EU Climate Funds Fuel €750 Million Expansion Of Green Home Loans

Table of Contents

The Impact of EU Climate Funds on Green Home Loan Availability

EU climate funds play a crucial role in making green home improvements more accessible and affordable. These funds provide the financial backing necessary for the expansion of green home loan programs across the EU, leveraging significant investments to drive the adoption of sustainable home upgrades. Initiatives like the EU's Renovation Wave are central to this effort, aiming to renovate a significant portion of Europe's building stock to improve energy efficiency.

The impact of these funds is multifaceted:

- Increased loan amounts available: Homeowners can now access larger loans to finance more extensive renovations.

- Lower interest rates offered on green mortgages: The subsidized interest rates make green home improvements more financially attractive.

- Wider accessibility to borrowers with varied credit profiles: The expanded programs aim to make green financing more inclusive, catering to a broader range of borrowers.

- Increased number of participating lenders: More financial institutions are offering green home loans, increasing competition and choice for consumers.

Benefits of Green Home Improvements Financed by Green Home Loans

Investing in green home improvements through green home loans offers a wealth of advantages for homeowners:

- Reduced energy bills through energy efficiency upgrades: Upgrades like improved insulation and energy-efficient windows significantly lower your energy consumption and reduce your monthly bills.

- Increased property value due to improved energy rating: Energy-efficient homes are highly sought after, boosting your property's market value and resale potential. A higher energy performance certificate (EPC) rating is a significant asset.

- Enhanced comfort and living standards within the home: Better insulation and ventilation create a more comfortable and healthier living environment.

- Lower carbon footprint, contributing to climate goals: By reducing your home's energy consumption, you actively contribute to lowering your carbon footprint and supporting Europe's climate targets.

- Access to government incentives and tax breaks: Many EU countries offer additional financial incentives, such as tax breaks or rebates, for undertaking green home renovations. Check with your local authorities for details.

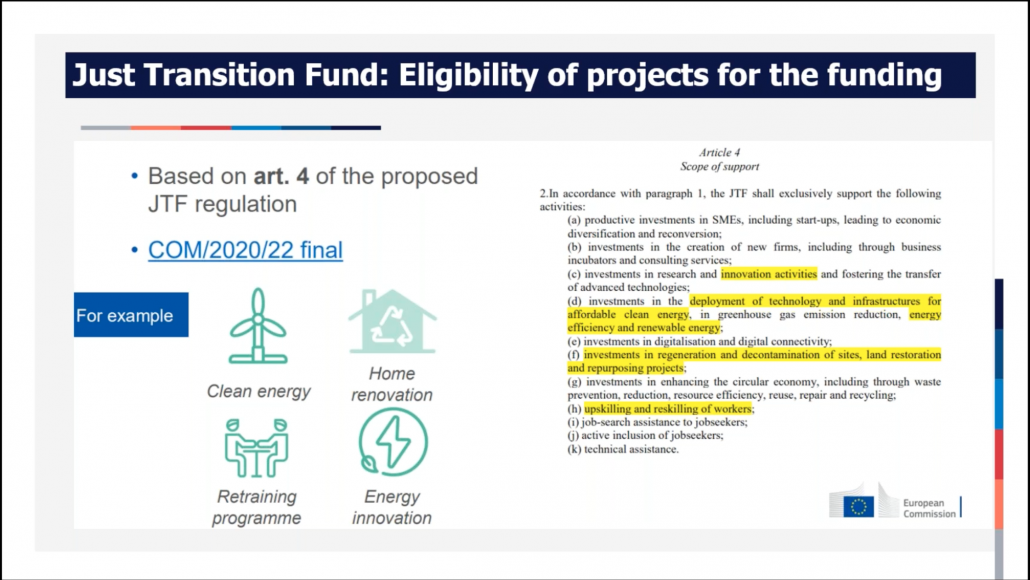

Types of Green Home Improvements Covered by the Expanded Loan Program

The expanded loan program covers a wide range of eligible green home improvements, empowering homeowners to undertake comprehensive renovations:

- Installation of renewable energy sources: This includes solar panels for electricity generation and heat pumps for efficient heating and hot water.

- Building insulation improvements: Upgrades include wall, roof, and floor insulation to minimize heat loss and improve energy efficiency.

- Energy-efficient window replacements: Replacing old, drafty windows with double or triple-glazed windows dramatically reduces energy loss.

- Smart home technology integration for energy management: Smart thermostats and energy monitoring systems optimize energy usage and reduce waste.

- Water conservation upgrades: Installing low-flow showerheads and toilets contributes to water conservation and reduces water bills.

Eligibility Criteria and Application Process for Green Home Loans

While specific eligibility criteria may vary depending on the country and lender, general requirements typically include:

- Property location within the EU: The program focuses on improving energy efficiency within the European Union. Specific regional eligibility may apply.

- Type of property: Most programs cover single-family homes, apartments, and other residential properties.

- Required energy efficiency improvements: Applicants usually need to demonstrate a commitment to significant energy efficiency upgrades.

- Steps involved in the application process: The process usually involves submitting an application, providing supporting documentation, and undergoing a credit check.

- Resources for finding participating lenders: Contact your local bank or search online for lenders offering green home loans in your region.

Conclusion

The €750 million expansion of green home loans, powered by EU climate funds, represents a significant step towards a more sustainable and energy-efficient Europe. Homeowners now have unparalleled access to financing for crucial green renovations, leading to considerable financial and environmental benefits. The program offers various incentives, making it more attractive than ever to upgrade your home sustainably.

Call to Action: Take advantage of this opportunity to secure a green home loan and embark on your energy-efficient home renovation journey. Explore the available options for green home loans in your region and start building a greener, more sustainable future, one home at a time! Don't miss out on the benefits of green home loans. Contact your local bank or search online for "green home loans" today!

Featured Posts

-

The Relationship Between Hailee Steinfeld And Josh Allen

May 28, 2025

The Relationship Between Hailee Steinfeld And Josh Allen

May 28, 2025 -

Cassidy Hutchinson To Publish Memoir Detailing January 6th Experience

May 28, 2025

Cassidy Hutchinson To Publish Memoir Detailing January 6th Experience

May 28, 2025 -

Jennifer Lopez Set To Host The 2024 American Music Awards In Las Vegas

May 28, 2025

Jennifer Lopez Set To Host The 2024 American Music Awards In Las Vegas

May 28, 2025 -

Office365 Security Failure Leads To Millions In Losses Fbi Investigation

May 28, 2025

Office365 Security Failure Leads To Millions In Losses Fbi Investigation

May 28, 2025 -

Irish Euro Millions Jackpot Two Players Win Big Locations Announced

May 28, 2025

Irish Euro Millions Jackpot Two Players Win Big Locations Announced

May 28, 2025