Falling Reserves In Indonesia: Analysis Of The Rupiah's Recent Weakness

Table of Contents

The Decline in Foreign Exchange Reserves

What are Foreign Exchange Reserves?

Foreign exchange reserves are assets held by a central bank, in this case, Bank Indonesia, in the form of foreign currencies, gold, and Special Drawing Rights (SDRs). These reserves are crucial for a country's economic stability, serving several vital functions:

- Managing currency fluctuations: Reserves act as a buffer against external shocks, allowing the central bank to intervene in the foreign exchange market to stabilize the national currency. A strong reserve position enhances a country's ability to manage currency volatility.

- Meeting external debt obligations: Reserves are essential for servicing and repaying foreign-denominated debt. Without sufficient reserves, a country risks defaulting on its international obligations.

- Maintaining investor confidence: Adequate reserves signal economic strength and stability, attracting foreign investment and supporting economic growth. Low reserves can damage investor confidence, leading to capital flight.

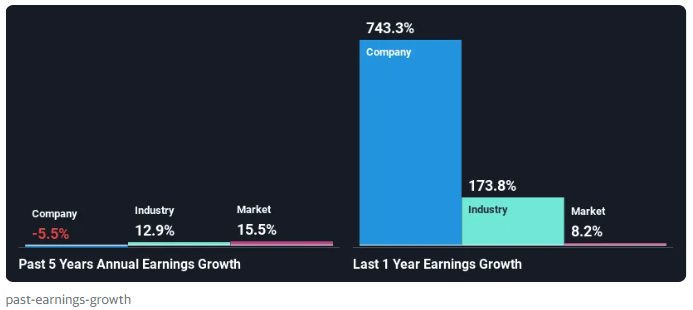

Magnitude of the Decline

Indonesia has witnessed a considerable decline in its foreign exchange reserves in recent years. [Insert Chart/Graph showing the decline in reserves over the past 2-3 years. Include data points for clarity]. For instance, reserves fell from [Insert previous year's figure] to [Insert current year's figure], representing a [Percentage] decrease. This drop is significant when compared to historical averages and to other regional economies such as Malaysia and Thailand, which have maintained relatively stronger reserve positions. This reduction has raised concerns among credit rating agencies, potentially impacting Indonesia's credit rating and investor confidence.

- The specific amount of the decline in recent months has been [Insert specific data].

- Compared to Malaysia and Thailand, Indonesia's reserves are [Compare quantitatively – e.g., lower by X percentage].

- The impact on Indonesia's credit rating is [Explain the impact – e.g., a potential downgrade or negative outlook].

Contributing Factors to Falling Reserves

Current Account Deficit

A persistent current account deficit is a major contributor to falling reserves. Indonesia's current account deficit reflects a situation where the value of imports exceeds the value of exports. This imbalance necessitates the use of foreign exchange reserves to cover the shortfall. Indonesia's reliance on imported goods, particularly in sectors like energy and capital goods, contributes significantly to this deficit. The widening trade gap due to [mention specific factors e.g., increased energy prices] further exacerbates the issue.

Capital Outflow

Capital flight, the movement of capital from Indonesia to other countries, significantly depletes foreign exchange reserves. Several factors contribute to capital outflow:

- Global economic uncertainty: Periods of global instability prompt investors to move their assets to perceived safer havens, leading to capital outflows from emerging markets like Indonesia.

- Interest rate differentials: Higher interest rates in other countries can attract capital away from Indonesia, especially if Indonesian interest rates remain relatively low.

- Investor sentiment: Negative news or concerns about the Indonesian economy can trigger investor panic and lead to rapid capital flight.

Impact of Global Economic Factors

External shocks significantly influence Indonesia's foreign exchange reserves. The strength of the US dollar, for instance, puts downward pressure on emerging market currencies, including the Rupiah. Fluctuations in global commodity prices, especially for Indonesia's key export commodities such as palm oil and coal, also impact export earnings and subsequently, the country's reserve levels. Rising inflation globally further complicates matters by impacting import costs and investor confidence.

