Gambling On Natural Disasters: The Case Of The Los Angeles Wildfires

Table of Contents

The Increasing Cost of Wildfire Insurance in Los Angeles

The cost of protecting your Los Angeles home from wildfires is rapidly increasing, creating a significant financial burden for residents. This escalating cost is driven by a confluence of factors, making wildfire insurance in Los Angeles a complex and expensive undertaking.

Skyrocketing Premiums and Coverage Limitations

Wildfire insurance premiums in high-risk Los Angeles areas are skyrocketing. Many homeowners are facing significant increases year over year, making insurance unaffordable for some. Furthermore, insurers are increasingly limiting coverage, adding to the financial vulnerability.

- Premium Increases: Annual premium increases of 20%, 30%, or even higher are becoming commonplace in high-risk zones. Some insurers are refusing to renew policies altogether.

- Coverage Exclusions: Many policies now exclude coverage for debris removal, specific types of damage (like damage caused by falling trees ignited by the fire), and even losses due to mandatory evacuations.

- Difficulty Obtaining Insurance: Homeowners in the most vulnerable areas are finding it increasingly difficult to obtain any wildfire insurance at all, leaving them completely exposed. This is particularly true for those living in areas with a history of significant wildfire damage. This creates a huge challenge for homeowners in terms of wildfire insurance Los Angeles.

These limitations on wildfire insurance Los Angeles represent a significant shift in the insurance market and highlight the growing risk associated with living in fire-prone areas.

The Role of Climate Change in Rising Premiums

Climate change is a key driver behind the escalating cost of wildfire insurance. The increasingly frequent and intense wildfires are directly linked to the changing climate.

- Increasing Wildfire Frequency and Intensity: Data shows a clear upward trend in the frequency and severity of wildfires in California, including Los Angeles County. Longer, hotter, and drier summers increase the risk of ignition and rapid fire spread.

- Drier Conditions: Climate change is leading to prolonged periods of drought, creating ideal conditions for wildfires to start and spread rapidly. This increased wildfire risk directly impacts insurance assessments.

- Impact on Insurance Assessments: Insurers use sophisticated wildfire risk assessment models to determine premiums. The increasing frequency and intensity of wildfires, directly linked to climate change, are driving up these assessments, leading to higher premiums for homeowners. The environmental impact is a major factor influencing the cost of wildfire insurance Los Angeles.

The Financial Gamble for Homeowners

Even with insurance, homeowners face considerable financial risks related to wildfires in Los Angeles. The cost of rebuilding after a wildfire can far exceed insurance payouts, and the disruption caused by evacuation can also lead to significant financial strain.

Underinsurance and the Cost of Reconstruction

Many homeowners are significantly underinsured, meaning their coverage is insufficient to cover the full cost of rebuilding their homes after a wildfire. This leads to substantial personal financial burden.

- Underinsurance Rates: A significant percentage of homeowners in wildfire-prone areas carry policies that undervalue their properties, leading to underinsurance.

- Reconstruction Costs Exceeding Insurance Payouts: The cost of materials and labor has risen sharply, frequently exceeding the insurance payouts even for those with seemingly adequate coverage. Rebuilding a home after a wildfire is often a far more expensive endeavor than anticipated.

- Emotional and Financial Stress: The combination of property loss, inadequate insurance coverage, and the long and arduous process of rebuilding creates immense emotional and financial stress on affected homeowners. Wildfire damage can have far-reaching consequences.

The Impact of Evacuation and Displacement

Wildfire evacuations lead to substantial financial losses beyond property damage. Evacuations result in lost income, temporary housing expenses, and potential business disruption.

- Lost Wages: Evacuation often forces individuals to miss work, resulting in lost wages and income disruption.

- Temporary Housing Expenses: Finding and paying for temporary housing during an evacuation can be expensive and burdensome, especially during prolonged events.

- Economic Impact: Business closures and disruptions due to evacuations have far-reaching economic consequences impacting individuals, communities, and the overall economy. The financial strain on individuals and families can be significant.

The Insurance Industry's Response to Wildfire Risk

The insurance industry is actively responding to the escalating wildfire risk in Los Angeles by implementing new strategies for risk assessment, mitigation, and pricing. However, challenges remain in balancing affordability and adequate coverage.

