Elon Musk's Anger And Tesla's Stock Price: A Correlation?

Table of Contents

Elon Musk, the visionary CEO of Tesla, is known for his ambitious projects and outspoken personality. His public image, however, is often controversial, sparking debate about its impact on Tesla's stock price. This article delves into the complex relationship between Elon Musk's anger, his public statements, and the volatility of Tesla stock, exploring whether a correlation exists and what it means for investors. We'll examine the influence of social media, analyze statistical evidence (where available), and discuss strategies for mitigating the risks associated with such volatile leadership.

Musk's Public Persona and Market Reaction

Elon Musk's public persona is characterized by a blend of genius, ambition, and unpredictable behavior. His outspoken nature, often expressed through social media, has led to numerous controversies, creating both excitement and apprehension among investors. This section examines how his actions, particularly his controversial tweets, impact Tesla's stock performance.

The Impact of Controversial Tweets

Musk's tweets have frequently caused significant fluctuations in Tesla's stock price. His impulsive communication style, sometimes bordering on erratic, has generated both positive and negative market reactions.

- Examples of controversial tweets: Musk's tweets about taking Tesla private, his comments about the SEC, and his pronouncements on cryptocurrency have all led to immediate and sometimes dramatic stock price movements.

- SEC investigations and resulting stock drops: The SEC investigations following some of his tweets have significantly impacted investor confidence, resulting in noticeable drops in Tesla's stock.

- Speed and magnitude of market reactions: The market's response to Musk's tweets is often swift and substantial, demonstrating the significant influence he wields over investor sentiment. The speed at which negative news spreads across social media platforms directly impacts stock prices.

The Role of Social Media in Shaping Investor Perception

Social media plays a crucial role in shaping investor perception of Tesla and its CEO. Platforms like Twitter act as amplifiers of both positive and negative news, impacting investor sentiment and driving market behavior.

- How negative news spreads rapidly online: Negative news about Musk or Tesla spreads rapidly through social media, potentially leading to a sell-off by investors concerned about the company's future.

- Impact on short-selling: Negative news often fuels short-selling, further depressing the stock price.

- Amplification of negative sentiment: The echo chamber effect of social media can amplify negative sentiment, leading to a disproportionate impact on the stock price compared to the actual implications of the news.

- Challenges of managing online reputation for publicly traded companies: Managing the online reputation of a publicly traded company like Tesla, especially when its CEO is so actively involved on social media, presents significant challenges for public relations and risk management teams.

Analyzing the Correlation – Statistical Evidence and Expert Opinions

While it's clear that Musk's public actions often coincide with Tesla stock price fluctuations, establishing a direct causal link requires careful analysis. This section explores the correlation versus causation debate and examines available evidence.

Correlation vs. Causation

It's crucial to distinguish between correlation and causation. While a correlation exists between Musk's actions and Tesla's stock price, this doesn't necessarily imply causation. Other factors significantly influence Tesla's stock performance.

- Other factors affecting Tesla's stock price: Economic conditions, competition from other electric vehicle manufacturers, new product launches, and overall market trends all play a role in determining Tesla's stock price.

- Limitations of solely relying on correlation analysis: Correlation analysis alone cannot definitively prove a causal relationship. Other variables must be considered to understand the full picture.

Quantitative Analysis of Stock Performance and Musk's Public Actions

Several studies have attempted to quantitatively analyze the relationship between Musk's public actions and Tesla's stock performance. However, isolating the impact of Musk's behavior from other market forces is challenging.

- Examples of research findings (if available): [Insert links to relevant research papers or studies here if available]. The absence of conclusive findings highlights the complexity of the relationship.

- Limitations of the data: Available data may not capture the full nuance of the relationship, and isolating the impact of Musk's behavior from other market factors is difficult.

- Challenges in isolating the effect of Musk's behavior: Numerous factors influence stock prices, making it difficult to definitively attribute price changes solely to Musk's actions.

Expert Views on the Matter

Financial analysts and market experts hold differing views on the extent to which Musk's actions influence Tesla's stock. Some believe his behavior is a significant factor, while others emphasize the broader market forces at play.

- Different perspectives on the influence of Musk's actions on investor confidence: Some experts argue that Musk's actions create unnecessary volatility, while others suggest that his dynamism is a key element of Tesla's brand and appeal to certain investors.

Strategies for Mitigating Risk Associated with CEO Behavior

Tesla and other companies with highly influential CEOs can implement strategies to mitigate the risks associated with volatile leadership.

Improving Internal Communication and PR Strategies

Tesla could benefit from improved internal communication and more proactive public relations strategies.

- Implementing stricter protocols for social media use: Clearer guidelines for social media use by executives could help minimize negative impacts.

- Better crisis management: A robust crisis management plan is crucial to address negative publicity effectively.

- Proactive communication strategies: Proactive communication can help manage investor expectations and mitigate negative sentiment.

The Importance of a Strong Corporate Governance Structure

A strong corporate governance structure is essential for managing CEO behavior and mitigating associated risks.

