Explaining The Recent Increase In CoreWeave (CRWV) Stock Value

Table of Contents

Increased Demand for AI Infrastructure

The explosive growth of the AI market is undeniably a primary catalyst for CoreWeave's success. The demand for powerful cloud computing infrastructure capable of handling the immense computational demands of AI applications is soaring. CoreWeave, with its specialization in providing GPU-powered cloud infrastructure perfectly suited for AI development and training, is ideally positioned to capitalize on this trend.

- The Rise of Large Language Models (LLMs): The proliferation of LLMs, such as those powering sophisticated chatbots and AI assistants, necessitates massive computational resources. CoreWeave's infrastructure is perfectly equipped to handle the training and deployment of these models, driving significant demand.

- Widespread AI Adoption: AI is rapidly transforming various industries, from healthcare and finance to manufacturing and retail. This widespread adoption fuels the need for scalable and powerful cloud computing solutions like those offered by CoreWeave.

- High-Performance Computing Scarcity: The current shortage of high-performance computing resources, particularly GPUs, creates a significant bottleneck for AI development. CoreWeave's ability to provide access to these crucial resources is a major advantage, contributing to its rapid growth. This scarcity is further driving the demand for reliable and scalable AI infrastructure solutions, making CoreWeave a key player.

Strategic Partnerships and Investments

CoreWeave's strategic partnerships and investments have played a crucial role in its recent success. These collaborations not only enhance the company's technological capabilities but also expand its market reach and solidify its position within the industry.

- Strategic Partnerships (examples needed here; replace with actual partnerships and their impact): [Insert details of specific partnerships, e.g., "A partnership with [Partner Name] provides access to their extensive client base, driving significant revenue growth."]. Such collaborations demonstrate the confidence industry leaders have in CoreWeave’s technology and potential.

- Successful Funding Rounds: [Insert details of funding rounds, e.g., "The recent Series [Series Number] funding round, securing [amount] in investment, underscores investor confidence in CoreWeave's future and its ability to continue expanding its infrastructure." This signifies strong investor belief in CRWV's growth trajectory.]

- Strategic Acquisitions (examples needed here; replace with actual acquisitions and their impact): [Insert details of any acquisitions, e.g., "The acquisition of [Acquired Company Name] significantly expanded CoreWeave's capabilities in [Specific Area], strengthening its competitive advantage."]. This expansion of capabilities positions CRWV for continued success.

Strong Financial Performance and Future Projections

CoreWeave's robust financial performance provides further evidence of its success. Positive financial indicators demonstrate the company's strong growth trajectory and potential for continued expansion.

- Revenue Growth and Increasing Customer Base: [Insert specific data from financial reports, e.g., "CoreWeave reported a [percentage]% increase in revenue year-over-year, showcasing strong market demand and a rapidly expanding customer base."]. This strong revenue growth supports the positive outlook for CRWV stock.

- Positive Analyst Predictions and Ratings: [Insert details of analyst ratings and predictions, e.g., "Several leading analysts have issued buy ratings for CRWV stock, citing the company's strong growth potential and market leadership."] These positive assessments further bolster investor confidence in CoreWeave.

- Long-Term Growth Strategy and Market Potential: CoreWeave's long-term strategy focuses on continued investment in its infrastructure, expansion into new markets, and development of innovative AI-centric solutions. The substantial market potential within the burgeoning AI cloud computing sector positions CoreWeave for significant future growth.

Positive Market Sentiment and Investor Confidence

The overall positive market sentiment surrounding CoreWeave is a significant contributor to the recent stock price increase. This positive sentiment reflects investor confidence in the company's future prospects and the overall growth potential of the AI cloud computing market.

- Positive News Coverage and Analyst Reports: [Insert examples of positive news articles and analyst reports.] Favorable media coverage and positive analyst assessments play a crucial role in shaping market perception and driving investor interest.

- Positive Outlook for Cloud Computing and AI: The overall optimistic outlook for the cloud computing and AI sectors further enhances investor confidence in CoreWeave's future performance. The strong growth trajectory of these sectors directly benefits CoreWeave.

- Market Dynamics (e.g., Short Squeezes): [If applicable, discuss any market dynamics that contributed to the price increase. This requires careful consideration and factual data.] Understanding market forces influencing CRWV's stock price provides valuable context.

