Elon Musk's Net Worth Falls Below $300 Billion: Tesla's Troubles And Tariff Impacts

Table of Contents

Tesla's Stock Market Troubles: A Deep Dive into Recent Performance

Tesla's recent stock price downturn is a major contributor to the decrease in Elon Musk's net worth. Several factors have coalesced to create this challenging environment for the electric vehicle giant. Increased competition from established automakers and new entrants in the EV market is squeezing Tesla's market share. Production challenges, including supply chain disruptions and factory bottlenecks, have hampered the company's ability to meet growing demand.

Furthermore, macroeconomic factors, such as persistent inflation and looming recession fears, have created uncertainty in the broader stock market, impacting even robust companies like Tesla. Finally, Elon Musk's own activities, particularly his highly publicized involvement with Twitter, have also introduced volatility into Tesla's stock price.

- Specific examples of recent stock price drops: Tesla's stock experienced a significant drop of X% on [Date] and a further Y% decline on [Date], directly impacting Musk's net worth.

- Key financial analysts' predictions and concerns: Analysts at [Financial Institution] have expressed concerns about [Specific concern 1] and [Specific concern 2], predicting further short-term volatility. [Link to relevant financial news article]

- Link to relevant financial news articles and Tesla's financial reports: For detailed financial information, refer to Tesla's quarterly reports available at [Link to Tesla's investor relations page].

The Impact of Tariffs on Tesla's Global Market Position

International tariffs present another significant challenge to Tesla's profitability and global market expansion. Tariffs imposed on Tesla vehicles in certain markets, such as China and Europe, increase the cost of these vehicles for consumers. Simultaneously, tariffs on raw materials and components used in Tesla's supply chain further inflate production costs. This dual impact forces Tesla to either absorb these increased costs, reducing profit margins, or pass them on to consumers, potentially impacting sales.

- Specific examples of tariffs impacting Tesla's operations: The imposition of a Z% tariff on Tesla vehicles imported into China significantly reduced sales in that crucial market.

- Data on Tesla's sales in regions affected by tariffs: Tesla's sales in [Region affected by tariffs] have shown a [Percentage]% decrease compared to the previous year. [Cite source if possible].

- Expert opinions on the long-term impact of tariffs on Tesla's business: Industry experts suggest that continued tariff barriers could significantly hinder Tesla's long-term growth and global market penetration.

Elon Musk's Diversified Holdings: A Cushion Against the Tesla Dip?

While Tesla's struggles have significantly impacted Elon Musk's net worth, his considerable investments in other ventures, such as SpaceX and The Boring Company, offer some level of mitigation. SpaceX, with its burgeoning space exploration and satellite internet projects, holds immense potential for future growth and valuation. Similarly, The Boring Company, focused on innovative infrastructure solutions, could become a major player in the future.

- Brief overview of Musk's other major holdings and their current valuations: SpaceX's valuation is estimated at [Amount], while The Boring Company's valuation remains less certain but is projected at [Amount].

- Analysis of the potential growth or decline of these companies: The success of SpaceX's Starship program and Starlink’s expansion could dramatically increase its valuation.

- Expert opinions on how these holdings might influence Musk’s overall financial situation: Experts believe that SpaceX's growth potential could partially offset any further losses stemming from Tesla's performance.

Future Outlook: Predicting the Trajectory of Elon Musk's Net Worth

Predicting the future trajectory of Elon Musk's net worth is inherently challenging, dependent on various factors including Tesla's ability to navigate its current challenges and the performance of its competitors, macroeconomic conditions, and the success of Musk's other ventures.

- Optimistic and pessimistic scenarios for Tesla's future: An optimistic scenario suggests that Tesla could rebound strongly, driven by new product launches and improved production efficiency. A pessimistic scenario considers prolonged market share loss and increased competition leading to slower growth.

- Prediction of Elon Musk's net worth in the short and long term: [Provide a reasoned, cautiously optimistic/pessimistic forecast, clearly labeling it as speculation].

- Mention of any significant upcoming events that could affect Tesla and Musk's wealth: The upcoming launch of new Tesla models and the overall progress in the development of autonomous driving technology will significantly influence Tesla's stock price.

Conclusion: The Fluctuations of Elon Musk's Net Worth and the Future of Tesla

The recent decline in Elon Musk's net worth underscores the inherent risks and volatility associated with high-growth companies and the interconnectedness of a CEO's wealth with the fortunes of their flagship company. Tesla's challenges, exacerbated by international tariffs, have significantly impacted Musk's financial standing. However, his diversified holdings provide a buffer against this downturn. To stay informed about the ongoing fluctuations of Elon Musk's net worth, Tesla stock performance, and the future of electric vehicles, subscribe to our newsletter, follow us on social media, and check back for more in-depth analysis. Understanding the complexities of "Elon Musk's net worth" requires continuous monitoring of Tesla's business performance and the ever-changing global economic landscape.