- Independent oversight: An independent board of directors can provide crucial oversight and guidance.

- Risk assessment: Regular risk assessments can help identify and mitigate potential problems.

- Ethical guidelines: Clear ethical guidelines can help ensure responsible conduct.

- Succession planning: Having a well-defined succession plan can minimize disruption in case of unexpected leadership changes.

Investor Education and Awareness

Investors should understand the risks associated with investing in companies with volatile leadership.

- Importance of diversification: Diversifying investments across different sectors and companies can mitigate risk.

- Due diligence: Thorough due diligence is crucial before making any investment decision.

- Risk tolerance: Investors should assess their risk tolerance before investing in potentially volatile stocks.

Conclusion

While a direct causal link between Elon Musk's anger and Tesla's stock price might be difficult to definitively prove, a clear correlation exists, highlighting the significant impact of his public actions. His behavior contributes to market volatility and significantly influences investor sentiment. Understanding the complexities of this relationship is crucial for investors. His actions create considerable uncertainty, impacting investor confidence and resulting in fluctuations in Tesla's stock price.

Therefore, it's vital for investors to remain informed about ongoing developments surrounding Elon Musk and Tesla, carefully considering the risks associated with investing in companies influenced by volatile leadership before making investment decisions. Learn more about the intricacies of Elon Musk's impact on Tesla's stock price by following [link to relevant resources/further reading].

Featured Posts

-

Eu Tariff Deadline Extended By Trump To July 9th

May 27, 2025

Eu Tariff Deadline Extended By Trump To July 9th

May 27, 2025 -

From Scatological Data To Engaging Audio An Ai Driven Solution

May 27, 2025

From Scatological Data To Engaging Audio An Ai Driven Solution

May 27, 2025 -

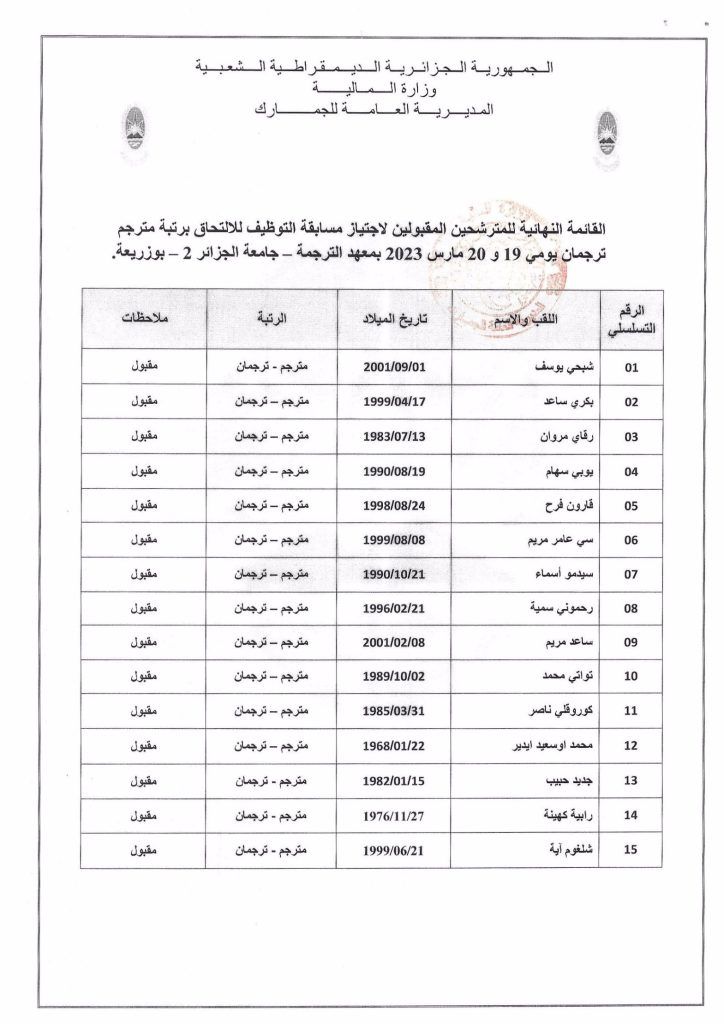

Ntayj Msabqt Bryd Aljzayr Dlyl Llmtrshhyn Almqbwlyn

May 27, 2025

Ntayj Msabqt Bryd Aljzayr Dlyl Llmtrshhyn Almqbwlyn

May 27, 2025 -

Chelseas Summer Transfer Plans Osimhens Potential Move

May 27, 2025

Chelseas Summer Transfer Plans Osimhens Potential Move

May 27, 2025 -

Hailey Bieber Plava Gucci Vintage Haljina I Iznenadujuca Obuca

May 27, 2025

Hailey Bieber Plava Gucci Vintage Haljina I Iznenadujuca Obuca

May 27, 2025

Latest Posts

-

Did Elon Musks Daughter Vivian Get His Approval For Her Modeling Career

May 30, 2025

Did Elon Musks Daughter Vivian Get His Approval For Her Modeling Career

May 30, 2025 -

Vivian Jenna Wilsons Modeling Career Launch A Look At Her Relationship With Elon Musk