Conclusion: Investing in the Future of CoreWeave (CRWV)

The recent surge in CoreWeave (CRWV) stock value is a result of a combination of factors, including the booming demand for AI infrastructure, strategic partnerships and investments, strong financial performance, and positive market sentiment. CoreWeave's focus on providing cutting-edge GPU-powered cloud computing solutions positions it at the forefront of the rapidly expanding AI market. While any investment carries inherent risks and uncertainties, the company's strong fundamentals and positive outlook suggest considerable potential. Learn more about CoreWeave (CRWV) stock, analyze the CRWV investment opportunity, and understand the potential of CoreWeave (CRWV) in the AI cloud market before making any investment decisions. Remember to conduct thorough research and consult with a financial advisor before investing in any stock.

Featured Posts

-

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure Following Shocking Appraisal

May 22, 2025

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure Following Shocking Appraisal

May 22, 2025 -

Beat The Heat An Unbeatable Hot Weather Beverage

May 22, 2025

Beat The Heat An Unbeatable Hot Weather Beverage

May 22, 2025 -

Cassis Blackcurrant A Comprehensive Guide

May 22, 2025

Cassis Blackcurrant A Comprehensive Guide

May 22, 2025 -

Real Madrid In Gelecegi Ancelotti Den Klopp A Gecisin Analizi

May 22, 2025

Real Madrid In Gelecegi Ancelotti Den Klopp A Gecisin Analizi

May 22, 2025 -

Cau Duong Lien Tinh Binh Duong Tay Ninh Huong Dan And Ban Do

May 22, 2025

Cau Duong Lien Tinh Binh Duong Tay Ninh Huong Dan And Ban Do

May 22, 2025

Latest Posts

-

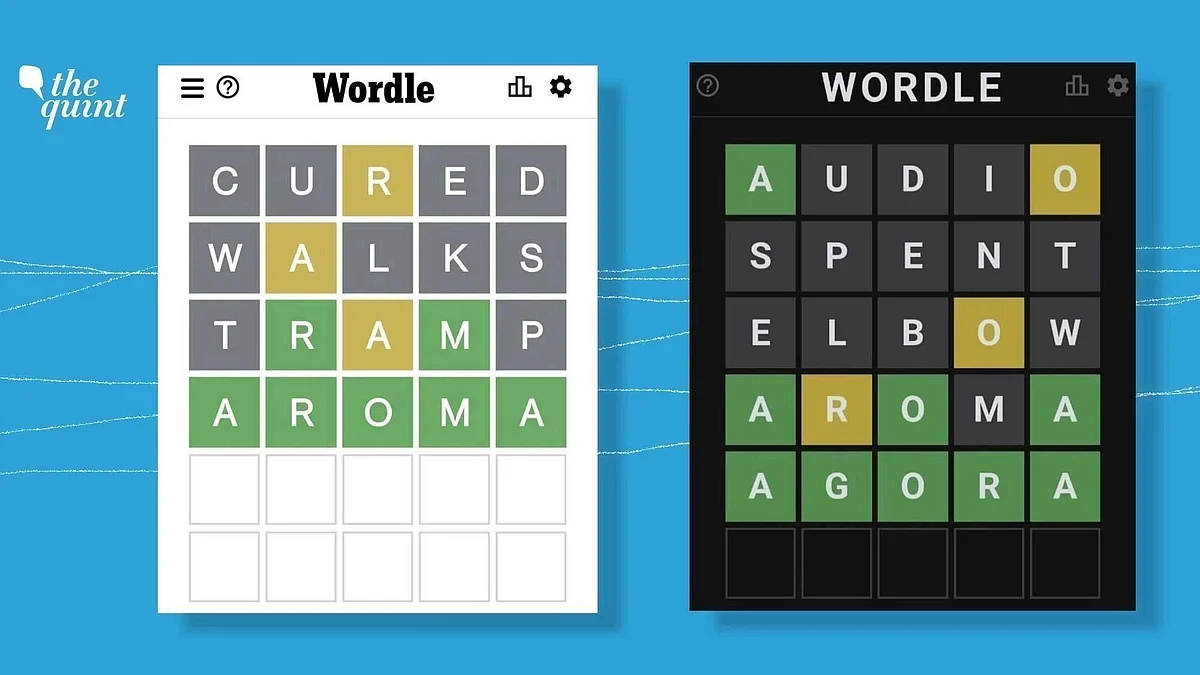

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025 -

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025 -

How To Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025

How To Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025 -

Wordle Hints And Answer For March 18th 2024 1368

May 22, 2025

Wordle Hints And Answer For March 18th 2024 1368

May 22, 2025 -

Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025

Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025