G-7 To Discuss Lowering Tariffs On Chinese Imports

Table of Contents

Potential Drivers for Tariff Reduction Discussion

The current global economic climate, characterized by persistent inflation and supply chain disruptions, has significantly impacted global trade. The arguments for reducing tariffs on Chinese imports are multifaceted:

- Easing Inflation: Lowering tariffs could reduce the cost of goods, thereby alleviating inflationary pressures. This is particularly crucial as many G7 nations grapple with stubbornly high inflation rates.

- Reducing Consumer Prices: Reduced tariffs translate directly into lower prices for consumers, boosting purchasing power and potentially stimulating economic activity.

- Boosting Economic Growth: Increased access to cheaper Chinese goods could stimulate economic growth by lowering production costs for businesses and fostering greater consumer spending.

- Strengthening Supply Chains: China plays a vital role in global supply chains. Reducing tariffs could help alleviate bottlenecks and improve the resilience of these crucial networks.

However, the political landscape is far from uniform. The decision-making process within the G7 will be heavily influenced by various national interests. For instance, while some members might prioritize economic benefits, others may harbor concerns about potential job losses in domestic industries or the implications for their strategic relationships with China. Analyzing current tariff levels and trade volumes between the G7 and China reveals a complex web of interdependencies. For example, the US imposed significant tariffs on Chinese goods during the Trump administration, leading to trade disputes. Understanding these existing trade flows and tariff structures is crucial to assessing the potential impact of any reductions.

Economic Implications of Lowering Tariffs

Lowering tariffs on Chinese imports holds both potential benefits and drawbacks for G7 economies.

Potential Benefits:

- Increased Consumer Spending: Lower prices could lead to a surge in consumer spending, boosting economic growth.

- Lower Production Costs for Businesses: Reduced import costs can lower production costs, enhancing competitiveness and profitability for businesses.

- Greater Access to Chinese Goods and Services: Reduced tariffs would open up greater access to a wide range of Chinese goods and services, increasing consumer choice and potentially driving innovation.

Potential Drawbacks:

- Job Losses in Certain Sectors: Industries competing directly with Chinese imports, such as textiles or manufacturing, could face job losses and increased pressure. The automotive industry, for instance, might experience challenges.

- Increased Competition for Domestic Industries: Lower tariffs could intensify competition for domestic industries, forcing them to adapt or risk losing market share.

- Potential Trade Imbalances: Increased imports from China could exacerbate existing trade imbalances between the G7 and China, potentially leading to further economic and political tensions.

The impact will vary significantly across different sectors. For example, the technology sector might benefit from cheaper components, while the agricultural sector might face increased competition. Detailed economic modeling and projections are essential to fully assess these varied impacts.

Geopolitical Considerations

The decision to lower tariffs on Chinese imports extends far beyond mere economics. It has profound geopolitical implications:

- US-China Relations: The decision would significantly influence US-China relations, potentially easing tensions or escalating them depending on the specifics of the agreement and the reaction from China.

- Influence of Other Global Powers: Other global powers, such as the EU and Russia, will inevitably play a role in shaping the G7’s decision and its subsequent impact on global trade dynamics.

- Impact on the WTO: The decision could have significant implications for the World Trade Organization (WTO) and the rules-based international trading system.

- Retaliatory Measures: China may take retaliatory measures if it perceives the tariff reductions as unfair or insufficient.

Potential Alternatives to Tariff Reduction

Instead of, or in addition to, tariff reductions, the G7 could explore alternative policies:

- Bilateral or Multilateral Trade Agreements: Negotiating comprehensive trade agreements with China could address concerns about market access and intellectual property rights while promoting fairer trade practices.

- Investment Deals: Facilitating increased foreign direct investment from G7 countries into China could foster economic cooperation and reduce reliance on trade alone.

These alternatives present their own sets of advantages and disadvantages, requiring careful consideration and negotiation.

The Future of G7-China Trade Relations

The decision on whether the G-7 will lower tariffs on Chinese imports hinges on a complex interplay of economic and geopolitical factors. While lower tariffs offer the potential for increased consumer benefits and economic growth, they also carry risks, including job losses and increased competition for domestic industries. The geopolitical implications are equally significant, potentially impacting US-China relations and the global trading system. The diverse perspectives within the G7 itself further complicate the issue. Predicting the exact outcome is difficult, but a nuanced approach, possibly involving a combination of tariff adjustments and alternative policy measures, seems most likely.

To stay informed about the ongoing developments regarding G-7 lowering tariffs on Chinese imports, regularly consult reputable news sources, official G7 websites, and reports from international organizations such as the WTO. Engage in the discussion and share your informed opinions to contribute to a balanced and insightful understanding of this crucial issue.

