Finance Loan Application: A Complete Guide To Interest Rates, EMIs, And Loan Tenure

Table of Contents

Understanding Interest Rates in Your Finance Loan Application

What are Interest Rates?

Interest rates represent the cost of borrowing money. They're expressed as a percentage of the principal loan amount and significantly impact the total repayment cost. A higher interest rate means you'll pay more in interest over the life of the loan. Understanding this is crucial for any successful finance loan application.

- APR (Annual Percentage Rate): The APR is the annual rate charged for borrowing, including fees and other costs. It provides a complete picture of the loan's true cost, unlike the simple interest rate. Always check the APR when comparing loan offers.

- Fixed vs. Variable Interest Rates: Fixed interest rates remain constant throughout the loan tenure, providing predictability. Variable interest rates fluctuate based on market conditions, leading to potential changes in your EMIs. Choose the option that best suits your risk tolerance and financial planning.

- Factors Influencing Interest Rates: Several factors influence the interest rate you'll receive on your finance loan application. These include:

- Your credit score: A higher credit score typically qualifies you for lower interest rates.

- The loan amount: Larger loan amounts might attract higher interest rates.

- The type of loan: Different loan types (e.g., personal loan, auto loan, home loan) carry varying interest rates.

- The lender: Different lenders have different lending policies and interest rate structures.

How Interest Rates Affect Your EMI

Interest rates directly influence your EMIs. A higher interest rate results in a higher EMI for the same loan amount and tenure.

- Higher Interest Rates = Higher EMIs: A simple example: A loan of $10,000 at 5% interest will have a lower EMI than the same loan at 10% interest.

- Prepayment and Interest Costs: Prepaying a portion of your loan can significantly reduce your total interest paid, especially in the early stages.

- Negotiating a Lower Interest Rate: Don't hesitate to negotiate with lenders to secure a lower interest rate. A lower rate can save you substantial money over the loan's lifetime. Shop around and compare offers from multiple lenders to find the most competitive rates.

Deciphering EMIs in Your Finance Loan Application

What are EMIs?

EMIs (Equated Monthly Installments) are fixed monthly payments made to repay a loan. They are calculated to cover both the principal loan amount and the accumulated interest. Understanding EMIs is essential for any finance loan application.

- EMI Calculation: While the exact formula is complex, a simplified explanation is that the EMI is calculated based on the loan amount, interest rate, and loan tenure. Online EMI calculators are readily available to assist you.

- Components of an EMI: Each EMI payment comprises two parts: principal repayment (reducing the outstanding loan amount) and interest payment.

- Amortization Schedules: An amortization schedule details the breakdown of each EMI payment, showing the allocation between principal and interest over the loan tenure. This helps you track your loan repayment progress.

Choosing the Right EMI

Choosing the right EMI depends on your individual financial capacity and goals.

- Higher EMI vs. Shorter Tenure: A higher EMI leads to a shorter loan tenure, minimizing the total interest paid but requiring a larger monthly outlay.

- Factors Influencing EMI Choice: Consider your monthly budget, financial goals (e.g., saving for a down payment on a house), and long-term financial planning when selecting an EMI.

- EMI Modifications: In some cases, you might be able to modify your EMIs through options like top-up loans (adding to your existing loan) or refinancing (obtaining a new loan with different terms).

Selecting the Optimal Loan Tenure for Your Finance Loan Application

What is Loan Tenure?

Loan tenure refers to the repayment period of your loan, typically expressed in months or years. The loan tenure significantly impacts the total interest paid.

- Loan Tenure and EMIs: A longer loan tenure results in lower EMIs but higher overall interest costs. A shorter tenure leads to higher EMIs but lower overall interest.

- Advantages and Disadvantages: Shorter tenures offer quicker debt repayment but demand higher monthly payments. Longer tenures provide affordability but increase the total interest paid.

Determining Your Ideal Loan Tenure

Choosing the right loan tenure involves careful consideration.

- Affordability, Financial Goals, and Long-Term Planning: Assess your financial capacity, future financial goals, and long-term financial stability when choosing a tenure.

- Comparing Loan Options: Compare loan offers with varying tenures to find the optimal balance between affordability and total cost.

- Prepaying Loans: Prepaying your loan, if financially feasible, can reduce the loan tenure and lower the total interest paid.

Conclusion

Successfully navigating a finance loan application requires a thorough understanding of interest rates, EMIs, and loan tenure. By carefully considering these factors and using this guide, you can make informed decisions that best suit your financial situation. Don't hesitate to explore various finance loan application options and compare offers to secure the most beneficial terms. Start your journey toward securing the best finance loan application today!

