Dow Jones Index: Cautious Climb Continues After Strong PMI Data

Table of Contents

Strong PMI Data Fuels Optimism (but with caveats):

The Purchasing Managers' Index (PMI) is a key economic indicator that tracks the activity levels of purchasing managers in the manufacturing and services sectors. A PMI reading above 50 generally indicates expansion, while a reading below 50 suggests contraction. Recent PMI figures have been surprisingly strong, exceeding expectations and signaling continued growth in these crucial sectors.

- Bullet Point 1: Positive PMI readings often correlate with increased investor confidence and potential market gains. The recent strong data has undoubtedly contributed to the improved sentiment surrounding the Dow Jones Index.

- Bullet Point 2: However, inflation concerns and geopolitical instability remain significant counterweights. While the PMI paints a positive picture of current economic activity, persistent inflation could lead to further interest rate hikes, potentially dampening future growth. Similarly, ongoing geopolitical uncertainties introduce a level of risk that investors cannot ignore.

- Bullet Point 3: The question remains whether this translates to a short-term rally or sustained long-term growth. While the current positive trend is encouraging, it's crucial to analyze the underlying factors and potential headwinds before making any long-term investment decisions based solely on this data.

Sectors most positively influenced by the strong PMI data include industrials and technology, reflecting increased demand for goods and services. However, it's vital to remember that relying solely on PMI data for investment decisions is risky. Other economic indicators and a comprehensive market analysis are crucial for a well-informed approach.

Analyzing the Dow Jones Index's Cautious Climb:

The Dow Jones Index has shown a cautious climb in recent weeks, with a percentage increase of [Insert specific percentage change over the last week/month – e.g., approximately 2% over the past month]. This "cautious" nature is noteworthy, considering the positive PMI data. The climb is not a dramatic surge, indicating investor hesitancy.

- Bullet Point 1: Ongoing concerns about interest rate hikes and their impact on economic growth are contributing to this cautious approach. Further rate increases could stifle economic expansion and negatively impact corporate profits, leading to a market correction.

- Bullet Point 2: Geopolitical risks, such as the ongoing war in Ukraine and rising tensions in other regions, continue to cast a shadow on market stability. These uncertainties can trigger sudden shifts in investor sentiment and market volatility.

- Bullet Point 3: The potential for profit-taking after recent gains is also a factor contributing to the slower pace of the climb. Investors who have realized significant profits might choose to secure their gains, leading to a temporary slowdown in the upward trend.

Technical indicators like trading volume and price volatility also suggest a degree of caution. Lower than expected trading volume could indicate a lack of strong conviction behind the upward movement, while high volatility points to underlying market uncertainty. Identifying key support and resistance levels for the Dow Jones Index is crucial for navigating this period of market uncertainty.

Sector-Specific Performance Within the Dow Jones:

Analyzing the performance of individual sectors within the Dow Jones Index reveals a nuanced picture. While some sectors, like industrials, have performed strongly, others have shown more moderate growth or even underperformance.

- Bullet Point 1: Sectors heavily reliant on manufacturing and consumer spending are typically most sensitive to changes in PMI readings. Strong PMI data often boosts these sectors, but the reverse is also true.

- Bullet Point 2: For investors interested in sector-specific investments, understanding these nuances is crucial. Targeted investments in sectors showing outperformance can offer higher returns, but also carry increased risk.

For example, the technology sector, while generally positively impacted by economic growth, might show more muted gains compared to industrials if interest rate hikes impact growth stocks more significantly. A thorough understanding of these sector-specific dynamics is vital for strategic investment decisions.

Investment Strategies in Light of Current Market Conditions:

Given the cautious climb of the Dow Jones Index and the mixed signals from the PMI data, a balanced investment strategy is recommended.

- Bullet Point 1: Investors with a higher risk tolerance might consider allocating a larger portion of their portfolio to growth stocks in sectors showing strong performance, based on a thorough due diligence process.

- Bullet Point 2: Investors with a lower risk tolerance should prioritize diversification and consider allocating a larger portion of their portfolio to defensive assets like bonds or high-quality dividend-paying stocks.

- Bullet Point 3: Regardless of risk tolerance, long-term investment planning remains paramount. Short-term market fluctuations should not dictate long-term investment strategies.

Dollar-cost averaging – investing a fixed amount at regular intervals – can be a beneficial strategy to mitigate risk and take advantage of market fluctuations.

Conclusion:

The Dow Jones Index's cautious climb, fueled by strong PMI data but tempered by various uncertainties, highlights the complexity of the current market landscape. While positive economic indicators offer some optimism, concerns regarding inflation, interest rates, and geopolitical risks necessitate a cautious approach to investment decisions. A balanced portfolio, diversified across different asset classes and sectors, remains the cornerstone of a robust investment strategy during periods of uncertainty.

