Global Commodity Markets: 5 Crucial Charts To Monitor This Week

Table of Contents

Crude Oil Price Chart: Geopolitical Risks and Supply Concerns

The crude oil price chart remains a pivotal indicator of global economic health and energy security. Several factors are currently influencing its trajectory, making it a crucial chart to watch this week.

OPEC+ Production Decisions and their Impact

- OPEC+ decisions directly impact global oil supply. Any reduction in production quotas by OPEC+ member countries can lead to tighter supplies and upward pressure on crude oil prices. Conversely, increased production can ease price pressures.

- Current geopolitical tensions are significantly impacting OPEC+ decisions. Sanctions, political instability, and conflicts in key oil-producing regions create uncertainty and ripple effects on global oil supply.

- Market speculation regarding OPEC+ actions fuels volatility. Anticipation of future production adjustments often leads to price swings in the crude oil market before any official announcements are made. For example, a predicted decrease of 1 million barrels per day (bpd) could drastically alter the price.

- Monitoring the daily changes in crude oil prices is essential. Small shifts can indicate larger underlying market trends.

US Strategic Petroleum Reserve Releases and their Effect

- The US Strategic Petroleum Reserve (SPR) releases can temporarily ease oil price pressures. By releasing oil from its reserves, the US aims to increase supply and stabilize prices during periods of scarcity or geopolitical uncertainty.

- The long-term implications of SPR releases are debated. While providing short-term relief, these releases reduce the strategic reserves available for future emergencies, raising concerns about long-term energy security.

- The level of SPR reserves is an important metric to track. Lower reserves indicate a dwindling buffer against future supply shocks, which could lead to greater price volatility.

- Market reaction to SPR announcements and the subsequent changes in crude oil prices need close attention. This will illuminate the overall market sentiment towards supply and demand dynamics.

Natural Gas Price Chart: Energy Demand and Weather Patterns

The natural gas price chart reflects the delicate balance between energy demand and supply, with weather patterns playing a significant role.

Seasonal Demand and Storage Levels

- Natural gas prices are highly sensitive to seasonal changes in demand. Higher demand during colder months (winter) typically leads to increased prices, while lower demand during warmer months can depress prices.

- Natural gas storage levels are a key indicator of future price movements. Low storage levels going into winter suggest a potential for price spikes if demand outstrips supply.

- Charts illustrating storage levels alongside price fluctuations provide valuable insights. Observing the correlation helps to predict future price trends based on storage capacity.

- Monitoring weather forecasts is crucial for anticipating shifts in natural gas demand and prices. Unexpected cold snaps can dramatically increase demand and push prices higher.

Geopolitical Factors Affecting Supply

- Geopolitical events can significantly disrupt natural gas supply and impact prices. Disruptions to key pipelines, export restrictions, or sanctions can constrain supply and trigger price increases.

- The reliance on LNG (Liquefied Natural Gas) imports in some regions makes them vulnerable to global supply chain issues. Shipping disruptions and competition for LNG cargoes can influence prices.

- Analyzing the impact of geopolitical tensions on natural gas supply chains is critical. Understanding potential disruptions can help anticipate price volatility.

- News related to pipeline projects, trade agreements, and international relations directly influences the natural gas market. Staying abreast of these developments is key to effective trading.

Agricultural Commodity Price Chart: Crop Yields and Weather Conditions

Agricultural commodity prices, particularly those of grains like wheat, corn, and soybeans, are highly susceptible to weather conditions and global production forecasts.

Global Grain Production Forecasts and Their Impact

- Global grain production forecasts significantly influence commodity prices. Reduced yields due to drought, floods, or other adverse weather events can cause prices to surge.

- Fertilizer costs play a crucial role in determining crop yields and prices. High fertilizer costs can reduce profitability for farmers and potentially impact overall production.

- Demand from key importing nations also shapes agricultural commodity prices. Changes in global demand can drive price fluctuations.

