Elon Musk's Net Worth: Below $300 Billion After Tesla's Recent Setbacks

Table of Contents

Tesla's Stock Performance and its Impact on Elon Musk's Net Worth

The Recent Decline in Tesla Stock Price

Tesla's stock price has experienced a notable downturn in recent months, directly impacting Elon Musk's net worth. This decline, measured in a significant percentage drop (specific percentage to be inserted here based on current data), can be attributed to a confluence of factors. The fluctuating market capitalization of Tesla is intrinsically linked to Musk's personal wealth, as a significant portion of his assets are tied to his ownership stake in the electric vehicle giant.

- Increased competition in the electric vehicle market: The EV market is becoming increasingly crowded, with established automakers and new entrants aggressively launching competitive models, impacting Tesla's market share and growth projections.

- Concerns regarding Tesla's production and delivery targets: Concerns have arisen about Tesla's ability to consistently meet its ambitious production and delivery goals, leading to investor uncertainty. Production bottlenecks and supply chain challenges have further fueled these concerns.

- Impact of macroeconomic factors such as inflation and interest rate hikes: Rising inflation and increased interest rates have negatively affected consumer spending and investor sentiment, dampening demand for high-priced consumer goods, including Tesla vehicles.

- Elon Musk's controversial tweets and their market impact: Elon Musk's active and often controversial presence on social media has occasionally impacted Tesla's stock price, with some of his tweets causing significant market fluctuations. This highlights the direct connection between his public image and the performance of his companies.

Diversification of Elon Musk's Assets and Their Current Valuation

Beyond Tesla: SpaceX and Other Ventures

While Tesla is the largest contributor to Elon Musk's net worth, he holds significant stakes in other ventures, including SpaceX, The Boring Company, Neuralink, and Twitter (now X). The current valuations of these companies also play a role in his overall financial picture.

- SpaceX's valuation and future prospects: SpaceX, a leading aerospace manufacturer and space exploration company, has a high valuation, reflecting its innovative technologies and ambitious goals. Its future prospects remain promising, potentially offsetting some of the losses from Tesla's recent setbacks.

- The Boring Company's progress and potential for profitability: The Boring Company, focused on infrastructure solutions, is still in its development phase and its path to profitability remains uncertain.

- Neuralink's development and its long-term market potential: Neuralink, a neurotechnology company, is developing groundbreaking brain-computer interface technology. While its long-term potential is significant, its current valuation is still relatively small compared to Tesla or SpaceX.

- The financial performance and challenges of Twitter (X): The acquisition of Twitter (now X) has presented significant financial challenges, impacting Elon Musk's overall net worth. The platform's financial performance and future trajectory remain uncertain, adding further complexity to the calculation of his total assets.

Market Volatility and its Influence on Billionaire Net Worths

The Impact of Broader Market Trends

The recent decline in Elon Musk's net worth is not solely attributable to Tesla's performance. Broader market volatility has significantly impacted the net worth of many high-profile billionaires.

- Explain the relationship between stock market fluctuations and billionaire wealth: Billionaire wealth is heavily tied to the performance of publicly traded companies. Fluctuations in stock prices directly affect the value of their holdings.

- Discuss the impact of inflation and recessionary fears: Economic uncertainty, including inflation and recessionary fears, can lead to significant drops in market valuations, affecting even the wealthiest individuals.

- Highlight the role of investor sentiment and market speculation: Investor sentiment and market speculation play a crucial role in determining stock prices. Negative sentiment can lead to sell-offs, causing significant drops in net worth.

Conclusion

The recent drop in Elon Musk's net worth below $300 billion is a result of multiple interconnected factors. Tesla's stock performance, influenced by increased competition, production concerns, macroeconomic conditions, and Elon Musk's public image, has been a major contributor. While his other ventures offer some diversification, the challenges facing Twitter (X) and the still-developing nature of companies like The Boring Company and Neuralink introduce uncertainty. Broader market volatility further exacerbates these effects, highlighting the dynamic and unpredictable nature of billionaire wealth. To stay informed on the latest developments impacting Elon Musk's net worth and the ever-changing world of high-finance, subscribe to our newsletter, follow us on social media, and check back regularly for updates. The fluctuating nature of Elon Musk's net worth ensures that there will always be more to follow.

