Euro And European Futures Surge: Swissquote Bank's Market Analysis

Table of Contents

Strengthening Euro: Underlying Economic Factors

The recent strengthening of the Euro can be attributed to several key underlying economic factors within the Eurozone. Stronger-than-expected economic data, coupled with the European Central Bank's (ECB) monetary policy decisions, have significantly impacted the currency's value. Let's examine these factors in detail:

-

Unexpectedly Strong Economic Data: Recent Eurozone economic indicators, such as GDP growth and employment figures, have surprised analysts with their positive performance. This unexpected strength suggests a resilient Eurozone economy, boosting investor confidence and driving up demand for the Euro. This positive economic outlook contrasts sharply with predictions earlier this year and reinforces the Euro's value against other major currencies.

-

European Central Bank (ECB) Monetary Policy: The ECB's active management of interest rates plays a crucial role in influencing the Euro's strength. Interest rate hikes, aimed at combating inflation, make the Euro more attractive to investors seeking higher returns, thus increasing demand and strengthening the currency. The ECB's commitment to price stability is a key factor underpinning investor confidence.

-

Improved Consumer Confidence and Spending: Rising consumer confidence and increased spending within the Eurozone contribute to economic growth and further strengthen the Euro. Positive sentiment among consumers translates into higher demand for goods and services, bolstering economic activity and making the Euro a more appealing investment.

-

Inflation Rates and Their Influence: While inflation remains a concern, the recent trend suggests a potential easing of inflationary pressures in the Eurozone. Successfully managing inflation without triggering a recession is crucial for maintaining the Euro's strength. The ECB’s ability to navigate this delicate balance will continue to influence the Euro's future trajectory.

-

Comparison to Other Major Economies: The Eurozone's economic performance relative to other major economies, such as the US, also plays a role in determining the Euro's exchange rate. Stronger-than-expected Eurozone growth compared to its peers increases the Euro's attractiveness to investors.

Geopolitical Events and Their Influence

Geopolitical events, particularly the ongoing conflict in Ukraine and the resulting energy crisis, have significantly influenced the Euro and European futures markets. Analyzing these external factors is crucial for understanding the current market dynamics:

-

Impact of the Ukraine War: The war in Ukraine continues to create significant geopolitical uncertainty, impacting energy supplies and investor sentiment. The Eurozone's resilience in the face of this challenge has, however, surprised many, showcasing a degree of strength that has supported the Euro.

-

Energy Crisis and Its Influence: The energy crisis stemming from the conflict in Ukraine has presented challenges for the Eurozone economy. However, the region's adaptation strategies and diversification efforts have mitigated the potential negative impacts, contributing to a more positive outlook for the Euro.

-

Political Developments within the Eurozone: Political stability within the Eurozone is vital for maintaining investor confidence. Significant political developments, either positive or negative, can influence the Euro's value and the performance of European futures contracts.

-

Global Geopolitical Uncertainty: Global geopolitical events beyond the Ukraine conflict also contribute to market volatility. Overall global uncertainty can impact investor sentiment and lead to fluctuations in the Euro and European futures markets.

Swissquote Bank's Market Outlook and Trading Strategies

Swissquote Bank offers expert analysis and insights into the current market trends, providing valuable guidance for investors navigating the complexities of the Euro and European futures markets. Here’s how Swissquote Bank can assist:

-

Expert Market Analysis: Swissquote Bank provides in-depth analysis of current market conditions, helping investors make informed decisions. Their expert forecasts provide valuable context for understanding market movements.

-

Potential Investment Opportunities: Swissquote Bank identifies potential investment opportunities based on its market analysis, providing tailored recommendations to its clients.

-

Suitable Trading Strategies: Swissquote Bank offers guidance on suitable trading strategies to navigate the current market conditions, considering both risk and reward.

-

Risk Management Strategies: Swissquote Bank emphasizes the importance of risk management, providing tools and strategies to mitigate potential losses.

