Federal Student Loan Refinancing: Pros, Cons, And How To Decide

Table of Contents

The Allure of Refinancing: Potential Advantages

Refinancing your federal student loans can offer several compelling benefits, potentially leading to significant long-term savings and a simpler repayment process. Let's delve into the key advantages.

Lower Interest Rates

One of the most attractive aspects of refinancing is the potential for significantly lower interest rates. Federal student loan interest rates can be relatively high, especially compared to rates offered by private lenders. By refinancing, you could secure a lower interest rate, leading to substantial savings over the life of your loan.

- Reduced monthly payments: A lower interest rate translates directly into lower monthly payments, making your repayment more manageable.

- Faster loan payoff: Lower interest means you'll pay off your loan faster, saving you money on overall interest paid.

- Lower overall interest paid: This is the most significant long-term benefit. By reducing your interest rate, you drastically reduce the total amount of interest you pay over the life of the loan.

Simplified Payment Plans

Managing multiple federal student loans can be overwhelming. Refinancing allows you to consolidate several loans into a single, streamlined payment. This simplifies your repayment process considerably.

- Streamlined repayment process: Instead of juggling multiple payments and due dates, you'll have just one monthly payment to track.

- One monthly payment instead of several: This simplifies budgeting and reduces the risk of missed payments.

- Potential for a longer repayment term (with caveats): While a shorter repayment term is ideal to minimize interest, a longer term might lower your monthly payment, making it more affordable in the short-term. However, remember that you'll pay more interest overall.

Access to Better Loan Terms

Refinancing can provide access to more favorable loan terms than your current federal loans. Private lenders often offer a wider range of repayment options and potentially lower fees.

- Flexible repayment options: Some lenders provide options like shorter or longer repayment periods, potentially customized to your financial situation.

- Potential for a lower monthly payment (though total interest paid may increase): Extending your loan term lowers your monthly payment but increases total interest paid.

- Access to additional benefits offered by private lenders: This may include features like autopay discounts or other perks.

The Downsides of Refinancing: Potential Drawbacks

While refinancing offers attractive benefits, it's crucial to understand the potential drawbacks before making a decision.

Loss of Federal Protections

One of the most significant disadvantages of refinancing federal student loans is the loss of crucial federal protections.

- No access to income-driven repayment (IDR) plans: IDR plans adjust your monthly payments based on your income, offering crucial relief during periods of financial hardship. These are lost when you refinance.

- Loss of potential loan forgiveness programs (e.g., Public Service Loan Forgiveness): Programs like PSLF forgive remaining loan balances after a period of qualifying public service. Refinancing eliminates eligibility for these programs.

- Fewer options for deferment or forbearance: These options provide temporary pauses in repayment during financial hardship. These are generally unavailable with private student loans.

Higher Interest Rates (Potential)

It's crucial to remember that refinancing doesn't guarantee lower interest rates. Your credit score and prevailing market interest rates play a significant role.

- Risk of securing a higher interest rate than your current federal loan rate: If your credit score is poor or interest rates rise, you could end up with a higher rate than your federal loans.

- Importance of shopping around for the best rates: Compare rates from multiple lenders to secure the most competitive offer.

- Credit score significantly impacts interest rate offered: A higher credit score translates to better interest rates.

Prepayment Penalties (Rare but Possible)

While uncommon, some lenders may include prepayment penalties in their loan agreements. This means you'll pay a fee if you pay off your loan early.

- Check for prepayment penalties in the loan agreement: Carefully review all loan documents before signing.

- Compare lender fees and closing costs: Fees and closing costs can vary significantly between lenders.

How to Decide If Refinancing is Right for You

Making an informed decision about refinancing requires careful consideration of your financial situation and a thorough comparison of lenders and rates.

Assess Your Financial Situation

Before considering refinancing, evaluate your financial health.

- Check your credit report and score: A higher credit score will result in better loan terms.

- Calculate your debt-to-income ratio: This indicates your ability to manage additional debt.

- Create a realistic budget to assess affordability: Ensure you can comfortably afford the new monthly payments.

Compare Lenders and Rates

Shop around and compare offers from multiple private student loan lenders to secure the best possible terms.

- Use online loan comparison tools: These tools help you quickly compare rates and terms from various lenders.

- Request quotes from multiple lenders: Don't settle for the first offer you receive.

- Thoroughly review loan terms and conditions: Pay close attention to interest rates, fees, and repayment options.

Understand the Long-Term Implications

Refinancing has long-term consequences. Consider all factors before making a decision.

- Carefully weigh the pros and cons: List the advantages and disadvantages to make a balanced decision.

- Consider the long-term financial implications: Think about how refinancing will affect your finances over the long term.

- Seek advice from a financial advisor if necessary: A financial professional can help you make an informed choice.

Conclusion

Federal student loan refinancing can offer significant advantages, including lower monthly payments and simplified repayment. However, it's crucial to carefully weigh the potential drawbacks, such as the loss of federal protections. Before making a decision, thoroughly assess your financial situation, compare offers from multiple lenders, and understand the long-term implications. By carefully considering all aspects of federal student loan refinancing, you can make an informed decision that best suits your financial goals. Start exploring your refinancing options today and see how you can potentially save on your federal student loans.

