Elon Musk's SpaceX Holdings Outpace Tesla: A $43 Billion Increase

Table of Contents

SpaceX's Valuation Surge: A Deep Dive into the $43 Billion Increase

The remarkable $43 billion increase in SpaceX's valuation isn't a fluke; it's the result of several converging factors that position the company for continued growth in the lucrative space launch market. Several key elements have fueled this exponential rise in SpaceX valuation:

-

Successful Starlink Deployment and Subscriber Growth: Starlink, SpaceX's satellite internet constellation, has been a phenomenal success. Its rapidly expanding subscriber base, reaching millions globally, generates substantial Starlink revenue, directly impacting SpaceX's overall valuation. The expansion into underserved areas and the provision of high-speed internet access have proven incredibly profitable.

-

Lucrative Government Contracts: SpaceX has secured numerous significant contracts with government entities, including NASA and the U.S. military. These contracts, for launching satellites, transporting cargo to the International Space Station, and developing advanced space technologies, provide crucial financial stability and contribute significantly to SpaceX valuation.

-

Booming Demand for Commercial Launch Services: The commercial space sector is experiencing explosive growth. SpaceX, with its Falcon 9 and Falcon Heavy rockets, is a major player, offering cost-effective and reliable launch services to various private companies and international organizations. This increased demand directly translates into higher revenue and a stronger SpaceX valuation.

-

Strategic Investments: Significant investment from private equity firms and venture capitalists demonstrates strong confidence in SpaceX's future prospects and has further bolstered its valuation. These investments underscore the belief in SpaceX's innovative technologies and long-term growth potential.

-

Starship Development and Interplanetary Travel: The development of Starship, a fully reusable launch system designed for interplanetary travel, represents a monumental undertaking with potentially transformative implications. Successful development and deployment of Starship could catapult SpaceX's valuation to unprecedented levels, establishing it as a dominant force in the space exploration industry.

Comparing SpaceX and Tesla's Market Capitalization

While Tesla remains a powerhouse in the electric vehicle market, the recent shift in market capitalization between SpaceX and Tesla is noteworthy. Historically, Tesla's market capitalization significantly exceeded that of SpaceX, primarily due to its established position in the consumer market and its widely recognized brand. However, SpaceX’s recent growth has dramatically changed the balance.

[Insert a comparison chart or graph here visually showing the growth of both companies' market capitalization over time. Data should be sourced from reputable financial websites.]

-

Tesla's Market Dominance and Fluctuations: Tesla's stock price has experienced its own set of fluctuations, influenced by factors such as production challenges, intensifying competition from other EV manufacturers, and regulatory changes.

-

Contrasting Investment Profiles: Investing in SpaceX carries a higher risk-reward profile than investing in Tesla. While Tesla has an established market presence, SpaceX operates in a comparatively nascent and volatile sector. However, the potential rewards for early investors in SpaceX are potentially much greater.

Implications for Elon Musk and the Future of Space Exploration

The dramatic increase in SpaceX's valuation significantly boosts Elon Musk's net worth and strengthens his influence within the technology and space exploration sectors. This success underscores the viability of his long-term vision of colonizing Mars.

-

Musk's Diversified Business Strategy: The success of SpaceX demonstrates the effectiveness of Musk's strategy of diversification across various high-growth sectors, mitigating risk and fostering innovation.

-

Increased Competition and Innovation: SpaceX's success is spurring increased competition and innovation in the private space sector, leading to a more dynamic and rapidly advancing industry.

-

Space Tourism and Colonization: The potential for space tourism and the long-term goal of space colonization are both significantly influenced by SpaceX's achievements, moving these ambitions closer to reality.

-

Ethical Considerations: The rapid advancement of space exploration technology raises numerous ethical considerations, demanding careful consideration and responsible development.

