Dutch Central Bank To Investigate ABN Amro Bonuses, Potential Fine Looms

Table of Contents

The DNB's Investigation into ABN Amro's Bonus Scheme

The DNB plays a crucial role in regulating the Dutch financial sector, including overseeing bank bonuses. Its mandate is to ensure financial stability and protect consumers. The ABN Amro bonus investigation stems from concerns regarding the bank's bonus scheme, specifically focusing on potential breaches of responsible remuneration guidelines. These concerns likely involve allegations of:

- Excessive bonuses: Payments exceeding what is considered justifiable given the bank's performance and risk profile.

- Misalignment with risk management: Bonuses potentially incentivizing excessive risk-taking, contradicting sound risk management practices.

- Lack of transparency: Insufficient clarity regarding the criteria used for bonus calculations and the overall structure of the compensation system.

Timeline and Public Statements:

- The investigation's precise start date hasn't been publicly disclosed, but news reports suggest it began following an internal review by ABN Amro.

- Both the DNB and ABN Amro have released carefully worded statements acknowledging the investigation but providing limited detail to protect the ongoing process.

- The legal framework underpinning the DNB’s action likely involves the European Union's Capital Requirements Directive (CRD) and the Dutch Financial Supervision Act, which both place restrictions on bank bonuses and executive compensation.

Potential Consequences for ABN Amro

The ABN Amro bonus investigation could have serious consequences for the bank. Potential penalties range from significant financial fines to reputational damage and stricter regulatory oversight.

Financial Implications:

- Potential Fine Amounts: Based on past DNB sanctions for similar violations, the fine could reach tens of millions of Euros. The final amount will depend on the severity of the findings.

- Impact on Profits and Shareholder Value: A substantial fine will directly impact ABN Amro's profitability and could negatively affect its stock price. Investor confidence might also suffer.

Reputational Damage:

- The investigation itself casts a shadow over ABN Amro's reputation, even before any findings are released. This damage could affect customer relationships and its ability to attract and retain talent.

- Negative media coverage surrounding the ABN Amro bonus investigation will further exacerbate reputational risks.

Broader Implications for the Dutch Banking Sector

The outcome of the ABN Amro bonus investigation will significantly impact the Dutch banking sector. Other banks will closely monitor the investigation's developments, anticipating potential changes to regulatory scrutiny and bonus structures.

Sector-Wide Implications:

- The investigation may prompt other banks to review their own bonus schemes and ensure full compliance with regulatory requirements to avoid similar investigations.

- The DNB might introduce stricter guidelines or increased oversight of bank compensation practices across the sector.

- Attracting and retaining top talent in the Dutch banking industry could become more challenging if stricter bonus regulations are implemented.

International Context:

- Similar investigations and regulatory actions concerning bank bonuses have occurred in other European countries, reflecting a broader trend of increased scrutiny of executive compensation within the financial sector. The ABN Amro bonus investigation fits into this larger global context.

Conclusion

The DNB's investigation into ABN Amro's bonus practices represents a significant development in the regulation of the Dutch banking sector. The potential for substantial fines and reputational damage underscores the importance of responsible remuneration policies. The outcome of this ABN Amro bonus investigation will likely influence bonus structures and regulatory oversight across the entire sector.

Call to Action: Stay informed about the ongoing ABN Amro bonus investigation and its impact on the Dutch banking landscape. Follow our updates for further developments on this crucial story concerning ABN Amro bonus regulations and the potential for significant fines. Keep checking back for the latest news on this ABN Amro bonus investigation.

