From $3K Babysitter To $3.6K Daycare: A Father's Financial Nightmare

Table of Contents

The Babysitting Budget Breakdown

Initially, relying on a babysitter seemed like a manageable solution. This father, let's call him Mark, budgeted $3000 a month for childcare. This seemingly hefty sum was broken down as follows: his babysitter charged a high hourly rate of $30, working approximately 40 hours a week. This equated to $1200 a week, totalling roughly $4800 per month, however, due to inconsistent availability, Mark had to supplement this with occasional backup care which brought his costs closer to $3000 a month. This already significant expense didn't include taxes or additional costs such as last-minute cancellations, which added to the financial strain.

- High hourly rate driven by experience and demand. Finding a reliable and experienced babysitter in his area proved challenging, driving up the hourly rate.

- Inconsistent availability leading to scheduling challenges and additional costs. The babysitter's unpredictable schedule forced Mark to scramble for alternative care, resulting in extra expenses.

- Lack of structured learning environment compared to daycare. While the babysitter provided adequate care, there was a lack of organized learning activities typically found in a daycare setting.

The Daycare Dilemma: A Costlier Solution?

Faced with the ongoing challenges and inconsistent availability of his babysitter, Mark decided to transition his child to a daycare center. This decision, however, brought an even greater financial shock. The daycare cost a staggering $3600 per month – a $600 increase compared to his previous babysitting expenses! This significant price difference highlighted the considerable overhead costs associated with running a daycare center.

- Higher overhead costs for daycare centers (rent, staff, supplies). Daycares have substantial fixed costs, including rent, utilities, staff salaries, and learning materials, all contributing to higher fees.

- Structured learning programs and activities included in the price. Daycares offer structured learning programs and activities, which contribute to the higher cost but also offer significant developmental benefits for the child.

- More reliable and consistent care compared to a babysitter. Daycares provide consistent care, eliminating the stress and extra costs associated with finding last-minute childcare.

The Financial Strain and its Impact

The substantial increase in childcare expenses had a profound impact on Mark and his family. The extra $600 per month, on top of the already considerable $3000 babysitting expense, significantly reduced their disposable income.

- Reduced disposable income. The increased childcare costs forced the family to cut back on other expenses, such as eating out, entertainment, and even groceries.

- Impact on savings and investment plans. Contributions to savings and investment accounts had to be reduced or temporarily halted to cover the higher childcare costs.

- Potential stress on the marital relationship due to financial pressures. The added financial burden created tension and stress within the family, highlighting the emotional toll of high childcare expenses.

Exploring Alternatives and Strategies

Navigating the high cost of childcare requires exploring all available options. Mark researched alternative childcare options and discovered several strategies to lessen the financial impact:

- Researching local childcare subsidies and assistance programs. Many governments offer childcare subsidies or assistance programs to families that meet certain income requirements.

- Negotiating rates with daycare providers or babysitters. It's often possible to negotiate rates with daycare centers, especially when enrolling multiple children or committing to long-term care.

- Utilizing family support networks. Engaging family members to assist with childcare can be a cost-effective solution.

Conclusion

The experience of this father underscores the significant financial challenge many families face when it comes to childcare costs. The transition from a $3000 monthly babysitter expense to a $3600 monthly daycare bill exemplifies the steep increase and the resulting financial strain on family budgets. Navigating the high cost of childcare can be daunting, but understanding the options and exploring strategies for saving money is crucial. Start your research today and find affordable childcare solutions that best fit your family's needs. Utilize resources to find childcare subsidies and explore different options to lessen the impact of high childcare costs. Don't hesitate to explore cost-effective childcare to alleviate the financial burden.

Featured Posts

-

Elizabeth City Weekend Shooting Arrest Announced

May 09, 2025

Elizabeth City Weekend Shooting Arrest Announced

May 09, 2025 -

Nl Federal Election Candidate Profiles And Platforms

May 09, 2025

Nl Federal Election Candidate Profiles And Platforms

May 09, 2025 -

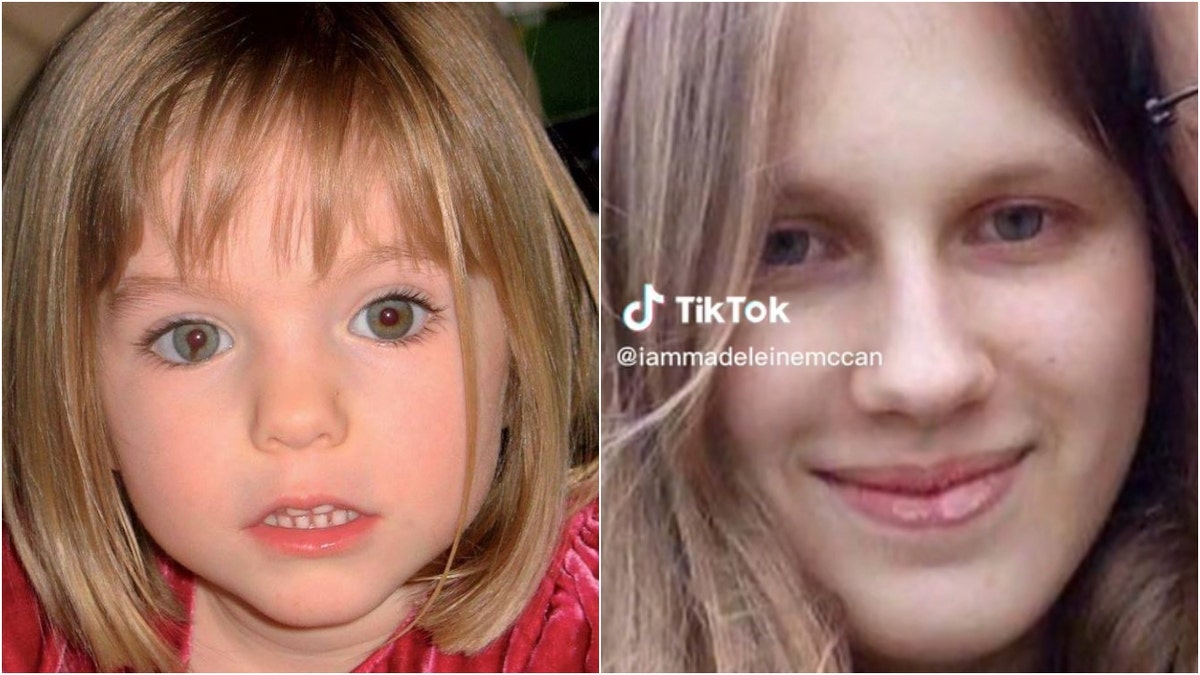

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Old Womans Claim

May 09, 2025

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Old Womans Claim

May 09, 2025 -

Stock Market Freefall Understanding The Fallout From Operation Sindoor

May 09, 2025

Stock Market Freefall Understanding The Fallout From Operation Sindoor

May 09, 2025 -

The Snl Harry Styles Impression His Response

May 09, 2025

The Snl Harry Styles Impression His Response

May 09, 2025