Strategies for Risk Mitigation and Pricing

Insurance companies are employing various strategies to manage wildfire risk and price their policies accordingly.

- Risk Assessment Models: Sophisticated models are used to assess the wildfire risk of individual properties based on factors such as proximity to wildlands, vegetation density, and building materials. This helps insurers determine appropriate premiums.

- Wildfire Mitigation Techniques: Insurers often encourage and sometimes incentivize homeowners to implement wildfire mitigation measures such as creating defensible space around their homes by removing flammable vegetation.

- Dynamic Pricing Models: Some insurers are utilizing dynamic pricing models, adjusting premiums based on real-time wildfire risk factors, such as weather conditions and fire activity. This aims to reflect the constantly evolving risk landscape more accurately. This contributes to more effective risk management.

The Future of Wildfire Insurance in Los Angeles

The future of wildfire insurance in Los Angeles remains uncertain. Premiums are likely to continue rising, and coverage may become increasingly limited.

- Predictions for Future Premiums and Coverage: Experts predict continued increases in premiums, potentially making insurance unaffordable for many. Coverage limitations are also expected to persist or even worsen.

- Government Intervention or Subsidies: There may be a growing need for government intervention, such as subsidies or incentives to make insurance more affordable and accessible.

- Stricter Building Codes: Implementing stricter building codes could help mitigate the risk of wildfire damage, leading to lower insurance premiums in the long term. Sustainable development practices are crucial for reducing long-term insurance costs. This requires a collaboration between government, insurance companies and homeowners.

The long-term solutions require a multifaceted approach combining risk mitigation, adaptive insurance strategies, and potentially government intervention.

Conclusion

Living in fire-prone areas like Los Angeles presents a significant financial gamble. The escalating costs of wildfire insurance, coupled with the risk of underinsurance and the devastating financial impact of wildfires, necessitates a multi-pronged approach. Homeowners need to be proactive in assessing their risk, securing adequate insurance coverage, and implementing wildfire mitigation measures. The insurance industry must continue to innovate and adapt to climate change. Understanding this gamble is crucial for making informed decisions about living in, or investing in, wildfire-prone areas. Don't gamble with your future; carefully assess your wildfire risk and secure appropriate insurance coverage. Learn more about mitigating your risk and planning for potential wildfire events in Los Angeles.

Featured Posts

-

San Jose Earthquakes Vs Seattle Sounders A Comprehensive Preview

May 15, 2025

San Jose Earthquakes Vs Seattle Sounders A Comprehensive Preview

May 15, 2025 -

Elon Musk And Amber Heard New Twins Fuel Embryo Dispute Speculation

May 15, 2025

Elon Musk And Amber Heard New Twins Fuel Embryo Dispute Speculation

May 15, 2025 -

2023 Warner Robins Murder Case Jury Delivers Verdict

May 15, 2025

2023 Warner Robins Murder Case Jury Delivers Verdict

May 15, 2025 -

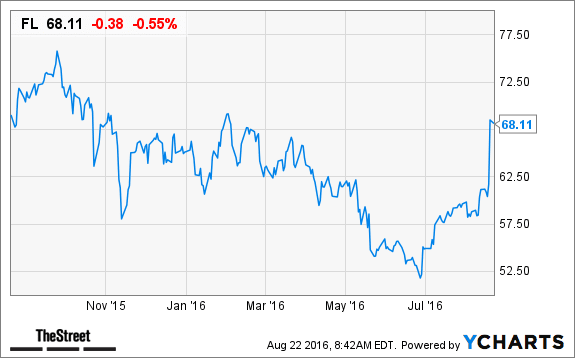

Foot Locker Stock Outlook Jefferies Weighs In On Nike Q3 Impact

May 15, 2025

Foot Locker Stock Outlook Jefferies Weighs In On Nike Q3 Impact

May 15, 2025 -

Key Dodgers Minor League Players To Watch Evan Phillips Sean Paul Linan Eduardo Quintero

May 15, 2025

Key Dodgers Minor League Players To Watch Evan Phillips Sean Paul Linan Eduardo Quintero

May 15, 2025