Flat Market Close: Sensex And Nifty 50 Unmoved Despite Bajaj Twins' Decline And Geopolitical Concerns

Table of Contents

Bajaj Twins' Decline: A Key Factor in Today's Market Inertia?

The decline in Bajaj Auto and Bajaj Finance share prices played a notable role in today's muted market performance. Both stocks, considered significant components of the Nifty 50 and broader market indices, experienced a noticeable drop, contributing to the overall flat trajectory.

Possible reasons for this decline include profit-booking by investors after a period of strong performance and potential sector-specific concerns impacting investor sentiment within the auto and financial sectors.

- Percentage drop: Bajaj Auto saw a [Insert Percentage]% drop, while Bajaj Finance declined by [Insert Percentage]%. (Please replace bracketed information with actual data).

- Trading Volume: Trading volume for both Bajaj Auto and Bajaj Finance was [Insert Volume Data], suggesting [Interpret the significance of the volume – high volume indicating strong selling pressure, low volume suggesting less significant impact].

- Analyst Comments: Analysts attributed the decline to [Summarize analyst opinions – e.g., profit-booking, concerns about future growth, etc.].

- Impact on Broader Sectors: The decline impacted investor confidence in the broader auto and financial sectors, although the impact was contained, preventing wider market fluctuations.

Keywords: Bajaj Auto, Bajaj Finance, stock price decline, profit booking, sector performance.

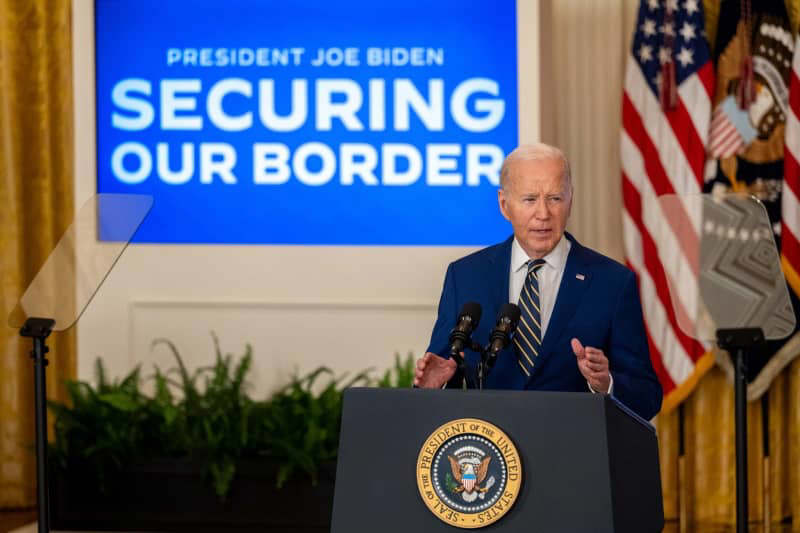

Geopolitical Tensions and Their Limited Impact on Indian Markets

Prevailing geopolitical concerns, including the ongoing Russia-Ukraine war and fluctuating US-China relations, continue to cast a shadow over global markets. However, their impact on the Indian market today was surprisingly limited, demonstrating a degree of resilience.

- Specific Geopolitical Events: [Mention specific events, e.g., escalation of conflict, new sanctions, etc.].

- Investor Reaction: Despite global uncertainty, Indian investors showed relative calm, likely due to [Explain reasons – e.g., belief in the resilience of the Indian economy, focus on domestic factors, etc.].

- Comparison with Previous Reactions: Compared to previous instances of similar geopolitical events, the market's response today was [Describe the difference – e.g., less volatile, more muted, etc.].

- Potential Future Impact: While the current geopolitical climate remains volatile, its immediate impact on Indian markets seems contained. However, sustained escalation could alter this scenario.

Keywords: Geopolitical risks, global market uncertainty, investor sentiment, risk aversion, Russia-Ukraine war, US-China relations.

Sector-Specific Performance: Identifying Winners and Losers

While the overall market exhibited a flat trajectory, individual sectors showcased varied performances. This divergence highlights the importance of sector-specific analysis in understanding market dynamics.

- Top-Performing Sectors: [List top-performing sectors, e.g., IT, Pharma] with percentage changes. [Briefly explain the reasons behind their strong performance – e.g., positive global outlook, robust domestic demand].

- Underperforming Sectors: [List underperforming sectors, e.g., Auto (excluding Bajaj), Real Estate] with percentage changes. [Explain the reasons – e.g., sector-specific challenges, regulatory concerns].

- Reasons for Divergence: The differing performances underscore the uneven impact of macroeconomic factors and investor sentiment across various sectors.

- Key Stocks Driving Performance: [Mention key stocks contributing significantly to sector performance, both positive and negative].

Keywords: Sectoral analysis, stock market performance, top performing sectors, underperforming sectors, Indian economy.

Technical Analysis: Interpreting the Market's Flat Trajectory

A brief technical analysis of the Sensex and Nifty 50 charts reveals a relatively flat trajectory, with the indices consolidating within a defined range.

- Key Support and Resistance Levels: The Sensex found support at [Insert Support Level] and faced resistance at [Insert Resistance Level]. Similarly, the Nifty 50 found support at [Insert Support Level] and resistance at [Insert Resistance Level].

- Technical Indicators: [Mention key technical indicators, e.g., RSI, MACD] and their current readings, suggesting [Interpret the signals – e.g., consolidation, potential breakout, etc.].

- Short-Term and Long-Term Outlook: The short-term outlook appears to be one of consolidation, while the long-term outlook remains [Describe the long-term outlook – e.g., positive, uncertain, etc.], contingent on various macroeconomic and geopolitical factors.

Keywords: Technical analysis, support levels, resistance levels, technical indicators, market trend.

Conclusion: Flat Market Close: What to Expect Next?

Today's flat market close reflects a complex interplay of factors. The decline of the Bajaj twins contributed to the subdued market sentiment, while geopolitical uncertainties remained a background influence. However, the broader market showed resilience, with certain sectors performing strongly, indicating underlying economic strength. The technical analysis suggests a period of consolidation, but the future trajectory remains dependent on various factors.

Stay updated on the latest developments in the Indian stock market and continue monitoring the Sensex and Nifty 50 for clues on future market movements. Follow us for daily analysis on the flat market and significant stock fluctuations. Remember to consult a financial advisor before making any investment decisions. Understanding the nuances of a flat market and its underlying drivers is crucial for effective investment strategies.

Keywords: Sensex, Nifty 50, flat market, stock market analysis, market outlook, investment strategy.

Featured Posts

-

Uk Government Tightens Asylum Rules Impact On Migrants From Three Countries

May 10, 2025

Uk Government Tightens Asylum Rules Impact On Migrants From Three Countries

May 10, 2025 -

Measles Outbreak In North Dakota School Quarantine For Unvaccinated Children

May 10, 2025

Measles Outbreak In North Dakota School Quarantine For Unvaccinated Children

May 10, 2025 -

Trumps Potential Dc Prosecutor Fox News Jeanine Pirro

May 10, 2025

Trumps Potential Dc Prosecutor Fox News Jeanine Pirro

May 10, 2025 -

Unprovoked Racist Attack A Familys Life Shattered

May 10, 2025

Unprovoked Racist Attack A Familys Life Shattered

May 10, 2025 -

Infineons Ifx Revised Sales Guidance A Deep Dive Into Tariff Impacts

May 10, 2025

Infineons Ifx Revised Sales Guidance A Deep Dive Into Tariff Impacts

May 10, 2025