Ethereum Price Prediction: Will ETH Hit $2,700?

Table of Contents

Will Ethereum (ETH) reach the coveted $2,700 price point? This question is on the mind of many cryptocurrency investors. This comprehensive analysis delves into the factors that could propel ETH to this level, examining current market conditions, technological advancements, and potential challenges. We'll explore key indicators and provide a well-informed prediction, helping you navigate the exciting world of Ethereum price forecasting.

Current Market Conditions and ETH's Performance

Analyzing the current Ethereum price requires a deep dive into its market performance and broader economic factors. Understanding ETH's trading volume and market capitalization is crucial for predicting future price movements. Currently, [insert current market cap and trading volume data with source citation]. These figures provide a snapshot of investor interest and overall market sentiment.

Recent price fluctuations have significantly impacted investor sentiment. [Describe recent price swings – e.g., a recent dip or surge and its causes – citing news articles or reputable sources]. This volatility underscores the inherent risks associated with cryptocurrency investments.

The correlation between Bitcoin's price and Ethereum's performance is undeniable. Often, when Bitcoin experiences significant price changes, Ethereum follows suit, albeit sometimes with a slightly delayed reaction. [Insert data or chart showing the correlation, ideally with a reputable source]. This interconnectedness highlights the importance of considering the broader cryptocurrency market landscape when analyzing ETH's price.

- Significant News Impacting the Market: [Mention recent regulatory updates, partnerships, or significant events, linking to credible news sources for each point]. For example, the recent [mention specific event] has caused [explain the effect on the ETH price].

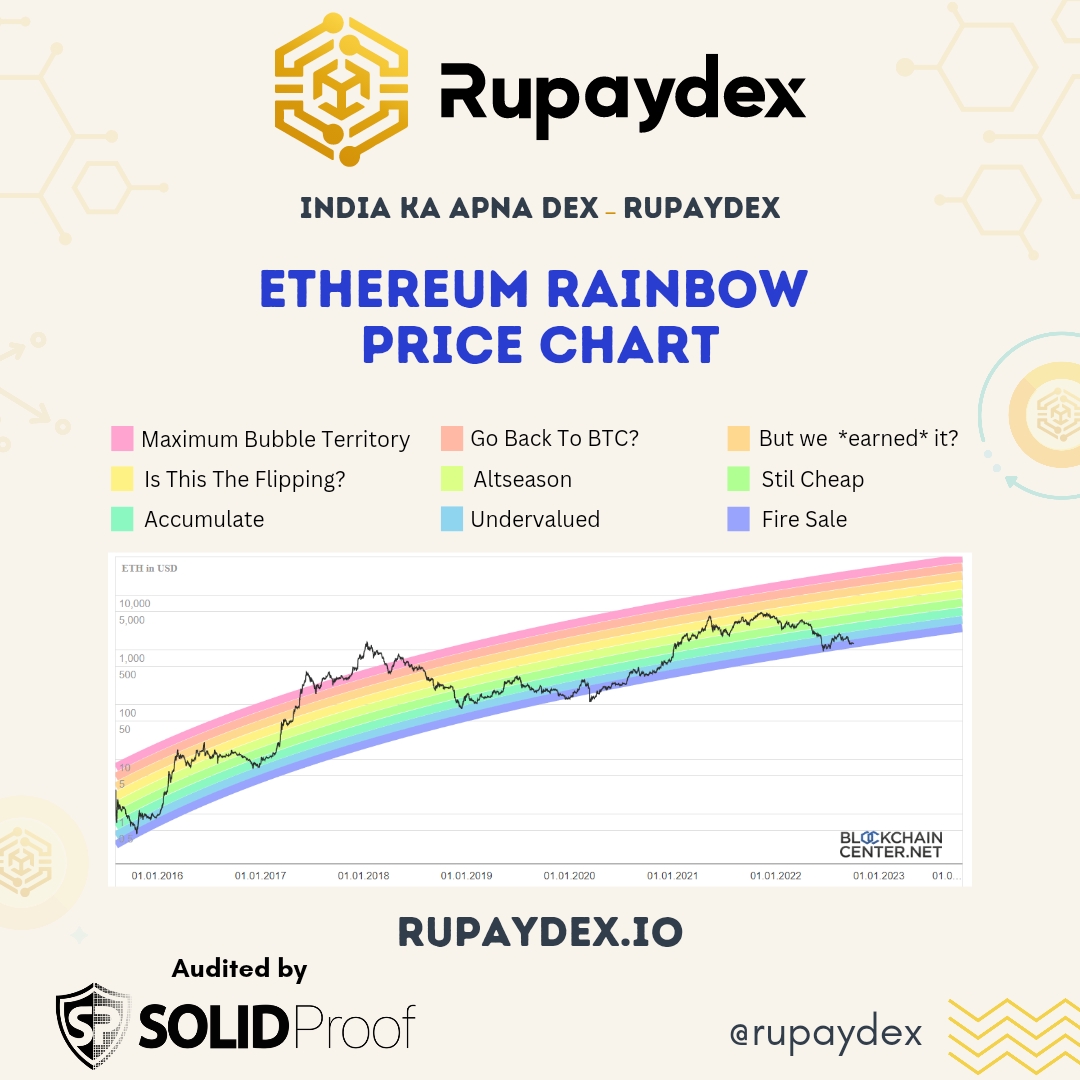

- ETH Price History and Recent Trends: [Include a clear and well-labeled chart showing ETH's price history over a relevant period, clearly indicating recent trends and support/resistance levels. Cite the source of the chart data].

