Find The Lowest Personal Loan Interest Rates Today

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into strategies for finding the lowest personal loan interest rates, it's crucial to understand what influences them.

Factors Affecting Interest Rates

Several factors determine the interest rate you'll receive on a personal loan. These factors significantly impact your overall loan cost.

-

Credit Score: Your credit score is the most significant factor. A higher FICO score (generally 670 or above) indicates lower risk to lenders, resulting in lower interest rates. Conversely, a lower credit score means higher rates, and possibly even loan rejection.

-

Debt-to-Income Ratio (DTI): Your DTI is the percentage of your gross monthly income that goes towards debt repayment. A lower DTI shows lenders you can comfortably manage additional debt, leading to better interest rates. Aim for a DTI below 43%.

-

Loan Amount and Term: Borrowing larger sums or extending the loan term typically results in higher interest rates. Shorter loan terms mean higher monthly payments but lower overall interest paid.

-

Type of Loan: Secured loans (backed by collateral) generally come with lower interest rates than unsecured loans (no collateral).

-

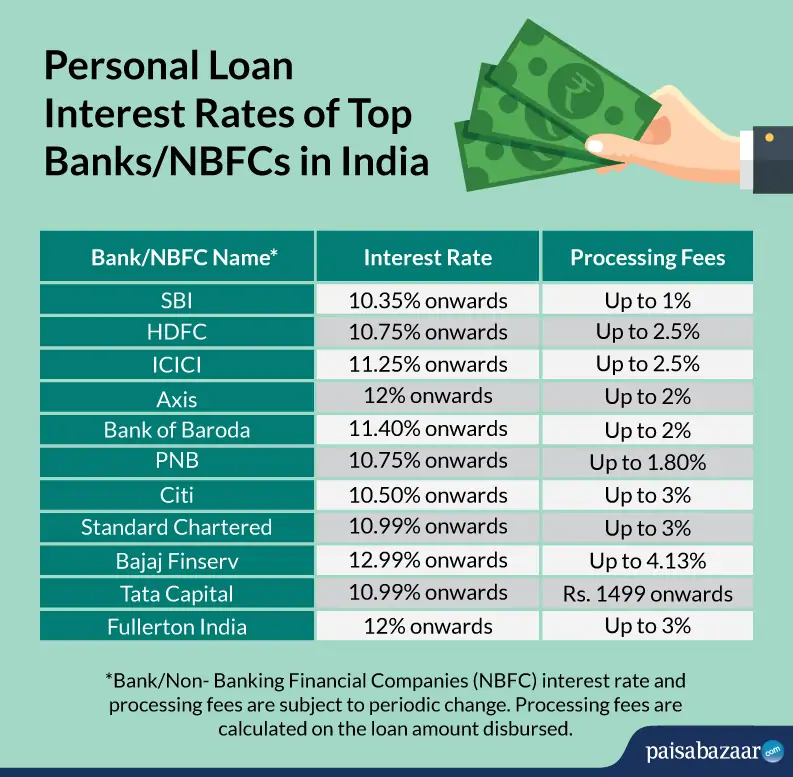

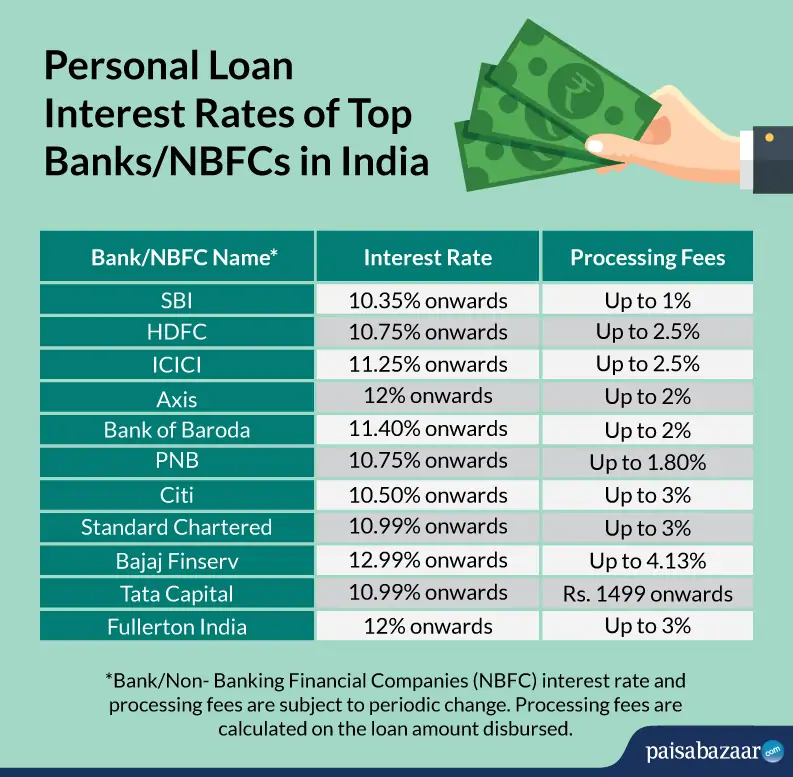

Lender Type: Different lenders offer varying rates. Banks often have slightly higher rates but offer more established services. Credit unions typically offer lower rates to their members, while online lenders can offer competitive rates through streamlined processes. Comparing rates across all types is key to finding the lowest personal loan interest rates.