Featured Posts

-

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Espanol

May 22, 2025

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Espanol

May 22, 2025 -

Airlines Confront Summer Travel Surge Potential Disruptions And Solutions

May 22, 2025

Airlines Confront Summer Travel Surge Potential Disruptions And Solutions

May 22, 2025 -

Trans Australia Run Record Attempt In The Spotlight

May 22, 2025

Trans Australia Run Record Attempt In The Spotlight

May 22, 2025 -

Abn Amro En Transferz Partnerschap Voor Innovatieve Digitale Oplossingen

May 22, 2025

Abn Amro En Transferz Partnerschap Voor Innovatieve Digitale Oplossingen

May 22, 2025 -

Trans Australia Run Record Attempt Update

May 22, 2025

Trans Australia Run Record Attempt Update

May 22, 2025

Latest Posts

-

Wyoming Fishing Volunteer To Help Manage Our Resources

May 22, 2025

Wyoming Fishing Volunteer To Help Manage Our Resources

May 22, 2025 -

Become A Wyoming Guided Fishing Advisory Board Volunteer

May 22, 2025

Become A Wyoming Guided Fishing Advisory Board Volunteer

May 22, 2025 -

Volunteer For Wyomings Guided Fishing Advisory Board

May 22, 2025

Volunteer For Wyomings Guided Fishing Advisory Board

May 22, 2025 -

Uw Documentary Shows Community Support For Pronghorn Following Devastating Winter

May 22, 2025

Uw Documentary Shows Community Support For Pronghorn Following Devastating Winter

May 22, 2025 -

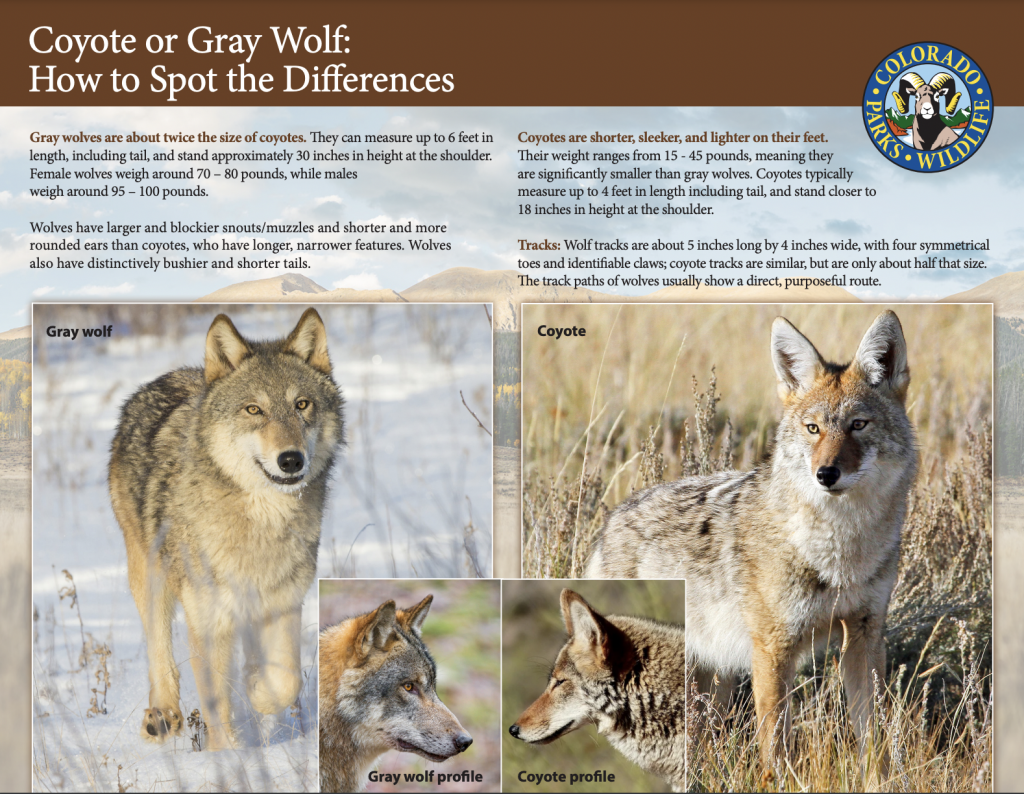

Colorado Gray Wolf Dies In Wyoming After Reintroduction

May 22, 2025

Colorado Gray Wolf Dies In Wyoming After Reintroduction

May 22, 2025