FTC's Appeal Challenges Judge's Ruling On Microsoft-Activision Merger

Table of Contents

The Judge's Initial Ruling and its Rationale

In July 2023, a US District Judge ruled in favor of Microsoft, allowing the merger to proceed. This decision marked a significant setback for the FTC, which had argued that the acquisition would stifle competition and harm consumers. The judge's ruling hinged on several key factors:

- Insufficient evidence of anti-competitive behavior: The judge found the FTC's evidence insufficient to prove that the merger would substantially lessen competition in the gaming market. This included questioning the FTC's projections of market dominance.

- Counterarguments regarding Call of Duty: The FTC's central concern revolved around Call of Duty, Activision's flagship franchise, and the potential for Microsoft to make it exclusive to its Xbox platform. The judge found Microsoft's commitment to keep Call of Duty on PlayStation for a "substantial period" convincing enough to dismiss these claims under the current Antitrust Law.

- Microsoft's commitments: The court considered Microsoft’s concessions, such as their commitment to maintaining Call of Duty on rival platforms, as sufficient to mitigate potential anti-competitive effects.

The judge's rationale essentially concluded that the FTC failed to meet the high burden of proof required to block a merger under antitrust law, emphasizing the judge's ruling and the subsequent Microsoft-Activision merger approval.

The FTC's Grounds for Appeal

The FTC's appeal against the judge's ruling rests on several key arguments, fundamentally challenging the judge's interpretation of anti-competitive practices within the context of the Microsoft-Activision merger. Their core argument centers on the belief that the merger will ultimately harm competition:

- Call of Duty exclusivity concerns: Despite Microsoft’s promises, the FTC maintains that the long-term implications of owning Call of Duty give Microsoft unfair leverage over its competitors, potentially leading to future exclusivity and harming the PlayStation ecosystem. This constitutes a significant part of the FTC appeal arguments.

- Potential for predatory pricing: The FTC argues that Microsoft's size and resources could allow them to engage in predatory pricing, undercutting competitors and driving them out of the market.

- Impact on cloud gaming: The FTC also expresses concerns about Microsoft's potential to dominate the cloud gaming market, leveraging Activision's content to solidify its position.

The FTC’s appeal hinges on demonstrating that the judge underestimated the potential for anti-competitive behavior and that the long-term consequences outweigh Microsoft's short-term commitments. The FTC aims to showcase the significant impact on the gaming market's competitive landscape.

Potential Outcomes and Implications

The appeal's outcome could significantly alter the landscape of the gaming industry. Several possibilities exist:

- Affirmation of the lower court ruling: This would allow the merger to proceed, potentially leading to greater consolidation within the gaming industry and raising concerns about future mergers and acquisitions in the tech sector.

- Reversal of the lower court ruling: This would block the merger, potentially setting a precedent for future antitrust cases involving large tech acquisitions. The long-term impact on Microsoft’s future plans and Activision Blizzard's market positioning would be substantial.

- Modification of the lower court ruling: The appellate court could impose conditions on the merger, such as stricter requirements for maintaining Call of Duty's multi-platform availability.

Impact on Consumers

The FTC's appeal directly impacts consumers. The potential outcomes significantly influence several factors:

- Gaming prices: If the merger goes through without significant regulatory oversight, consumers might face higher prices for games and gaming subscriptions.

- Game availability: Exclusivity deals could limit the availability of certain titles on specific platforms, potentially forcing gamers to switch consoles or pay more for access.

The ultimate impact on consumer choice and the gaming market requires careful consideration of the appeal outcome.

Conclusion: The Future of the FTC's Appeal and the Microsoft-Activision Merger

The FTC's appeal against the Microsoft-Activision merger is a pivotal moment for the gaming industry and antitrust law. The arguments for and against the merger highlight complex issues surrounding competition, market dominance, and consumer welfare. While predicting the outcome is challenging, the appeal’s significance is undeniable. The decision will have far-reaching consequences, shaping the future of gaming mergers and setting a precedent for future antitrust battles in the tech industry. Stay informed about further developments regarding the FTC's appeal on the Microsoft-Activision merger by subscribing to legal news sources or following industry experts. The implications of this decision will continue to unfold, and understanding the ongoing developments surrounding the Microsoft-Activision merger update and the FTC Appeal decision is crucial. The future of gaming mergers may well depend on the final outcome of this appeal.

