Europe Car Sales Decline: Economic Headwinds Slow Consumer Spending

Table of Contents

The Impact of Inflation on Car Purchases in Europe

Rising Prices and Reduced Disposable Income

High inflation is significantly eroding consumer purchasing power across Europe. The rising cost of living makes purchasing a new car, a significant discretionary expense, less affordable for many. This is exacerbated by several factors:

- Increased fuel costs: Soaring energy prices directly translate to higher running costs for vehicles, impacting the overall cost of car ownership.

- Higher interest rates on car loans: Increased borrowing costs make car financing significantly more expensive, pushing many potential buyers out of the market.

- Increased prices of essential goods: Inflation impacts the cost of essential goods like food and housing, reducing disposable income available for non-essential purchases like cars.

Inflation rates in key European countries have reached multi-decade highs. For instance, the Eurozone reported an inflation rate of X% in [Month, Year], while individual countries like Germany and France experienced even higher rates. This dramatic increase in the cost of living directly impacts consumer spending on discretionary items, including automobiles.

Shifting Consumer Priorities

Faced with rising costs, European consumers are shifting their spending priorities. Essential needs are now taking precedence over discretionary purchases like new cars. This leads to a decline in demand, contributing significantly to the Europe car sales decline.

- Public transportation is becoming a more attractive option for many, especially in urban areas with well-developed networks.

- Used car sales are experiencing a surge as consumers seek more affordable alternatives.

- Consumers are delaying or forgoing car purchases altogether, opting to repair existing vehicles instead.

Data comparing spending on cars versus essential goods shows a clear shift in consumer behavior, with spending on necessities increasing while spending on automobiles decreases.

The Energy Crisis and its Effect on European Car Sales

Increased Fuel Costs and Uncertainty

The ongoing energy crisis in Europe is directly impacting the cost of running a car. Volatile fuel prices create uncertainty and hesitation among potential buyers.

- Fluctuations in fuel prices make it difficult to accurately predict the long-term cost of car ownership, discouraging purchases.

- The uncertainty surrounding future energy prices undermines consumer confidence, leading to postponed purchasing decisions.

- Consumers are more likely to delay large purchases like cars amid unpredictable energy costs.

Data illustrating the correlation between fuel price hikes and decreased consumer spending on vehicles is readily available and further supports this point.

Demand for Electric Vehicles (EVs)

The energy crisis has a complex impact on the demand for Electric Vehicles (EVs). While some consumers see EVs as a hedge against fluctuating fuel prices, others are hesitant due to concerns about charging infrastructure and electricity costs.

- Increased electricity prices can negate some of the cost savings associated with EVs.

- Limited charging infrastructure in some regions poses a barrier to widespread EV adoption.

- Government policies supporting EV adoption, such as subsidies and tax breaks, play a crucial role in shaping demand.

Statistics on EV sales in Europe show a mixed picture, with growth rates varying significantly across different countries depending on these factors.

Rising Interest Rates and Their Influence on Car Financing

Higher Loan Costs and Reduced Affordability

Rising interest rates have a direct and significant impact on the cost of car loans. Higher interest rates translate directly into increased monthly payments, making car ownership less attractive.

- The increase in interest rates makes car loans more expensive, impacting affordability.

- Higher borrowing costs reduce the number of consumers who qualify for car financing.

- This leads to a lower overall demand for new vehicles.

Data on interest rate changes and their effect on car loan applications clearly demonstrates this correlation. As interest rates rise, the number of applications and approvals for car loans declines.

Impact on Leasing and Financing Options

Higher interest rates also influence the availability and terms of car leasing and financing options. Manufacturers and financial institutions adjust their offers based on the prevailing interest rate environment.

- Leasing deals become less attractive as interest rates rise, impacting consumer choice.

- Financing options may become less readily available or come with stricter requirements.

- This further restricts consumer access to new cars.

The impact is reflected in changes in car leasing and financing market shares.

Conclusion: Understanding the Europe Car Sales Decline and Looking Ahead

The decline in Europe car sales is primarily driven by a confluence of economic headwinds: inflation, the energy crisis, and rising interest rates. These factors significantly impact consumer purchasing power, affordability of car ownership, and consumer confidence, leading to reduced spending on automobiles. The future trajectory of European car sales will depend on the evolution of these economic conditions and potential government interventions. While some predict a gradual recovery, the challenges remain significant.

To stay updated on the latest developments in the Europe car sales decline and its impact on the automotive industry, continue following our insightful analysis and subscribe to our newsletter for regular updates.