- ETH's Dominance in the Crypto Market: Ethereum currently holds approximately [insert percentage] of the total cryptocurrency market capitalization. [Discuss the implications of this dominance and its potential impact on future price movements].

Technical Analysis: Indicators Suggesting a Potential Rise to $2,700

Technical analysis provides valuable insights into potential future price movements. By studying key indicators, we can gain a better understanding of Ethereum's short-term and long-term trajectory.

Several technical indicators suggest a possible rise towards $2,700. Let's explore some key ones:

- Moving Averages: The [mention specific moving average, e.g., 50-day or 200-day] moving average is currently [above/below] the price, suggesting [bullish/bearish] momentum. [Include chart demonstrating this].

- Relative Strength Index (RSI): The RSI is currently at [insert value], indicating [overbought/oversold] conditions. This suggests [potential for a price correction/further upward movement]. [Include chart].

- Moving Average Convergence Divergence (MACD): The MACD is currently [above/below] the signal line, suggesting [bullish/bearish] momentum. [Include chart and explanation].

Support and Resistance Levels: Key support levels for ETH are currently around [insert price levels] and resistance levels are near [insert price levels]. A breakout above the resistance levels could pave the way for a move towards $2,700. [Include a chart illustrating these levels].

Chart Patterns: [Discuss any relevant chart patterns, such as head and shoulders, triangles, or flags, that could indicate future price movements. Provide clear visual examples and explain their implications].

Ethereum's Technological Advancements and Future Developments

Ethereum's technological roadmap and the flourishing DeFi ecosystem are significant factors influencing its price.

Ethereum 2.0: The much-anticipated Ethereum 2.0 upgrade promises significant improvements in scalability, security, and transaction speeds. This will likely reduce transaction fees and enhance the overall user experience, potentially attracting more users and driving up demand for ETH. [Explain specific benefits of ETH 2.0 and its expected timeline].

DeFi Ecosystem Growth: The decentralized finance (DeFi) ecosystem built on Ethereum continues to expand rapidly. The total value locked (TVL) in DeFi protocols on Ethereum is currently [insert data with source]. This growing ecosystem increases the demand for ETH, as it's the primary currency used for transactions and governance within these protocols. [List and briefly describe some major DeFi protocols on Ethereum].

NFTs and their Influence: Non-fungible tokens (NFTs) built on the Ethereum blockchain have exploded in popularity. This increased demand for NFTs directly impacts the demand for ETH, as it's the primary gas currency for transactions on the Ethereum network. [Discuss the potential for future NFT growth and its effect on ETH price].

Potential Challenges and Risks Affecting ETH's Price

Despite the bullish indicators, several challenges and risks could impact Ethereum's price.

Cryptocurrency Market Volatility: The cryptocurrency market is inherently volatile. Sudden market crashes or corrections are possible, potentially leading to significant price drops for ETH. [Explain factors that contribute to market volatility].

Regulatory Hurdles: Regulatory uncertainty remains a significant risk for the entire cryptocurrency market, including Ethereum. Stringent regulations could stifle innovation and adoption, negatively impacting ETH's price. [Discuss potential regulatory challenges and their possible impact].

Competition from Other Blockchains: Ethereum faces competition from other blockchain platforms offering alternative solutions. These competitors may offer faster transaction speeds, lower fees, or other advantages, potentially drawing users and developers away from Ethereum. [Discuss specific competing platforms and their advantages and disadvantages compared to Ethereum].

Conclusion

Based on our analysis of current market conditions, technical indicators, and future developments, the potential for Ethereum to reach $2,700 is certainly present. Significant upside potential exists, driven by technological advancements like Ethereum 2.0, the growth of the DeFi ecosystem, and the continued adoption of NFTs. However, various challenges and market volatility remain. Regulatory uncertainty and competition from other blockchain platforms could significantly influence the timeline and success of any price surge.

Prediction: While a move to $2,700 is certainly possible, significant factors like regulatory uncertainty and overall market sentiment could influence the timeline. We predict that ETH could reach $2,700 within [insert timeframe – e.g., the next 12-18 months] under favorable market conditions and continued technological progress. However, a more conservative approach suggests that reaching this level may take longer due to the inherent volatility of the cryptocurrency market.

Call to Action: Stay informed on the latest Ethereum price predictions and market analysis by following [Your Website/Platform]. Keep an eye on our future articles for more in-depth Ethereum price predictions and insights into the evolving cryptocurrency market. Learn more about Ethereum price trends and make informed investment decisions.

Featured Posts

-

Ethereum Price Current Stability And Future Potential

May 08, 2025

Ethereum Price Current Stability And Future Potential

May 08, 2025 -

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025 -

5 0 355 3

May 08, 2025

5 0 355 3

May 08, 2025 -

Gjranwalh Myn Wlyme Ke Mwqe Pr Dl Ka Dwrh Dlhn Ka Ghm

May 08, 2025

Gjranwalh Myn Wlyme Ke Mwqe Pr Dl Ka Dwrh Dlhn Ka Ghm

May 08, 2025 -

Arsenal Protiv Ps Zh Kluchni Fakti Pred Natprevarot Vo Ligata Na Shampionite

May 08, 2025

Arsenal Protiv Ps Zh Kluchni Fakti Pred Natprevarot Vo Ligata Na Shampionite

May 08, 2025