Featured Posts

-

Uluslararasi Yatirim Pozisyonu Verileri Subat 2024 Tuerkiye Degerlendirmesi

May 17, 2025

Uluslararasi Yatirim Pozisyonu Verileri Subat 2024 Tuerkiye Degerlendirmesi

May 17, 2025 -

Increased Rent In Los Angeles Following Fires Landlord Price Gouging Concerns

May 17, 2025

Increased Rent In Los Angeles Following Fires Landlord Price Gouging Concerns

May 17, 2025 -

Delhi And Mumbai Get Uber Pet Convenient Pet Transportation

May 17, 2025

Delhi And Mumbai Get Uber Pet Convenient Pet Transportation

May 17, 2025 -

Affordable And Reliable Products That Punch Above Their Weight

May 17, 2025

Affordable And Reliable Products That Punch Above Their Weight

May 17, 2025 -

Stock Market Update Rockwell Automation Leads Gains Alongside Disney Voya And Others

May 17, 2025

Stock Market Update Rockwell Automation Leads Gains Alongside Disney Voya And Others

May 17, 2025

Latest Posts

-

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025 -

Djokovic Miami Acik Ta Finale Yuekseldi

May 17, 2025

Djokovic Miami Acik Ta Finale Yuekseldi

May 17, 2025 -

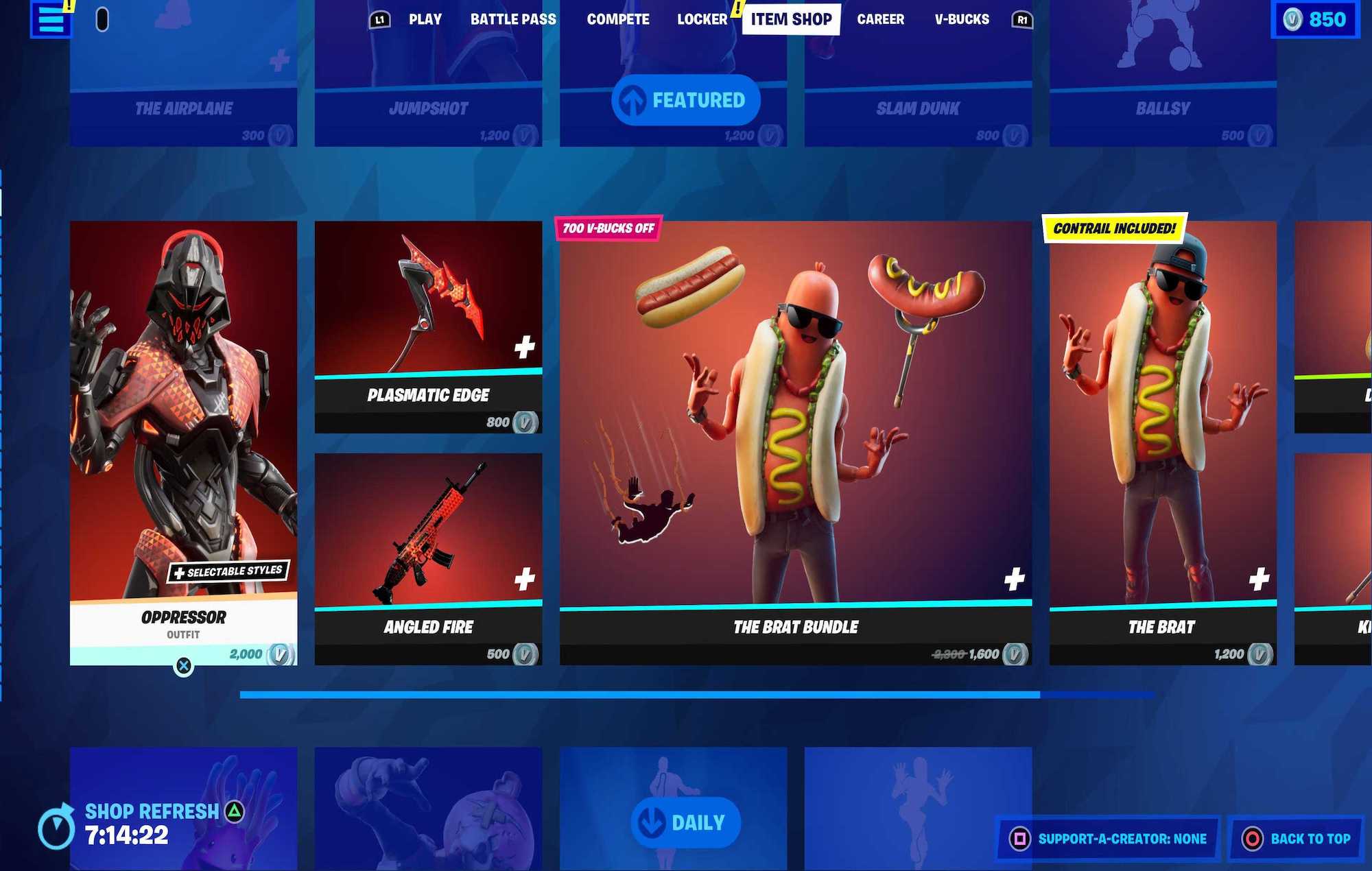

Lost Fortnite Skins Will They Return To The Item Shop

May 17, 2025

Lost Fortnite Skins Will They Return To The Item Shop

May 17, 2025 -

Novak Djokovic Miami Acik Finalinde

May 17, 2025

Novak Djokovic Miami Acik Finalinde

May 17, 2025 -

Epic Games Sued Allegations Of Large Scale Deceptive Practices In Fortnite

May 17, 2025

Epic Games Sued Allegations Of Large Scale Deceptive Practices In Fortnite

May 17, 2025