Featured Posts

-

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Bold Move

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Bold Move

Apr 24, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 24, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 24, 2025 -

Chinese Stocks In Hong Kong Surge Trade Tension Easing Fuels Rally

Apr 24, 2025

Chinese Stocks In Hong Kong Surge Trade Tension Easing Fuels Rally

Apr 24, 2025 -

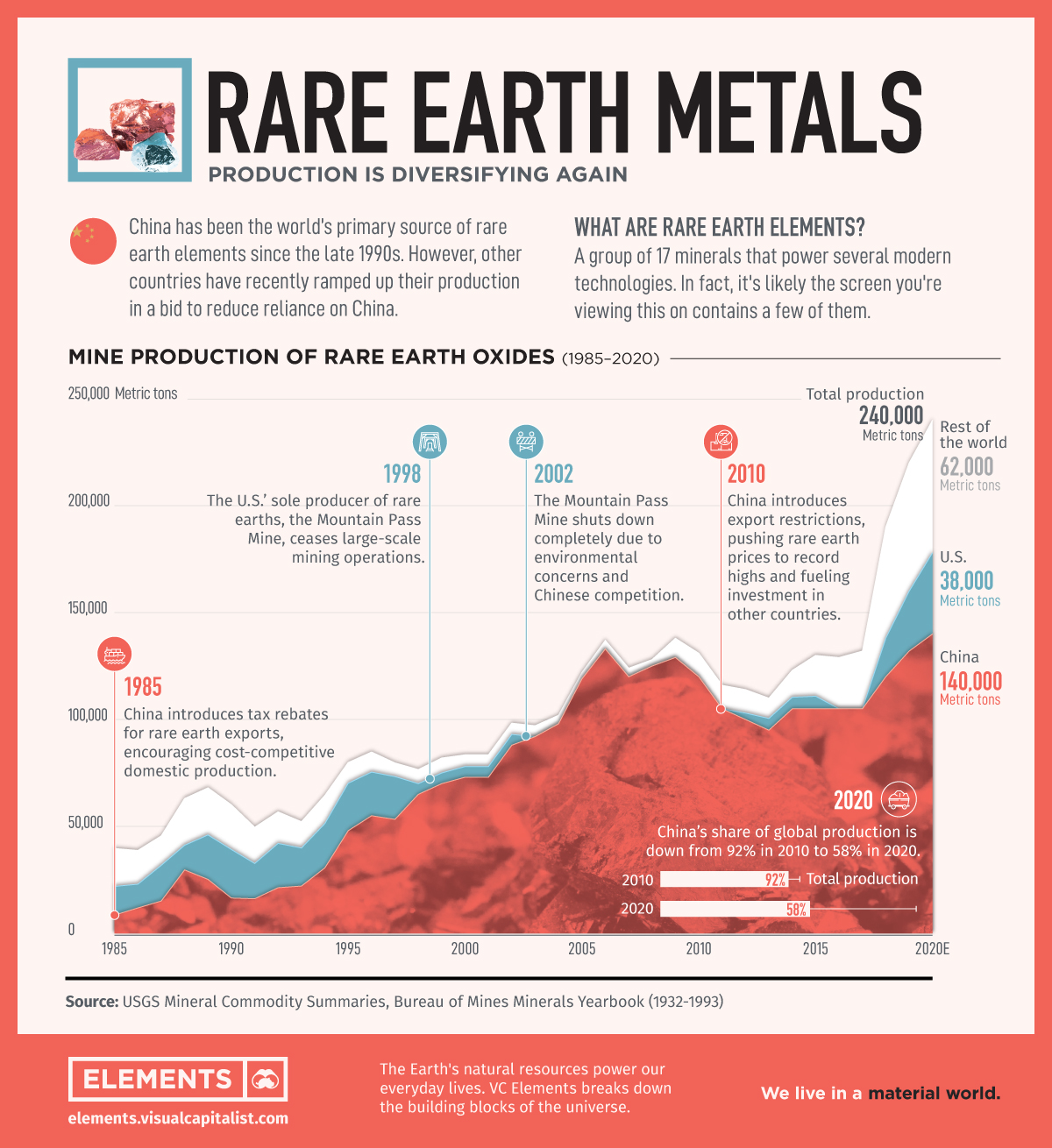

Optimus Robot Production How Chinas Rare Earth Policy Creates Challenges For Tesla

Apr 24, 2025

Optimus Robot Production How Chinas Rare Earth Policy Creates Challenges For Tesla

Apr 24, 2025 -

Market Analysis Whats Driving The Niftys Bullish Trend In India

Apr 24, 2025

Market Analysis Whats Driving The Niftys Bullish Trend In India

Apr 24, 2025