Extreme Price Hike: Broadcom's VMware Deal Impacts AT&T Costs

Table of Contents

Broadcom's VMware Acquisition: A Deep Dive

Broadcom's acquisition of VMware represents a significant shift in the enterprise software market. This acquisition not only gives Broadcom control over VMware's dominant virtualization and cloud computing technologies but also significantly expands Broadcom's reach into enterprise software, increasing its market power considerably.

-

Significant Market Share: VMware holds a substantial market share in virtualization technologies, particularly with its vSphere hypervisor and vSAN storage solutions. This dominance provides Broadcom with immediate access to a vast customer base and a critical piece of the cloud computing infrastructure.

-

Expansion into Enterprise Software: Broadcom, primarily known for its semiconductor chips, is aggressively expanding its presence in the lucrative enterprise software sector. The VMware acquisition is a major step in this strategy, positioning Broadcom as a key player alongside giants like Microsoft and Oracle.

-

Regulatory Scrutiny: The acquisition has faced regulatory scrutiny from antitrust authorities globally, raising concerns about potential monopolistic practices and the impact on competition. The outcome of these reviews will significantly shape the future landscape of the enterprise software market.

The Direct Impact on AT&T's Costs

AT&T, like many large telecommunications companies, relies heavily on VMware's products and services for its network infrastructure and operations. The acquisition has directly translated into significantly higher costs for AT&T.

-

VMware Products Used by AT&T: AT&T utilizes a range of VMware products, including vSphere for server virtualization, vSAN for storage virtualization, and likely VMware NSX for network virtualization. These are critical components of AT&T's network infrastructure.

-

Quantifiable Cost Increase: While precise figures remain undisclosed, industry analysts predict a substantial increase in AT&T's licensing and support costs due to Broadcom's price hikes following the acquisition. These increases could run into the hundreds of millions of dollars annually.

-

Contract Renegotiations: AT&T is likely facing challenging contract renegotiations with Broadcom, potentially leading to protracted negotiations and uncertainty regarding future costs. The leverage held by Broadcom, given VMware's market position, puts AT&T in a difficult bargaining position.

Ripple Effects Across AT&T's Operations

The cost increase stemming from Broadcom's acquisition of VMware will have far-reaching consequences for AT&T's operations.

-

Potential Service Price Increases for Consumers: To offset the increased costs, AT&T may be forced to raise prices for its services, impacting consumers' bills for internet, mobile, and other telecommunication services.

-

Impact on Network Infrastructure and Operational Efficiency: Higher costs could constrain AT&T's investments in its network infrastructure, potentially slowing down upgrades and impacting the quality and efficiency of its services.

-

Effect on Profitability and Future Investments: The significant cost increase will inevitably reduce AT&T's profitability, potentially leading to a decrease in future investments in research and development, expansion projects, and other key areas.

AT&T's Response and Mitigation Strategies

Faced with this extreme price hike, AT&T will need to implement strategies to mitigate the impact on its business.

-

Cost-Cutting Measures: AT&T will likely explore various cost-cutting measures across its operations to compensate for the increased VMware expenses. This could involve streamlining processes, reducing headcount in certain areas, or delaying some projects.

-

Alternative Software Solutions: AT&T may investigate and potentially switch to alternative virtualization and cloud computing solutions to reduce its reliance on VMware products. However, migrating away from a deeply entrenched system like VMware presents significant technical and operational challenges.

-

Negotiating Power with Broadcom: AT&T's negotiating power with Broadcom will be a crucial factor. Given the size and importance of AT&T as a customer, it might still be able to negotiate more favorable terms, though this remains uncertain.

The Broader Implications for the Telecom Industry

The impact of Broadcom's VMware acquisition extends beyond AT&T, affecting other telecommunications companies and the industry as a whole.

-

Similar Price Hikes: Other telecom giants using VMware products are likely to experience similar price hikes, forcing them to make similar difficult decisions regarding cost management and potential service price increases.

