ECB Rate Cuts: Simkus Hints At Two More Reductions Due To Trade Slowdown

Table of Contents

Simkus's Statement and its Implications

A recent statement by [Insert Name and Title of Simkus or source of the statement] has fueled speculation regarding further ECB interest rate cuts. [Insert a direct quote from Simkus or the source about the predicted rate cuts]. This statement immediately impacted market expectations, signaling a more dovish stance from the ECB than previously anticipated.

The potential consequences of these predicted European Central Bank interest rate cuts are multifaceted:

- Lower Borrowing Costs: Reduced interest rates will likely lower borrowing costs for businesses and consumers, potentially stimulating investment and consumption. This could boost economic activity, but only if businesses and consumers are confident enough to borrow and spend.

- Inflation Targets: The ECB's primary mandate is to maintain price stability. Lowering interest rates could help achieve the inflation target (typically around 2%), but carries the risk of pushing inflation too high if demand increases significantly.

- Euro Exchange Rate: Lower interest rates can make the Euro less attractive to foreign investors, potentially leading to a weaker Euro exchange rate. This could benefit exports but also increase import prices, impacting inflation. The ECB will need to carefully manage this delicate balance. The "Simkus prediction" has already begun to influence the Eurozone economy. The ECB monetary policy statement will be crucial to understanding the complete implications.

The "Simkus prediction," along with the ECB monetary policy statement, suggests significant changes are coming for the Eurozone economy.

The Role of Global Trade Slowdown in ECB Decision-Making

The primary driver behind the anticipated ECB rate cuts is the persistent global trade slowdown. Weakening global trade significantly impacts the Eurozone economy, which is heavily reliant on exports. Trade wars, geopolitical uncertainties, and Brexit-related disruptions have all contributed to reduced economic growth.

Several key factors highlight the impact of the global trade slowdown:

- Reduced Export Demand: Lower global demand directly translates to reduced export orders for Eurozone businesses, impacting their revenue and investment plans.

- Lower Business Investment: Uncertainty surrounding future economic prospects discourages businesses from investing in expansion or new projects, hindering job creation and economic growth.

- Recessionary Risks: Prolonged trade slowdown poses a significant risk of pushing the Eurozone into a recession, further necessitating drastic measures such as interest rate reductions.

The interplay between the "global trade slowdown" and "Eurozone GDP" growth is a key factor in the ECB's decision-making process. Geopolitical risks further complicate the situation, necessitating a careful response from the ECB.

Market Reactions and Expert Opinions on Further ECB Rate Cuts

Simkus's statement triggered immediate reactions in financial markets. [Describe the observed market reactions, e.g., stock market fluctuations, changes in bond yields]. However, expert opinions on the efficacy and implications of further ECB rate cuts are varied.

Different perspectives highlight the ongoing debate:

- Stimulative Growth: Some economists believe that further interest rate reductions are necessary to stimulate economic growth and prevent a recession, arguing the benefits outweigh the risks.

- Inflationary Pressures: Others express concern that lower interest rates could fuel inflation, especially if combined with other factors such as rising energy prices.

- Effectiveness Debate: There's ongoing debate on the effectiveness of rate cuts in the current environment, with some arguing that other policy tools might be more appropriate. Analyzing the "ECB rate cut impact" requires understanding these complex dynamics. The "market reaction" to the announcement gives a glimpse into the various opinions and the market's sensitivity to this development.

Potential Alternatives and Future Outlook for ECB Monetary Policy

Besides rate cuts, the ECB has other monetary policy tools at its disposal. Quantitative easing (QE), for instance, involves purchasing government bonds to inject liquidity into the market. The long-term implications of the predicted rate reductions are uncertain, depending largely on the evolution of the global trade environment and the effectiveness of the ECB's actions.

Potential scenarios for the future of ECB monetary policy include:

- Continued Rate Cuts: If the trade slowdown worsens, the ECB may opt for further interest rate reductions to stimulate the economy.

- Pause or Reversal: If economic conditions improve, the ECB might pause or even reverse its rate-cutting policy.

- Alternative Tools: Depending on economic circumstances, the ECB could consider using alternative monetary policy tools, such as QE or targeted lending programs. The "ECB future policy" will depend on several crucial factors that remain to be seen. "Monetary policy tools" such as QE offer different outcomes and need to be assessed carefully. The "economic outlook" is the driving factor for future decisions.

Conclusion: Understanding the Implications of ECB Rate Cuts

Simkus's prediction of two more ECB rate cuts highlights the growing concerns surrounding the global trade slowdown and its impact on the Eurozone economy. The potential consequences of these interest rate reductions are significant, affecting borrowing costs, inflation targets, and the Euro exchange rate. Understanding these implications is crucial for businesses and investors alike.

Stay updated on the latest developments concerning ECB rate cuts and their potential effect on your investments and business strategies. [Insert link to relevant resources, such as the ECB website].

Featured Posts

-

Banking Regulation Overhaul Ecb Establishes A New Task Force

Apr 27, 2025

Banking Regulation Overhaul Ecb Establishes A New Task Force

Apr 27, 2025 -

February 20 2025 Ideas For A Happy Day

Apr 27, 2025

February 20 2025 Ideas For A Happy Day

Apr 27, 2025 -

Ariana Grandes Dramatic Hair And Tattoo Transformation Exploring The Significance

Apr 27, 2025

Ariana Grandes Dramatic Hair And Tattoo Transformation Exploring The Significance

Apr 27, 2025 -

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025 -

Sorpresa En Indian Wells Eliminacion Inesperada

Apr 27, 2025

Sorpresa En Indian Wells Eliminacion Inesperada

Apr 27, 2025

Latest Posts

-

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025 -

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

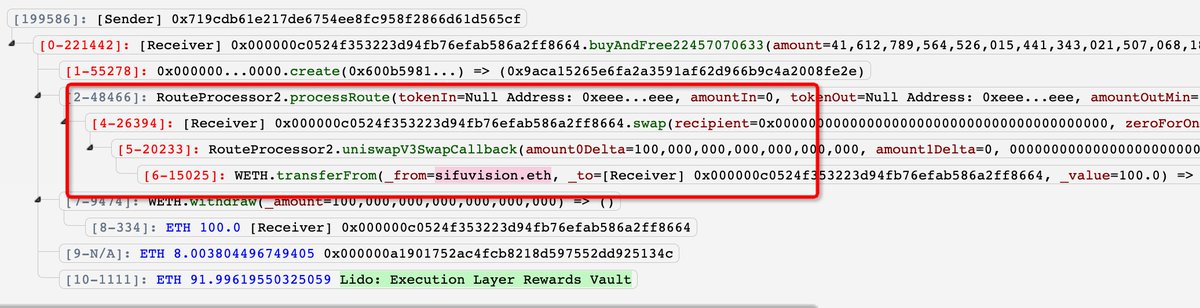

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025 -

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025 -

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025