Emerging Markets Soar While US Stocks Slump: A 2023 Market Overview

Table of Contents

The Rise of Emerging Markets in 2023

The robust performance of emerging markets in 2023 is a compelling story, driven by a confluence of factors. Understanding these factors is key to grasping the opportunities and challenges presented by this asset class.

Stronger Economic Growth in Emerging Nations

Many key emerging economies are experiencing significantly higher GDP growth rates than their developed counterparts.

- India: Projected to achieve over 7% GDP growth in 2023, fueled by strong domestic consumption and technological advancements.

- Brazil: Benefiting from a commodity boom and recovering domestic demand, with growth projections exceeding 2%.

- Indonesia: Strong infrastructure development and a growing middle class contribute to its consistent economic expansion.

This growth is driven by several factors, including:

- Robust Domestic Consumption: A burgeoning middle class in many emerging economies is driving increased consumer spending, boosting economic activity.

- Government Initiatives: Many emerging market governments are implementing policies aimed at stimulating economic growth, including infrastructure investments and pro-business reforms.

- Foreign Direct Investment (FDI): Emerging markets are attracting significant FDI, further fueling economic expansion and creating investment opportunities.

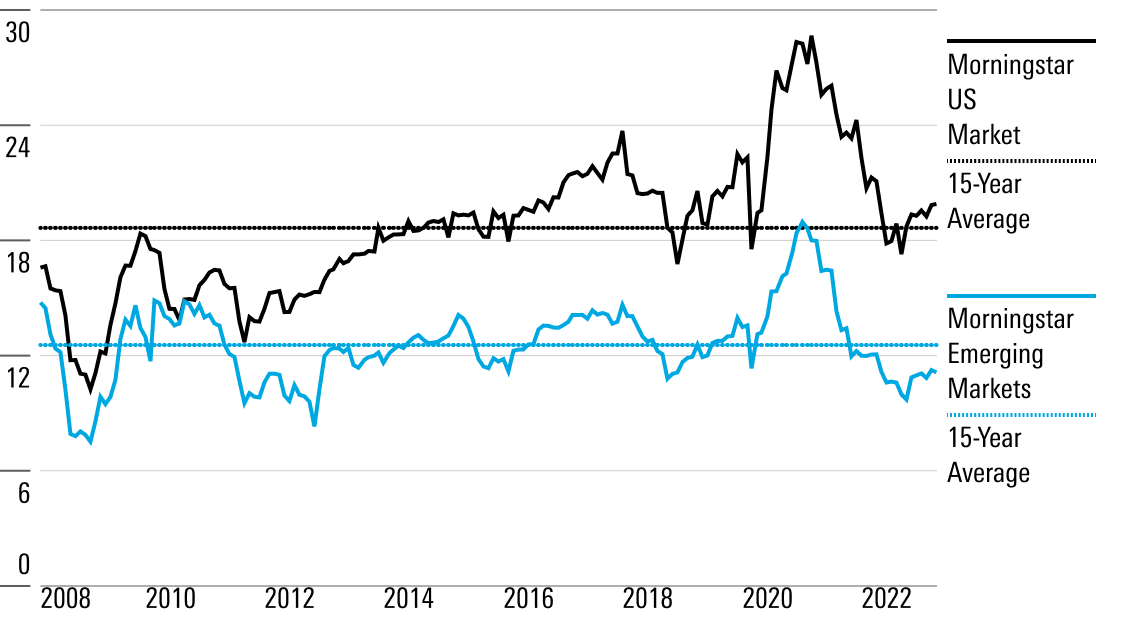

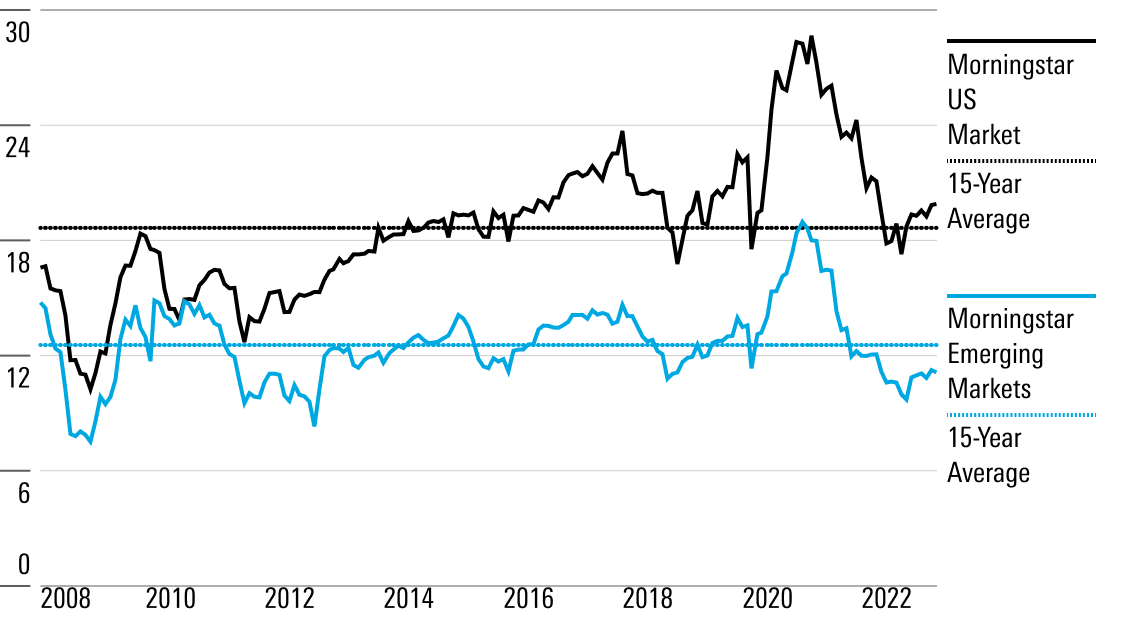

Attractive Valuation and Investment Opportunities

Compared to developed markets, many emerging markets offer significantly more attractive valuations.

