Frankfurt Stock Market Opening: DAX Stability After Record High

Table of Contents

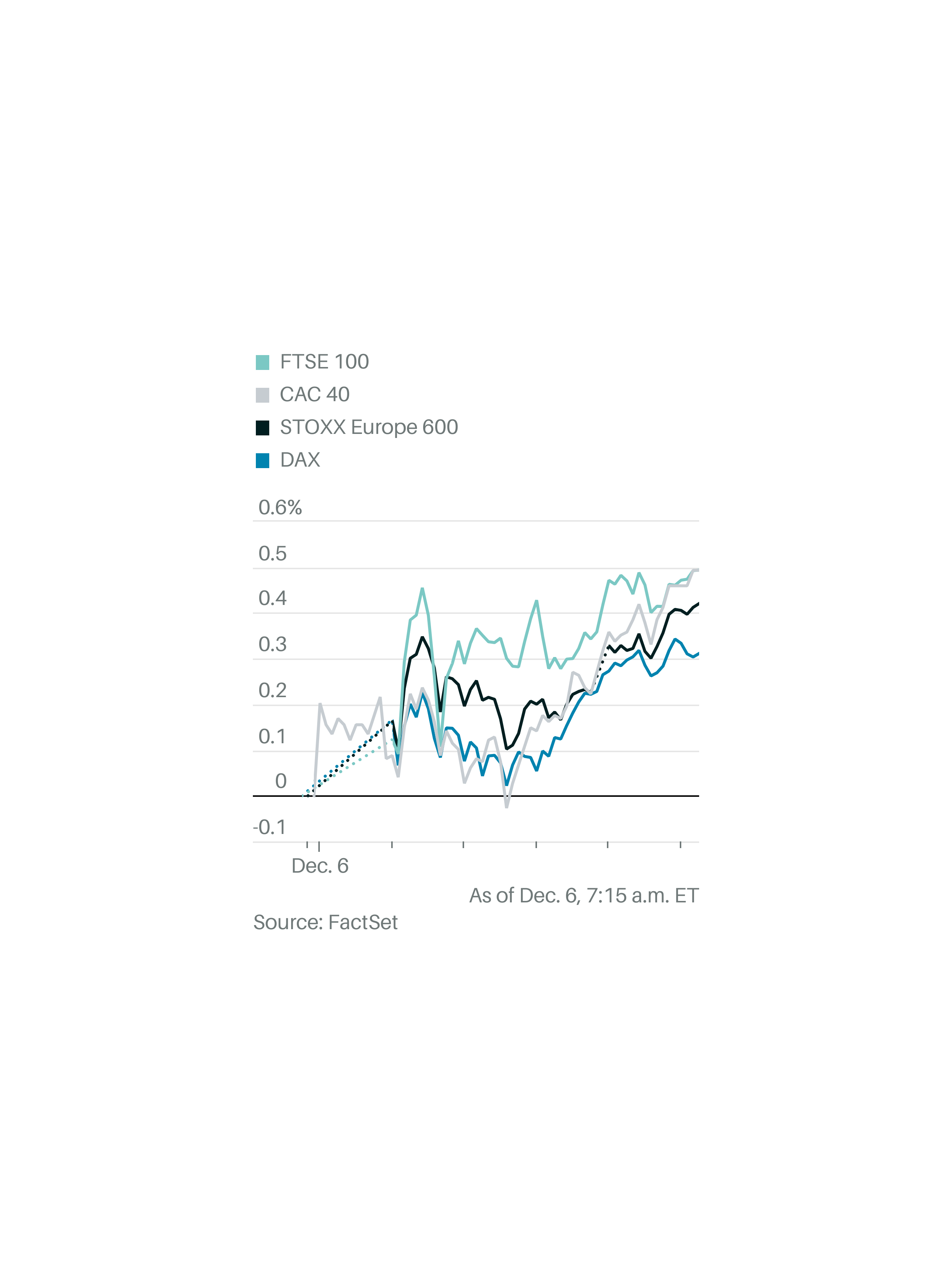

DAX Performance and Market Sentiment

Yesterday's Record High and its Impact

Yesterday's DAX surge marked a significant milestone, closing at a record high of [Insert Yesterday's Closing Value] – a [Insert Percentage Increase]% increase compared to the previous day. This impressive jump followed [mention significant news events, e.g., positive corporate earnings reports, positive economic data releases]. This record high achievement created a ripple effect influencing investor behaviour.

- Closing Value: [Insert Yesterday's Closing Value]

- Percentage Increase: [Insert Percentage Increase]%

- Significant News Events: [List significant news events]

The question remains: did this record high prompt widespread profit-taking or fuel further investment? While some profit-taking is expected after such a dramatic rise, early indicators suggest continued investor confidence. Many analysts believe the underlying strength of the German economy and positive global sentiment have outweighed any immediate pressure to sell.

Current Market Sentiment Analysis

Current market sentiment appears cautiously optimistic. While the record high undoubtedly injected some excitement, a degree of caution prevails amongst investors.

