Fluctuations In Elon Musk's Net Worth: A US Perspective

Table of Contents

Tesla's Stock Performance as a Primary Driver

Tesla's stock price is the biggest single factor influencing Elon Musk's net worth. His substantial ownership stake means even minor changes in Tesla's valuation translate to massive shifts in his personal wealth.

Impact of Innovation and Product Launches

Tesla's success hinges on continuous innovation and the timely launch of compelling new products. New vehicle releases directly impact investor confidence and the stock price.

- New vehicle releases: The anticipation and subsequent launch of vehicles like the Cybertruck, Model Y, and future models significantly influence Tesla's stock valuation. Positive reviews, high pre-orders, and successful production ramp-ups all contribute to a positive market reaction. Conversely, production delays or negative reviews can lead to declines.

- Technological advancements: Advancements in Full Self-Driving (FSD) capabilities, battery technology, and charging infrastructure are crucial for long-term growth projections. Demonstrations of superior technology can boost investor confidence and drive up the stock price.

- Successful production ramp-ups and delivery numbers: Meeting production targets and delivering vehicles to customers are essential for demonstrating Tesla's ability to scale its operations. Strong delivery numbers are a key indicator of success and typically translate into positive market reactions. Keywords: Tesla stock, Tesla valuation, EV market, electric vehicle, stock market fluctuations, innovation, product launch.

Market Sentiment and Investor Confidence

The overall market sentiment towards Tesla and the broader electric vehicle (EV) sector significantly impacts the stock price.

- News cycles and media coverage: Positive news coverage, such as groundbreaking technological advancements or strong sales figures, fuels investor optimism. Conversely, negative news, including production challenges or safety concerns, can lead to a sell-off.

- Analyst ratings and predictions: The opinions and predictions of financial analysts heavily influence investor behavior. Upward revisions of price targets can boost the stock price, while downgrades can lead to significant declines.

- Economic conditions: Macroeconomic factors like recessions, inflation, and interest rate hikes impact investor risk appetite. During economic uncertainty, investors may move away from riskier assets, like Tesla stock, leading to price drops. Keywords: investor sentiment, market volatility, risk appetite, Tesla news, stock market analysis.

Competition within the EV Industry

Tesla faces increasing competition within the burgeoning EV industry. This competition impacts its market share and, consequently, its valuation.

- The emergence of strong competitors: The rise of competitors like Rivian, Lucid Motors, and established automakers launching their own EV lines puts pressure on Tesla's market share and profitability. Successful launches from competitors can lead to a decrease in Tesla's stock price.

- Government policies promoting EV adoption: Government incentives such as tax credits and subsidies can boost the entire EV market, benefiting Tesla. However, these policies can also encourage competition and potentially reduce Tesla's competitive edge.

- Supply chain disruptions and material costs: Global supply chain disruptions and rising costs of raw materials like lithium and cobalt directly impact Tesla's production costs and profitability, influencing its stock price. Keywords: EV competition, electric vehicle market share, supply chain, industry trends.

SpaceX and Other Ventures' Contributions

While Tesla is the primary driver of Elon Musk's net worth, SpaceX and his other ventures also play a role, albeit a currently smaller one.

SpaceX's Role in Elon Musk's Net Worth

SpaceX's success is another significant contributor to Elon Musk's wealth, although less directly tied to daily market fluctuations compared to Tesla.

- Successful launches and contracts: Successful launches of rockets, especially those securing lucrative contracts with NASA or private companies, significantly increase SpaceX's valuation and, consequently, Musk's net worth.

- Future prospects for space tourism and satellite internet: The potential for future revenue streams from space tourism (through SpaceX's Starship program) and the rapidly expanding Starlink satellite internet service greatly impacts SpaceX's long-term valuation and Musk's overall wealth.

- Funding rounds and private investments: Further funding rounds and private investments in SpaceX directly increase its valuation, thereby boosting Musk's net worth. Keywords: SpaceX valuation, space exploration, Starlink, space tourism, private investment.

Diversification Beyond Tesla and SpaceX

Elon Musk's investments extend beyond Tesla and SpaceX, though their current contribution to his overall net worth is relatively minor.

- The influence of other ventures: Companies like The Boring Company and Neuralink, while less impactful currently, represent potential future growth areas that could significantly alter the trajectory of his net worth.

- Potential future growth: Successful development and commercialization of Neuralink's brain-computer interface technology, or The Boring Company's infrastructure projects, could substantially increase Musk's overall wealth in the future.

- Impact of investments and partnerships: Investments and partnerships in other companies also contribute to his overall portfolio and net worth, though these are less publicly visible. Keywords: diversification, portfolio, investments, Neuralink, The Boring Company.

External Factors Influencing Musk's Net Worth

Numerous external factors beyond Musk's direct control influence the valuation of his assets and, therefore, his net worth.

Geopolitical Events and Economic Uncertainty

Global events and economic uncertainty create significant volatility in the financial markets, impacting all asset classes, including Tesla stock.

- Global economic downturns: During global recessions, investors tend to move away from riskier investments, negatively affecting Tesla's stock price and, consequently, Musk's net worth.

- International trade policies and regulations: International trade disputes and regulations can impact Tesla's global expansion and profitability. Tariffs and trade restrictions can increase production costs and reduce market access.

- Geopolitical instability: Geopolitical instability, including wars, sanctions, and political unrest, creates market uncertainty and impacts investor sentiment, potentially leading to decreased valuation of Tesla and SpaceX. Keywords: geopolitical risk, economic uncertainty, global markets, international trade.