- Monitoring forecasts from reputable agricultural organizations provides critical insights into anticipated supply levels. These forecasts are valuable tools for anticipating price trends.

Impact of Climate Change on Agricultural Production

- Climate change is increasingly impacting agricultural production and commodity prices. More frequent and intense extreme weather events such as droughts and floods threaten crop yields.

- The long-term implications of climate change on food security are a growing concern. Sustained changes in weather patterns can lead to chronic food shortages and price volatility.

- Strategies for sustainable agriculture and climate change adaptation are gaining importance. Innovations in farming techniques and crop varieties are crucial for mitigating the impact of climate change.

- Understanding the interplay between climate change and agricultural production is critical for long-term investment and risk management. Considering these impacts ensures more informed decision-making.

Precious Metals Price Chart: Safe-Haven Demand and Inflation

Precious metals, particularly gold and silver, often serve as safe-haven assets during times of economic uncertainty and inflation.

Inflationary Pressures and their Influence on Gold and Silver

- Inflation often drives up demand for gold and silver, pushing prices higher. Investors often view precious metals as a hedge against inflation, seeking to preserve their purchasing power.

- Gold and silver's inherent scarcity contributes to their value as inflation hedges. Unlike fiat currencies, their supply is relatively fixed.

- Central bank monetary policies significantly influence inflation and, consequently, precious metal prices. Changes in interest rates and other monetary policy tools affect the value of these assets.

- Monitoring inflation rates and central bank announcements provides valuable context for understanding precious metal price movements. This helps anticipate price fluctuations.

Impact of Interest Rate Hikes on Precious Metal Prices

- Interest rate hikes tend to negatively impact precious metal prices in the short term. Higher interest rates often increase the opportunity cost of holding non-interest-bearing assets like gold and silver.

- However, sustained high inflation can still drive demand for precious metals despite higher interest rates. The long-term implications of inflation often outweigh the short-term effects of higher rates.

- Investor sentiment towards precious metals is also crucial. Changes in investor confidence can significantly impact price volatility.

- Analyzing the interplay between interest rates, inflation, and investor sentiment is key for understanding the dynamics of the precious metals market. This requires a nuanced approach considering multiple economic factors.

Industrial Metals Price Chart: Global Economic Growth and Manufacturing Activity

Industrial metal prices, including copper, aluminum, and steel, are closely tied to global economic growth and manufacturing activity.

Manufacturing PMI Data and its Correlation with Metal Prices

- Manufacturing Purchasing Managers' Indices (PMI) provide insights into the health of the manufacturing sector. Strong PMI readings often suggest robust demand for industrial metals, pushing prices higher.

- Copper, aluminum, and steel are crucial inputs in various manufacturing processes. Demand for these metals is directly linked to manufacturing output.

- Analyzing PMI data from various regions provides a broader perspective on global industrial activity and its impact on metal prices. This gives a more comprehensive understanding of price drivers.

- The correlation between PMI data and metal prices isn't always linear. Other factors, such as supply chain disruptions, can also influence prices.

Supply Chain Disruptions and Their Effect on Metal Prices

- Supply chain disruptions can significantly impact industrial metal prices. Bottlenecks and shortages can lead to price spikes, even if demand remains stable.

- Geopolitical events, natural disasters, and logistics challenges contribute to supply chain disruptions. These issues can severely limit the supply of essential metals.

- Monitoring global trade flows and supply chain news is important for anticipating potential price fluctuations. This helps anticipate potential challenges to the supply of industrial metals.

- Long-term strategies for diversifying supply chains and improving resilience are becoming increasingly crucial. This is an important consideration for investors and businesses alike.

