FTC To Appeal: Microsoft's Activision Blizzard Acquisition Faces Setback

Table of Contents

The FTC's Arguments Against the Merger

The FTC's primary concern revolves around the potential anti-competitive effects of the merger. They argue that Microsoft's acquisition of Activision Blizzard, a company boasting a portfolio of hugely popular titles including Call of Duty, Candy Crush, and World of Warcraft, would significantly reduce competition in the gaming market, particularly in the console and cloud gaming sectors. Their argument centers on Microsoft's potential to leverage its ownership of Activision Blizzard's intellectual property to stifle competition and harm consumers.

- Loss of competition in console gaming: The FTC fears that Microsoft could make Call of Duty exclusive to Xbox consoles, severely disadvantaging PlayStation and harming competition.

- Potential for higher game prices: Reduced competition can lead to artificially inflated prices for games and related services.

- Reduced innovation in the gaming industry: A less competitive market can stifle innovation as companies lack the pressure to improve and develop new technologies.

- Exclusion of competitors from access to key titles (like Call of Duty): The FTC is concerned that Microsoft could use its ownership of Activision Blizzard to limit access to key franchises, hindering rival game developers and platforms.

Microsoft's Response and Defense Strategy

Microsoft has vehemently refuted the FTC's claims, arguing that the acquisition will actually benefit consumers and increase competition. Their defense strategy hinges on several key points. They've pledged to keep Call of Duty available on PlayStation and other platforms, offering long-term agreements to ensure continued access for players.

- Long-term agreements to keep Call of Duty on PlayStation: Microsoft has publicly committed to keeping Call of Duty on PlayStation for many years to come, attempting to alleviate the FTC’s concerns about exclusivity.

- Investment in cloud gaming infrastructure: Microsoft highlights its investments in cloud gaming, arguing that this will expand access to games for a broader audience, fostering a more competitive landscape.

- Arguments against the FTC's assessment of market dominance: Microsoft argues that the FTC's assessment of its market dominance is inaccurate, highlighting the strong competition from other major players in the industry.

The Implications of the Appeal for the Gaming Industry

The FTC's appeal casts a long shadow over the gaming industry, creating uncertainty and potential delays. Gamers face uncertainty regarding future Call of Duty releases and potential impacts on other games. Developers may face delays or altered plans depending on the outcome.

- Uncertainty for gamers regarding future Call of Duty releases: The protracted legal battle creates uncertainty about the future of the Call of Duty franchise and its availability on different platforms.

- Potential impact on game development and release schedules: The appeal could lead to delays in game development and release schedules as companies wait for the outcome.

- The setting of a precedent for future antitrust cases in the tech industry: This case could set a significant precedent for future mergers and acquisitions in the tech sector, impacting how antitrust regulators approach similar deals.

- Effect on Microsoft's stock price and overall market value: The legal battle and its outcome will undoubtedly influence Microsoft's stock price and overall market valuation.

Legal and Regulatory Perspectives on the Case

Legal experts are closely scrutinizing the FTC's appeal and Microsoft's counterarguments. The case will likely hinge on the interpretation of existing antitrust laws and regulations, with the FTC needing to prove that the merger would substantially lessen competition. The involvement of other regulatory bodies globally adds another layer of complexity.

- Analysis of the FTC’s legal strategy and likelihood of success: Legal experts are analyzing the strength of the FTC's legal arguments and the likelihood of their success on appeal.

- Examination of relevant antitrust laws and regulations: The case will rely on the interpretation of relevant antitrust laws and regulations, which can be complex and subject to varying interpretations.

- Discussion of potential international regulatory responses: The outcome of the FTC's appeal could influence regulatory responses in other jurisdictions around the world.

