Form 20-F: ING Group's 2024 Financial Performance And Outlook

Table of Contents

Key Financial Highlights from ING Group's Form 20-F Filing

ING Group's Form 20-F provides a detailed account of their financial performance. Let's examine some key highlights:

Revenue and Net Income Analysis:

ING Group's revenue streams are diverse, encompassing retail banking, wholesale banking, and insurance services. Analyzing the Form 20-F reveals:

- Retail Banking: Strong performance driven by growth in mortgages and consumer lending.

- Wholesale Banking: Fluctuations reflecting global market conditions and investment banking activities.

- Insurance: Steady contributions, though growth may be impacted by market competition.

Comparing 2024 performance to previous years requires a close examination of the Form 20-F's detailed financial statements. Key metrics like Return on Equity (ROE) and Net Interest Margin (NIM) will be crucial in assessing profitability and efficiency. Charts and graphs visualizing these trends will be presented in a subsequent, more detailed report. [Link to hypothetical detailed report].

Balance Sheet Strength and Capital Adequacy:

The Form 20-F will detail ING's liquidity position, capital ratios (Tier 1 Capital Ratio, Common Equity Tier 1 Ratio), and overall balance sheet strength. This analysis will assess:

- ING's ability to meet its short-term and long-term obligations.

- Compliance with regulatory capital requirements (Basel III, etc.).

- The resilience of their capital structure against potential economic downturns.

A comparison to industry benchmarks will help contextualize ING's financial health and provide a clearer picture of their capital adequacy.

Loan Portfolio Performance and Credit Risk:

A crucial aspect of any financial institution's health is its loan portfolio. The Form 20-F will disclose:

- The level of non-performing loans (NPLs) and loan defaults.

- ING's credit risk management strategies and their effectiveness.

- The impact of macroeconomic factors (inflation, interest rate hikes, recessionary pressures) on credit quality.

Understanding these factors is essential to assessing potential risks and the overall sustainability of ING's lending operations.

ING Group's Strategic Initiatives and Outlook for 2024

ING Group's Form 20-F will likely outline their strategic plans for 2024 and beyond. Let's explore key areas:

Growth Strategies and Market Opportunities:

ING's strategic initiatives likely focus on:

- Expansion into new or existing markets, potentially highlighted by geographic region and business segment.

- Development of new financial products and services to cater to evolving customer needs.

- Leveraging competitive advantages to enhance market share.

The Form 20-F will provide specifics on these strategies and their potential impact on revenue growth.

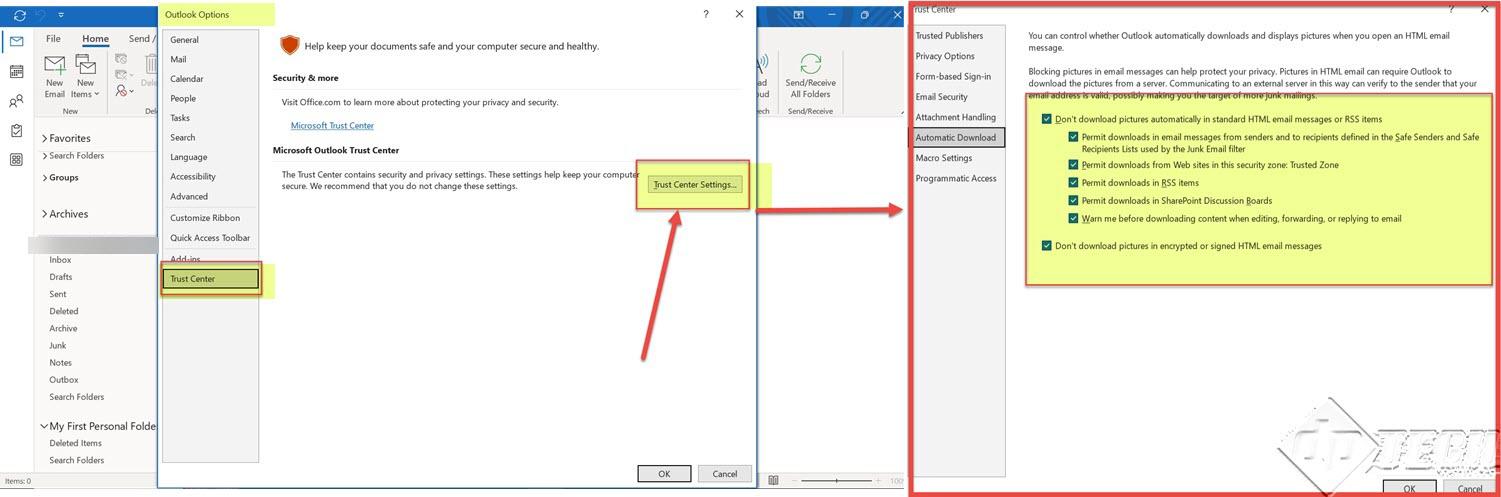

Technological Advancements and Digital Transformation:

ING's continued investment in technology will be a key focus:

- Details on fintech partnerships and investments.