Conclusion: Staying Ahead in the Global Commodity Markets

Monitoring these five key charts—crude oil, natural gas, agricultural commodities, precious metals, and industrial metals—provides invaluable insights into the current state of global commodity markets. Understanding the interplay of geopolitical risks, weather patterns, economic growth, and inflation is crucial for navigating the complexities of commodity market trends. The trends observed this week highlight the interconnected nature of these markets and the need for constant vigilance. To effectively manage risks and capitalize on opportunities, track the global commodity markets closely, monitor these key commodity charts regularly, and stay informed about the latest developments. Consider subscribing to a premium market analysis service for detailed updates and projections to better understand the global commodity market trends.

Featured Posts

-

Celtics Vs Suns Game Time Tv Channel And Live Stream Info April 4th

May 06, 2025

Celtics Vs Suns Game Time Tv Channel And Live Stream Info April 4th

May 06, 2025 -

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025 -

The Perils Of Predictable Peril Analyzing The Wildfire Betting Market

May 06, 2025

The Perils Of Predictable Peril Analyzing The Wildfire Betting Market

May 06, 2025 -

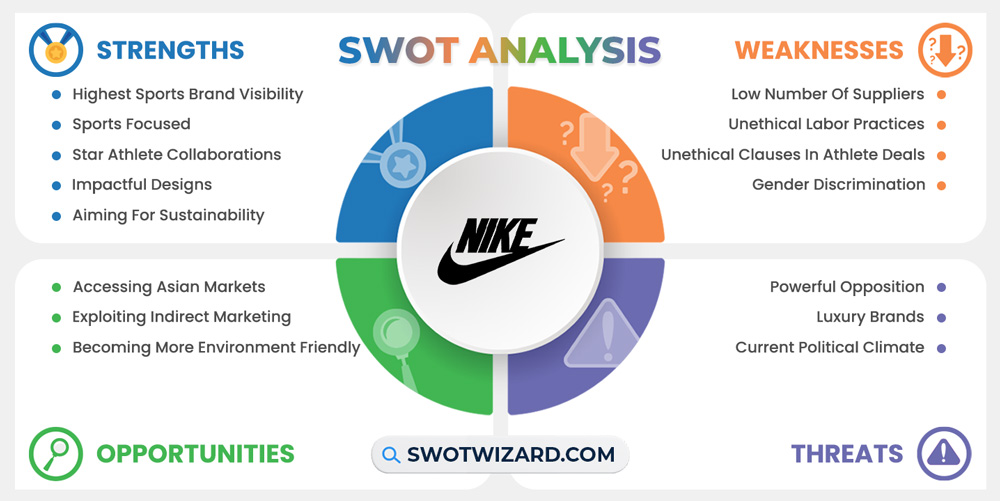

Doechii Narrates Nikes First Super Bowl Commercial In 30 Years

May 06, 2025

Doechii Narrates Nikes First Super Bowl Commercial In 30 Years

May 06, 2025 -

Pratts Blunt Comment On Patrick Schwarzeneggers White Lotus Scene

May 06, 2025

Pratts Blunt Comment On Patrick Schwarzeneggers White Lotus Scene

May 06, 2025

Latest Posts

-

Celebrating Victory Nikes Jordan Chiles And Sha Carri Richardson So Win Shirts

May 06, 2025

Celebrating Victory Nikes Jordan Chiles And Sha Carri Richardson So Win Shirts

May 06, 2025 -

Nike Facing Five Year Revenue Low Analysis And Predictions

May 06, 2025

Nike Facing Five Year Revenue Low Analysis And Predictions

May 06, 2025 -

Review Of Nikes New Jordan Chiles And Sha Carri Richardson So Win Apparel

May 06, 2025

Review Of Nikes New Jordan Chiles And Sha Carri Richardson So Win Apparel

May 06, 2025 -

Met Gala 2025 An Early Look At The Potential Celebrity Attendees

May 06, 2025

Met Gala 2025 An Early Look At The Potential Celebrity Attendees

May 06, 2025 -

Nikes So Win Collection Show Your Support For Jordan Chiles And Sha Carri Richardson

May 06, 2025

Nikes So Win Collection Show Your Support For Jordan Chiles And Sha Carri Richardson

May 06, 2025