Conclusion

In conclusion, the recent surge in Elon Musk's SpaceX holdings, surpassing Tesla's valuation by a remarkable $43 billion, is a testament to the company's innovative spirit and the rapidly growing commercial space sector. This unexpected shift highlights the potential for disruptive technology to transform industries and the enormous potential of space exploration. The factors driving SpaceX's success – Starlink’s popularity, lucrative government contracts, and the ambitious Starship project – all point towards a future where SpaceX continues to play a leading role in shaping the future of space travel.

Stay updated on the dynamic world of Elon Musk's SpaceX holdings and Tesla's performance by subscribing to our newsletter. Learn more about the ever-evolving landscape of space exploration and investment opportunities!

Featured Posts

-

These 4 Randall Flagg Theories Will Change Your View Of Stephen King

May 10, 2025

These 4 Randall Flagg Theories Will Change Your View Of Stephen King

May 10, 2025 -

Soglashenie Makrona I Tuska 9 Maya Chto Ozhidat Ukraine

May 10, 2025

Soglashenie Makrona I Tuska 9 Maya Chto Ozhidat Ukraine

May 10, 2025 -

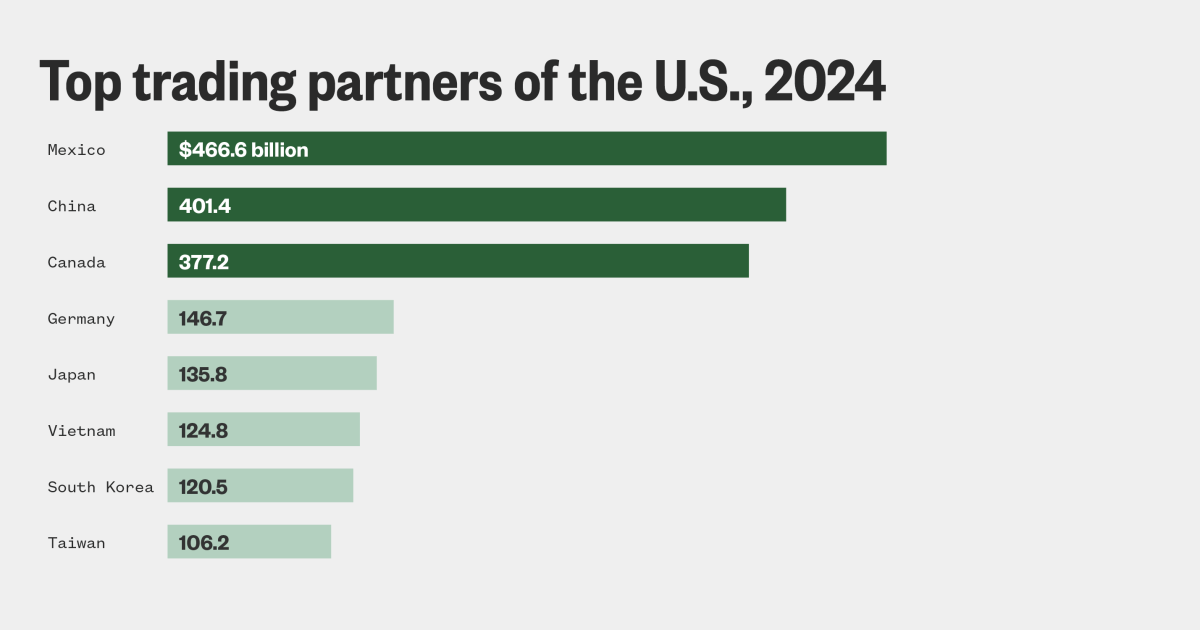

Market Volatility Trumps Tariff Plan And The Implications For Uk Trade

May 10, 2025

Market Volatility Trumps Tariff Plan And The Implications For Uk Trade

May 10, 2025 -

Kilmar Abrego Garcia From Gang Violence In El Salvador To Us Political Flashpoint

May 10, 2025

Kilmar Abrego Garcia From Gang Violence In El Salvador To Us Political Flashpoint

May 10, 2025 -

Transgenero Arrestada En Universidad Discriminacion Y Derechos En El Bano

May 10, 2025

Transgenero Arrestada En Universidad Discriminacion Y Derechos En El Bano

May 10, 2025