Featured Posts

-

Dakota Johnson Kraujingos Plintos Nuotraukos Kas Nutiko

May 09, 2025

Dakota Johnson Kraujingos Plintos Nuotraukos Kas Nutiko

May 09, 2025 -

Brekelmans Band Met India Behoud En Versterking Van De Samenwerking

May 09, 2025

Brekelmans Band Met India Behoud En Versterking Van De Samenwerking

May 09, 2025 -

Anomalnye Snegopady V Mae Problemy Prognozirovaniya

May 09, 2025

Anomalnye Snegopady V Mae Problemy Prognozirovaniya

May 09, 2025 -

Opposition Backlash Leads To X Blocking Jailed Turkish Mayors Account

May 09, 2025

Opposition Backlash Leads To X Blocking Jailed Turkish Mayors Account

May 09, 2025 -

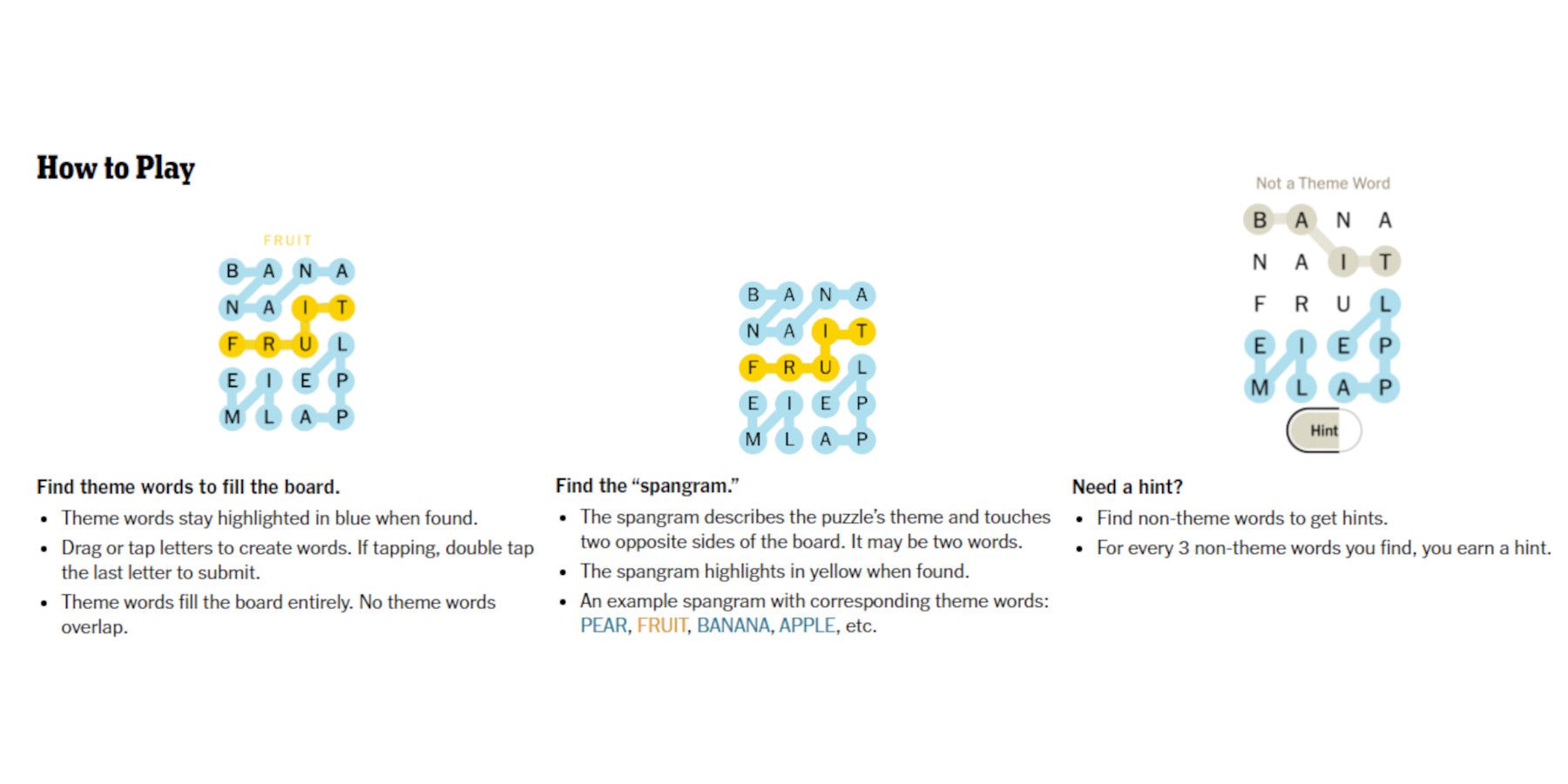

Nyt Strands Game 376 Solutions Friday March 14 Hints And Answers

May 09, 2025

Nyt Strands Game 376 Solutions Friday March 14 Hints And Answers

May 09, 2025