Elon Musk's Public Persona and Controversies

Elon Musk's public statements and actions significantly impact investor confidence and brand perception, affecting the valuation of his companies.

- Public statements and actions: Controversial tweets or public statements can lead to short-term market volatility, impacting investor confidence and, therefore, Tesla's stock price.

- Controversies and negative media coverage: Negative media coverage, whether related to his business dealings or personal life, can negatively influence brand perception and potentially lead to short-term stock price declines.

- Social media activity and its influence: His extensive use of social media platforms, while increasing his visibility, also exposes him to potential PR challenges that can impact investor sentiment. Keywords: brand reputation, public relations, media coverage, social media influence.

Conclusion

Elon Musk's net worth is a complex interplay of factors, primarily driven by Tesla's stock performance and SpaceX's success, but significantly influenced by external economic conditions and his public image. Understanding the US-centric perspectives and interconnectedness of these elements is key to comprehending the dramatic fluctuations in his wealth. Further analysis of fluctuations in Elon Musk's net worth and its contributing factors is necessary to understand the dynamics of the modern tech-driven economy. To stay informed on the latest developments, continue researching Elon Musk's net worth and related market trends.

Featured Posts

-

China Seeks New Canola Sources Amidst Canada Trade Tensions

May 09, 2025

China Seeks New Canola Sources Amidst Canada Trade Tensions

May 09, 2025 -

Daycare Decisions Finding The Best Fit For Your Familys Needs

May 09, 2025

Daycare Decisions Finding The Best Fit For Your Familys Needs

May 09, 2025 -

Snls Impression Of Harry Styles His Reaction And Why It Matters

May 09, 2025

Snls Impression Of Harry Styles His Reaction And Why It Matters

May 09, 2025 -

Makron Starmer Merts I Tusk Propustyat Vizit V Kiev 9 Maya

May 09, 2025

Makron Starmer Merts I Tusk Propustyat Vizit V Kiev 9 Maya

May 09, 2025 -

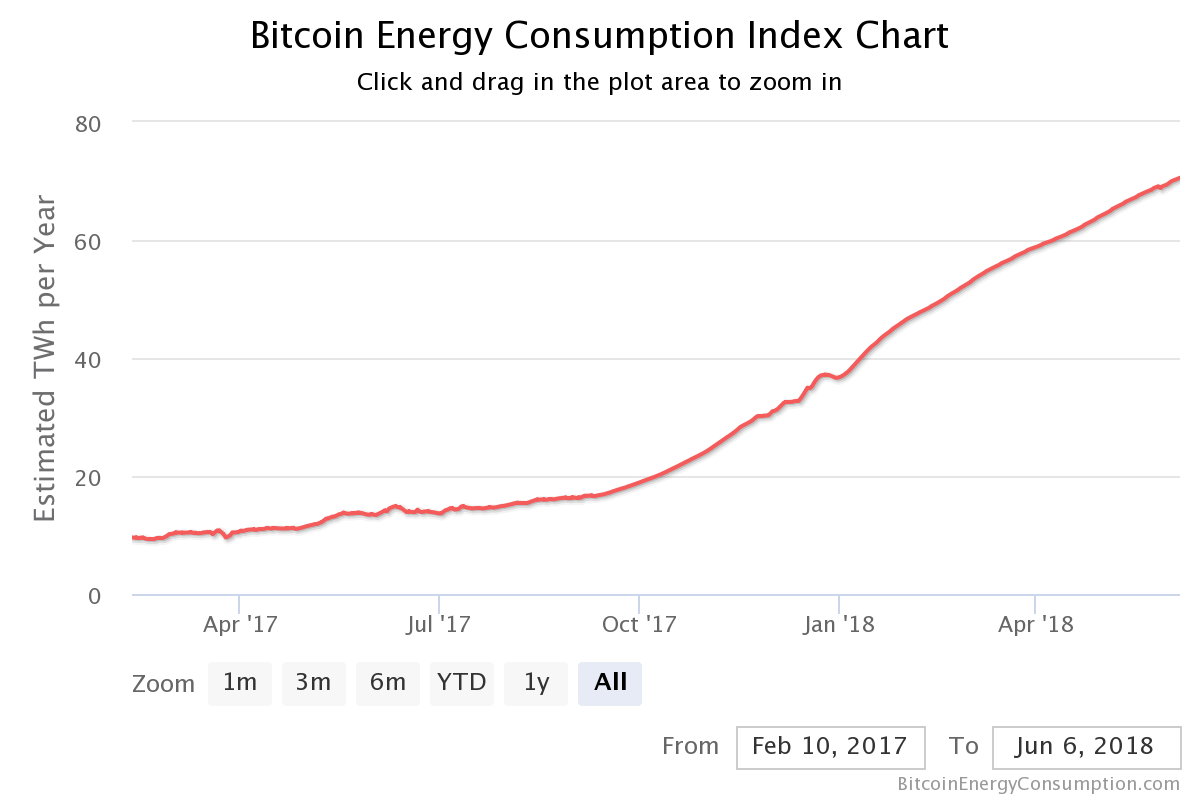

Exploring The Factors Contributing To The Recent Bitcoin Mining Increase

May 09, 2025

Exploring The Factors Contributing To The Recent Bitcoin Mining Increase

May 09, 2025