May 30, 2025

Vivian Jenna Wilsons Modeling Career Launch A Look At Her Relationship With Elon Musk

May 30, 2025 -

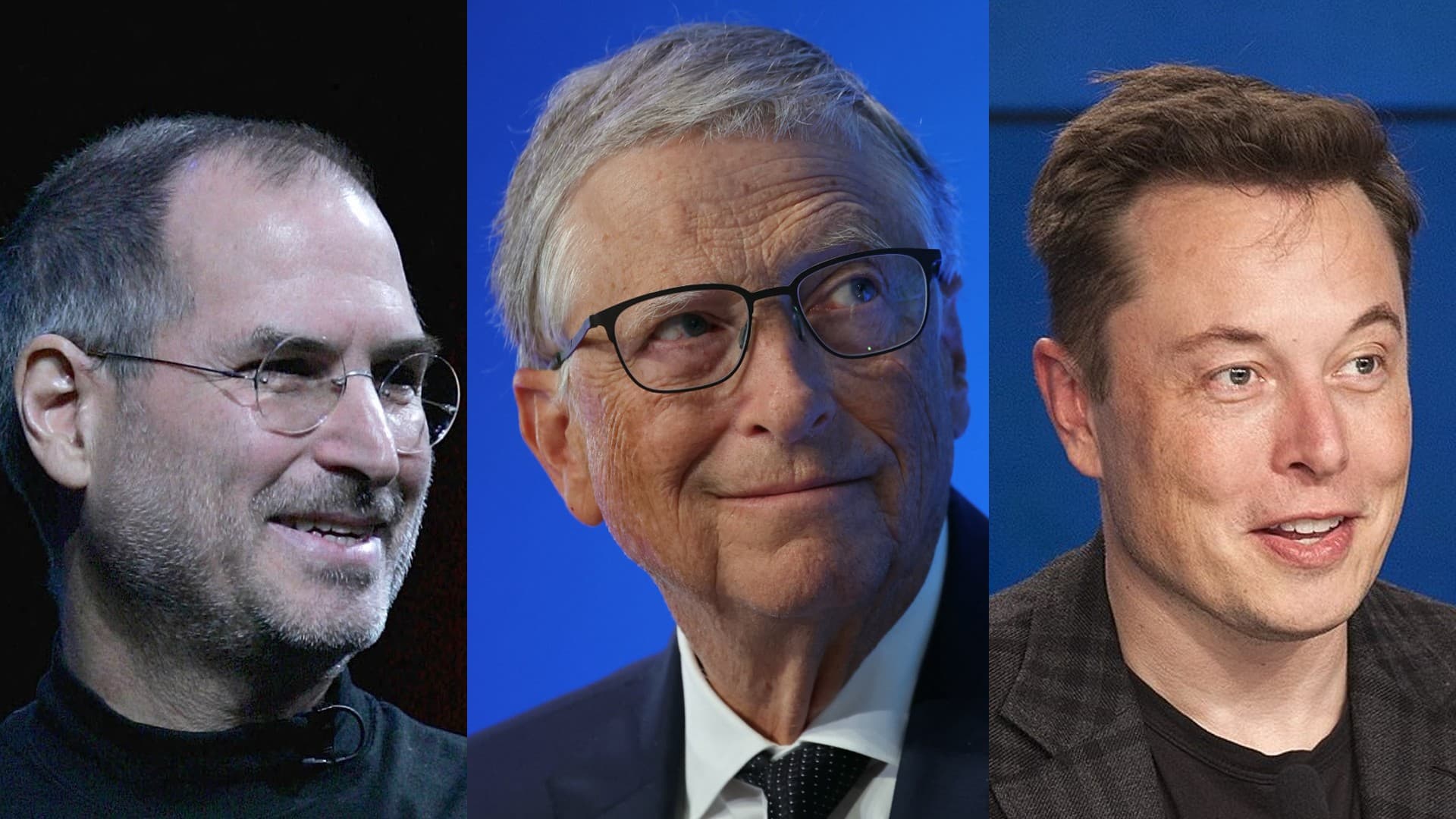

Child Poverty And Technological Advancements Analyzing The Elon Musk Bill Gates Debate

May 30, 2025

Child Poverty And Technological Advancements Analyzing The Elon Musk Bill Gates Debate

May 30, 2025 -

The Musk Gates Dispute Examining The Allegations Of Harm To Millions Of Children

May 30, 2025

The Musk Gates Dispute Examining The Allegations Of Harm To Millions Of Children

May 30, 2025 -

Elon Musks Actions And Their Impact On Child Poverty A Critical Analysis Of Bill Gates Claims

May 30, 2025

Elon Musks Actions And Their Impact On Child Poverty A Critical Analysis Of Bill Gates Claims

May 30, 2025