ECB's Simkus Signals Two More Interest Rate Cuts Amidst Trade War Impact

Table of Contents

Šimkus's Comments and Their Significance

Gediminas Šimkus's recent pronouncements regarding potential ECB interest rate cuts have sent ripples through the financial markets. While the ECB typically maintains a united front on monetary policy decisions, Šimkus's relatively outspoken comments are noteworthy. His statements were likely prompted by the increasingly gloomy economic outlook for the Eurozone, characterized by slowing growth and persistent uncertainty stemming from global trade tensions. The unusual nature of such a public declaration from a member of the ECB board suggests a growing internal consensus within the bank for further easing of monetary policy.

- Specific quotes from Šimkus: (Insert actual quotes here if available from reputable news sources. Cite the source.) For example: “[Insert Quote about the need for further rate cuts]” – Source: [Source Name and Link].

- Current state of the Eurozone economy: The Eurozone is experiencing a slowdown in GDP growth, with inflation remaining stubbornly below the ECB's target of "close to, but below, 2 percent." Unemployment, while relatively low, shows signs of stagnation.

- Weight of Šimkus’s opinion: While not the president of the ECB, Šimkus's position on the board carries significant weight, and his comments are often seen as an indication of prevailing sentiment within the institution regarding future policy direction.

The Impact of the Trade War on the Eurozone

The ongoing trade war, particularly the US-China trade dispute, is significantly impacting the Eurozone economy. The uncertainty created by tariffs and trade restrictions is dampening investment and hindering business confidence. Export-oriented sectors, such as manufacturing and automotive, are particularly vulnerable. This uncertainty is leading to a decline in consumer spending, creating a negative feedback loop that further slows economic growth.

- Examples of trade disputes impacting Eurozone businesses: The imposition of tariffs on European goods by the US has directly affected several key industries, leading to job losses and reduced output. (Provide specific examples with sources).

- Statistics illustrating the economic slowdown: Cite relevant economic data, such as GDP growth figures, industrial production indices, and consumer confidence surveys, to illustrate the negative impact of the trade war. (Source all statistics).

- Expert opinions on the trade war's impact: Include quotes from reputable economists and analysts who have commented on the Eurozone's vulnerability to the trade war.

Potential Consequences of Further ECB Interest Rate Cuts

Lowering interest rates is a traditional tool used by central banks to stimulate economic activity. Further ECB interest rate cuts could incentivize borrowing and investment, potentially boosting economic growth. However, this approach also carries risks. Lower rates could fuel inflation, particularly if coupled with other expansionary measures. There's also the risk of creating asset bubbles in already inflated markets. The ECB may also explore other monetary policy tools, such as quantitative easing (QE), which involves purchasing assets to increase money supply.

- Economic models predicting the impact of rate cuts: Mention any economic models used to predict the impact of interest rate cuts on the Eurozone economy.

- Risks associated with further quantitative easing: Discuss the potential risks and side effects of QE, such as increased public debt and the distortion of market mechanisms.

- Opinions from economists on the efficacy of proposed measures: Include diverse perspectives from economists on the effectiveness of the proposed measures and the potential unintended consequences.