- Improvements in digital banking services aimed at enhancing customer experience and operational efficiency.

- Investment in cybersecurity infrastructure to mitigate risks.

The Form 20-F should offer insights into the progress and impact of these initiatives.

Environmental, Social, and Governance (ESG) Initiatives:

ESG considerations are increasingly important for investors. The Form 20-F will reveal:

- ING's commitment to sustainable banking practices and its progress towards ESG targets.

- The impact of ESG factors on their financial performance and reputation.

- Specific ESG initiatives and their measurable outcomes.

This section will provide crucial information for investors focused on responsible investing.

Potential Risks and Challenges Facing ING Group

While ING Group enjoys a strong position, several risks and challenges need consideration:

Macroeconomic Factors and Geopolitical Risks:

Global economic uncertainty presents significant challenges:

- The impact of inflation, interest rate fluctuations, and geopolitical instability on ING's financial performance.

- Potential impact of recessionary pressures on loan defaults and overall profitability.

The Form 20-F will likely address these factors and their potential implications.

Regulatory and Compliance Risks:

The financial industry is highly regulated:

- Potential changes in financial regulations and their impact on ING’s operations.

- Any ongoing or potential legal or regulatory investigations or issues.

Compliance and regulatory risks are significant considerations.

Cybersecurity and Operational Risks:

Cyberattacks and operational disruptions are a major concern:

- Potential for data breaches and their financial and reputational impact.

- ING's cybersecurity measures and disaster recovery plans.

Conclusion: Key Takeaways and Call to Action on Form 20-F: ING Group's 2024 Financial Performance and Outlook

Analyzing ING Group's Form 20-F reveals a complex picture. While the company demonstrates financial strength and pursues strategic growth initiatives, potential risks associated with macroeconomic factors, regulatory changes, and cybersecurity remain. A thorough review of the Form 20-F is crucial for a complete understanding. This analysis highlights key financial metrics, strategic priorities, and potential challenges. To gain a deeper understanding of ING Group's financial performance and future outlook, download ING Group's Form 20-F filing today to conduct your own thorough analysis. Further research into "ING Group stock analysis" and best practices related to "20-F filings" will also provide valuable insights. Stay informed about ING Group’s financial performance by subscribing to our newsletter for future updates.

