Financial Planning: CFP Board CEO's Retirement Announcement

Table of Contents

H2: The Impact of the CEO's Retirement on the CFP Certification Process

The retirement of a long-standing CEO inevitably leads to questions about the future direction of the CFP Board. This change has the potential to significantly alter the CFP certification process, impacting both current and future financial advisors.

H3: Potential Changes in CFP Board Leadership and Direction:

A new leadership team could bring shifts in policy, potentially influencing several key aspects of the CFP certification:

- Stricter Exam Requirements: The new CEO might implement more rigorous exam standards, increasing the difficulty of the CFP exam and potentially requiring more extensive financial planning education.

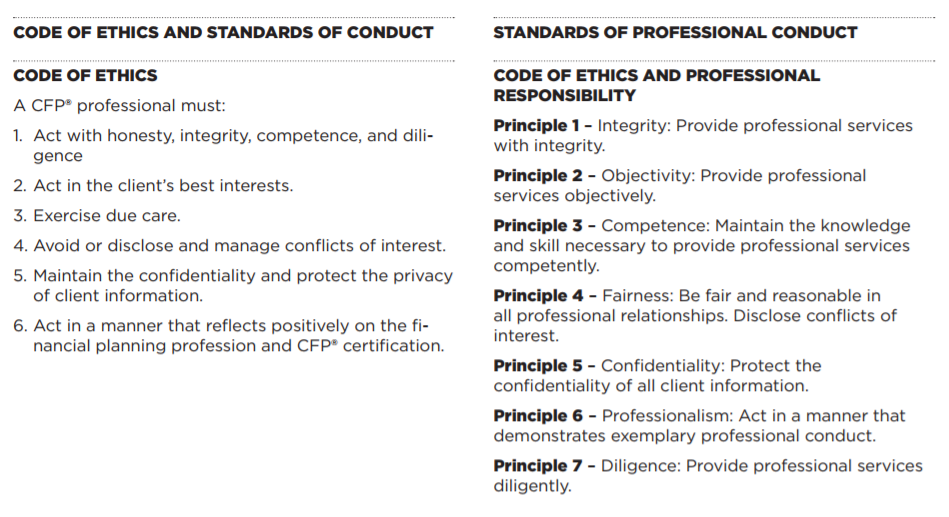

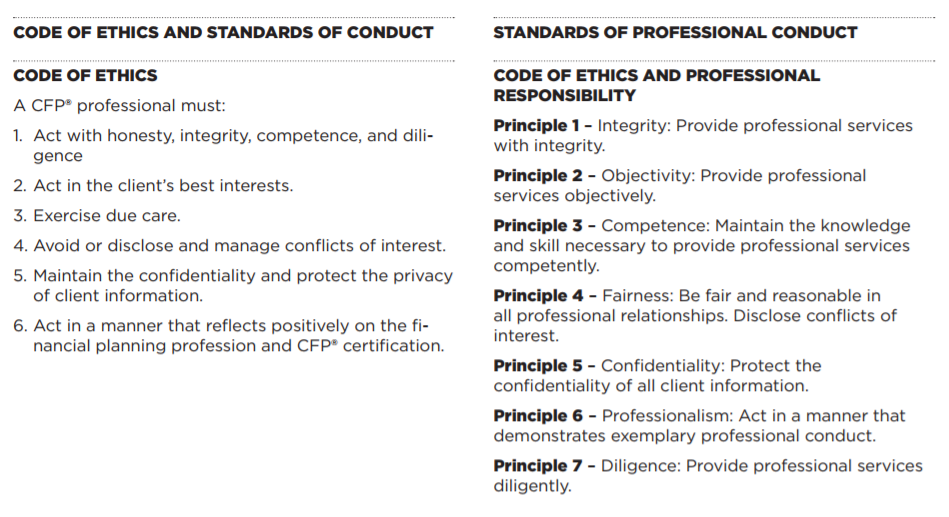

- Enhanced Ethical Standards: A heightened focus on ethics within the financial planning industry could result in more stringent ethical guidelines and enforcement procedures for CFP professionals.

- Curriculum Changes: Updates to the CFP curriculum could incorporate emerging trends in financial technology (fintech) and specialized areas of financial planning, such as retirement planning strategies or sustainable investing.

- Increased Focus on Specific Areas: The CFP Board might place a greater emphasis on particular financial planning areas, such as retirement planning, estate planning, or wealth management, reflecting evolving client needs.