- Indonesia's current account deficit in [year] was [insert data].

- Capital outflows include [specify types, e.g., portfolio investment, FDI withdrawal].

- [mention specific global events – e.g., the war in Ukraine] significantly impacted capital flows.

- Rising inflation leads to [mention consequences – e.g., higher import costs, decreased purchasing power].

Implications of the Rupiah's Weakness

Impact on Imports

A weaker Rupiah makes imports more expensive, increasing the cost of goods and services for Indonesian consumers and businesses. This leads to higher inflation, impacting purchasing power and potentially reducing consumer spending.

Impact on Exports

Conversely, a weaker Rupiah can enhance the competitiveness of Indonesian exports by making them cheaper for foreign buyers. This could potentially boost export volumes and revenue, though the extent of this benefit depends on global demand and competition.

Impact on Debt Repayment

A weaker Rupiah increases the cost of servicing and repaying foreign-denominated debt, placing a greater burden on the Indonesian government and businesses. This could strain the national budget and potentially lead to further economic difficulties.

- Import costs are projected to increase by [estimate percentage] due to the weaker Rupiah.

- Export revenue might increase, but this depends on [mention factors – e.g., global demand, competitor actions].

- The increase in debt repayment costs could be [quantify the potential increase].

Government Response and Policy Measures

The Indonesian government, through Bank Indonesia, has implemented several measures to address falling reserves and stabilize the Rupiah. These measures may include:

-

Monetary policy adjustments: Increasing interest rates to attract foreign investment and curb inflation.

-

Fiscal policy changes: Implementing measures to reduce the current account deficit and improve the government's budget balance.

-

Foreign exchange interventions: Direct intervention in the foreign exchange market to support the Rupiah.

-

Bank Indonesia has recently [mention specific policy actions – e.g., raised interest rates by X%].

-

The effectiveness of these measures is [assess their impact – e.g., still being evaluated, partially successful].

-

Future policy options might include [suggest possible future actions – e.g., further interest rate hikes, trade policy adjustments].

Conclusion

The decline in Indonesia's foreign exchange reserves and the resulting weakness of the Rupiah pose significant challenges to the Indonesian economy. The contributing factors are multifaceted, encompassing both internal vulnerabilities, such as the current account deficit, and external pressures from global economic uncertainties. While the government has taken steps to mitigate these issues, ongoing monitoring and possibly further policy adjustments are vital to stabilize the Rupiah and secure Indonesia's economic future. Staying informed about falling reserves in Indonesia and their impact on the Rupiah is crucial for anyone with investments in the Indonesian market or a keen interest in the nation's economic well-being. Further investigation into the Indonesian Rupiah's weakness is essential for understanding long-term consequences and developing effective strategies for managing future risks.

Featured Posts

-

Strictly Come Dancing Wynne Evans Responds To Return Speculation

May 10, 2025

Strictly Come Dancing Wynne Evans Responds To Return Speculation

May 10, 2025 -

How Beyonces Tour Launched Cowboy Carter To Doubled Streams

May 10, 2025

How Beyonces Tour Launched Cowboy Carter To Doubled Streams

May 10, 2025 -

Britannian Kruununperimysjaerjestys Taessae On Ajankohtainen Lista

May 10, 2025

Britannian Kruununperimysjaerjestys Taessae On Ajankohtainen Lista

May 10, 2025 -

Weight Watchers Bankruptcy Filing Amidst Rise Of Weight Loss Drugs

May 10, 2025

Weight Watchers Bankruptcy Filing Amidst Rise Of Weight Loss Drugs

May 10, 2025 -

Mediatheque Champollion Dijon Un Incendie Declenche L Intervention Des Pompiers

May 10, 2025

Mediatheque Champollion Dijon Un Incendie Declenche L Intervention Des Pompiers

May 10, 2025