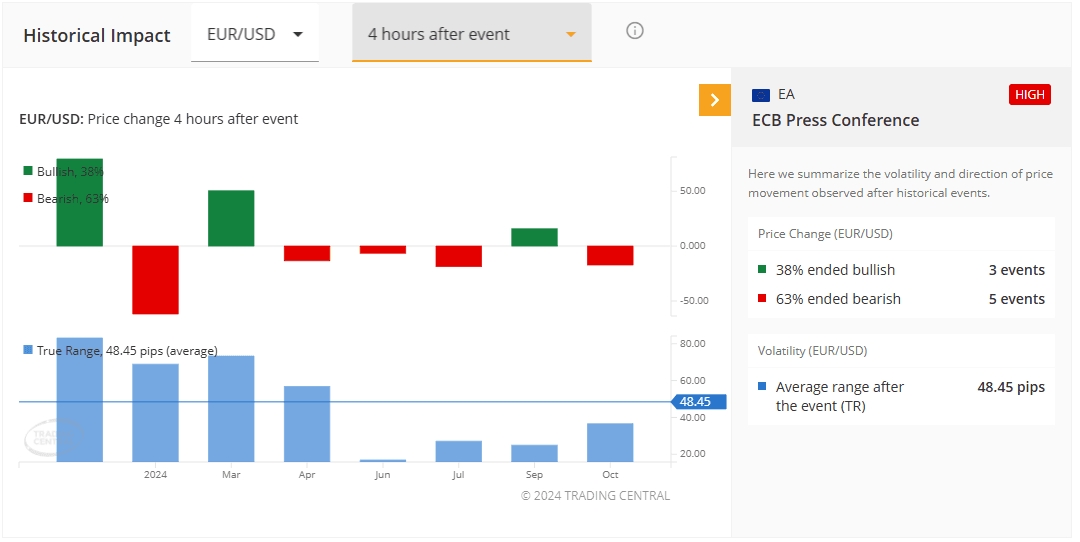

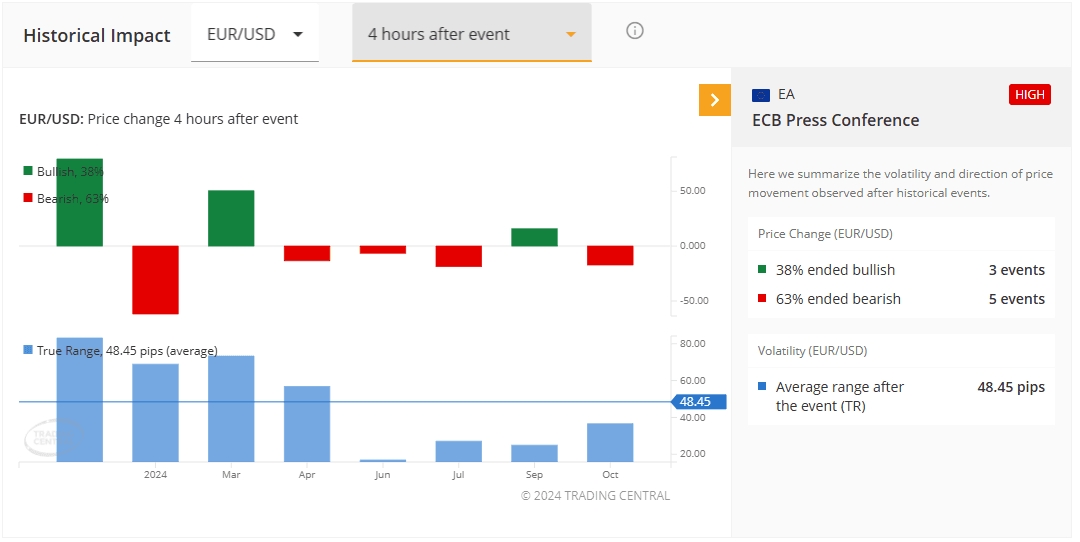

Market Reaction and Investor Sentiment

Šimkus's statements have already impacted financial markets. The Euro experienced some volatility following the announcement, reflecting uncertainty about the ECB's future monetary policy direction. Investor sentiment towards Eurozone assets is likely to remain cautious until further clarity emerges. The potential for further volatility in the coming months is significant, particularly if the trade war intensifies or if economic data continues to disappoint.

- Stock market performance following the announcement: Describe how European stock markets reacted to the news.

- Changes in the Euro exchange rate: Note any significant fluctuations in the value of the Euro against other major currencies.

- Expert analysis of investor behavior: Include insights from financial analysts on how investors are interpreting the situation and adjusting their portfolios.

