GM's Shifting Strategy: US Tariffs And The Future Of Canadian Auto Production

Table of Contents

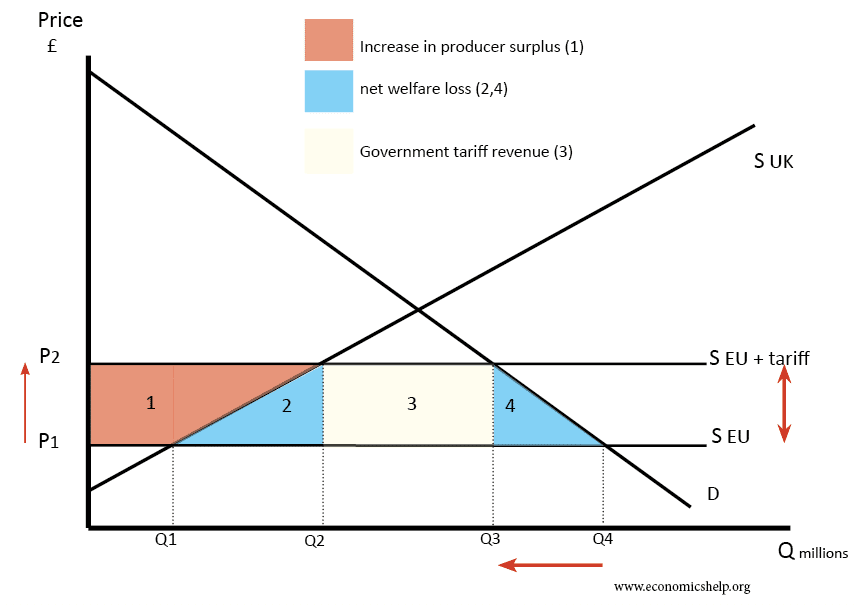

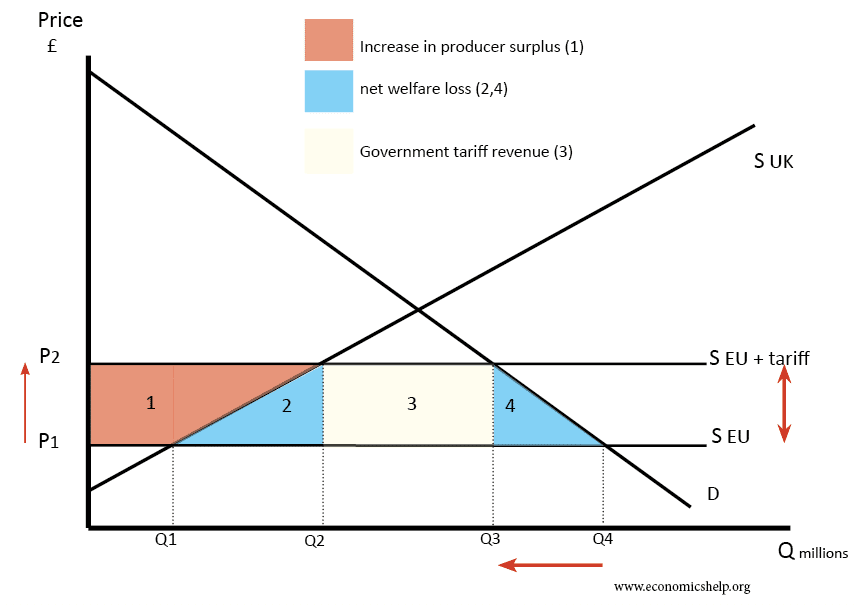

The Impact of US Tariffs on Canadian Auto Parts

US tariffs have significantly increased the cost of Canadian auto parts imported into the US, disrupting the supply chain and impacting Canadian suppliers. This section explores the multifaceted consequences of these tariffs.

-

Increased Import Costs: Tariffs have led to a substantial increase in the cost of Canadian auto parts for GM's US assembly plants. This directly impacts the profitability of both GM and its Canadian suppliers. Data from [cite a relevant source, e.g., a government report or industry analysis] shows a [percentage]% increase in import costs for specific parts since the implementation of the tariffs.

-

Relocation of Sourcing: To mitigate the impact of tariffs, GM is exploring the potential relocation of some of its Canadian parts sourcing to reduce costs. This could involve shifting production to US-based suppliers or exploring alternative sources in other countries.

-

Impact on Canadian Suppliers: Many Canadian auto parts suppliers are facing reduced profitability due to the higher import costs and potential loss of contracts with GM. Smaller suppliers are particularly vulnerable, potentially leading to job losses and business closures in the Canadian automotive parts industry.

-

Tariff Impact on Specific Parts: The impact of tariffs varies across different auto part categories. For example, [mention specific part categories and their corresponding tariff rates and impacts]. This disparity necessitates a nuanced approach to mitigating the effects of tariffs on the supply chain.