-

Future Direction of the Euro and European Futures: Swissquote Bank's predictions offer insights into the potential future direction of the Euro and European futures, enabling investors to anticipate market movements.

Analyzing European Futures Contracts

Understanding European futures contracts is essential for investors looking to participate in these markets. This section will examine various aspects of futures trading:

-

Types of European Futures Contracts: The market offers a variety of European futures contracts with different specifications and maturities, catering to various investment strategies.

-

Market Volatility: European futures markets have experienced periods of volatility recently. Understanding these fluctuations and their causes is crucial for effective risk management.

-

Hedging Strategies: European futures contracts can be used as effective hedging tools to mitigate risk related to currency fluctuations or interest rate changes.

-

Liquidity and Trading Volume: High liquidity and trading volume in European futures markets ensure efficient price discovery and ease of entry and exit for traders.

Conclusion

The recent surge in the Euro and European futures is a complex phenomenon driven by a confluence of factors, including strong economic data from the Eurozone, the ECB's monetary policy, geopolitical events, and investor sentiment. Swissquote Bank's analysis offers valuable insights into navigating this dynamic market. The interplay between economic fundamentals, geopolitical factors, and market sentiment ultimately dictates the trajectory of the Euro and European futures.

Call to Action: Stay informed on the latest market movements and leverage the expertise of Swissquote Bank for informed decision-making regarding your Euro and European futures investments. Visit Swissquote Bank's website today for more in-depth analysis and trading opportunities related to the Euro and European futures.

Featured Posts

-

Credit Mutuel Am La Geopolitique Exacerbe Les Pressions Environnementales Maritimes

May 19, 2025

Credit Mutuel Am La Geopolitique Exacerbe Les Pressions Environnementales Maritimes

May 19, 2025 -

Cliffs Pavilion Cinderella Pantomime Rylan Clarks Role Confirmed

May 19, 2025

Cliffs Pavilion Cinderella Pantomime Rylan Clarks Role Confirmed

May 19, 2025 -

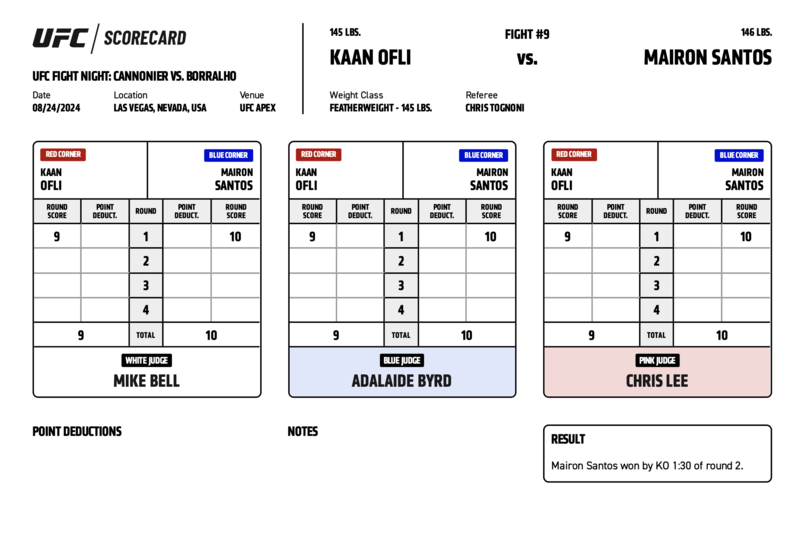

Mairon Santos To Lightweight Permanent Or Temporary

May 19, 2025

Mairon Santos To Lightweight Permanent Or Temporary

May 19, 2025 -

Georgia Tech Falls To Cavaliers Powerful Offensive Performance Secures Victory

May 19, 2025

Georgia Tech Falls To Cavaliers Powerful Offensive Performance Secures Victory

May 19, 2025 -

Kuzey Kibris Mutfagi Itb Berlin De Tanitildi

May 19, 2025

Kuzey Kibris Mutfagi Itb Berlin De Tanitildi

May 19, 2025