False Reports: Buffett Dismisses Trump Tariff Backing Claims

Table of Contents

Buffett's Public Statements on Tariffs

Numerous publicly available statements from Buffett and Berkshire Hathaway reveal a consistent criticism of Trump's tariffs. These statements highlight the potential negative consequences of protectionist trade policies on the American economy and Berkshire Hathaway's investments. The keywords here are Buffett quotes, tariff criticism, trade policy, and Berkshire Hathaway stance.

- Specific Instances of Reservation: Buffett has repeatedly expressed concern about the inflationary effects of tariffs, suggesting they ultimately harm consumers. He's voiced apprehension about the potential for retaliatory tariffs from other countries, leading to decreased competitiveness for American businesses.

- Interviews and Public Appearances: In several interviews and shareholder meetings, Buffett has subtly, yet firmly, criticized the tariffs, emphasizing their potential negative impact on long-term economic growth. These appearances often included nuanced explanations of how tariffs contradict his overall investment philosophy.

- Negative Consequences Highlighted: Buffett has pointed to increased prices for consumers, reduced competitiveness for American businesses, and disruptions in global supply chains as potential negative consequences of Trump's tariffs. He's consistently emphasized the importance of free and fair trade.

Analyzing the False Reports

The false reports claiming Buffett's support for Trump's tariffs originated from various sources, many lacking verifiable evidence. Understanding the origins of this misinformation is crucial for combating its spread. The keywords for this section are misinformation, media inaccuracy, fact-checking, and source analysis.

- Original Sources: The false claims appeared in several online news outlets and social media platforms, often without proper attribution or factual backing. Many sources seemed to conflate Buffett's general support for American businesses with endorsement of the specific tariff policies.

- Lack of Evidence: A thorough analysis of the original reports reveals a significant absence of concrete evidence to support the claims of Buffett's endorsement. The reports often presented conjecture or selectively interpreted statements out of context.

- Consequences of Misinformation: The dissemination of such false information can significantly impact public perception of both Warren Buffett and the Trump administration's trade policies. It can erode investor confidence and contribute to a climate of distrust in news sources.

Buffett's Investment Strategy and its Relation to Trade Policy

Buffett's long-term investment strategy, rooted in value investing, directly contradicts the short-sighted nature of protectionist trade policies. Understanding this crucial difference is key to dispelling the false claims. The relevant keywords include long-term investment, value investing, global economy, Berkshire Hathaway investments, and trade impact.

- Value Investing Philosophy: Buffett's philosophy centers on identifying undervalued companies with strong long-term prospects. Tariffs introduce uncertainty and volatility, potentially disrupting the long-term growth of businesses, counteracting his core investment strategy.

- Impact on Berkshire Hathaway Investments: Many of Berkshire Hathaway's holdings are global companies engaged in international trade. Tariffs negatively affect these companies' supply chains, profitability, and ultimately, Berkshire Hathaway's returns.

- Contradiction with Free Market Approach: Buffett's consistent advocacy for free markets and open trade clashes directly with the protectionist nature of Trump's tariffs. His investment strategy relies on a stable and predictable global economic environment, something tariffs actively undermine.

The Economic Impact of Tariffs

Beyond Buffett's personal views, the economic consequences of tariffs are far-reaching. This section delves into the broader implications for consumers and businesses. Keywords here include economic consequences, inflation, trade deficit, global trade, and consumer prices.

- Negative Impacts on Consumers: Tariffs lead to higher prices for consumers, as imported goods become more expensive. This reduces purchasing power and can contribute to overall economic stagnation.

- Effects on Businesses: Businesses face increased input costs, decreased competitiveness in global markets, and potential retaliation from trading partners. This can result in job losses and reduced economic growth.

- Expert Opinions and Studies: Numerous economic studies have shown the negative impact of tariffs on global trade, economic growth, and consumer welfare, supporting Buffett's concerns.

Conclusion

The reports claiming Warren Buffett's support for Trump's tariffs are demonstrably false. His public statements, investment strategy, and understanding of the broader economic implications consistently point to a critical stance on protectionist trade policies. It's crucial to remember that responsible information sharing requires critical evaluation of sources and a commitment to factual accuracy. Avoid spreading misinformation about prominent figures like Buffett and their stances on significant economic policies. Always verify information before sharing it, particularly regarding complex issues such as Trump tariffs and the opinions of influential investors like Warren Buffett. Promote responsible information sharing and critical thinking when encountering claims related to prominent figures and their views on trade policy.