Featured Posts

-

Become A Better Ally Your Guide To International Transgender Day Of Visibility

May 10, 2025

Become A Better Ally Your Guide To International Transgender Day Of Visibility

May 10, 2025 -

Increased Rent After La Fires Investigation Into Landlord Price Gouging

May 10, 2025

Increased Rent After La Fires Investigation Into Landlord Price Gouging

May 10, 2025 -

Unlocking Stock Market Potential The Jazz Cash And K Trade Partnership

May 10, 2025

Unlocking Stock Market Potential The Jazz Cash And K Trade Partnership

May 10, 2025 -

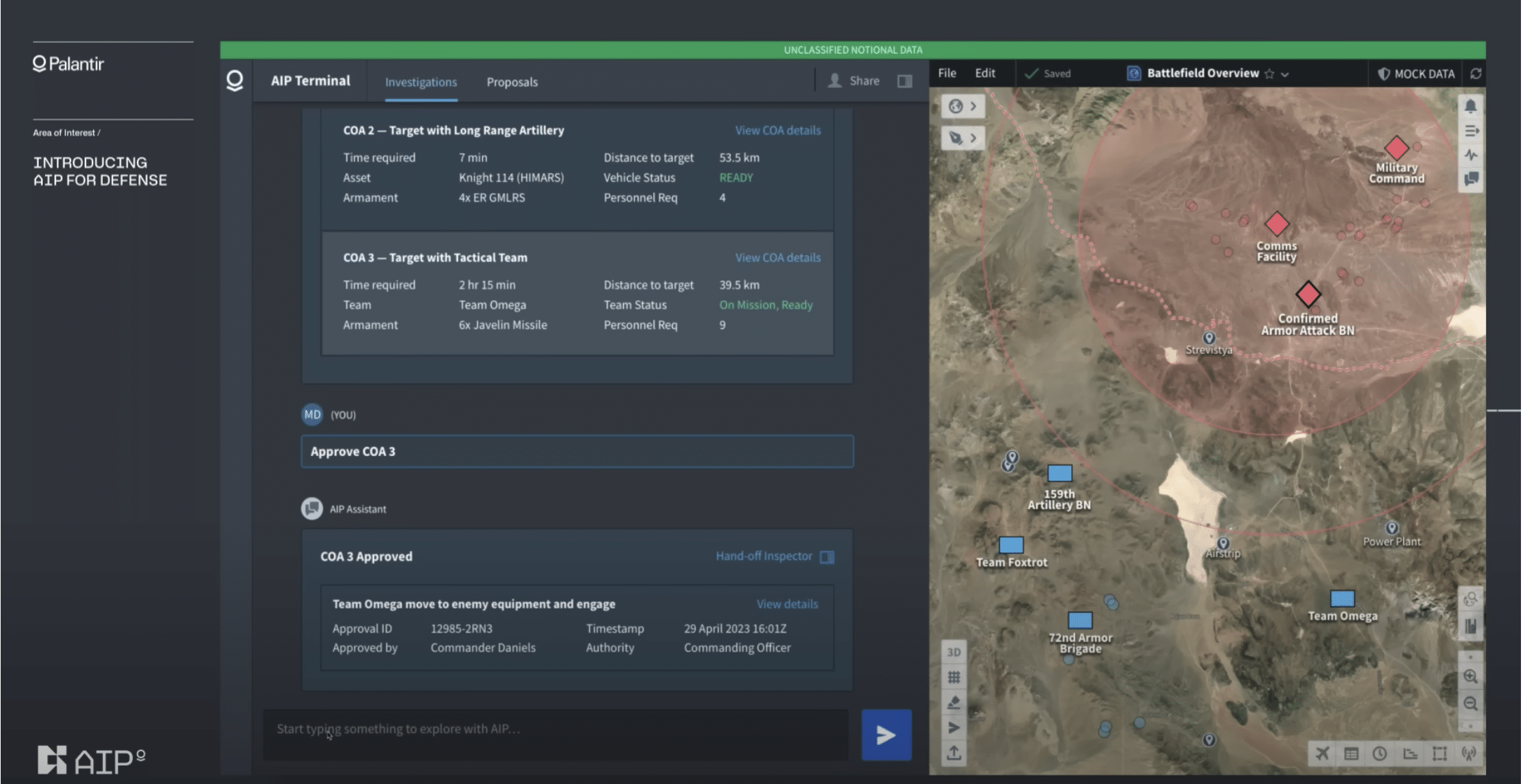

How Palantirs Nato Partnership Will Reshape Public Sector Ai

May 10, 2025

How Palantirs Nato Partnership Will Reshape Public Sector Ai

May 10, 2025 -

Cassidy Hutchinson To Publish Memoir On January 6th Hearings

May 10, 2025

Cassidy Hutchinson To Publish Memoir On January 6th Hearings

May 10, 2025