Easing Bond Forward Rules: A Key Demand From Indian Insurers

Table of Contents

Current Challenges Faced by Insurers Due to Strict Bond Forward Rules

The current regulatory framework governing bond forward transactions in India presents several challenges for insurers. These rules, designed to mitigate risk, inadvertently restrict investment flexibility and limit the ability of insurers to optimize returns. The impact is multifaceted:

-

Constrained Investment Strategies: Strict limits on the use of bond forwards restrict insurers' ability to effectively manage interest rate risk and actively manage their portfolios. This leads to suboptimal investment choices and reduced profitability. They are forced to rely on less efficient hedging strategies.

-

Limitations on Risk Management: The inability to utilize sophisticated hedging techniques through bond forwards increases insurers' exposure to market volatility. This directly impacts their ability to meet their long-term obligations to policyholders.

-

Barriers to Diversification: The regulations often restrict access to a wider range of investment opportunities, including international markets. This lack of diversification limits potential returns and increases overall portfolio risk.

-

Increased Transaction Costs: The complexity and restrictions surrounding bond forward transactions often lead to higher transaction costs for insurers, further eroding profitability.

Bullet Points Summarizing Challenges:

- Restrictions on hedging strategies, limiting risk mitigation.

- Limited access to international bond markets, hindering diversification.

- Higher transaction costs compared to more liberalized markets.

- Reduced investment flexibility, hampering portfolio optimization.

The Case for Easing Bond Forward Rules

The call for easing bond forward rules stems from a need for greater flexibility and efficiency within the Indian insurance sector. Insurers argue that a more liberalized framework would significantly benefit the industry and the broader economy.

-

Improved Risk Management: Relaxing restrictions would empower insurers to employ more sophisticated hedging strategies, effectively managing interest rate risk and protecting policyholder interests.

-

Enhanced Investment Returns: Increased investment flexibility and access to a wider range of assets, including international markets, would lead to potentially higher investment returns. This translates to better profitability and stronger financial health for insurers.

-

Increased Global Competitiveness: A more favorable regulatory environment would improve the competitiveness of Indian insurers in the global marketplace, attracting both domestic and foreign investment.

-

Stimulated Economic Growth: Increased investment activity by insurers, fueled by higher returns and greater flexibility, would contribute significantly to overall economic growth.

Bullet Points Summarizing Benefits:

- Improved risk management capabilities through advanced hedging techniques.

- Enhanced investment returns leading to greater profitability.

- Increased competitiveness in the global insurance market.

- Stimulated economic growth through increased investment activity.

Potential Solutions and Regulatory Adjustments

Easing bond forward rules doesn't necessitate complete deregulation. A balanced approach is crucial – one that promotes growth while maintaining financial stability. Potential solutions include:

-

Phased Deregulation: A gradual relaxation of regulations, allowing insurers to adapt to changes and minimizing potential disruptions. This would provide time for market participants to adjust and for regulators to monitor market behavior.

-

Enhanced Transparency and Reporting: Implementing stricter reporting requirements and increasing transparency within the bond forward market would help enhance regulatory oversight and mitigate potential risks.

-

Strengthened Supervisory Oversight: Increased scrutiny by regulatory bodies is necessary to ensure that any easing of regulations doesn't compromise the overall stability of the financial system.

-

Collaboration with Stakeholders: Open communication and collaboration between regulatory bodies and industry stakeholders are crucial for developing effective and appropriate regulations. This ensures that the regulations are practical and meet the needs of the sector.

Bullet Points Summarizing Solutions:

- Gradual deregulation with phased implementation to manage risks.

- Increased transparency and robust reporting mechanisms.

- Strengthening supervisory oversight and monitoring capabilities.

- Collaboration between regulatory bodies and insurance industry professionals.

Impact on the Indian Economy and Financial Stability

Easing bond forward rules would have a positive ripple effect across the Indian economy.

-

Increased Foreign Investment: A more attractive investment climate would attract significant foreign investment into the Indian insurance sector, boosting capital inflows.