H3: Short-Term and Long-Term Implications for CFP Professionals:

The transition period might present both challenges and opportunities for CFP professionals:

- Impact on Exam Scheduling: Changes to the exam schedule or application process could affect those preparing for the CFP exam.

- Changes in Continuing Education Requirements: The new leadership may alter continuing education requirements for maintaining CFP certification, potentially requiring more specialized professional development courses.

- Networking Opportunities: A change in leadership could affect networking opportunities and professional development resources offered by the CFP Board.

H2: Succession Planning and the Future of the CFP Board

The success of the CFP Board hinges on the careful selection of its next CEO and a well-executed succession plan. This transition requires a strategic approach to maintain public trust and the integrity of the CFP designation.

H3: The Search for a New CEO and the Selection Process:

The search for a new CEO will likely focus on candidates who possess:

- Extensive Industry Expertise: Candidates with a deep understanding of financial planning, retirement planning, and wealth management will be highly sought after.

- Strong Leadership Skills: The ability to guide the organization through change and maintain its overall direction is crucial.

- Commitment to Ethical Standards: A strong commitment to ethical conduct and consumer protection is paramount.

- Proven Track Record: Successful experience in a leadership role within a similar organization is highly desirable.

H3: Maintaining the Integrity and Reputation of the CFP Mark:

Ensuring a seamless transition is vital for maintaining the reputation of the CFP designation:

- Transparency and Communication: Open communication with CFP professionals and the public throughout the transition period can help alleviate concerns and foster trust.

- Continued Focus on Ethical Conduct: Upholding the highest ethical standards will reinforce the public's confidence in the CFP mark.

- Maintaining Relevance: The CFP Board must continue adapting to industry changes to ensure the CFP certification remains highly valued and relevant.

H2: Opportunities and Challenges for Financial Planners in the Post-Retirement Era

The retirement of the CEO presents both challenges and significant opportunities for financial planners. Adapting to emerging trends and focusing on professional growth are key to thriving in this evolving landscape.

H3: Adapting to Emerging Trends in Financial Planning:

Financial planners must be prepared to navigate emerging trends including:

- Technological Advancements (Fintech): Integrating financial technology into their practice is essential for efficiency and enhanced client service.

- Regulatory Changes: Staying informed about and adapting to regulatory changes is critical for compliance.

- Increased Demand for Specialized Services: Clients increasingly seek specialized services, such as retirement planning, estate planning, and sustainable investing.

H3: Strategies for Financial Planners to Maintain Professional Growth and Development:

To stay competitive, CFPs should prioritize:

- Continuing Education: Staying updated through continuing education credits and professional development courses is crucial.

- Networking and Collaboration: Engaging in professional networking helps build relationships and share best practices.

- Specialization: Focusing on a niche area within financial planning can enhance career prospects.

3. Conclusion:

The CFP Board CEO's retirement announcement marks a turning point for the financial planning industry. While the transition presents potential challenges regarding the CFP certification process and the overall direction of the organization, it also offers opportunities for professional growth and adaptation. By proactively embracing change, embracing new technologies, and focusing on continuing education, financial planners can position themselves for success in this dynamic environment. Stay informed about the developments within the CFP Board and continue to refine your financial planning strategies to best serve your clients. To further enhance your knowledge of financial planning and retirement planning, explore additional resources and continuing education opportunities available through the CFP Board website and other reputable sources. Invest in your future by investing in your knowledge of financial planning.

Featured Posts

-

Frimpong Transfer Speculation And Elliotts Liverpool Future

May 03, 2025

Frimpong Transfer Speculation And Elliotts Liverpool Future

May 03, 2025 -

Sydney Harbour Surveillance Monitoring The Rise Of Chinese Maritime Presence

May 03, 2025

Sydney Harbour Surveillance Monitoring The Rise Of Chinese Maritime Presence

May 03, 2025 -

Lotto Results April 12 2025 Lotto And Lotto Plus Numbers

May 03, 2025

Lotto Results April 12 2025 Lotto And Lotto Plus Numbers

May 03, 2025 -

Emmanuel Macron Et Les Victimes De L Armee Israelienne Une Image Rare Et Poignante

May 03, 2025

Emmanuel Macron Et Les Victimes De L Armee Israelienne Une Image Rare Et Poignante

May 03, 2025 -

Soupcons A Rome Macron Et L Influence Sur Le Conclave

May 03, 2025

Soupcons A Rome Macron Et L Influence Sur Le Conclave

May 03, 2025