Frankfurt Stock Market Report: DAX Closes Near 24,000

Table of Contents

DAX Index Performance Analysis: A Deep Dive into the 24,000 Point Milestone

The DAX index experienced a thrilling ride today. While the exact closing value fluctuated throughout the day, its proximity to 24,000 points represents a remarkable achievement. Let's break down the key performance indicators:

- Daily Percentage Change: [Insert Percentage Change Here] – This indicates a [positive/negative] trend for the day. The exact percentage will depend on the closing value relative to the opening value.

- Opening Value: [Insert Opening Value Here]

- Closing Value: [Insert Closing Value Here] (approximately 24,000)

- Intraday High: [Insert Intraday High Here]

- Intraday Low: [Insert Intraday Low Here]

- Trading Volume: [Insert Trading Volume Here] – High trading volume often suggests significant market interest and potential for further movement.

Several factors influenced the DAX's movement. Recent positive inflation data, coupled with the European Central Bank's (ECB) interest rate decision [Insert details on ECB decision and its impact], contributed to a generally positive investor sentiment. Furthermore, positive earnings reports from key companies in the automotive and technology sectors played a significant role in boosting the index. Geopolitical events, such as [mention any relevant geopolitical factors and their impact], also had a noticeable effect on market sentiment. Technical analysis suggests that the DAX has broken through a key resistance level, potentially indicating further upward momentum in the short term.

Leading Contributors and Laggards: Which Stocks Drove the DAX's Performance?

The DAX's performance wasn't uniform. While some stocks soared, others lagged behind. Understanding which companies drove the index's movement provides valuable insights into market dynamics.

Top Performers: [Insert names of top 3-5 performing DAX stocks, their percentage gains, and brief explanations for their strong performance, e.g., "SAP AG (+3.5%) saw strong gains after announcing a new strategic partnership."]

Underperformers: [Insert names of top 3-5 underperforming DAX stocks, their percentage losses, and brief explanations for their poor performance, e.g., "Volkswagen (-1.2%) experienced a slight dip due to concerns about supply chain disruptions."]

Here's a table summarizing the top 5 gainers and losers:

| Stock Name | Percentage Change | Reason for Performance |

|---|---|---|

| [Stock Name 1] | [Percentage] | [Reason] |

| [Stock Name 2] | [Percentage] | [Reason] |

| [Stock Name 3] | [Percentage] | [Reason] |

| [Stock Name 4] | [Percentage] | [Reason] |

| [Stock Name 5] | [Percentage] | [Reason] |

Market Outlook and Predictions: What Does the Future Hold for the DAX?

Predicting the future of the DAX is inherently challenging, but analyzing current trends and expert opinions offers valuable insights. Several analysts predict continued growth for the DAX in the short term, citing the positive economic indicators and strong corporate earnings. However, potential risks remain. Rising inflation, geopolitical instability, and a potential global economic slowdown could negatively impact the DAX's performance. Opportunities for growth exist primarily in the technology, renewable energy, and healthcare sectors.

Potential Risks:

- Global economic slowdown

- Rising inflation and interest rates

- Geopolitical uncertainties

Growth Sectors:

- Technology

- Renewable Energy

- Healthcare

Expert Opinion: [Insert quotes from relevant financial analysts regarding the future outlook of the DAX. Attribute the quote to the analyst and their organization.]

Conclusion: The DAX's Journey Towards 24,000 and Beyond

The DAX index's near-24,000 close marks a significant milestone for the Frankfurt Stock Exchange, driven by a combination of positive economic data, strong corporate performance, and relatively stable geopolitical conditions. While certain sectors outperformed others, the overall positive trend reflects a generally optimistic market sentiment. However, investors should remain vigilant about potential risks that could impact future performance. Stay updated on the DAX and monitor the Frankfurt Stock Exchange closely to make informed investment decisions. Track the DAX index's progress and follow the latest DAX reports for continued market insights.

