Gibraltar Industries (NASDAQ: ROCK) Earnings Preview And Stock Outlook

Table of Contents

Analyzing Gibraltar Industries' Recent Performance (Q3 2024): Key Financial Metrics

Gibraltar Industries' Q3 2024 performance will be crucial in shaping investor sentiment. Let's examine the key financial metrics that will define this quarter's success.

Revenue Growth and Trends

Revenue growth is a primary indicator of Gibraltar Industries' overall health. Comparing Q3 2024 figures to Q2 2024 and Q3 2023 will reveal important trends. We anticipate a detailed breakdown of performance across different segments, including building products and renewable energy.

- Q3 2024 Revenue: (Placeholder - replace with actual figures upon release)

- Year-over-Year Revenue Growth: (Placeholder - replace with actual figures upon release)

- Quarterly Revenue Growth: (Placeholder - replace with actual figures upon release)

- Significant Contracts: Any large-scale contracts secured during the quarter significantly impacting revenue should be highlighted. This could include contracts for solar mounting systems or other building products.

Strong performance in the renewable energy segment, driven by increasing demand for solar energy solutions, could signal positive growth trends for Gibraltar Industries. Conversely, any decline in the building products segment may reflect broader macroeconomic headwinds affecting the construction industry.

Profitability and Margins

Profitability, as measured by gross profit margin, operating margin, and net income, is crucial for evaluating Gibraltar Industries' efficiency and financial health. Analyzing changes in these margins compared to previous quarters and the same quarter last year provides insights into the company's ability to manage costs and generate profits.

- Gross Profit Margin: (Placeholder - replace with actual figures upon release)

- Operating Margin: (Placeholder - replace with actual figures upon release)

- Net Income: (Placeholder - replace with actual figures upon release)

Factors such as raw material costs (steel, aluminum), labor costs, and transportation expenses will significantly influence profitability. Any fluctuations in these costs will directly impact the margins and overall net income.

Cash Flow and Debt

A robust cash flow is vital for Gibraltar Industries' future growth and financial stability. Analyzing cash flow from operations, capital expenditures (CAPEX), and debt levels will reveal the company's financial strength.

- Cash Flow from Operations: (Placeholder - replace with actual figures upon release)

- Capital Expenditures (CAPEX): (Placeholder - replace with actual figures upon release)

- Debt-to-Equity Ratio: (Placeholder - replace with actual figures upon release)

High levels of debt can pose a risk, limiting the company's flexibility in pursuing growth opportunities. A strong cash flow from operations, however, demonstrates the company's ability to generate cash and service its debt obligations.

Upcoming Earnings Report Expectations for Gibraltar Industries (ROCK): What to Watch For

The upcoming earnings report will provide a clearer picture of Gibraltar Industries' Q3 2024 performance. Several key factors will influence investor reaction.