Conclusion: The Future of the Microsoft Activision Blizzard Acquisition Remains Uncertain

The FTC's appeal against the Microsoft Activision Blizzard acquisition creates substantial uncertainty. The arguments presented by both sides highlight significant concerns regarding competition, innovation, and consumer welfare in the gaming industry. The outcome will not only affect Microsoft and Activision Blizzard but also set a precedent for future mergers and acquisitions in the tech sector. The potential impact on game prices, innovation, and the availability of key titles remains a major point of contention.

Stay tuned for further updates on the FTC's appeal of the Microsoft Activision Blizzard acquisition and its impact on the gaming industry. Follow us for the latest news and analysis on this landmark antitrust case.

Featured Posts

-

Assessing Trumps Repeated Two Week Timeline For Ukraine Peace

May 30, 2025

Assessing Trumps Repeated Two Week Timeline For Ukraine Peace

May 30, 2025 -

Jon Jones Scathing Rebuke Of Tom Aspinall Shut Your Mouth

May 30, 2025

Jon Jones Scathing Rebuke Of Tom Aspinall Shut Your Mouth

May 30, 2025 -

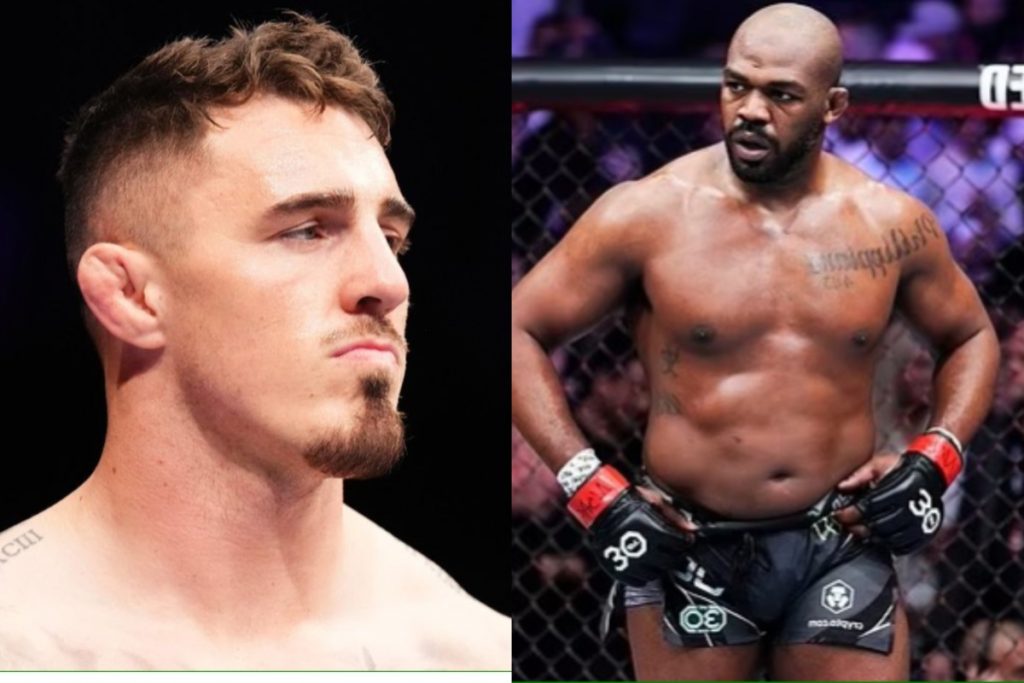

Preduprezhdenie Mada Anomalnaya Zhara Pokholodanie I Silniy Shtorm V Izraile