Featured Posts

-

Apple Stock Aapl Price Prediction Key Levels To Consider

May 24, 2025

Apple Stock Aapl Price Prediction Key Levels To Consider

May 24, 2025 -

Dax Falls Below 24 000 Frankfurt Stock Market Closing Losses

May 24, 2025

Dax Falls Below 24 000 Frankfurt Stock Market Closing Losses

May 24, 2025 -

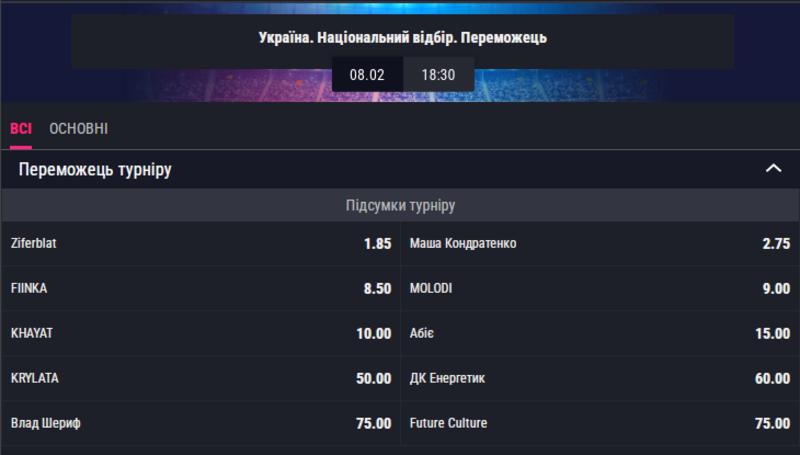

Prognoz Konchiti Vurst Peremozhtsi Yevrobachennya 2025

May 24, 2025

Prognoz Konchiti Vurst Peremozhtsi Yevrobachennya 2025

May 24, 2025 -

Pomnite Li Konchita Vurst Transformatsiyata Y Sled Evroviziya

May 24, 2025

Pomnite Li Konchita Vurst Transformatsiyata Y Sled Evroviziya

May 24, 2025 -

Demna Gvasalias Appointment At Gucci A New Era In Fashion

May 24, 2025

Demna Gvasalias Appointment At Gucci A New Era In Fashion

May 24, 2025

Latest Posts

-

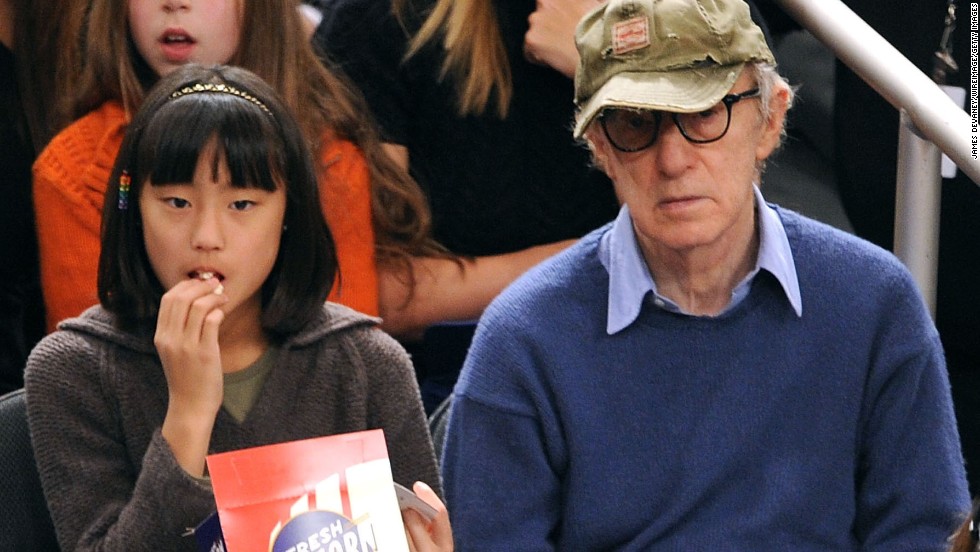

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 24, 2025 -

17 Celebrity Reputations Destroyed In 24 Hours

May 24, 2025

17 Celebrity Reputations Destroyed In 24 Hours

May 24, 2025 -

Sean Penns Doubts Surrounding Dylan Farrows Account Of Sexual Assault By Woody Allen

May 24, 2025

Sean Penns Doubts Surrounding Dylan Farrows Account Of Sexual Assault By Woody Allen

May 24, 2025 -

17 Celebrities Whose Careers Imploded Overnight

May 24, 2025

17 Celebrities Whose Careers Imploded Overnight

May 24, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Doubts And The Ongoing Debate

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Doubts And The Ongoing Debate

May 24, 2025