Conclusion

Gediminas Šimkus's indication of potential further ECB interest rate cuts reflects the growing concern within the ECB about the Eurozone's economic outlook, heavily influenced by the negative impact of the global trade war. Lowering interest rates could provide a much-needed stimulus, but carries inherent risks of inflation and asset bubbles. The market reaction highlights the significant uncertainty surrounding the future path of the ECB's monetary policy. The ECB's actions in navigating these turbulent economic waters will be crucial for the Eurozone's economic health. Stay informed about further developments regarding the ECB's monetary policy and the impact of the trade war on the Eurozone economy. Keep up-to-date on all news regarding ECB interest rate cuts and their consequences by regularly checking reliable financial news sources.

Featured Posts

-

Spd Coalition Future Uncertain Following Crumbachs Resignation From Bsw

Apr 27, 2025

Spd Coalition Future Uncertain Following Crumbachs Resignation From Bsw

Apr 27, 2025 -

Vaccine Skeptic Appointed To Lead Federal Autism Immunization Study

Apr 27, 2025

Vaccine Skeptic Appointed To Lead Federal Autism Immunization Study

Apr 27, 2025 -

Canadas Divided Response To Trump Albertas Unique Position

Apr 27, 2025

Canadas Divided Response To Trump Albertas Unique Position

Apr 27, 2025 -

Hhs Investigation Into Autism Vaccine Link Draws Criticism Anti Vaccine Activist Involved

Apr 27, 2025

Hhs Investigation Into Autism Vaccine Link Draws Criticism Anti Vaccine Activist Involved

Apr 27, 2025 -

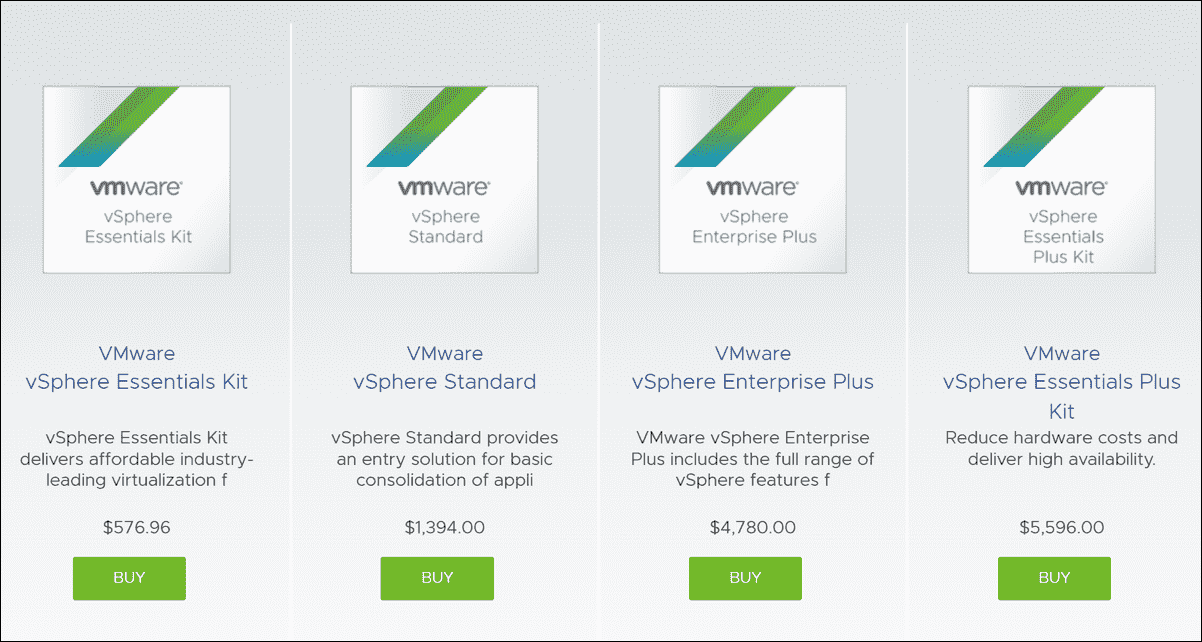

1050 Price Hike On V Mware At And T Highlights Broadcoms Extreme Cost Increase

Apr 27, 2025

1050 Price Hike On V Mware At And T Highlights Broadcoms Extreme Cost Increase

Apr 27, 2025

Latest Posts

-

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025 -

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025 -

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025 -

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025