May 30, 2025

Preduprezhdenie Mada Anomalnaya Zhara Pokholodanie I Silniy Shtorm V Izraile

May 30, 2025 -

Analyzing Andre Agassis Transition To Professional Pickleball

May 30, 2025

Analyzing Andre Agassis Transition To Professional Pickleball

May 30, 2025 -

La Sncf Face A La Crise Le Ministre Reagit A La Menace De Greve

May 30, 2025

La Sncf Face A La Crise Le Ministre Reagit A La Menace De Greve

May 30, 2025

Latest Posts

-

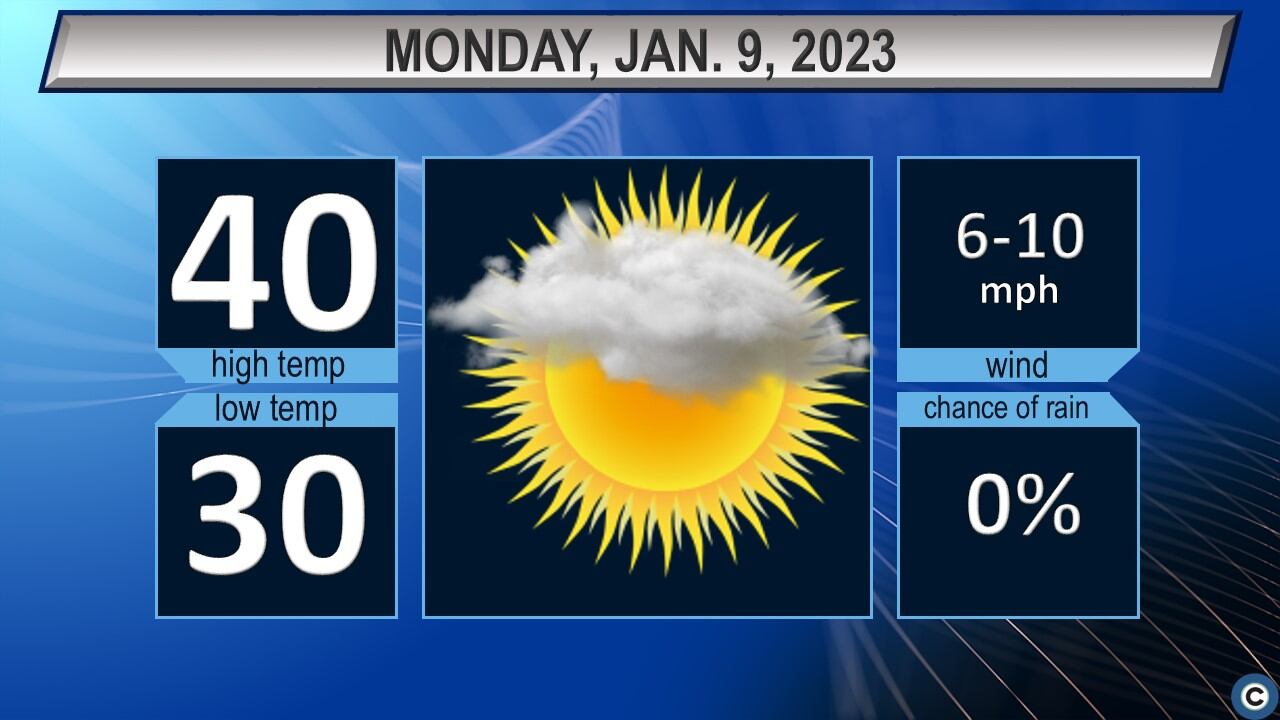

Northeast Ohio To See Rain Thursday Weather Update

May 31, 2025

Northeast Ohio To See Rain Thursday Weather Update

May 31, 2025 -

Special Weather Statement Increased Fire Risk In Cleveland And Akron

May 31, 2025

Special Weather Statement Increased Fire Risk In Cleveland And Akron

May 31, 2025 -

Increased Fire Risk Prompts Special Weather Statement In Cleveland Akron

May 31, 2025

Increased Fire Risk Prompts Special Weather Statement In Cleveland Akron

May 31, 2025 -

Northeast Ohio Weather Forecast Thursday Rain Returns

May 31, 2025

Northeast Ohio Weather Forecast Thursday Rain Returns

May 31, 2025 -

Cleveland And Akron Special Weather Statement High Fire Danger

May 31, 2025

Cleveland And Akron Special Weather Statement High Fire Danger

May 31, 2025