Economic Headwinds Push National Gas Price Average Near $3

Table of Contents

The Role of Inflation in Rising Gas Prices

Inflation plays a significant role in the recent surge in gas price inflation. As the cost of living increases across the board, reflected in the Consumer Price Index (CPI), the price of energy, including gasoline, follows suit. The relationship between the CPI and energy costs is undeniable; when the CPI rises, energy prices generally climb alongside it. This isn't just about the price at the pump; inflation impacts the entire supply chain, from crude oil extraction to refining and distribution.

- Percentage Increase: Gas prices have seen a substantial increase of X% compared to last year and Y% compared to the same period five years ago (replace X and Y with actual data).

- Impact on Crude Oil: Inflation significantly impacts the cost of crude oil, the primary ingredient in gasoline. Increased production costs, including labor and transportation, directly translate to higher prices for consumers.

- Weaker Dollar: A weaker US dollar can also contribute to higher global oil prices, as it makes oil more expensive for those purchasing it with other currencies, further impacting the national gas price average.

Global Geopolitical Factors and Energy Market Volatility

Global geopolitical events are significant drivers of energy market volatility and, consequently, fluctuating gas prices. Instability in oil-producing regions, sanctions, and international conflicts all contribute to disruptions in the global oil supply. This reduced availability directly impacts prices, pushing them higher.

- Impact of Specific Events: For example, the ongoing conflict in [mention specific geopolitical event] has significantly impacted oil production and distribution networks, resulting in supply chain bottlenecks and increased prices.

- Reduced Oil Supply: Any disruption to the global oil supply, regardless of the cause, invariably leads to higher gas prices due to the basic principles of supply and demand.

- OPEC+'s Role: The decisions made by OPEC+ (Organization of the Petroleum Exporting Countries and its allies) regarding oil production quotas significantly influence global oil prices and directly affect the national gas price average. Adjustments to production levels can either stabilize or exacerbate price fluctuations.

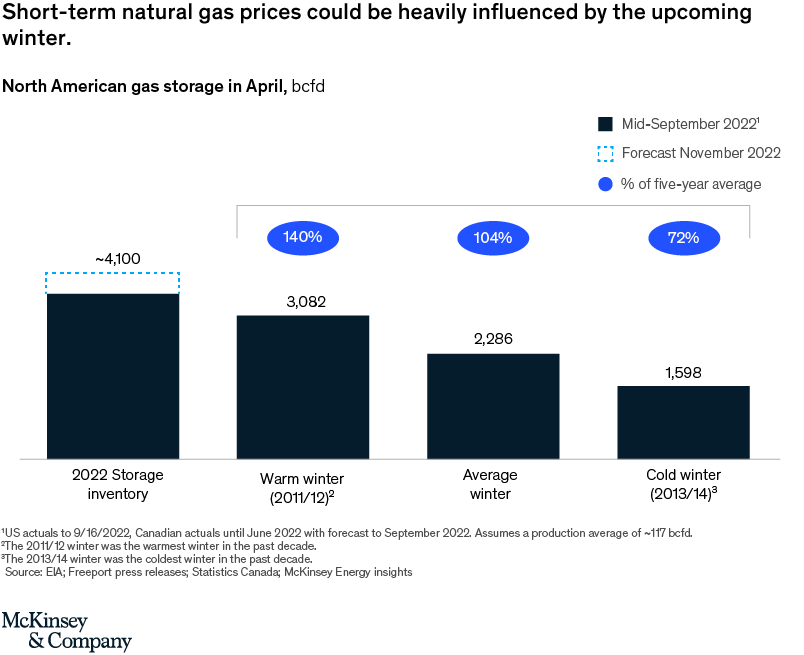

Increased Demand and Seasonal Factors Affecting Gas Prices

The increased demand for gasoline during warmer months, often referred to as the "driving season," significantly contributes to higher gas prices. This peak demand period coincides with increased travel, vacationing, and outdoor activities, all requiring more fuel consumption. The interplay of supply and demand dictates prices; when demand surpasses supply, prices inevitably rise.