Featured Posts

-

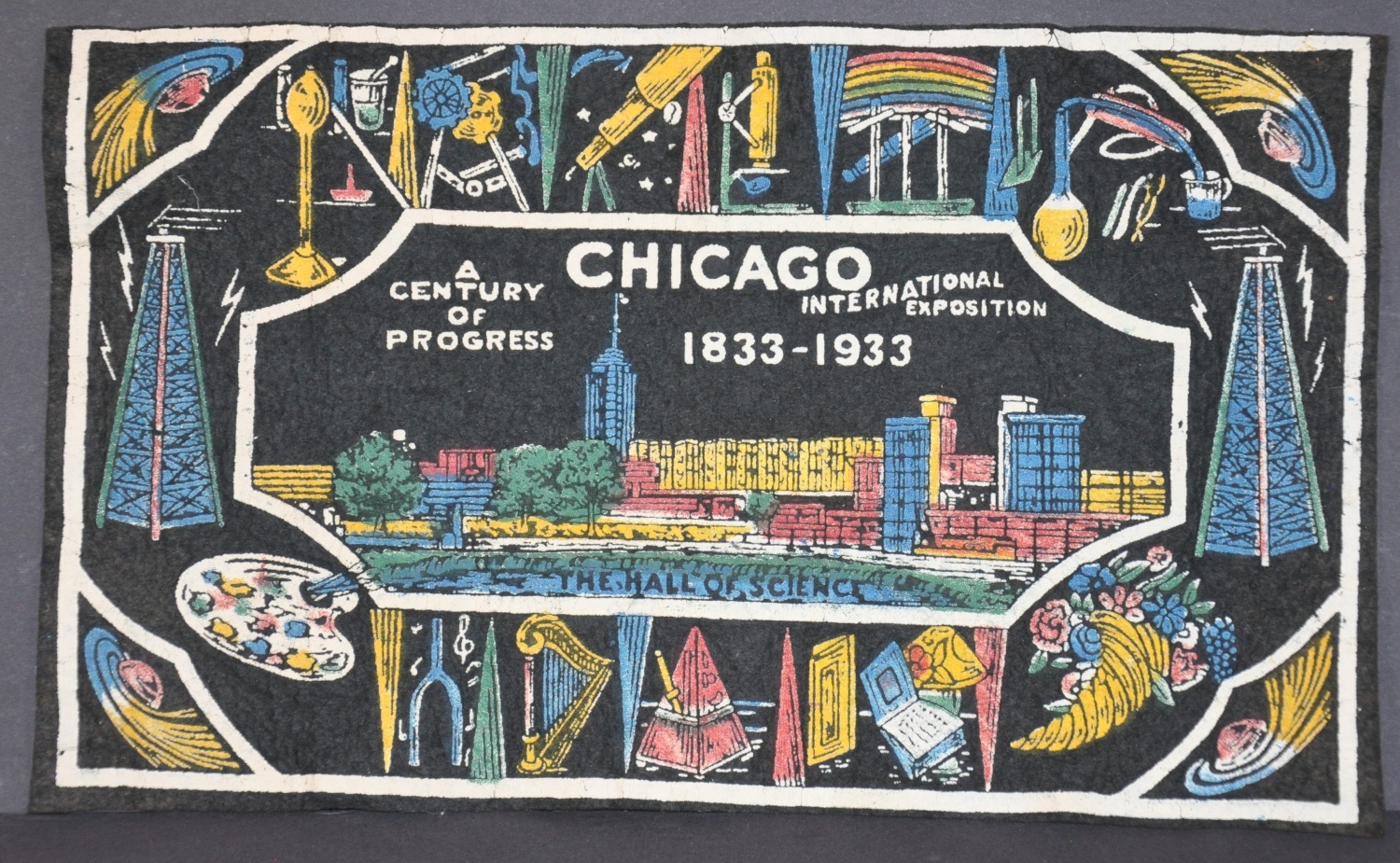

Today In Chicago History The Century Of Progress International Exposition Opens

May 28, 2025

Today In Chicago History The Century Of Progress International Exposition Opens

May 28, 2025 -

Wes Andersons Phoenician Scheme Venetian Palazzo Inspiration

May 28, 2025

Wes Andersons Phoenician Scheme Venetian Palazzo Inspiration

May 28, 2025 -

Truck Explodes Near Homes Propane Leak A Possible Cause

May 28, 2025

Truck Explodes Near Homes Propane Leak A Possible Cause

May 28, 2025 -

San Diego Padres Pregame Update Lineup Changes And Injury Report

May 28, 2025

San Diego Padres Pregame Update Lineup Changes And Injury Report

May 28, 2025 -

13th Century Construction Unearthed During Binnenhof Renovations

May 28, 2025

13th Century Construction Unearthed During Binnenhof Renovations

May 28, 2025