Call to Action: Stay informed about the Dow Jones Index and other key economic indicators like PMI data to make well-informed investment decisions. Regularly monitor the Dow Jones Index performance and adapt your investment strategy accordingly. Learn more about effective strategies for navigating market volatility related to the Dow Jones Index and building a resilient investment portfolio.

Featured Posts

-

Police Helicopter Pursuit Astonishing Text And Refuel At 90mph

May 25, 2025

Police Helicopter Pursuit Astonishing Text And Refuel At 90mph

May 25, 2025 -

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 25, 2025

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 25, 2025 -

Severe Congestion On M6 Due To Van Crash

May 25, 2025

Severe Congestion On M6 Due To Van Crash

May 25, 2025 -

Crystal Palace Eyeing Kyle Walker Peters On A Free Transfer

May 25, 2025

Crystal Palace Eyeing Kyle Walker Peters On A Free Transfer

May 25, 2025 -

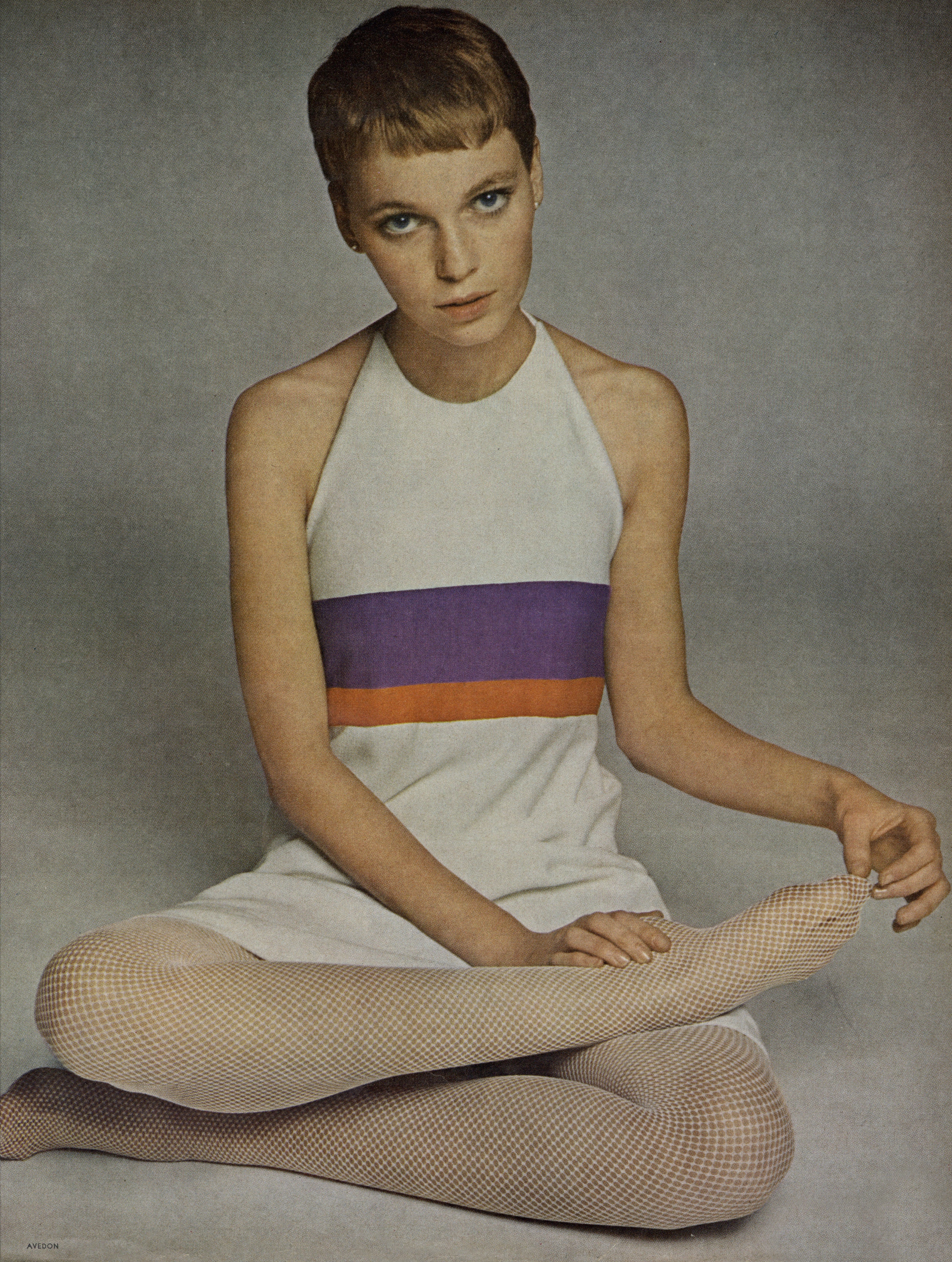

Michael Caines Mia Farrow Sex Scene Story An Unexpected Guest

May 25, 2025

Michael Caines Mia Farrow Sex Scene Story An Unexpected Guest

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025