Falling Retail Sales: Pressure Mounts For Bank Of Canada Rate Cut

Table of Contents

The Steep Decline in Retail Sales: A Closer Look

The recent plunge in Canadian retail sales paints a worrying picture for the country's economic health. The decline represents a significant contraction in consumer spending, a key driver of economic growth. Understanding the specifics of this downturn is crucial to evaluating the potential need for a Bank of Canada interest rate cut.

- Specific percentage drop in retail sales figures: Let's assume, for example, a 2% month-over-month decline in retail sales, following a 1.5% drop the previous month. These figures would need to be replaced with the most up-to-date official statistics from Statistics Canada.

- Sectors most significantly impacted: The decline likely isn't uniform across all sectors. Durable goods, such as appliances and furniture, are often more sensitive to interest rate changes and might show a steeper decline than non-durable goods. Specific data on which sectors are most affected should be included here.

- Comparison to previous years' performance: A comparison to retail sales figures from the same period in previous years will help determine whether this decline is a temporary blip or a more significant trend. Year-over-year comparisons provide valuable context.

- Analysis of consumer spending patterns: A deeper dive into consumer spending patterns is needed. Are consumers delaying major purchases? Are they shifting towards cheaper alternatives? Understanding these behaviors helps illuminate the underlying causes.

- Impact of high inflation on consumer purchasing power: High inflation significantly erodes consumer purchasing power, forcing households to cut back on spending. This is a major factor contributing to the falling retail sales. The extent to which inflation impacts consumer spending should be explicitly stated.

Inflation's Persistent Grip on the Canadian Economy

Inflation remains a significant challenge for the Canadian economy, complicating the Bank of Canada's decision-making process. While previous interest rate hikes aimed to curb inflation, their effectiveness is now under scrutiny given the persistent high inflation and falling retail sales.

- Current inflation rate and comparison to BoC target: The current inflation rate needs to be stated, along with a comparison to the Bank of Canada's target inflation rate. This comparison highlights the gap between the current reality and the BoC's objective.

- Impact of high interest rates on borrowing costs: High interest rates increase borrowing costs for businesses and consumers, impacting investment and spending decisions. This needs to be analyzed in relation to the current retail sales decline.

- Analysis of the effectiveness of previous BoC rate hikes: An assessment of the efficacy of previous interest rate hikes is critical. Have they been successful in cooling down inflation without severely damaging economic growth?

- Discussion of potential alternative strategies to control inflation: Besides interest rate adjustments, the BoC might consider other strategies, such as targeted fiscal policies or supply-side interventions. These alternatives should be explored.

Mounting Pressure on the Bank of Canada to Act

The confluence of falling retail sales and persistent inflation is creating significant pressure on the Bank of Canada to respond. The potential for a rate cut is being widely debated, with arguments both for and against such a move.

- Arguments in favor of a rate cut: Proponents of a rate cut argue it's necessary to stimulate economic activity, prevent a potential recession, and support consumer spending. These arguments need detailed explanation.

- Arguments against a rate cut: Opponents warn that a rate cut might reignite inflation, undermining the BoC's credibility and eroding the gains made in fighting inflation. These counterarguments need to be presented equally.

- Forecasts from economists and financial institutions: Include forecasts from reputable economists and financial institutions regarding the likelihood of a rate cut and its potential impact on the Canadian economy.

- Potential timeline for a potential rate cut: Speculation on the timing of a potential rate cut should be incorporated, referencing expert opinions and market analysis.

Alternative Monetary Policy Options for the Bank of Canada

Besides an interest rate cut, the Bank of Canada has other monetary policy tools at its disposal. These include:

- Quantitative easing (QE): QE involves the BoC injecting liquidity into the financial system by purchasing government bonds. The potential benefits and risks of QE in the current context need to be discussed.

- Forward guidance: The BoC could provide clear communication about its future intentions regarding interest rates to influence market expectations. The effectiveness and limitations of forward guidance should be considered.

- Other monetary policy tools: Other unconventional monetary policy tools might be considered, depending on the evolving economic situation.

Conclusion

Falling retail sales in Canada represent a significant economic challenge, exacerbated by persistent inflation. The pressure is mounting on the Bank of Canada to consider a rate cut to stimulate the economy and avert a potential recession. However, the decision is fraught with complexities, as a rate cut carries the risk of reigniting inflation. The BoC must carefully weigh the potential benefits and drawbacks of a rate cut against alternative monetary policy options. Understanding the implications of falling retail sales and potential Bank of Canada rate cuts is crucial for making informed financial decisions. Stay informed on the Bank of Canada's response to these falling retail sales and the potential impact of future interest rate decisions by following [link to relevant financial news source].