- Seasonal Price Differences: Gas prices are consistently higher during peak driving seasons (summer months) compared to the off-seasons (winter months). This seasonal fluctuation is a predictable pattern influenced by consumer behavior.

- Consumer Behavior: Consumer behavior plays a pivotal role. Increased driving leads to greater demand for gasoline, and the market reacts by adjusting prices upward.

- Future Demand Scenarios: Predicting future demand is crucial for understanding future price trends. Factors like economic growth, population increases, and technological advancements (e.g., electric vehicles) will influence gasoline demand and subsequent gas prices.

The Impact on Consumers and the Economy

The rising national gas price average has substantial implications for both consumers and the overall economy. Increased fuel costs directly impact household budgets, reducing disposable income and potentially leading to decreased consumer spending in other areas. This ripple effect extends to businesses and industries reliant on transportation for goods and services.

- Decreased Consumer Spending: Higher gas prices force consumers to cut back on spending in other areas, affecting various sectors of the economy.

- Ripple Effect on Businesses: Businesses, especially those in transportation-dependent industries (e.g., trucking, delivery services), face increased operating costs, potentially leading to higher prices for consumers.

- Government Intervention: Governments may introduce measures to mitigate the impact on consumers, such as tax cuts or subsidies, to help offset the burden of higher fuel costs.

Conclusion

The current upward trend in national gas prices, pushing towards $3 per gallon, is a complex issue driven by a combination of factors: persistent inflation, global geopolitical instability, and increased seasonal demand. These factors all contribute to reduced supply, increased costs, and higher prices at the pump, significantly impacting consumers' budgets and the economy.

Stay ahead of the curve and monitor changes in national gas prices to better manage your budget and navigate the current economic climate. Understanding the factors influencing these national gas prices is crucial!

Featured Posts

-

Cassis Blackcurrant From Vine To Glass A Journey Of Taste

May 22, 2025

Cassis Blackcurrant From Vine To Glass A Journey Of Taste

May 22, 2025 -

Fastest Australian Crossing Man Achieves Unprecedented Feat On Foot

May 22, 2025

Fastest Australian Crossing Man Achieves Unprecedented Feat On Foot

May 22, 2025 -

Blake Lively And Taylor Swift Their Stance Amidst The It Ends With Us Legal Dispute

May 22, 2025

Blake Lively And Taylor Swift Their Stance Amidst The It Ends With Us Legal Dispute

May 22, 2025 -

Fed Ex Truck Inferno Shuts Down Part Of Route 283 In Lancaster County

May 22, 2025

Fed Ex Truck Inferno Shuts Down Part Of Route 283 In Lancaster County

May 22, 2025 -

Nieuwe Directeur Hypotheken Intermediair Abn Amro Florius En Moneyou Karin Polman

May 22, 2025

Nieuwe Directeur Hypotheken Intermediair Abn Amro Florius En Moneyou Karin Polman