Featured Posts

-

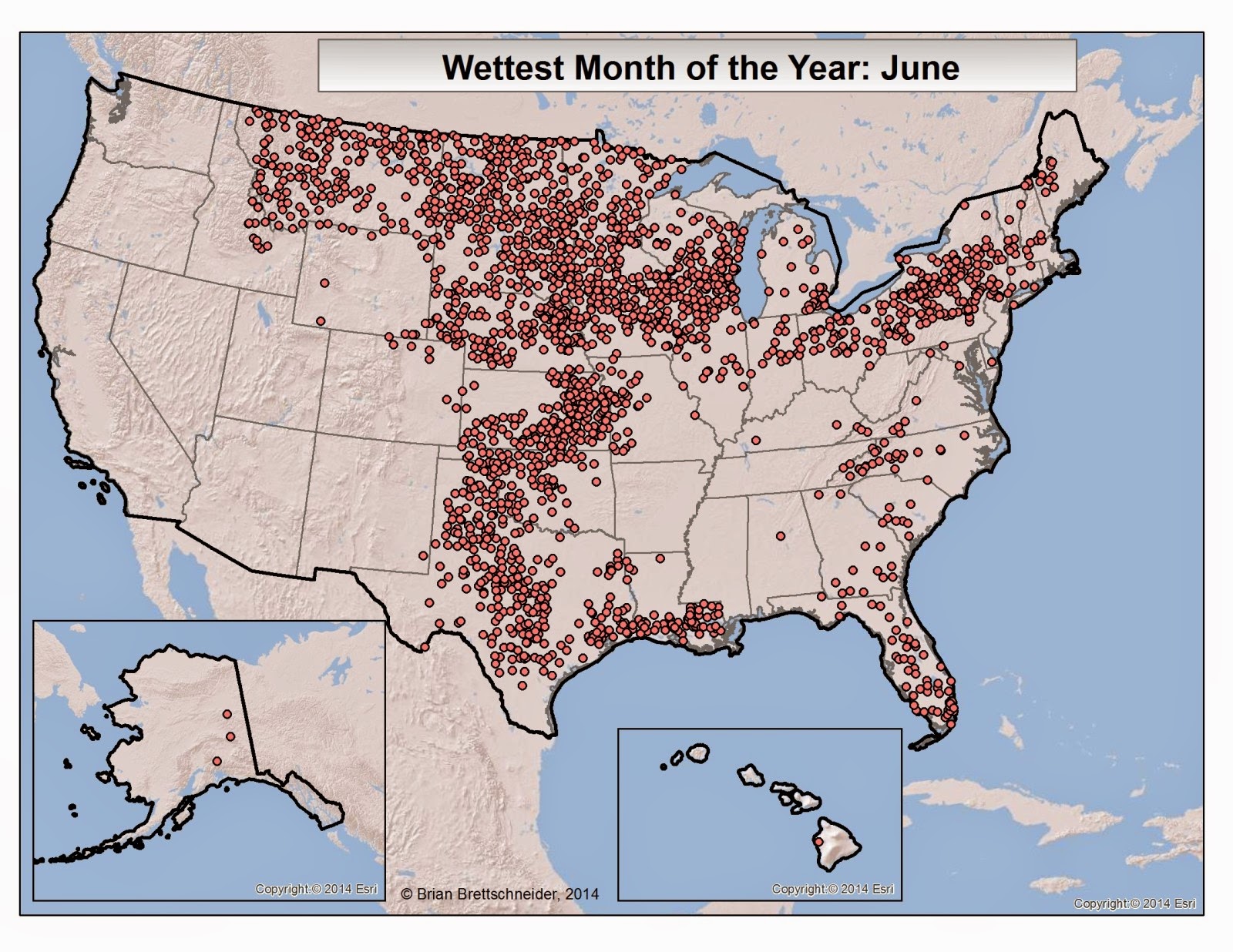

Is April The Wettest Month Reviewing Current Rainfall

May 28, 2025

Is April The Wettest Month Reviewing Current Rainfall

May 28, 2025 -

Hailee Steinfelds Sharp Suit At Good Morning America

May 28, 2025

Hailee Steinfelds Sharp Suit At Good Morning America

May 28, 2025 -

Leeds United Transfer News Kalvin Phillips Return On The Cards

May 28, 2025

Leeds United Transfer News Kalvin Phillips Return On The Cards

May 28, 2025 -

Chinas Reliance On Consumer Spending Challenges And Opportunities

May 28, 2025

Chinas Reliance On Consumer Spending Challenges And Opportunities

May 28, 2025 -

Understanding The Impact Of Dangerous Climate Whiplash On Urban Infrastructure

May 28, 2025

Understanding The Impact Of Dangerous Climate Whiplash On Urban Infrastructure

May 28, 2025