- News Articles: [Cite relevant news articles indicating market sentiment]

- Analyst Reports: [Cite analyst reports supporting the sentiment analysis]

- Investor Surveys: [Cite relevant investor surveys reflecting market sentiment]

Several factors are influencing this cautious optimism. The ongoing global economic uncertainty, geopolitical tensions, and the upcoming release of key corporate earnings reports all play a role. While the overall outlook remains positive for the DAX, investors remain alert to potential shifts in the global economic landscape.

Key Economic Indicators and their Influence

Inflation Data and its Impact on DAX

The latest inflation figures released [Insert Date] show an inflation rate of [Insert Inflation Rate]%. While this is [higher/lower/similar] compared to the previous period, its impact on the DAX remains relatively muted.

- Inflation Rate: [Insert Inflation Rate]%

- Comparison to Previous Periods: [Compare to previous periods and explain the trend]

- Central Bank Responses: [Explain the central bank's response to the inflation data]

The European Central Bank's (ECB) monetary policy response to inflation is a key factor influencing investor behavior. Any interest rate adjustments by the ECB will directly impact borrowing costs for businesses and investment decisions. Currently, the market seems to have already factored in the anticipated ECB actions, leading to a relatively stable DAX performance.

Other Relevant Economic Indicators

Other key economic indicators are also contributing to the DAX's stability.

- GDP Growth: [Insert GDP Growth Data and its impact]

- Unemployment Rates: [Insert Unemployment Rate Data and its impact]

- Manufacturing PMI: [Insert Manufacturing PMI Data and its impact]

Strong GDP growth, low unemployment, and a healthy manufacturing PMI point towards a robust German economy, which underpins investor confidence in the DAX. The interconnectedness of these indicators creates a positive feedback loop, boosting market sentiment and contributing to the DAX's stability.

Sectoral Performance within the DAX

Top Performing Sectors

Several sectors within the DAX are exhibiting strong performance.

- Top Performing Sectors: [List top-performing sectors, e.g., Technology, Automotive, Pharmaceuticals]

- Contributing Factors: [Explain the reasons for their growth, e.g., technological advancements, increased demand, government support]

The technology sector, in particular, is benefiting from [mention specific factors, e.g., strong innovation, increased digitalization]. The automotive sector is showing resilience due to [mention specific factors, e.g., strong global demand, successful electric vehicle launches].

Underperforming Sectors and Potential Concerns

Not all sectors within the DAX are performing equally well.

- Underperforming Sectors: [List underperforming sectors and explain reasons for underperformance]

- Potential Risks and Challenges: [Discuss potential risks and challenges faced by these sectors]

The [mention underperforming sector] sector is facing challenges due to [explain the challenges], leading to its relatively weaker performance. Investors are closely monitoring these sectors for any signs of significant deterioration.

Conclusion

The DAX opened relatively stable today despite reaching a record high yesterday. This stability can be attributed to a confluence of factors: cautiously optimistic market sentiment, positive economic indicators like strong GDP growth and low unemployment, and a mixed sectoral performance within the DAX. While some sectors are flourishing, others face headwinds. Understanding the interplay between these factors is crucial for investors navigating the Frankfurt Stock Market.

Key Takeaways: Investors should carefully monitor inflation data, ECB policy responses, and the performance of individual sectors within the DAX. Paying close attention to corporate earnings reports and global economic developments will also be critical in gauging future DAX performance.

Call to Action: Follow the Frankfurt Stock Market Opening regularly to stay updated on DAX Index performance. Monitor the DAX for further insights and understand the fluctuations of the Frankfurt Stock Market to make informed investment decisions. Stay informed about the latest news and analysis to navigate this dynamic market effectively.

Featured Posts

-

Demnas Gucci Collection And Kerings Sales Figures A September Update

May 24, 2025

Demnas Gucci Collection And Kerings Sales Figures A September Update

May 24, 2025 -

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025 -

The 10 Fastest Production Ferraris Around Their Own Test Track

May 24, 2025

The 10 Fastest Production Ferraris Around Their Own Test Track

May 24, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Quelles Innovations Attendre

May 24, 2025

Amsterdam Accueille Le Ces Unveiled Europe Quelles Innovations Attendre

May 24, 2025 -

Traffic Congestion On M6 Southbound 60 Minute Delays Expected

May 24, 2025

Traffic Congestion On M6 Southbound 60 Minute Delays Expected

May 24, 2025

Latest Posts

-

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025 -

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025 -

Sean Penn Questions Woody Allens Accusations Dylan Farrow Case Revisited

May 24, 2025

Sean Penn Questions Woody Allens Accusations Dylan Farrow Case Revisited

May 24, 2025 -

The Sean Penn Woody Allen Relationship A Me Too Case Study

May 24, 2025

The Sean Penn Woody Allen Relationship A Me Too Case Study

May 24, 2025 -

Is Sean Penn A Me Too Hypocrite His Support Of Woody Allen Examined

May 24, 2025

Is Sean Penn A Me Too Hypocrite His Support Of Woody Allen Examined

May 24, 2025