Focus On De-escalation: A Look At This Week's U.S.-China Trade Discussions

Table of Contents

Key Talking Points of This Week's Trade Discussions

This week's U.S.-China trade talks centered on several critical areas crucial for achieving meaningful de-escalation. Successful negotiation in these areas could pave the way for a more stable and predictable trade relationship between the two economic giants.

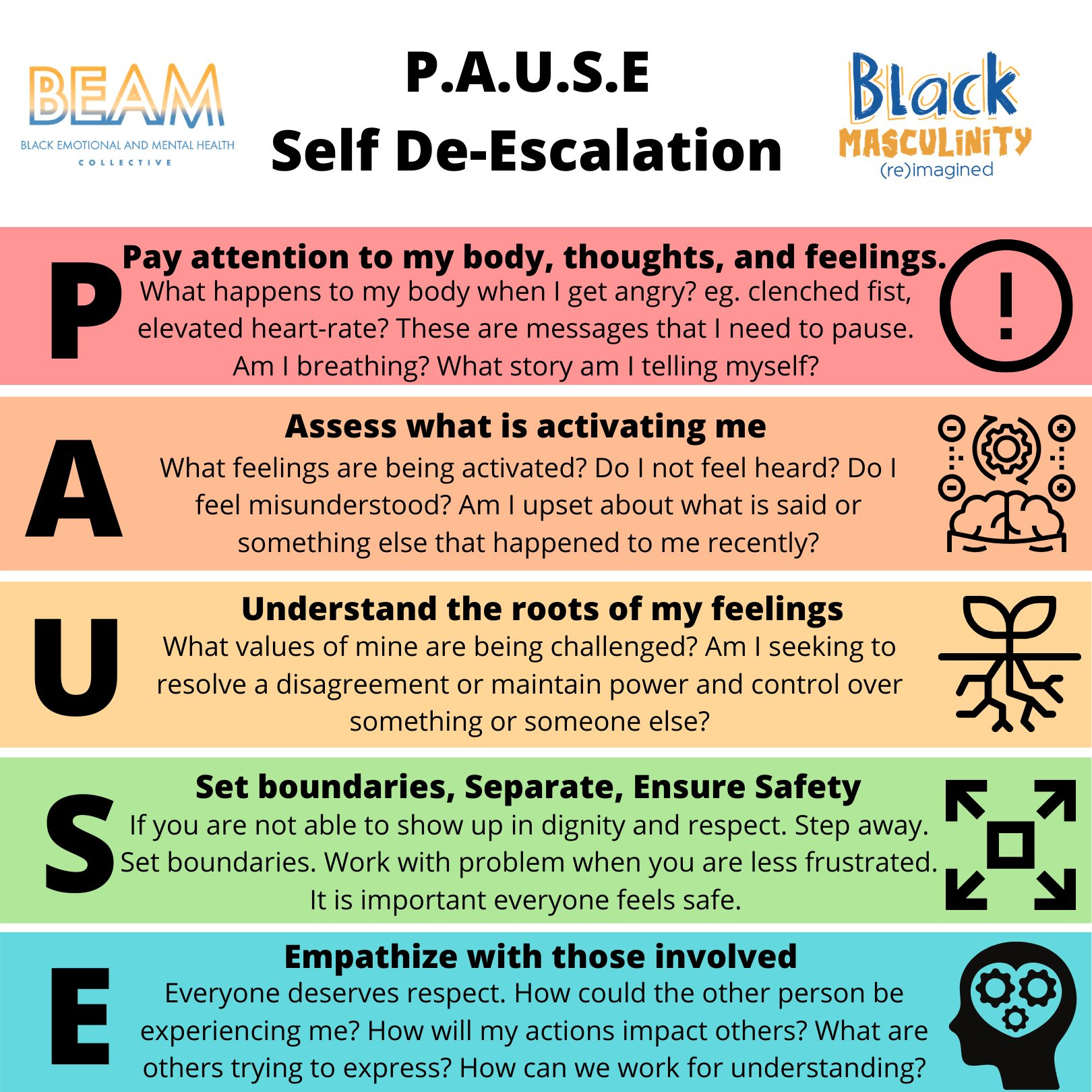

Tariff Reductions and Removal

A significant portion of the discussions revolved around tariff reductions and potential eliminations. The current trade war has imposed substantial tariffs on billions of dollars worth of goods, impacting businesses and consumers on both sides.

- Specific examples: Tariffs on agricultural products, technology goods, and manufactured items were key points of discussion.

- Potential economic impacts: Reducing or eliminating tariffs could boost economic growth in both countries, leading to increased consumer spending and business investment. Conversely, a failure to reach an agreement could further exacerbate existing economic uncertainties.

- Stakeholder reactions: Businesses, particularly those heavily reliant on trade between the two countries, are keenly watching for signs of de-escalation. Positive developments could signal renewed confidence and investment. The agricultural sector, in particular, has been severely impacted by the ongoing trade war and will be closely monitoring developments regarding tariff reductions. Keyword integration: "Tariff reduction," "trade war de-escalation," "bilateral trade agreement."

Intellectual Property Rights Protection

Protecting intellectual property (IP) rights is another crucial element in fostering trust and fair trade between the U.S. and China. The U.S. has long expressed concerns about the enforcement of IP rights in China.