Featured Posts

-

Zimbabwe To Host High Level International Cricket Meetings

May 23, 2025

Zimbabwe To Host High Level International Cricket Meetings

May 23, 2025 -

Erik Ten Hag Next Juventus Manager Man United News And Transfer Speculation

May 23, 2025

Erik Ten Hag Next Juventus Manager Man United News And Transfer Speculation

May 23, 2025 -

Hulu Movie Departures Whats Leaving This Month

May 23, 2025

Hulu Movie Departures Whats Leaving This Month

May 23, 2025 -

2025 Rendez Vous With French Cinema Festival Highlights And Award Predictions

May 23, 2025

2025 Rendez Vous With French Cinema Festival Highlights And Award Predictions

May 23, 2025 -

Netflix Unveils Trailer For Dark Comedy Featuring Kevin Bacon And Julianne Moore

May 23, 2025

Netflix Unveils Trailer For Dark Comedy Featuring Kevin Bacon And Julianne Moore

May 23, 2025

Latest Posts

-

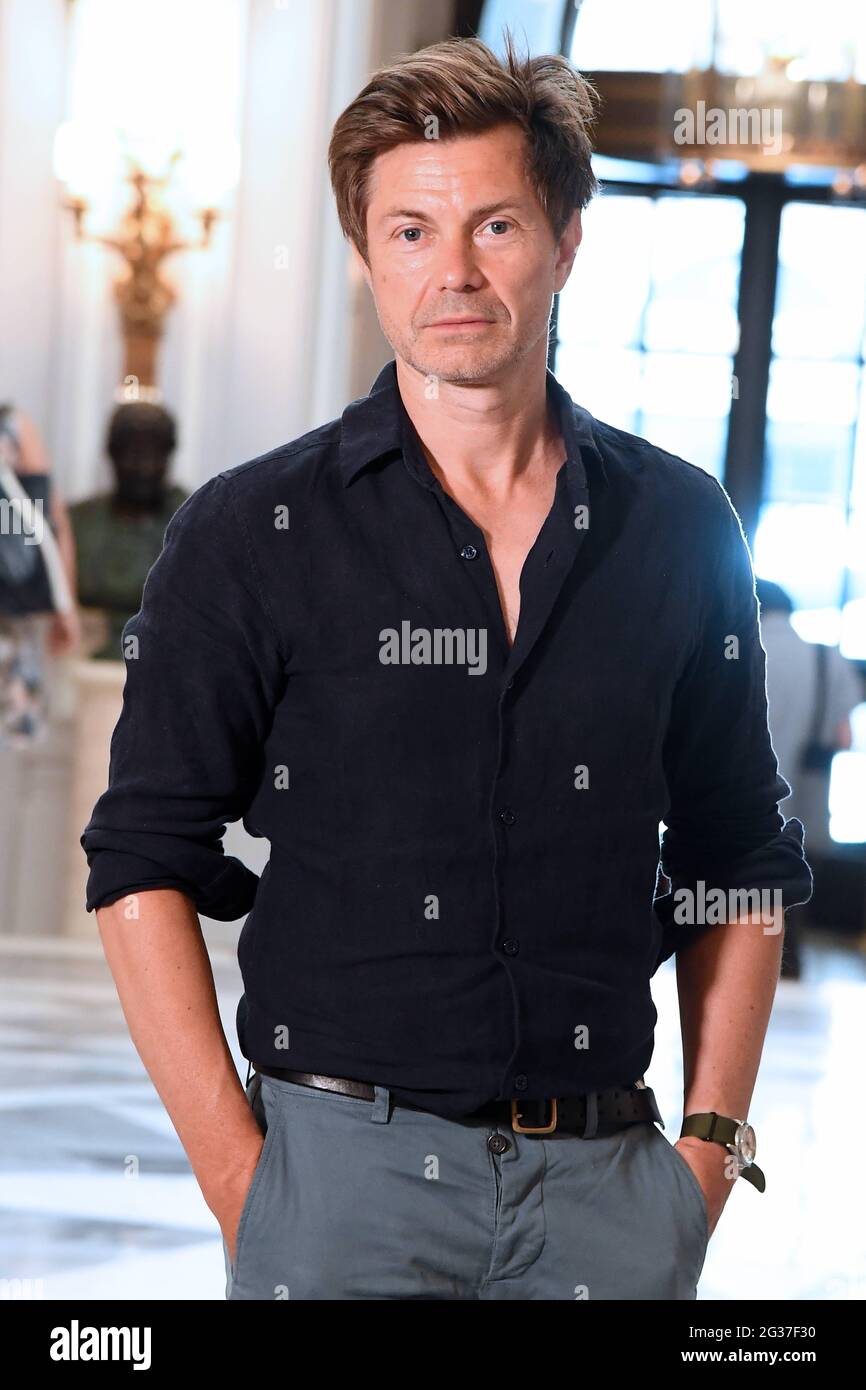

Exclusive Sam Altman And Jony Ives Unannounced Project

May 23, 2025

Exclusive Sam Altman And Jony Ives Unannounced Project

May 23, 2025 -

Todays Market Bond Sell Off Dow Futures Bitcoin Price Surge

May 23, 2025

Todays Market Bond Sell Off Dow Futures Bitcoin Price Surge

May 23, 2025 -

Universals Massive Theme Park Investment Implications For The Theme Park Industry

May 23, 2025

Universals Massive Theme Park Investment Implications For The Theme Park Industry

May 23, 2025 -

Sam Altmans Secret Device What He Told Open Ai About His Collaboration With Jony Ive

May 23, 2025

Sam Altmans Secret Device What He Told Open Ai About His Collaboration With Jony Ive

May 23, 2025 -

Stock Market News Bonds Fall Dow Futures Fluctuate Bitcoin Climbs

May 23, 2025

Stock Market News Bonds Fall Dow Futures Fluctuate Bitcoin Climbs

May 23, 2025