-

Improved Bond Market Liquidity: Increased activity in the bond forward market would enhance liquidity, making it easier for businesses and governments to raise capital.

-

Greater Economic Growth: The combined effects of increased investment, higher returns, and improved liquidity would contribute to robust economic growth.

-

Enhanced Financial System Resilience: A stronger and more diversified insurance sector would contribute significantly to the overall resilience of the Indian financial system.

Bullet Points Summarizing Economic Impact:

- Attracting increased foreign direct investment (FDI) in the insurance sector.

- Improving liquidity within the Indian bond market.

- Fueling greater economic growth through increased investment activity.

- Strengthening the resilience of the Indian financial system.

Conclusion: The Need for Action on Easing Bond Forward Rules

The arguments presented strongly support the need for regulatory adjustments to ease bond forward rules for Indian insurers. Easing these restrictions will unlock significant potential for growth, improve risk management, and enhance the overall stability of the Indian financial system. Relaxing bond forward regulations will not only benefit insurers but will also contribute significantly to the nation's economic progress. We urge regulatory bodies to seriously consider these proposals and take proactive steps towards improving bond forward market access for insurers. The time for action is now. Share your thoughts and opinions – let's create a constructive dialogue on easing bond forward rules and shaping a more dynamic and competitive Indian insurance sector.

Featured Posts

-

Nba Stars Kuzmas Comments On Tatums Viral Instagram

May 09, 2025

Nba Stars Kuzmas Comments On Tatums Viral Instagram

May 09, 2025 -

India Overtakes Uk France And Russia A New Global Powerhouse

May 09, 2025

India Overtakes Uk France And Russia A New Global Powerhouse

May 09, 2025 -

Mulher Que Se Diz Madeleine Mc Cann Presa No Reino Unido Policia Investiga Caso

May 09, 2025

Mulher Que Se Diz Madeleine Mc Cann Presa No Reino Unido Policia Investiga Caso

May 09, 2025 -

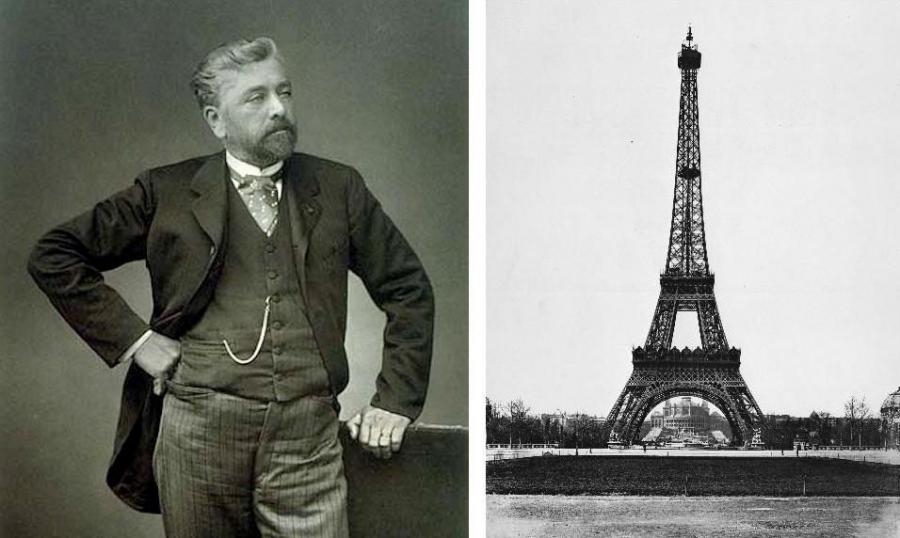

Dijon Une Nouvelle Lumiere Sur Gustave Eiffel Et Son Heritage Maternel

May 09, 2025

Dijon Une Nouvelle Lumiere Sur Gustave Eiffel Et Son Heritage Maternel

May 09, 2025 -

New Leaks Reveal Potential Microsoft And Asus Collaboration On Xbox Portable Device

May 09, 2025

New Leaks Reveal Potential Microsoft And Asus Collaboration On Xbox Portable Device

May 09, 2025