market.

Featured Posts

-

Nba Prediction Celtics Vs 76ers Expert Picks Odds And Best Bets 2 20 2025

May 06, 2025

Nba Prediction Celtics Vs 76ers Expert Picks Odds And Best Bets 2 20 2025

May 06, 2025 -

Fortnites Next Big Event Sabrina Carpenters Virtual Concert Announced

May 06, 2025

Fortnites Next Big Event Sabrina Carpenters Virtual Concert Announced

May 06, 2025 -

The Fly Jeff Goldblum Discusses His Idea For An Alternate Ending

May 06, 2025

The Fly Jeff Goldblum Discusses His Idea For An Alternate Ending

May 06, 2025 -

Independence Day A Comprehensive Guide To The Holiday

May 06, 2025

Independence Day A Comprehensive Guide To The Holiday

May 06, 2025 -

Watch Celtics Vs Heat Game Details For February 10th Time Channel Stream

May 06, 2025

Watch Celtics Vs Heat Game Details For February 10th Time Channel Stream

May 06, 2025

Latest Posts

-

The Wiz Coming To The Criterion Collection June 2024 Or Relevant Year

May 06, 2025

The Wiz Coming To The Criterion Collection June 2024 Or Relevant Year

May 06, 2025 -

Diana Rosss Nyc Concert A Stars Promise To Never Retire

May 06, 2025

Diana Rosss Nyc Concert A Stars Promise To Never Retire

May 06, 2025 -

The Wiz Joins The Prestigious Criterion Collection This June

May 06, 2025

The Wiz Joins The Prestigious Criterion Collection This June

May 06, 2025 -

Nyc Show Diana Ross Vows To Continue Performing Declares No Retirement

May 06, 2025

Nyc Show Diana Ross Vows To Continue Performing Declares No Retirement

May 06, 2025 -

The Wiz A Criterion Collection Release In June

May 06, 2025

The Wiz A Criterion Collection Release In June

May 06, 2025