- Lower Price-to-Earnings (P/E) Ratios: Emerging market equities often trade at lower P/E ratios than their US counterparts, indicating potential undervaluation.

- High Growth Potential: Companies in emerging markets often exhibit higher growth potential compared to established firms in developed economies.

- Specific Sectors: The technology, infrastructure, and consumer goods sectors in many emerging markets present particularly compelling investment opportunities.

This undervaluation presents lucrative investment opportunities for those willing to take on the inherent risks associated with emerging markets. For example, select technology companies in India and Southeast Asia show significant growth potential at comparatively lower valuations than their US-based competitors.

Geopolitical Factors Favoring Emerging Markets

Geopolitical shifts are playing a significant role in the relative performance of emerging and developed markets.

- Diversification: Investors are increasingly diversifying their portfolios away from US-centric investments to reduce risk and seek higher returns.

- Global Uncertainty: Events such as the war in Ukraine and persistent global inflation have negatively impacted US stocks, while some emerging markets have shown relative resilience.

- Reduced Dependence on the US Dollar: Some emerging markets are actively reducing their reliance on the US dollar, strengthening their economic independence.

The ongoing geopolitical uncertainty is creating both opportunities and risks in emerging markets. While some markets may experience volatility, others may thrive due to their relative insulation from specific global events.

The 2023 Slump in US Stocks: Underlying Causes

The underperformance of US stocks in 2023 is attributable to several interconnected factors.

High Inflation and Interest Rate Hikes

The Federal Reserve's aggressive interest rate hikes to combat inflation have had a significant negative impact on US stock valuations.

- Higher Borrowing Costs: Increased interest rates make borrowing more expensive for businesses, hindering investment and potentially slowing economic growth.

- Reduced Corporate Profitability: Higher interest rates can squeeze profit margins for companies with significant debt loads.

- Technology Sector Impact: The technology sector, which is highly sensitive to interest rate changes, has been particularly affected.

This relationship between inflation, interest rates, and stock market performance is complex but undeniable. As interest rates rise, the present value of future earnings decreases, leading to lower stock valuations.

Geopolitical Uncertainty and Global Economic Slowdown

Geopolitical instability and fears of a global recession are weighing heavily on investor sentiment.

- War in Ukraine: The war in Ukraine has created significant economic uncertainty, impacting energy prices and supply chains globally.

- Energy Crisis: The energy crisis has further fueled inflation and heightened concerns about economic growth.

- Recessionary Fears: Widespread fears of a global recession are prompting investors to adopt a more cautious approach.

Global uncertainty significantly impacts investor confidence, leading to increased market volatility and decreased investment in riskier assets.

Overvaluation Concerns in Certain US Sectors

Certain sectors of the US stock market, particularly technology, have shown signs of overvaluation in recent years.

- Tech Stock Corrections: The tech sector experienced significant corrections in 2023, reflecting concerns about overvaluation and slowing growth.

- High Valuations: Some companies in the technology sector continue to trade at very high valuations, despite slowing growth prospects.

- Impact on Overall Market: Corrections in the technology sector have had a ripple effect on the broader US stock market.

The potential for further corrections in overvalued sectors remains a significant risk for US investors.

Investment Strategies for 2023 and Beyond

Navigating the current market requires a well-defined investment strategy.

Diversification: The Key to Mitigating Risk

Diversification remains a crucial strategy for mitigating risk and maximizing returns.

- Geographic Diversification: Including emerging market assets in a portfolio can help reduce exposure to the risks associated with any single market.

- Sector Diversification: Investing across different sectors can help reduce portfolio volatility.

- Asset Class Diversification: Diversifying across different asset classes, such as equities, bonds, and real estate, is essential for long-term portfolio resilience.

A well-diversified portfolio can help weather market downturns and capitalize on growth opportunities in different regions and sectors.

Strategic Asset Allocation

Strategic asset allocation involves adjusting your portfolio based on your risk tolerance and market conditions.

- Risk Tolerance: Investors with a higher risk tolerance may allocate a larger portion of their portfolio to emerging markets.

- Investment Vehicles: Exchange-traded funds (ETFs) and mutual funds provide convenient and diversified access to emerging markets.

- Rebalancing: Regularly rebalancing your portfolio to maintain your desired asset allocation is crucial.

Conclusion: Navigating the Emerging Markets and US Stock Landscape in 2023

In summary, 2023 has witnessed a striking divergence between the performance of emerging markets and US stocks. Strong economic growth, attractive valuations, and geopolitical shifts have fueled the rise of emerging markets, while high inflation, interest rate hikes, and global uncertainty have weighed on US stocks. The key takeaways emphasize the importance of diversification and strategic asset allocation in navigating this dynamic landscape. Ready to explore the potential of emerging markets and strategically navigate the complexities of the 2023 market overview? Consult with a financial advisor today!

Featured Posts

-

High Rollers An Exclusive Preview Of Posters And Photos From The New John Travolta Action Film

Apr 24, 2025

High Rollers An Exclusive Preview Of Posters And Photos From The New John Travolta Action Film

Apr 24, 2025 -

Bethesdas Oblivion Remastered Everything You Need To Know

Apr 24, 2025

Bethesdas Oblivion Remastered Everything You Need To Know

Apr 24, 2025 -

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025 -

California Gas Prices Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 24, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 24, 2025