May 22, 2025

Latest Posts

-

Cobra Kai A Study In Continuity And Its Relationship To The Karate Kid Films

May 23, 2025

Cobra Kai A Study In Continuity And Its Relationship To The Karate Kid Films

May 23, 2025 -

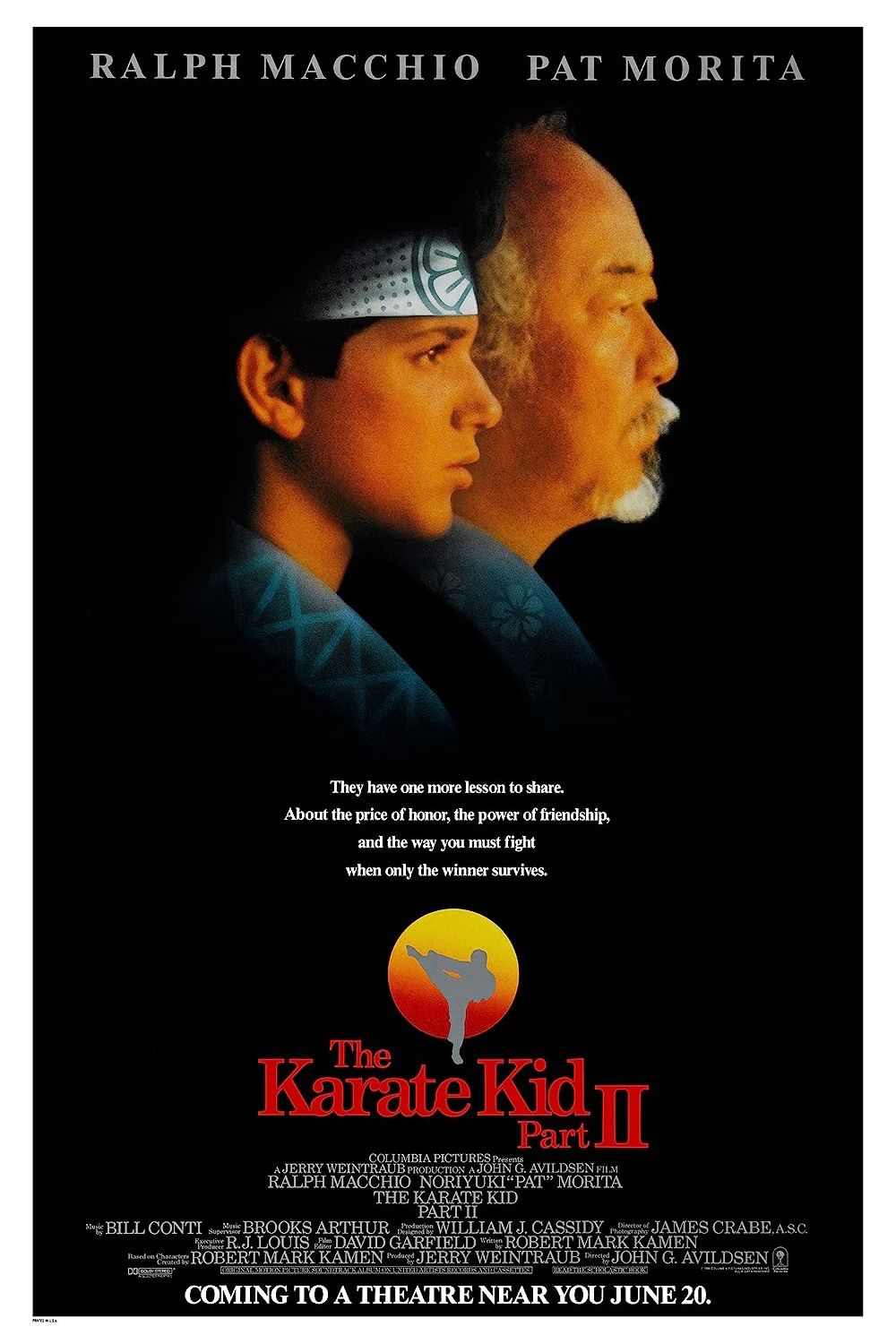

The Karate Kid Part Ii A Comparative Analysis Of The Film Series

May 23, 2025

The Karate Kid Part Ii A Comparative Analysis Of The Film Series

May 23, 2025 -

Connecting The Dots Cobra Kais Continuity And Its Impact On The Karate Kid Universe

May 23, 2025

Connecting The Dots Cobra Kais Continuity And Its Impact On The Karate Kid Universe

May 23, 2025 -

Review Of The Karate Kid Part Ii Thirty Years Later

May 23, 2025

Review Of The Karate Kid Part Ii Thirty Years Later

May 23, 2025 -

Analyzing Cobra Kai Maintaining Continuity Across Multiple Karate Kid Generations

May 23, 2025

Analyzing Cobra Kai Maintaining Continuity Across Multiple Karate Kid Generations

May 23, 2025