- Specific concerns addressed: Counterfeit goods, forced technology transfer, and inadequate IP protection mechanisms were central concerns.

- Proposed solutions: Discussions likely included measures to strengthen IP protection laws in China, enhance enforcement mechanisms, and establish clearer guidelines for technology transfer.

- Importance of IP protection for innovation: Strong IP protection is essential for incentivizing innovation and fostering a level playing field for businesses. Keyword integration: "IP protection," "trade negotiations," "de-escalation strategies."

Market Access and Fair Competition

Ensuring fair market access for U.S. companies in China, and vice-versa, is a critical component of achieving sustainable de-escalation. Barriers to market access hinder competition and stifle economic growth.

- Specific sectors discussed: Discussions likely encompassed various sectors, including financial services, technology, and agriculture.

- Potential barriers to market access: These can include regulatory hurdles, discriminatory practices, and non-tariff barriers that limit market access for foreign firms.

- Strategies for achieving fair competition: Discussions likely explored mechanisms to ensure transparency, reduce bureaucratic hurdles, and promote fair competition in both markets. Keyword integration: "Market access," "fair trade practices," "de-escalation initiatives."

Signs of De-escalation and Potential Breakthroughs

While significant challenges remain, there have been some positive signals suggesting a potential path towards de-escalation.

Positive Signals from Both Sides

- Specific quotes or actions from officials: Statements indicating a willingness to compromise and find common ground are positive signs. Public pronouncements emphasizing the importance of a constructive dialogue should be viewed favorably.

- Potential compromises reached: Any concessions made by either side on key issues, such as tariff reductions or IP protection, can signal progress towards de-escalation.

- Positive indicators for future cooperation: Agreements to hold further talks, establish working groups to address specific concerns, or enhance communication channels are all promising developments. Keyword integration: "Positive trade relations," "de-escalation progress," "trade deal prospects."

Challenges and Obstacles to Overcome

Despite these positive signs, significant challenges remain and could potentially derail de-escalation efforts.

- Points of contention: Issues such as technology transfer, cybersecurity, and state-owned enterprises may continue to be points of contention.

- Unresolved issues: Failure to address underlying structural issues could undermine any short-term agreements.

- Potential risks to the de-escalation process: Unexpected events or changes in domestic politics could disrupt negotiations and hinder progress. Keyword integration: "Trade tensions," "obstacles to de-escalation," "mitigating trade risks."

The Role of International Pressure and Global Implications

The U.S.-China trade dispute has far-reaching global implications, and the influence of other nations and international organizations is undeniable.

Influence of other nations and international organizations

- Statements or actions from other nations or organizations: Statements from the World Trade Organization (WTO) or other nations urging de-escalation can exert significant pressure on both sides.

- Their impact on negotiations: International pressure can create incentives for both sides to find common ground and avoid further escalation.

- Global consequences of the trade dispute: The ongoing trade war has already negatively impacted global economic growth and supply chains. De-escalation is crucial for mitigating these wider consequences. Keyword integration: "Global trade," "international cooperation," "impact of de-escalation."

Wider Economic Impacts of De-escalation

Successful de-escalation would have significant positive economic impacts globally.

- Potential benefits for various sectors and countries: Reduced trade barriers would boost economic activity, particularly in sectors heavily reliant on trade between the U.S. and China.

- Reduced uncertainty for businesses: A more stable trade relationship would reduce uncertainty for businesses, encouraging investment and economic growth.

- Improved global economic growth: Easing trade tensions would likely contribute to improved global economic growth and greater stability. Keyword integration: "Global economic growth," "positive trade impact," "benefits of de-escalation."

The Path Forward for U.S.-China Trade De-escalation

This week's trade discussions demonstrated both the challenges and opportunities for de-escalation in U.S.-China trade relations. While progress towards specific agreements remains to be seen, the willingness to engage in dialogue is a crucial first step. Continued commitment to addressing underlying concerns, particularly regarding intellectual property rights, market access, and fair competition, will be essential for achieving lasting de-escalation.

The path forward requires sustained commitment from both sides, alongside international cooperation and a focus on finding mutually beneficial solutions. Ignoring these challenges risks further economic damage and geopolitical instability. To remain informed about this crucial issue, follow the latest news on de-escalation efforts and learn more about the importance of de-escalation in U.S.-China trade. Stay updated on the progress of de-escalation efforts and their impact on the global economy.

Featured Posts

-

Us Tariffs French Minister Pushes For Increased Eu Retaliation

May 10, 2025

Us Tariffs French Minister Pushes For Increased Eu Retaliation

May 10, 2025 -

Abcs High Potential Season 1 Finale And Its Impact

May 10, 2025

Abcs High Potential Season 1 Finale And Its Impact

May 10, 2025 -

Analysis Fox News Debate On Trump Tariffs And Economic Consequences

May 10, 2025

Analysis Fox News Debate On Trump Tariffs And Economic Consequences

May 10, 2025 -

Brian Brobbey Physical Prowess Poses A Threat In Europa League

May 10, 2025

Brian Brobbey Physical Prowess Poses A Threat In Europa League

May 10, 2025 -

Transgender Women And Pregnancy Exploring The Potential Of Uterine Transplantation

May 10, 2025

Transgender Women And Pregnancy Exploring The Potential Of Uterine Transplantation

May 10, 2025