-

Alternative Sourcing Strategies: GM is actively exploring alternative sourcing strategies, including increased reliance on US suppliers or suppliers in other countries with more favorable trade agreements. This could lead to a restructuring of GM's global supply chain, with significant implications for Canadian auto parts manufacturers.

GM's Response to Tariff Challenges: Restructuring and Investment

In response to tariff challenges, GM is implementing a multifaceted strategy focused on restructuring, investment, and production optimization.

-

Investment in Canadian Plants: To maintain competitiveness, GM is investing in modernization and upgrades at its Canadian plants. These investments focus on enhancing automation and improving production efficiency to offset the increased costs associated with tariffs. Specific examples of these investments include [mention specific examples if available, e.g., new robotics, upgraded machinery].

-

Automation and Production Optimization: GM is prioritizing automation and advanced manufacturing technologies to reduce labor costs and improve productivity in its Canadian facilities. This includes investing in robotics, AI-driven systems, and other efficiency-enhancing technologies.

-

Plant Closures or Consolidations: While GM has committed to some investments, the possibility of plant closures or consolidations in Canada cannot be ruled out. Such actions would have significant repercussions for employment and economic development in affected communities.

-

Lobbying Efforts: GM is actively involved in lobbying efforts to influence trade policies and potentially secure more favorable trade agreements that benefit its Canadian operations. This includes engagement with both Canadian and US government officials.

-

Long-Term Effects: The long-term effects of GM's adaptation strategies on its Canadian operations will depend on various factors, including the continued evolution of trade policies, the success of its investment initiatives, and the overall competitiveness of the Canadian automotive sector.

The USMCA's Role in Shaping the Future of Canadian Auto Production

The USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA, plays a crucial role in shaping the future of Canadian auto production. This section analyzes the impact of USMCA on GM's Canadian operations.

-

USMCA vs. NAFTA: The USMCA introduced some changes compared to NAFTA, impacting rules of origin and tariff structures. These changes have had both positive and negative implications for the Canadian automotive industry. A key difference is [mention a key difference, e.g., regional content requirements].

-

Rules of Origin: The USMCA's rules of origin for automobiles stipulate specific regional content requirements for vehicles to qualify for tariff-free trade. This places pressure on automakers like GM to increase regional sourcing, potentially affecting their sourcing decisions for Canadian plants.

-

Integration vs. Fragmentation: The USMCA's impact on the North American automotive industry could lead to either increased integration or further fragmentation, depending on how automakers respond to its provisions and the overall trade landscape.

-

USMCA and Future Investment: The USMCA's provisions could foster or hinder future investments in Canadian auto manufacturing, depending on the specific interpretation and implementation of its regulations.

-

Benefits and Challenges: The USMCA presents both benefits and challenges for GM's Canadian operations. While it offers some opportunities for tariff-free trade, it also introduces new regulations and complexities that require careful navigation.

The Future of Canadian Jobs in the Automotive Sector

The shifting strategies of GM, influenced by US tariffs and the USMCA, directly impact the future of Canadian jobs in the automotive sector. The potential consequences include job losses in certain segments due to plant closures or decreased sourcing, but also job creation in other areas due to investments in automation and modernization. Retraining initiatives for workers affected by these changes will be crucial for economic stability in communities dependent on the automotive industry. Government support and investment in workforce development programs are essential for mitigating the negative impacts and preparing workers for the evolving landscape.

Conclusion

GM's response to US tariffs has significantly reshaped its strategy in Canadian auto production, requiring investment in modernization, automation, and navigating the complexities of USMCA. The impact on Canadian suppliers, employment, and the broader economy is substantial and requires ongoing monitoring. The future of Canadian auto production remains intertwined with GM’s strategic decisions and the ongoing impact of US tariffs and the USMCA. Continued monitoring of GM’s actions and the broader effects of USMCA is crucial to understanding the long-term implications for both the Canadian and North American automotive industries. Further research into the specific effects of tariffs on individual Canadian auto parts manufacturers is needed to fully grasp the depth of the current challenge. Stay informed on the latest developments concerning GM's shifting strategy and the future of Canadian auto production.

Featured Posts

-

Ptt Personel Alimi 2025 Kpss Li Ve Kpss Siz Alimlar

May 08, 2025

Ptt Personel Alimi 2025 Kpss Li Ve Kpss Siz Alimlar

May 08, 2025 -

Rogues Unexpected Rise As X Men Leader

May 08, 2025

Rogues Unexpected Rise As X Men Leader

May 08, 2025 -

New War Film Challenges Saving Private Ryans Legacy

May 08, 2025

New War Film Challenges Saving Private Ryans Legacy

May 08, 2025 -

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025 -

Dwp Clarifies New Six Month Rule For Universal Credit Claimants

May 08, 2025

Dwp Clarifies New Six Month Rule For Universal Credit Claimants

May 08, 2025