How Interest Rates are Calculated

Understanding how interest is calculated is essential to comparing loan offers effectively.

-

Simple Interest vs. Compound Interest: Simple interest is calculated only on the principal amount borrowed. Compound interest is calculated on both the principal and accumulated interest, growing exponentially over time. Most personal loans use compound interest.

-

APR (Annual Percentage Rate): The APR is the annual cost of borrowing, including interest and other fees. It's crucial for comparing loan offers because it provides a comprehensive cost picture. Always compare APRs when shopping for loans to find the lowest personal loan interest rates.

-

Examples: Let's say you borrow $10,000 at 5% simple interest over 2 years. You'll pay $1,000 in interest. The same loan at 5% compound interest would cost you slightly more due to interest accruing on interest. Understanding this difference is key when comparing lowest personal loan interest rates.

Strategies to Find the Lowest Personal Loan Interest Rates

Now, let's explore practical strategies to secure the best possible interest rate.

Check Your Credit Report

Before applying for any loan, review your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) for errors. Fixing errors can significantly improve your score and secure better rates.

- Importance of Reviewing: Errors can drastically affect your credit score, resulting in higher interest rates.

- Improving Your Score: Pay bills on time, reduce outstanding debt, and consider using credit responsibly to boost your creditworthiness.

- Free Credit Reports: Access your free annual credit reports at AnnualCreditReport.com.

Shop Around and Compare Offers

Don't settle for the first offer you receive. Compare rates from multiple lenders.

- Online Comparison Tools: Use online comparison tools to quickly see rates from various lenders.

- Contact Lenders Directly: Obtain personalized quotes by contacting lenders directly; their rates might differ from what comparison websites show.

- Pre-qualification: Pre-qualify with several lenders to get an idea of your potential interest rates without impacting your credit score.

Negotiate with Lenders

Negotiating isn't always possible, but it's worth a try, particularly if you have an excellent credit score and compelling offers from competitors. Highlight your financial responsibility and compare the offers you've received.

Explore Different Loan Types

Consider various loan options, as interest rates vary significantly.

- Secured vs. Unsecured Loans: Secured loans (using collateral) usually have lower rates.

- Peer-to-Peer Loans: These loans can sometimes offer competitive rates. Understand the risks involved.

Avoiding Common Mistakes When Searching for Personal Loans

Avoid these common pitfalls to ensure you secure the lowest personal loan interest rates.

Ignoring Your Credit Score

Your credit score is paramount. A poor credit score significantly increases your interest rate or can prevent approval altogether. Work on improving your credit before applying for a loan.

Rushing the Application Process

Take your time to compare offers and thoroughly research lenders. Don't rush into accepting the first offer you receive.

Ignoring the Fine Print

Carefully read the loan agreement before signing. Pay close attention to fees and charges that can significantly increase the total cost of your loan.

Borrowing More Than Necessary

Borrow only the amount you truly need. A larger loan amount increases your risk and can negatively affect your credit score and overall financial health.

Conclusion: Securing the Best Personal Loan Interest Rates

Finding the lowest personal loan interest rates requires careful planning and research. By understanding the factors that influence interest rates, checking your credit report, shopping around, and negotiating effectively, you can significantly reduce your borrowing costs. Don't delay your savings! Start your search for the lowest personal loan interest rates today and secure the best possible financing for your needs. Use reputable loan comparison websites to begin your search. [Link to reputable loan comparison website 1] [Link to reputable loan comparison website 2]

Featured Posts

-

Al Nassr Ve Cristiano Ronaldo 2 Yillik Soezlesmenin Ardindaki Hikaye

May 28, 2025

Al Nassr Ve Cristiano Ronaldo 2 Yillik Soezlesmenin Ardindaki Hikaye

May 28, 2025 -

Creating The World Of The Phoenician Scheme A Bts Featurette

May 28, 2025

Creating The World Of The Phoenician Scheme A Bts Featurette

May 28, 2025 -

Manchester Uniteds Garnacho Atletico Madrids Pursuit

May 28, 2025

Manchester Uniteds Garnacho Atletico Madrids Pursuit

May 28, 2025 -

Kapolda Irjen Daniel Pimpin Sertijab 7 Pamen Polda Bali Pesan Penting Untuk Jajarannya

May 28, 2025

Kapolda Irjen Daniel Pimpin Sertijab 7 Pamen Polda Bali Pesan Penting Untuk Jajarannya

May 28, 2025 -

John Haliburtons Pacers Return Facing Giannis After Injury Layoff

May 28, 2025

John Haliburtons Pacers Return Facing Giannis After Injury Layoff

May 28, 2025