Featured Posts

-

Jenson Fw 22 Extended Key Pieces And Highlights

May 26, 2025

Jenson Fw 22 Extended Key Pieces And Highlights

May 26, 2025 -

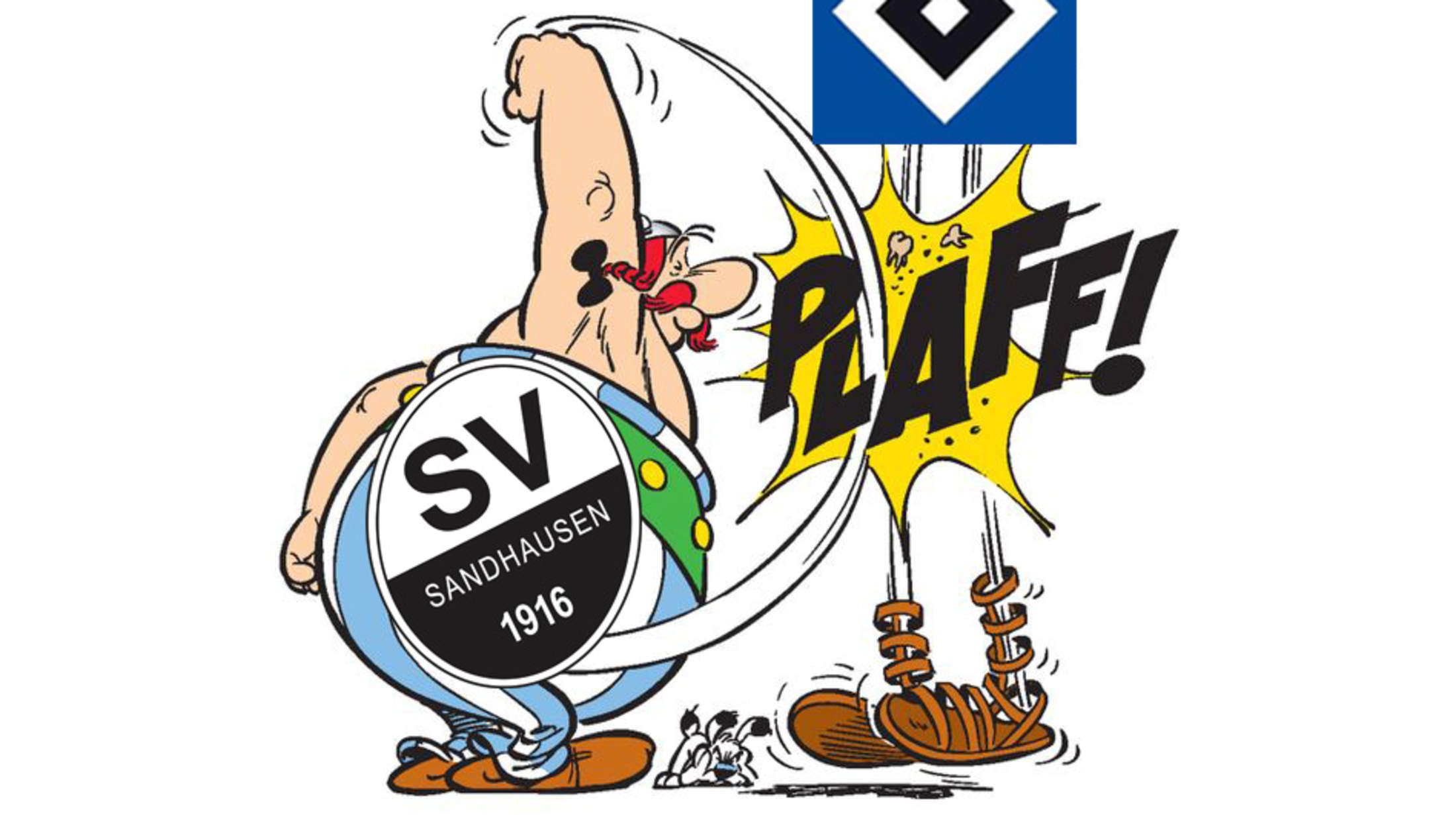

Hsv Aufstieg In Hamburg Der Weg Zurueck In Die Bundesliga

May 26, 2025

Hsv Aufstieg In Hamburg Der Weg Zurueck In Die Bundesliga

May 26, 2025 -

Le Proces Le Pen Consequences Et Impact Sur La Scene Politique Francaise

May 26, 2025

Le Proces Le Pen Consequences Et Impact Sur La Scene Politique Francaise

May 26, 2025 -

The Final Lap Assessing Success And Failure In F1 After 40

May 26, 2025

The Final Lap Assessing Success And Failure In F1 After 40

May 26, 2025 -

Paris Roubaix 2024 Van Der Poels Third Place Finish Pogacar A Minute Behind

May 26, 2025

Paris Roubaix 2024 Van Der Poels Third Place Finish Pogacar A Minute Behind

May 26, 2025

Latest Posts

-

Hailee Steinfeld Premium Beers Group And The Angel Margarita A Perfect Pairing

May 28, 2025

Hailee Steinfeld Premium Beers Group And The Angel Margarita A Perfect Pairing

May 28, 2025 -

The Impact Of Hailee Steinfelds Career On Her Wedding Timeline

May 28, 2025

The Impact Of Hailee Steinfelds Career On Her Wedding Timeline

May 28, 2025 -

Hailee Steinfelds Busy Schedule Wedding Plans On Hold

May 28, 2025

Hailee Steinfelds Busy Schedule Wedding Plans On Hold

May 28, 2025 -

Journaling And The Rise Of Kyle Stowers In Miami

May 28, 2025

Journaling And The Rise Of Kyle Stowers In Miami

May 28, 2025 -

Hailee Steinfelds Red Cape Look Sinner Photo Call In Mexico

May 28, 2025

Hailee Steinfelds Red Cape Look Sinner Photo Call In Mexico

May 28, 2025