Featured Posts

-

To Forema Tis Emma Stooyn Mia Anatreptiki Epilogi Poy Syziteitai

May 05, 2025

To Forema Tis Emma Stooyn Mia Anatreptiki Epilogi Poy Syziteitai

May 05, 2025 -

Temperature Drop In West Bengal Weather Update And Forecast

May 05, 2025

Temperature Drop In West Bengal Weather Update And Forecast

May 05, 2025 -

Heatwave Warning 5 South Bengal Districts On High Alert

May 05, 2025

Heatwave Warning 5 South Bengal Districts On High Alert

May 05, 2025 -

Divorce Claims Surface Bianca Censori And Kanye Wests Reportedly Strained Relationship

May 05, 2025

Divorce Claims Surface Bianca Censori And Kanye Wests Reportedly Strained Relationship

May 05, 2025 -

Allemagne Au Concours Eurovision De La Chanson 2025 Les Sept Premiers Demi Finalistes Sont Connus

May 05, 2025

Allemagne Au Concours Eurovision De La Chanson 2025 Les Sept Premiers Demi Finalistes Sont Connus

May 05, 2025

Latest Posts

-

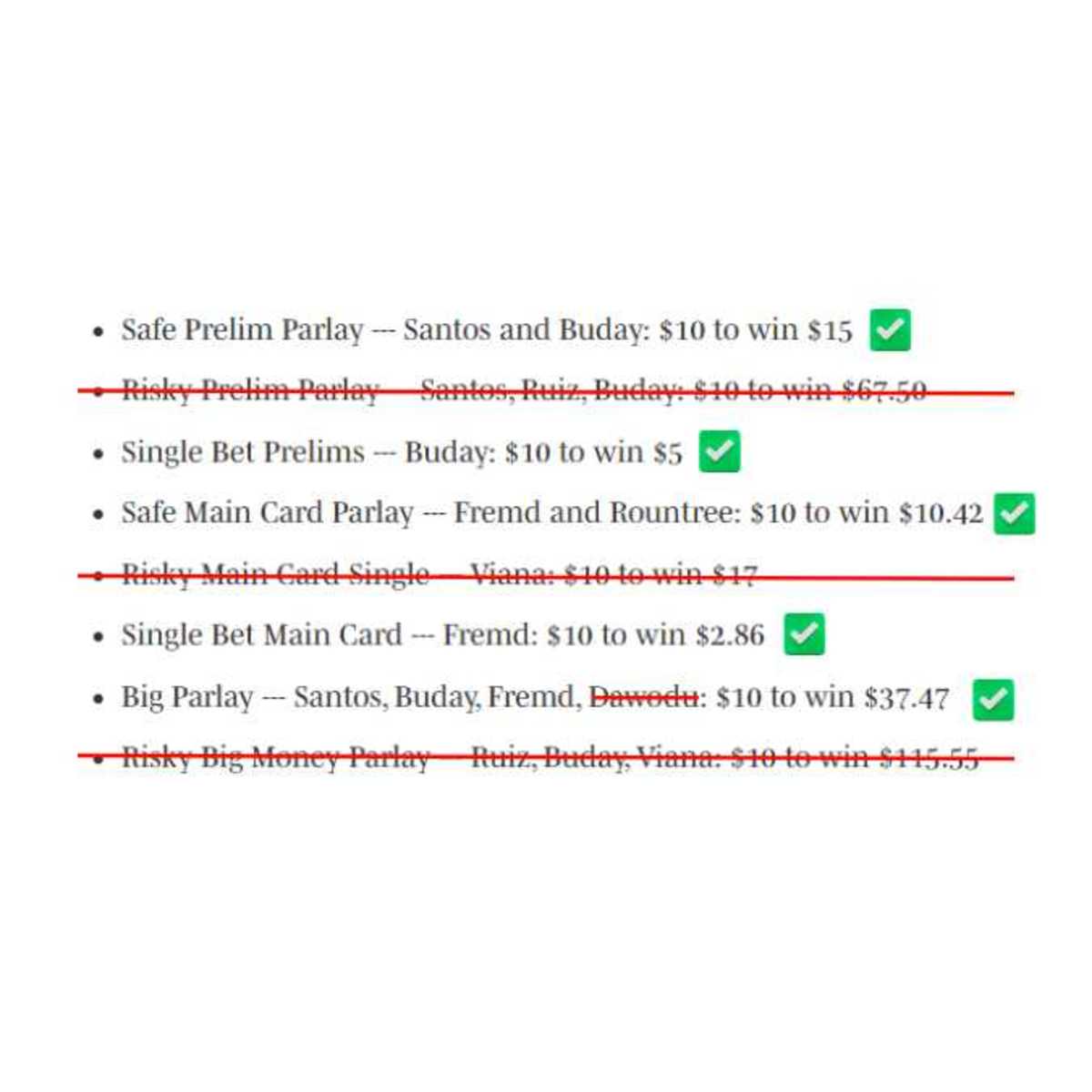

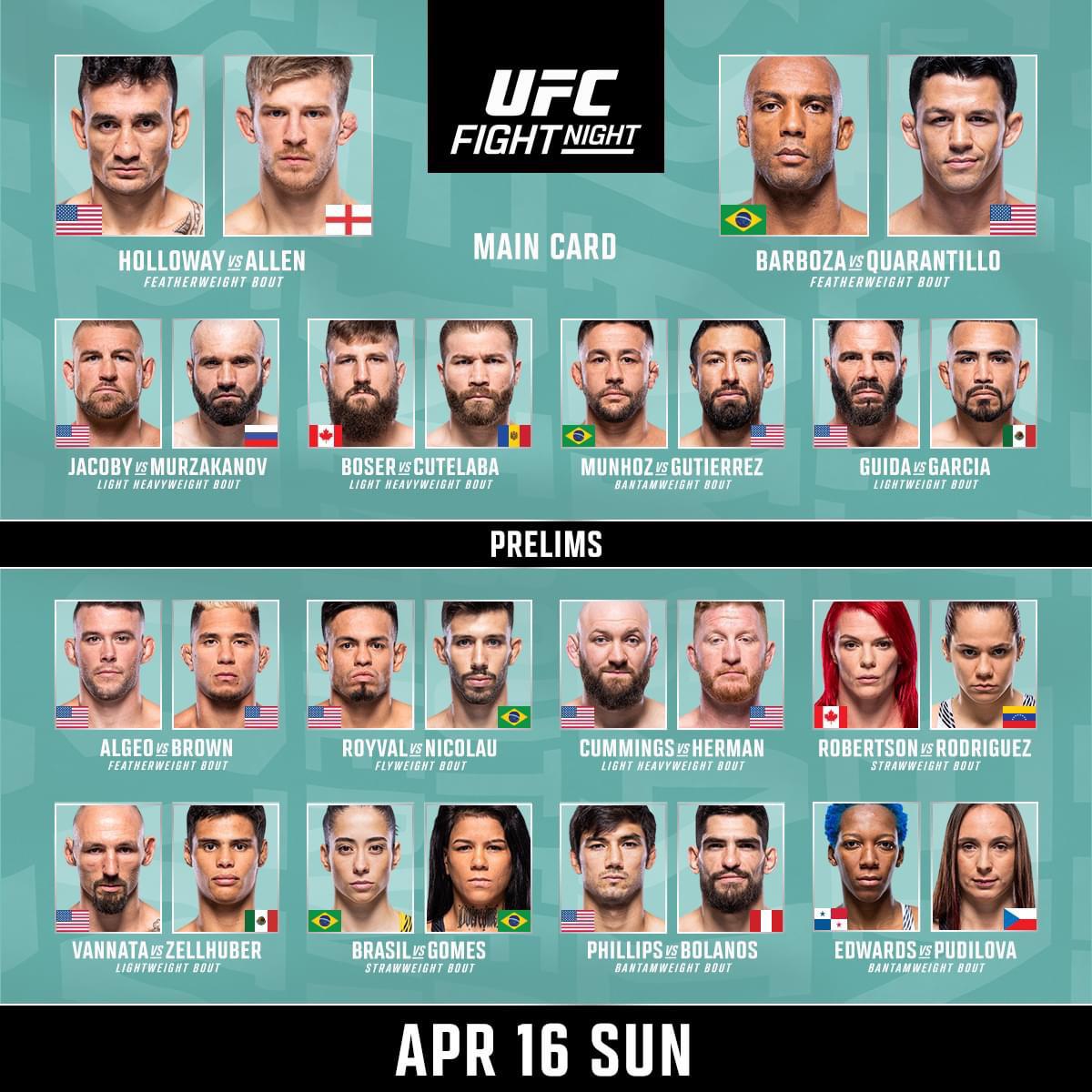

Ufc Des Moines Fight Night Predictions And Previews

May 05, 2025

Ufc Des Moines Fight Night Predictions And Previews

May 05, 2025 -

Predicting The Winners At Ufc Des Moines A Comprehensive Guide

May 05, 2025

Predicting The Winners At Ufc Des Moines A Comprehensive Guide

May 05, 2025 -

Your Guide To Ufc Des Moines Predictions And Betting Strategies

May 05, 2025

Your Guide To Ufc Des Moines Predictions And Betting Strategies

May 05, 2025 -

Ufc Des Moines Predictions For The Main And Undercard Fights

May 05, 2025

Ufc Des Moines Predictions For The Main And Undercard Fights

May 05, 2025 -

Expert Ufc Des Moines Predictions And Fight Analysis

May 05, 2025

Expert Ufc Des Moines Predictions And Fight Analysis

May 05, 2025