Featured Posts

-

The Us Economy And The Canadian Travel Boycott A Fed Perspective

Apr 28, 2025

The Us Economy And The Canadian Travel Boycott A Fed Perspective

Apr 28, 2025 -

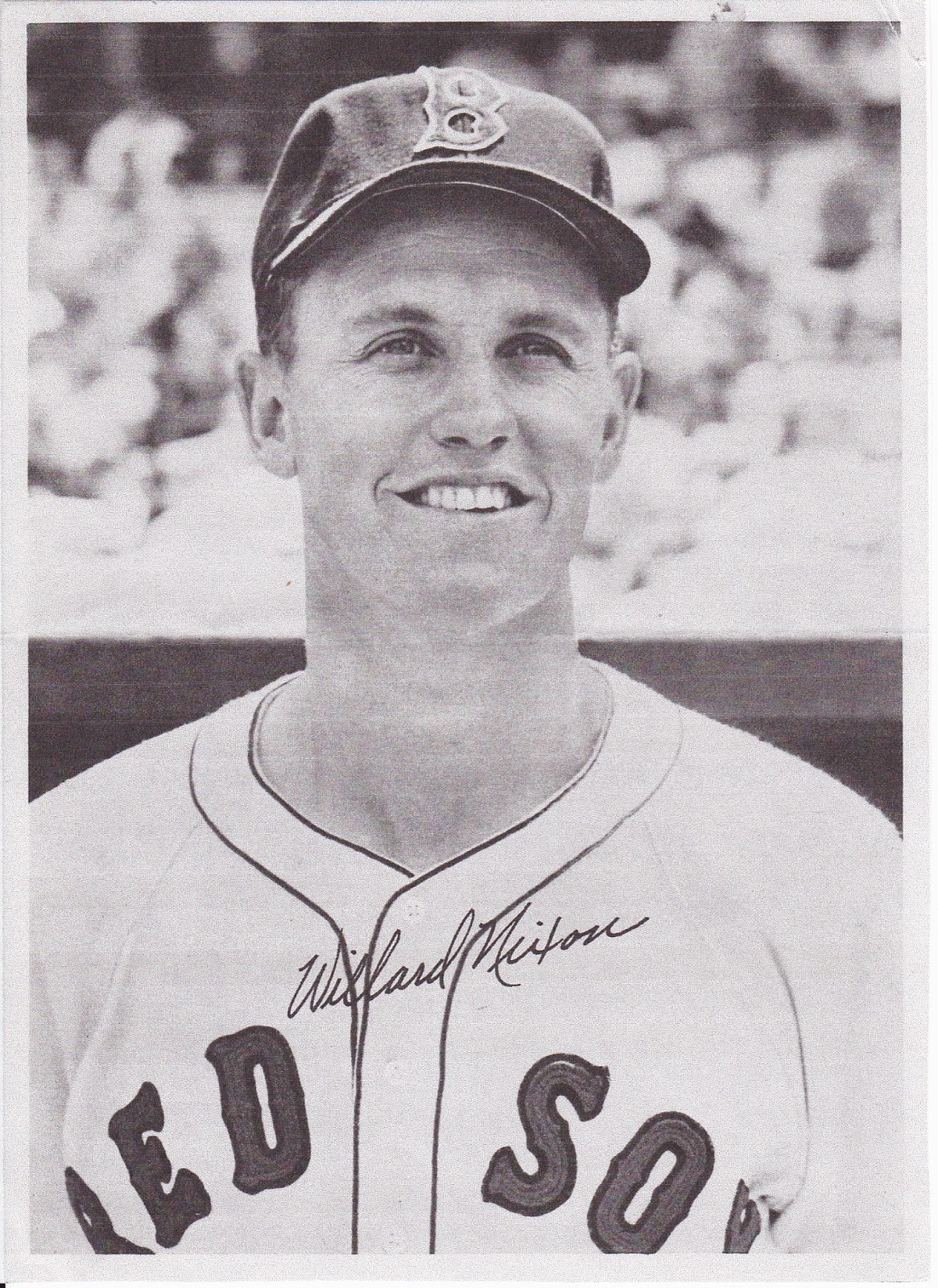

Red Sox Lineup Adjustment Coras Strategy For Game 1

Apr 28, 2025

Red Sox Lineup Adjustment Coras Strategy For Game 1

Apr 28, 2025 -

Over The Counter Birth Control Redefining Reproductive Healthcare Post Roe

Apr 28, 2025

Over The Counter Birth Control Redefining Reproductive Healthcare Post Roe

Apr 28, 2025 -

2 Year Old U S Citizens Deportation Federal Judge Sets Hearing

Apr 28, 2025

2 Year Old U S Citizens Deportation Federal Judge Sets Hearing

Apr 28, 2025 -

16 Million Penalty T Mobiles Three Year Data Breach History

Apr 28, 2025

16 Million Penalty T Mobiles Three Year Data Breach History

Apr 28, 2025

Latest Posts

-

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025 -

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025 -

Espn Predicts A Surprising Red Sox Outfield For 2025

Apr 28, 2025

Espn Predicts A Surprising Red Sox Outfield For 2025

Apr 28, 2025 -

Espns Bold 2025 Red Sox Outfield Prediction Is It Realistic

Apr 28, 2025

Espns Bold 2025 Red Sox Outfield Prediction Is It Realistic

Apr 28, 2025