Analyst Estimates and Consensus

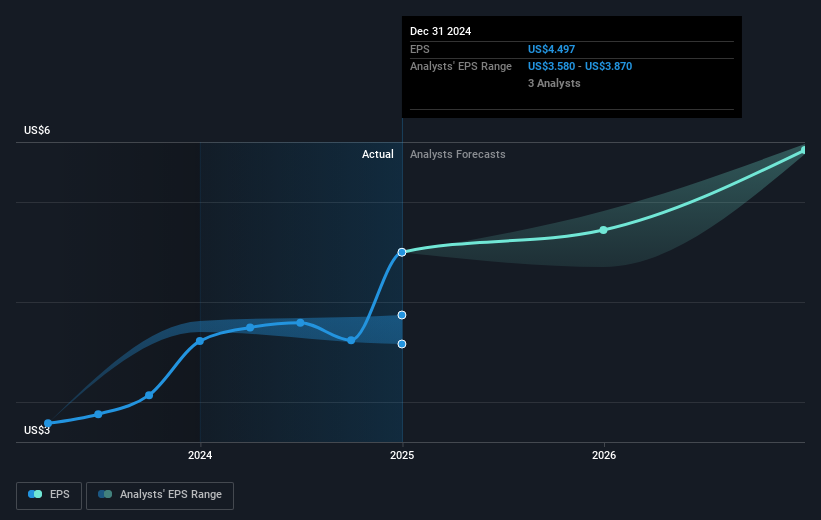

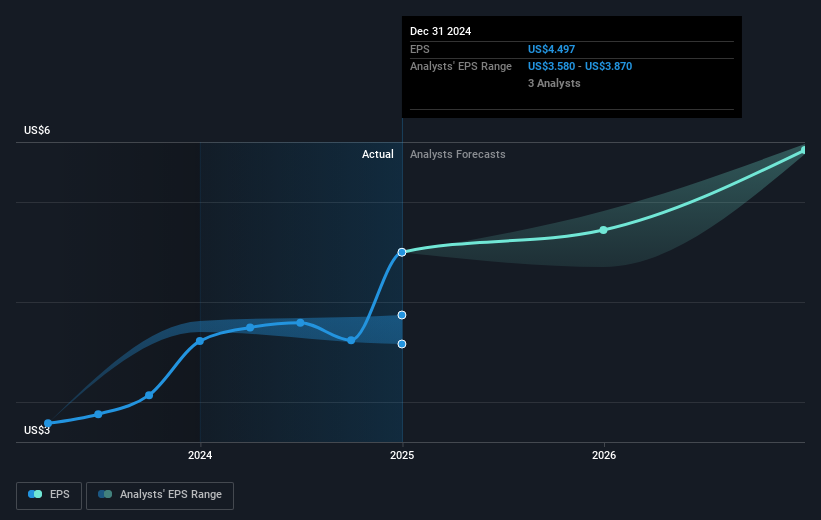

Before the earnings release, various financial analysts offer estimates for Gibraltar Industries' earnings per share (EPS) and revenue. Analyzing the consensus estimate and comparing it to the company's previous guidance will provide a benchmark for performance evaluation.

| Analyst Firm | EPS Estimate | Revenue Estimate (USD Millions) |

|---|---|---|

| (Placeholder - Analyst 1) | (Placeholder) | (Placeholder) |

| (Placeholder - Analyst 2) | (Placeholder) | (Placeholder) |

| (Placeholder - Analyst 3) | (Placeholder) | (Placeholder) |

Any significant upward or downward revisions to analyst expectations will likely influence the market's reaction to the actual earnings report.

Key Factors Influencing Earnings

Several factors beyond the company's control can influence Gibraltar Industries' earnings. These external factors need careful consideration.

- Macroeconomic Conditions: Inflation, interest rates, and overall economic growth will affect both consumer demand and construction activity.

- Supply Chain Disruptions: Continued supply chain challenges could impact material costs and production timelines.

- Competition: The competitive landscape within the building products and renewable energy sectors will impact market share and pricing strategies.

Management Commentary and Guidance

Management's commentary during the earnings call is crucial. Investors should pay close attention to their assessment of Q3 2024 performance, their outlook for the remainder of the year, and any strategic initiatives for future growth. This guidance will provide a valuable insight into the company's long-term plans and prospects.

Gibraltar Industries (ROCK) Stock Outlook: Investment Implications

Assessing the investment implications requires a thorough valuation analysis and a consideration of potential risks and opportunities.

Valuation and Stock Price Analysis

Evaluating Gibraltar Industries' stock price requires examining key valuation metrics.

- Price-to-Earnings (P/E) Ratio: (Placeholder – replace with actual figures upon release and compare to industry averages)

- Price-to-Sales (P/S) Ratio: (Placeholder – replace with actual figures upon release and compare to industry averages)

Comparing these ratios to historical valuations and those of competitors provides context for assessing whether the stock is undervalued or overvalued. A chart illustrating the stock's price performance over time will reveal any trends or significant fluctuations.

Risks and Opportunities

Investing in Gibraltar Industries involves inherent risks and opportunities.

Potential Risks:

- Economic downturn impacting construction and renewable energy sectors.

- Increased competition from both domestic and international players.

- Regulatory changes affecting building codes or renewable energy incentives.

- Supply chain disruptions impacting production and costs.

Potential Opportunities:

- Growth in the renewable energy market driving demand for solar mounting systems.

- Expansion into new geographic markets or product lines.

- Strategic acquisitions enhancing market position and product offerings.

Conclusion: Gibraltar Industries (ROCK) Stock: A Final Word and Call to Action

Gibraltar Industries' Q3 2024 earnings report will be a pivotal moment for investors. Analyzing the key financial metrics, understanding analyst expectations, and considering the potential risks and opportunities will help form a well-informed investment strategy. While the company faces external challenges, its strong position in growing sectors presents exciting opportunities. We recommend conducting your own thorough research before making any investment decisions. Consider adding Gibraltar Industries (ROCK) to your watchlist and monitoring its performance following the earnings release. Stay informed by following financial news outlets and the company's investor relations page for updates. Remember, this analysis is for informational purposes only and not financial advice.

