Fed Rate Cuts: Why The US Is Different

Table of Contents

The Federal Reserve's decisions on interest rate cuts significantly impact the US economy, but its effects are unique compared to other nations. Unlike many countries, the US boasts a robust, dollar-dominated global financial system and a complex interplay of factors that shape its reaction to monetary policy changes. This article delves into the key reasons why Fed rate cuts have different consequences in the US.

The Powerful US Dollar's Influence

The US dollar's status as the world's primary reserve currency profoundly influences the global economy and how the US responds to Fed rate cuts. This dominance shapes international capital flows and creates a unique dynamic not seen in economies with less influential currencies.

Global Currency Reserve

Rate cuts can weaken the dollar, triggering a ripple effect across international markets. This impact is multifaceted:

- Decreased dollar value can boost US exports: A weaker dollar makes US goods and services cheaper for foreign buyers, potentially stimulating export growth and boosting domestic production. However, this advantage is not always guaranteed, depending on global demand and other economic factors.

- Foreign investors may react negatively to a weaker dollar, leading to capital outflows: Investors might move their funds to currencies perceived as stronger and more stable, potentially reducing investment in US assets. This capital outflow can put downward pressure on the dollar, creating a feedback loop.

- The impact on emerging markets can be significant, creating ripple effects through the global economy: A weaker dollar can affect the value of emerging market currencies and their ability to service dollar-denominated debt, potentially leading to financial instability in these regions. This interconnectedness underscores the global implications of US monetary policy.

The US Employment Market's Resilience

The US employment market, characterized by its size and diversity, responds to Fed rate cuts in a complex and nuanced manner. Unlike smaller, more homogenous economies, the effects aren't uniform across all sectors or demographics.

Labor Market Dynamics

While lower interest rates generally aim to stimulate employment, the actual impact is multifaceted:

- Lower interest rates can encourage borrowing and investment, leading to job creation: Businesses might take advantage of cheaper borrowing to expand operations, invest in new projects, and hire more workers. This is a key mechanism through which monetary policy aims to stimulate job growth.

- However, inflation resulting from rate cuts might erode purchasing power, offsetting potential employment gains: If rate cuts lead to significant inflation, the increased cost of goods and services could negate the positive effects on employment, as wages may not keep pace with rising prices. This creates a trade-off for policymakers.

- The impact on specific industries (e.g., construction, manufacturing) can differ based on their sensitivity to interest rate changes: Some industries are more sensitive to interest rate fluctuations than others. For example, the construction sector relies heavily on borrowing, making it particularly vulnerable to changes in interest rates.

Inflation and the Fed's Balancing Act

The Federal Reserve's primary mandate is price stability. This means maintaining a healthy rate of inflation while avoiding excessive price increases. Rate cuts, intended to boost economic activity, can easily fuel inflationary pressures, forcing the Fed to walk a tightrope.

Inflationary Pressures and Consumer Spending

The relationship between rate cuts and inflation is complex:

- Low interest rates can increase consumer spending and investment, potentially pushing up inflation: Cheaper borrowing encourages consumers to spend more and businesses to invest more, increasing demand for goods and services. If supply cannot keep up, prices rise, leading to inflation.