-

Competitive Landscape: The acquisition's impact on the competitive landscape within the telecom sector is complex. While it creates a more consolidated market, it also increases the pressure on smaller players lacking the resources to absorb the higher costs.

-

Increased Consumer Prices: The cascading effect of these price increases throughout the telecom industry might translate into higher consumer prices across the board, affecting access and affordability of essential telecommunication services.

Conclusion

Broadcom's acquisition of VMware has resulted in an extreme price hike for AT&T, impacting its operations and potentially affecting its services and consumers. The ripple effects are far-reaching, impacting the entire telecom industry and potentially leading to increased costs for consumers. The increased consolidation in the enterprise software market raises serious concerns about competition and pricing.

Call to Action: Stay informed about the ongoing developments surrounding Broadcom's VMware acquisition and its impact on AT&T and the wider telecom industry. Understanding this extreme price hike and its consequences is crucial for navigating the changing landscape of enterprise software and telecommunications. Keep an eye out for further updates on this significant Broadcom/VMware deal and its impact on pricing for businesses and consumers alike.

Featured Posts

-

Chainalysis Expands Ai Capabilities With Alterya Acquisition

Apr 22, 2025

Chainalysis Expands Ai Capabilities With Alterya Acquisition

Apr 22, 2025 -

The Bezos Blue Origin Debacle A Case Study In Business Failure Compared To Katy Perry

Apr 22, 2025

The Bezos Blue Origin Debacle A Case Study In Business Failure Compared To Katy Perry

Apr 22, 2025 -

Conclave 2024 A Legacy On The Line For Pope Francis

Apr 22, 2025

Conclave 2024 A Legacy On The Line For Pope Francis

Apr 22, 2025 -

Ftc Investigates Open Ais Chat Gpt What This Means For Ai

Apr 22, 2025

Ftc Investigates Open Ais Chat Gpt What This Means For Ai

Apr 22, 2025 -

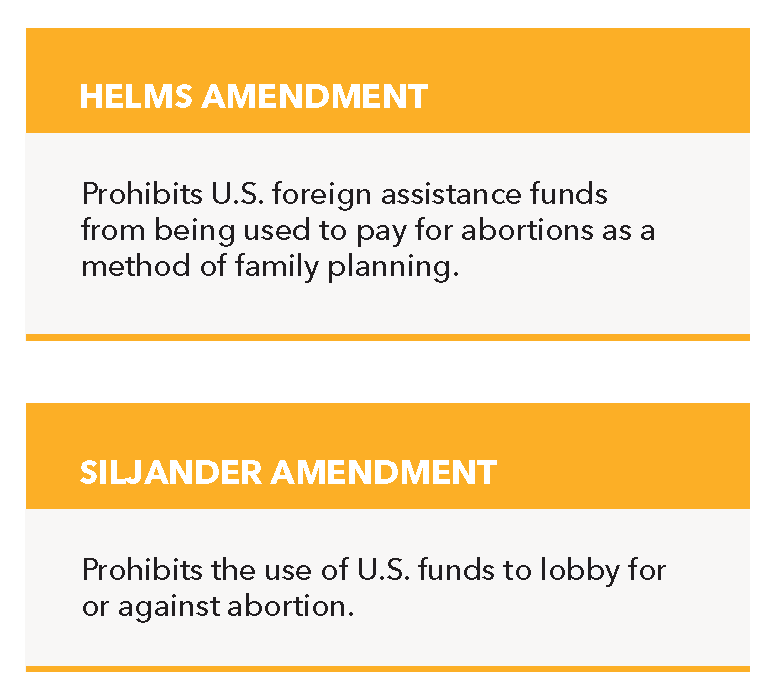

The Impact Of Over The Counter Birth Control On Reproductive Rights Post Roe

Apr 22, 2025

The Impact Of Over The Counter Birth Control On Reproductive Rights Post Roe

Apr 22, 2025