Featured Posts

-

Efl Highlights Your Guide To The Best English Football League Moments

May 13, 2025

Efl Highlights Your Guide To The Best English Football League Moments

May 13, 2025 -

Zontanes Metadoseis Serie A Epiloges Gia Ellines Theates

May 13, 2025

Zontanes Metadoseis Serie A Epiloges Gia Ellines Theates

May 13, 2025 -

Report Tory Lanez Stabbed Transported To Hospital

May 13, 2025

Report Tory Lanez Stabbed Transported To Hospital

May 13, 2025 -

Columbus Crew Defeat San Jose Earthquakes 2 1 After Initial Setback

May 13, 2025

Columbus Crew Defeat San Jose Earthquakes 2 1 After Initial Setback

May 13, 2025 -

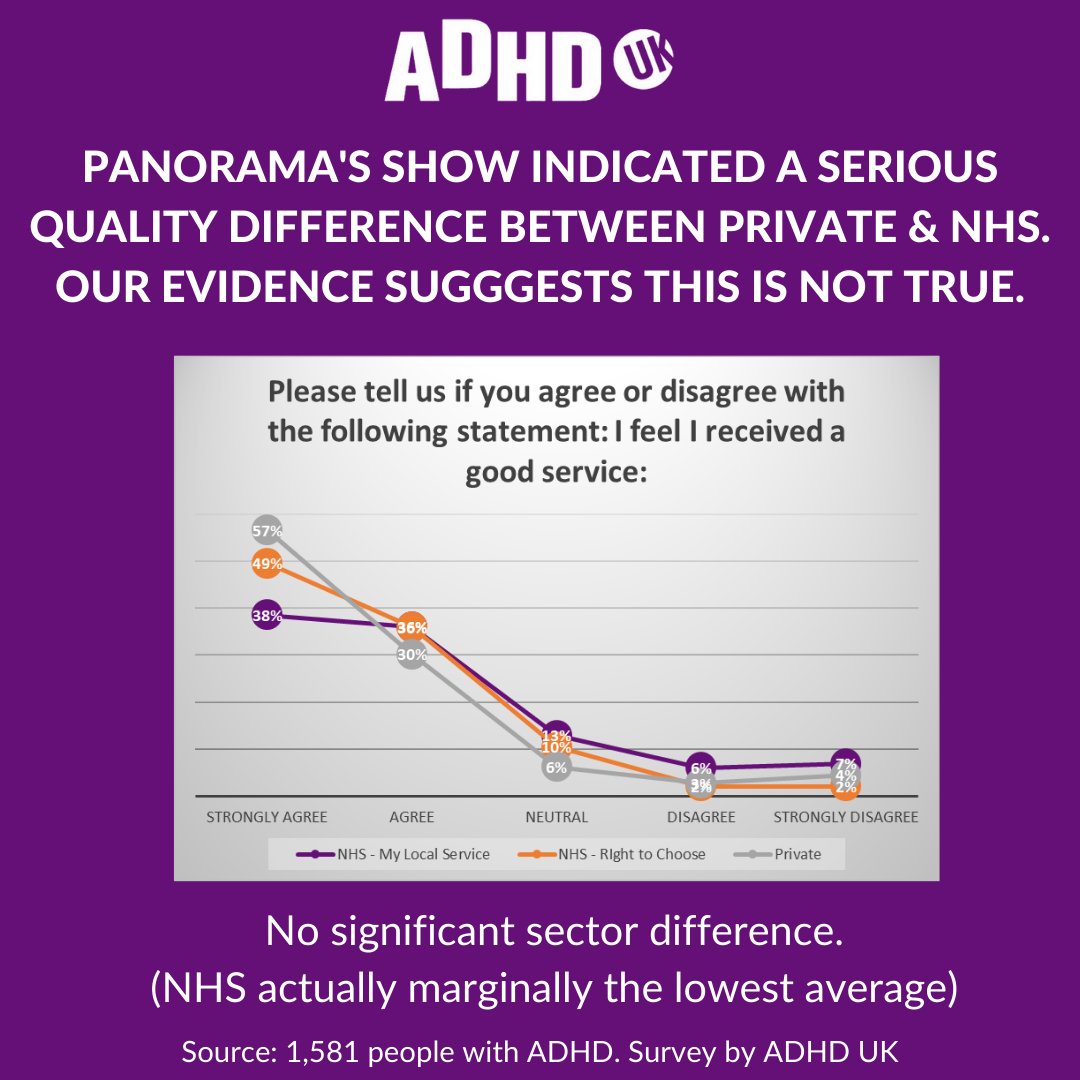

Are You One Of 3 Million Brits With Autism Or Adhd Understanding The Spectrum

May 13, 2025

Are You One Of 3 Million Brits With Autism Or Adhd Understanding The Spectrum

May 13, 2025