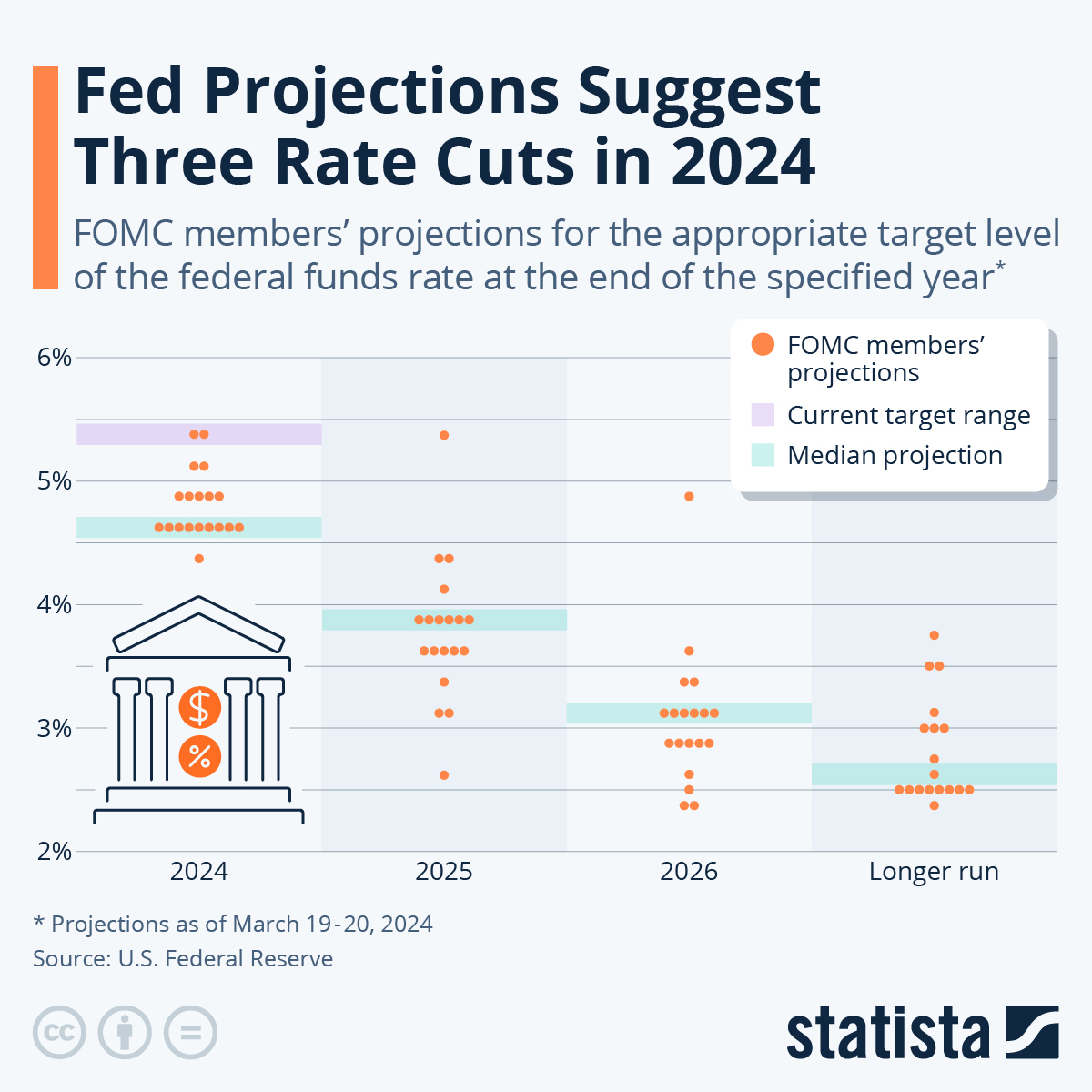

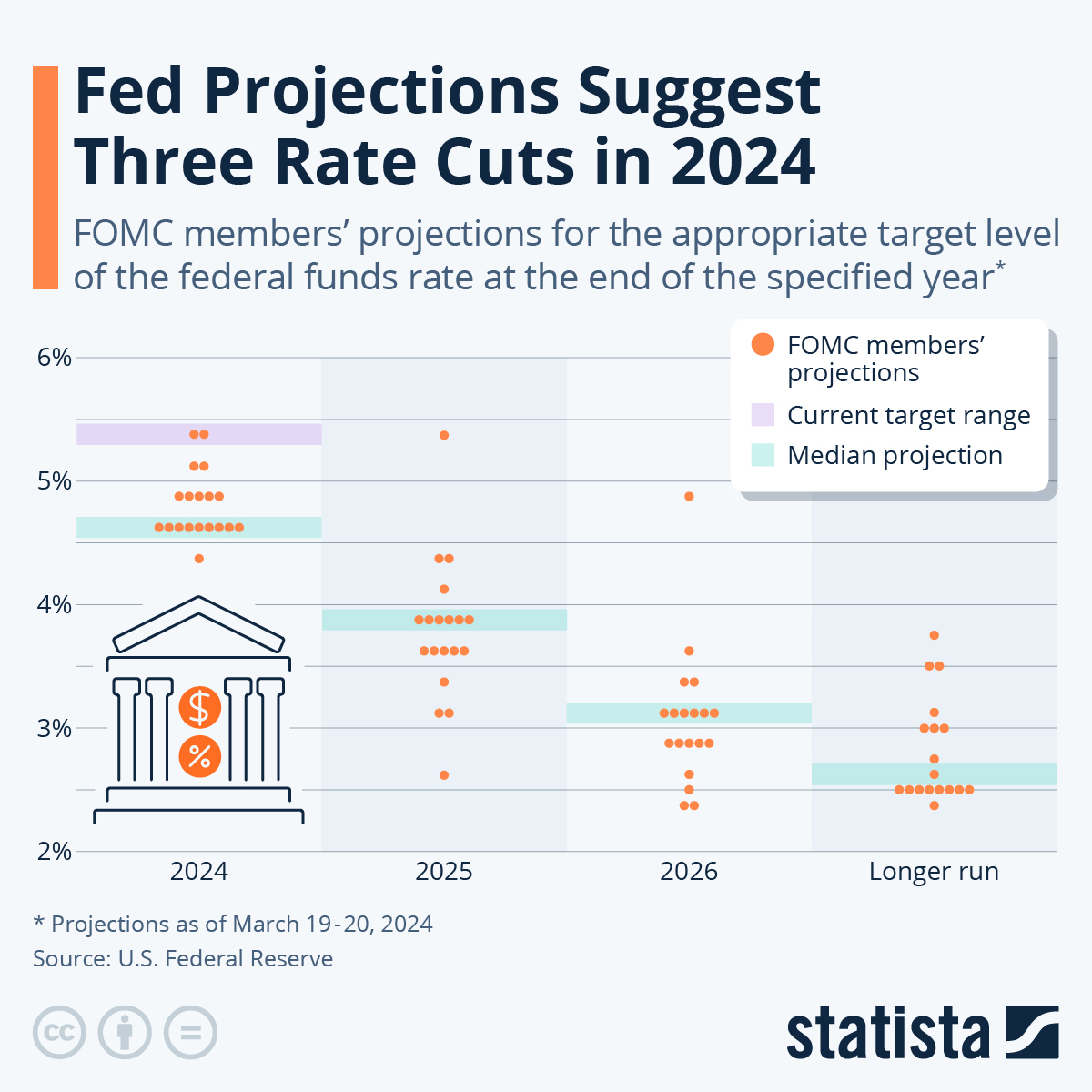

- The Fed must carefully assess the risks of inflation versus the need for economic stimulus: This necessitates a thorough analysis of economic indicators and projections. The Fed utilizes various tools and models to predict the likely impact of rate cuts on inflation.

- Analyzing inflation data (CPI, PPI) is crucial in determining the appropriate level of rate cuts: The Consumer Price Index (CPI) and Producer Price Index (PPI) are key metrics used to track inflation. The Fed closely monitors these indicators to assess the effectiveness of its monetary policy and make necessary adjustments.

Regulatory Environment and Financial System Stability

The US financial system, with its complex regulatory framework, significantly influences how effectively Fed rate cuts translate into real-world economic changes. The structure and stability of this system are key differentiating factors compared to other nations.

Unique Regulatory Framework

The regulatory landscape shapes the impact of rate cuts:

- The structure of banking and financial institutions determines how effectively rate cuts translate into lending and investment: The way banks and other financial institutions are regulated affects their willingness and ability to lend money. Stricter regulations might limit lending even with lower interest rates.

- Regulatory changes and oversight can modify the flow of credit and the overall impact of monetary policy: Changes to regulations can significantly impact the effectiveness of monetary policy. For instance, increased capital requirements for banks could restrict lending, dampening the effect of rate cuts.

- Stability within the US financial system is paramount and influences the Fed's decision-making process: Maintaining financial stability is a top priority for the Fed. Any action, including rate cuts, must consider the potential impact on financial system stability.

Conclusion

Fed rate cuts, while aiming to boost economic growth, have unique consequences in the US compared to other nations. The strength of the US dollar, the dynamics of the labor market, the delicate balance between stimulating growth and controlling inflation, and the complexity of the US financial regulatory environment all play significant roles. Understanding these nuances is crucial for investors, businesses, and policymakers alike. Staying informed on future announcements regarding Fed rate cuts and their potential impact is vital for navigating the US economic landscape. Keep an eye on the Federal Reserve's announcements and economic data to understand the ongoing impact of interest rate cuts on the US economy.

Featured Posts

-

Exploring Divine Mercy Religious Groups And Individuals In 1889

May 09, 2025

Exploring Divine Mercy Religious Groups And Individuals In 1889

May 09, 2025 -

The Trade Wars Impact On Crypto One Cryptocurrency That Could Thrive

May 09, 2025

The Trade Wars Impact On Crypto One Cryptocurrency That Could Thrive

May 09, 2025 -

Hundreds Protest Trump Administration Actions In Alaska

May 09, 2025

Hundreds Protest Trump Administration Actions In Alaska

May 09, 2025 -

Gambling On Climate Change The Case Of The Los Angeles Wildfires And Its Implications

May 09, 2025

Gambling On Climate Change The Case Of The Los Angeles Wildfires And Its Implications

May 09, 2025 -

Increased Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025

Increased Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025